Money talks. In the United States, it screams. If you look at the latest numbers for us states by gdp, you aren't just looking at a spreadsheet; you're looking at a map of where the power is moving. Honestly, it's a bit wild. California is still the king, but the ground is shaking underneath those Silicon Valley skyscrapers.

The U.S. economy just crossed that massive $30 trillion threshold. But here’s the kicker: more than a third of that entire pile of cash comes from just four states. That’s it. California, Texas, New York, and Florida basically carry the team.

The Big Four and the 14.5% Behemoth

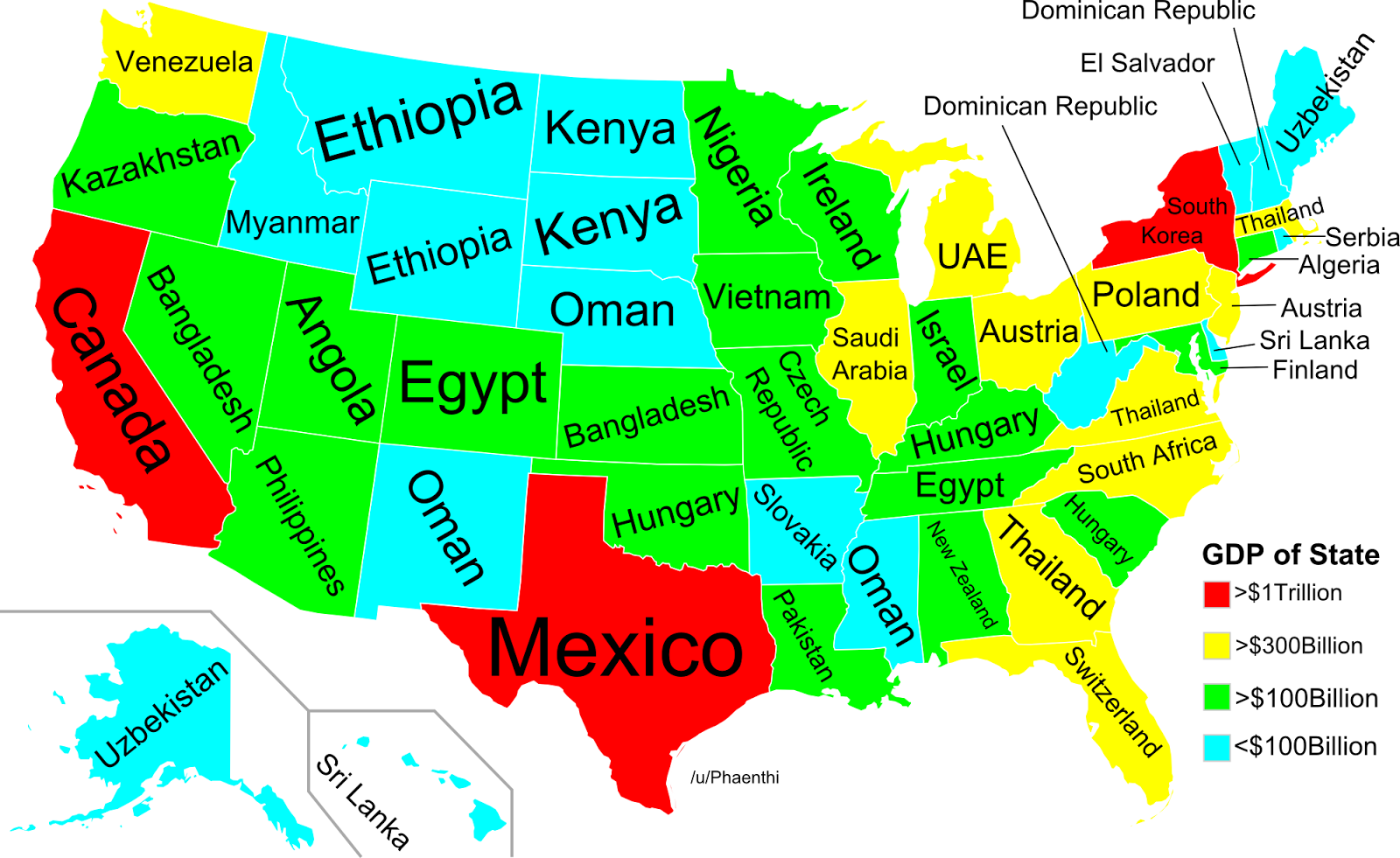

California is still sitting at number one. Its share of the national pie is roughly 14.5%. To put that into perspective, if the Golden State were its own country, it would be the fifth-largest economy on the planet. We’re talking about over $4 trillion in output. It’s huge. But you've probably noticed the headlines—businesses are leaving. Even with a slow growth rate of around 1.2% at the start of last year, the sheer inertia of its tech and entertainment sectors keeps it on the throne.

📖 Related: Why the 6 Down Played One Strategy Still Works for Modern Brands

Then you have Texas. The Lone Star State is the real story lately. It’s sitting at 9.4% of the U.S. GDP, but it’s growing like a weed. While California was "treading water" (as economist Mark Zandi puts it), Texas was clocking annualized growth rates near 6.8% in mid-2025. It’s not just oil anymore. It’s Tesla. It’s Oracle. It’s a massive surge in data centers—Texas is currently second only to Virginia in that department.

Moving Down the List: The New York and Florida Duel

New York ranks third at 7.9%, mostly because Manhattan is still the world's bank vault. Finance and insurance are the engines there. But Florida is breathing down everyone's neck at 5.8%.

What’s interesting about Florida isn't just the tourism. It’s the population. People are moving there in droves, and that brings money. Florida and New York actually had a weirdly close budget battle recently—the Sunshine State’s fiscal plan actually edged out New York City’s for the first time.

The rest of the top ten for us states by gdp looks like this:

- Illinois (3.9%)

- Pennsylvania (3.5%)

- Ohio (3.1%)

- Georgia (3.0%)

- Washington (3.0%)

- New Jersey (2.9%)

It's a steep drop-off after the big guys. Most states contribute between 1% and 2%. Then you have the tiny ones. Vermont, Wyoming, and Alaska each bring in less than 0.5% of the total.

Growth vs. Size: Who is Actually Winning?

Size is one thing. Momentum is another.

💡 You might also like: Who Owns Electrify America? The Surprising Truth Behind the Charging Giant

In 2025, the U.S. economy had a weird year. It contracted a bit at the start—down 0.5%—but then it roared back with a 4.3% jump in the third quarter. During that rollercoaster, the "Plains" region got hammered. Iowa and Nebraska saw GDP declines of over 6% because the agriculture sector took a massive hit from drought and weird commodity prices.

On the flip side, the Southeast is the comeback kid. South Carolina led the nation in growth at one point last year, hitting a 1.7% increase when almost everyone else was in the red.

Why Per Capita GDP Changes the Conversation

If you really want to understand the vibe of a state, you look at GDP per capita. This is basically the "how rich is the average person" metric.

Massachusetts and New York usually win here because of high-paying jobs in tech and finance. But here is a fact that sort of blew my mind: Mississippi is technically the "poorest" state by GDP per capita, right? Well, it still outperforms four of the G7 countries. Let that sink in. Even the American "bottom" is doing better than most of the developed world right now.

What This Means for You

So, why do you care about us states by gdp? If you're looking for a job or trying to start a business, the "Texas vs. California" debate is real. California has the highest income tax, while Texas has none. That’s why the labor force in Texas just hit a record 15.8 million people.

But it’s not all sunshine in the South. Rapid growth in places like Austin and Miami has made housing basically impossible to afford for regular people.

✨ Don't miss: Escaping the Build Trap: Why Your Roadmap Is Killing Your Product

Actionable Insights for 2026

- Watch the Energy Transition: States like North Dakota and Texas are still tied to oil, but they are pivoting fast to data centers and "green" manufacturing. If you're in tech, look at the "Silicon Prairie" (Midwest) where costs are lower.

- Cost of Living Adjustments: A high GDP in a state often correlates with high grocery and housing costs. In Mississippi, people spend over 10% of their income just on food. In Massachusetts, it's only 6%.

- Remote Work Shifts: The "Great Migration" isn't over. Keep an eye on states with growing GDP but lower tax footprints—that’s where the investment is flowing.

If you're planning a move or a business expansion, check the latest Bureau of Economic Analysis (BEA) quarterly releases. They come out every few months and tell you exactly which states are entering a recession and which are booming. Don't just follow the crowd; follow the data.

Next Steps for Your Research:

Verify the specific industry strengths in your target state by checking the BEA’s "GDP by Industry" breakdown. This will tell you if a state’s wealth is built on a single volatile sector like oil or a diversified mix like healthcare and professional services. Don't forget to cross-reference this with the latest state-level unemployment data from the Bureau of Labor Statistics to get the full picture of the local labor market.