Finding a dusty envelope in the back of a junk drawer or a safety deposit box can feel like winning a mini-lottery. Inside, you find them. Paper bonds. Or maybe you just have a vague memory of Grandma mentioning she bought some for you back in the nineties. If you’re trying to figure out what they're worth or if they even exist anymore, a us savings bond lookup is basically your only way forward. People lose track of billions—yes, billions with a "B"—in unredeemed savings bonds every single year. It’s wild.

Most of us assume the government just keeps track of everything for us. They do, but they won't exactly call you up to remind you to cash in. You have to go get it. Honestly, the process used to be a total nightmare involving paper forms and weeks of waiting for a letter. Now, it’s mostly digital, though "mostly" is doing a lot of heavy lifting there.

Why the US Savings Bond Lookup Matters Right Now

There are currently over $30 billion in matured, unredeemed savings bonds sitting in the U.S. Treasury. That is money that has stopped earning interest. It’s just sitting there, losing value against inflation every single day. If you have an Series E bond from 1980, it stopped earning interest decades ago. You’re essentially giving the government a free loan at that point.

The Treasury Department launched a tool called TreasuryHunt.gov specifically for this. It’s the official us savings bond lookup portal. You don't need a private investigator. You just need a Social Security Number (SSN) or an Employer Identification Number (EIN). Sometimes, you might need the bond's serial number if you have the physical paper in hand but aren't sure if it's still "live."

The Paper Bond Problem

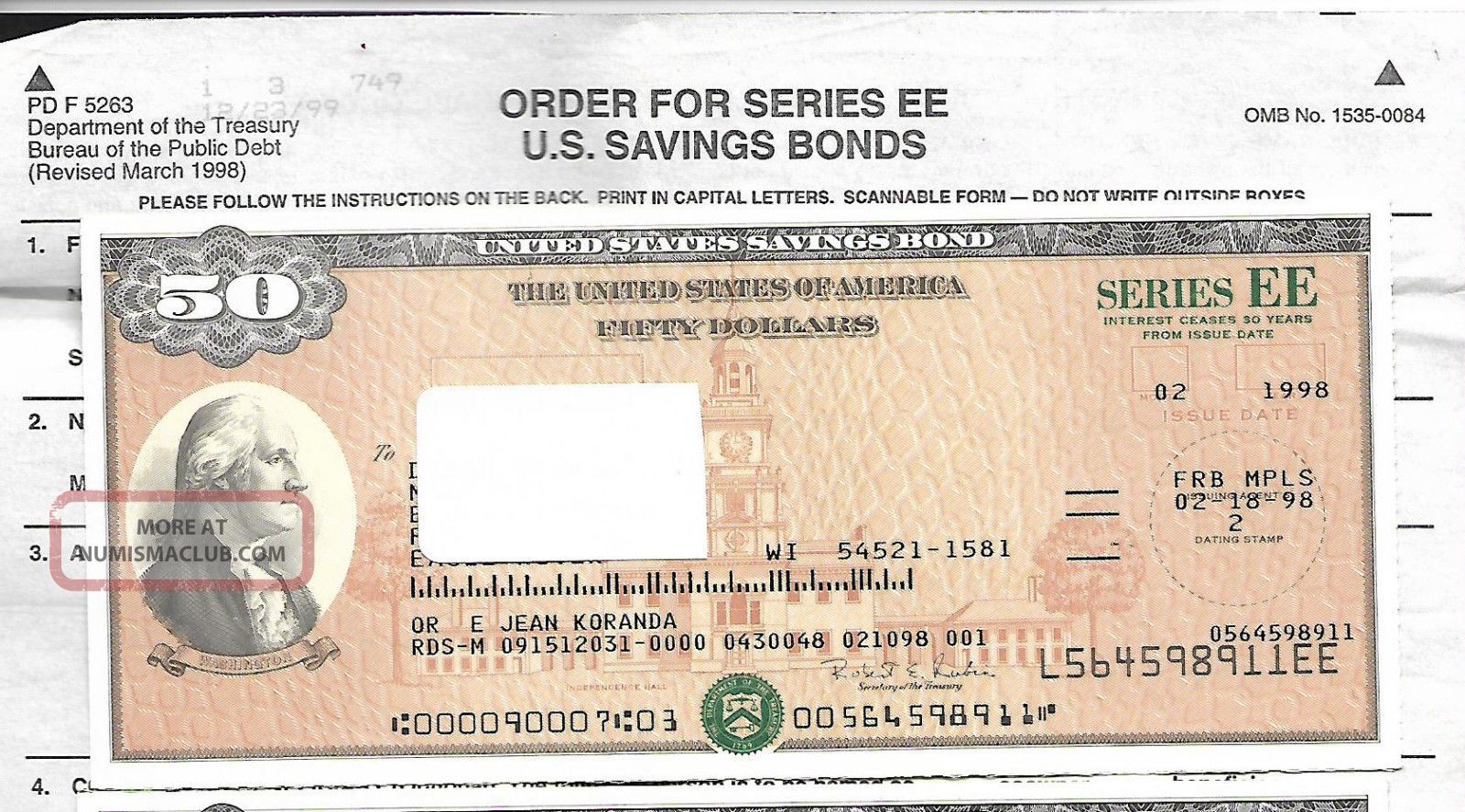

Paper bonds are becoming relics. The Treasury stopped selling them through banks back in 2011. Now, everything is through TreasuryDirect. But millions of those paper Series EE and Series I bonds are still floating around in attics. If you find one, the first thing you should do is check the issue date.

A lot of people think that because a bond says "Face Value $100," that's what it's worth. Nope. For older Series EE bonds, you actually bought them for $50. The $100 is what it's worth after it reaches original maturity. If it’s been sitting for 30 years, it could be worth way more than the face value because of the way interest doubles.

How to Actually Use the Treasury Hunt Tool

Go to the official site. Don't use those "bond finder" third-party sites that look like they were designed in 1998; they usually just want your data or a cut of the money. Use the government site.

When you perform a us savings bond lookup, you enter your SSN. The system checks for bonds that have reached maturity—meaning they are no longer earning interest—and are linked to that number. It’s not a perfect system. If the bond was bought in 1974 and the SSN wasn't recorded properly (which happened a lot), it might not show up.

If the search comes up empty but you know those bonds exist, you have to go the manual route. This involves FS Form 1048. It’s the "Claim for Lost, Stolen, or Destroyed United States Savings Bonds." You’ll need to provide as much detail as possible: the approximate date of purchase, the name on the bond, and the address that would have been used at the time.

The Series I vs. Series EE Confusion

People get these mixed up constantly. Series I bonds are inflation-indexed. They’ve been super popular lately because when inflation spikes, the interest rate on these things goes through the roof. Series EE bonds are different; they guarantee to double in value if you hold them for 20 years.

If you're doing a us savings bond lookup for an "I bond," you're likely checking to see if you can cash it out yet without losing the last three months of interest. If you’ve held it less than five years, there’s a penalty. After five years, you get everything.

Lost Bonds and Deceased Relatives

This is where it gets complicated. Really complicated.

Often, a us savings bond lookup is part of settling an estate. If you’re the heir, you can’t just walk into a bank with your dad’s bonds and walk out with cash. You need proof of death. You need proof that you are the legal representative of the estate or the named beneficiary.

If the bond has a "POD" (Payable on Death) designation, it’s easier. You just need the death certificate and your own ID. If it doesn't, you’re looking at probate court paperwork. It’s a bit of a slog, but considering some of these old bonds can be worth thousands, it's worth the paperwork.

What if the Bank Won't Help?

Local banks used to be the go-to for cashing bonds. Now? Not so much. Many big national banks have stopped cashing paper bonds for people who aren't long-time account holders. Some have stopped altogether.

If your bank says no, don't panic. You can mail them directly to the Treasury Retail Securities Services. You’ll need to sign the back of the bonds in the presence of a certifying officer (usually at a bank, ironically) and mail them with Form 1522. It takes longer—sometimes weeks or months—but the money will eventually hit your bank account via direct deposit.

📖 Related: Getting a cash in 1 hour payday loan: What the fine print actually means for your wallet

Tax Implications You Can't Ignore

The IRS always gets their cut. Always.

When you finally finish your us savings bond lookup and cash those suckers in, you owe federal income tax on the interest earned. The good news is that savings bonds are exempt from state and local taxes. That’s a nice little win if you live in a high-tax state like New York or California.

You can choose to pay the tax every year as the interest accrues, but almost nobody does that. Most people defer it until they cash the bond. When you do, you'll get a 1099-INT. Don't forget to include it on your tax return, or the IRS will definitely send you a very unfun letter a year later.

There's one big exception: education. If you use the bond money to pay for qualified higher education expenses, you might be able to exclude that interest from your income altogether. There are income limits, though. Check IRS Publication 970 before you assume you’re off the hook.

Common Mistakes During the Lookup Process

The biggest mistake is giving up too early. The online search tool only shows bonds that have stopped earning interest. If you have a bond from 2005, it’s still earning interest. It won't show up in the "lost" database because, in the government's eyes, it’s not lost; it’s just growing.

Another mistake? Thinking the name on the bond is the only way to find it. If your name changed due to marriage or divorce, you might need to search under your maiden name.

Also, watch out for "reissue" scams. You should never have to pay a fee to a private company to find your bonds. The us savings bond lookup is a free service provided by the Department of the Treasury. If a site asks for a credit card number to "search the database," close the tab immediately.

Why Some Bonds Never Show Up

Sometimes the records are just... old. Before the mid-1970s, the record-keeping wasn't as digitized as you'd think. If you’re looking for "War Bonds" from the 1940s, the Treasury might have a harder time matching them to a modern SSN. In those cases, having the physical bond is almost mandatory. If you don't have the bond, you'll need the exact serial number, which most people don't just have written down in a notebook.

Actionable Steps to Take Today

If you suspect you have money sitting in the Treasury's vault, don't wait.

- Start by gathering any old paperwork or family records. Look for mentions of "bonds," "savings," or "Treasury."

- Use the official Treasury Hunt tool with your SSN. Try variations if you’re searching for a deceased relative (using their SSN).

- If the online tool fails, download FS Form 1048. Fill it out with as much "best guess" information as you have.

- Check your physical bonds for the series type. If they are Series E, EE, or I, use the Savings Bond Calculator on the TreasuryDirect website to see exactly what they are worth today.

- Decide on a cashing strategy. If you don't need the money and the bond is still earning interest (especially I bonds with high fixed rates), let it ride. If it has matured, cash it immediately.

- Contact your bank to see if they still process paper bonds. If not, prepare to mail them to the Treasury. Use certified mail. You do not want these getting lost in the post.

The money belongs to you. It’s not a gift from the government; it’s a debt they owe you. Go collect it.