You’ve probably seen those viral graphics. You know the ones—bright red and green blobs splashed across a map of the United States, usually accompanied by some heated caption about how we're sitting on more "black gold" than the entire Middle East combined. Or, conversely, that we're about to run dry by next Tuesday. Most of the time, looking at a us oil reserves map feels more like reading a Rorschach test than looking at actual geology. People see what they want to see.

But if you actually dig into the data from the Energy Information Administration (EIA) or the U.S. Geological Survey (USGS), the reality is way more interesting. And way more complicated.

Texas isn't the only player. Not by a long shot.

When we talk about an oil reserves map, we aren't just talking about a puddle of liquid sitting underground waiting for a straw. We are talking about "proved reserves." That is a very specific legal and accounting term. It means the oil that we know for a fact is there and that we can actually get out of the ground profitably right now with current technology. If the price of oil crashes? The "reserves" on that map technically shrink, even though the oil didn't go anywhere. It’s a weird, shifting landscape.

The Permian Basin is Still the Heavyweight Champion

If you look at a us oil reserves map today, your eyes are going to get pulled toward the border of West Texas and Southeastern New Mexico. That’s the Permian. It is the absolute monster of American energy.

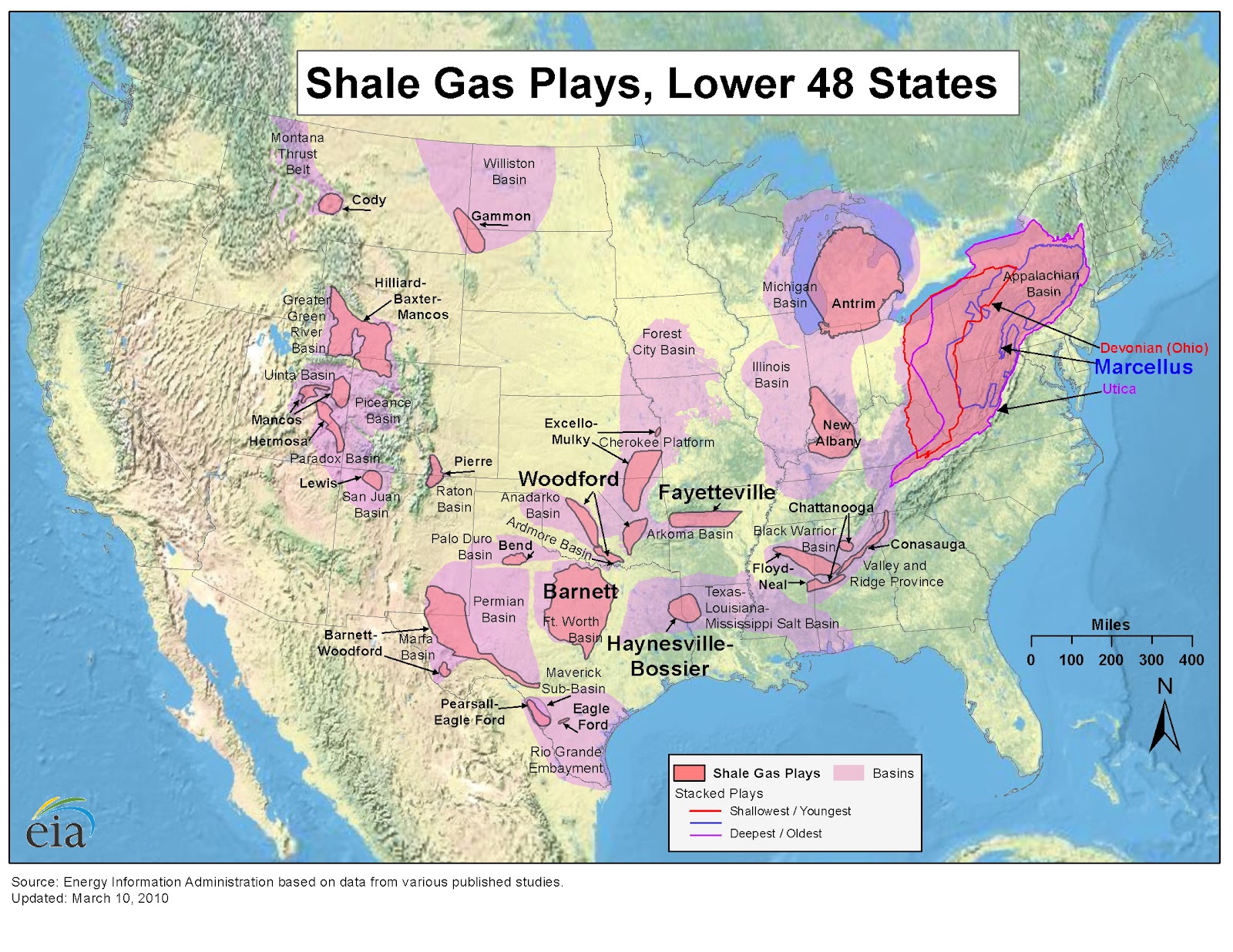

For a while, people thought the Permian was played out. Conventional drilling had taken the easy stuff. Then horizontal drilling and hydraulic fracturing (fracking) showed up and basically rewrote the entire map. Suddenly, layers of shale rock that were previously "trash" became the most valuable real estate in the world.

The Permian is broken into two main sub-basins: the Delaware and the Midland. According to the Federal Reserve Bank of Dallas, the Permian accounts for nearly 40% of all U.S. oil production. When you look at the map, this area is a dense cluster of activity. It’s not just one layer of oil, either. It’s like a giant underground layer cake. Companies are drilling into the Wolfcamp, the Bone Spring, and the Spraberry formations.

The sheer scale is hard to wrap your head around. Honestly, if the Permian Basin were its own country, it would be one of the top producers in OPEC.

Why the Bakken and Eagle Ford Look Different Now

About ten years ago, the Bakken formation in North Dakota was the superstar. It was the poster child for the American energy boom. If you look at a historical us oil reserves map from 2012, North Dakota looks like the center of the universe.

Things have cooled off.

It’s not that the oil is gone. Not at all. It’s just that the "sweet spots" have been heavily drilled. The Bakken is still a massive contributor—centering around the Williston Basin—but the growth has leveled out. Investors got tired of companies spending billions to chase growth without making a profit. Now, the map shows a more mature, stable region.

Then you have the Eagle Ford in South Texas. It’s a similar story. It was the "it" spot for a while, stretching from the Mexican border up toward Austin. Now, it’s a steady producer, but it’s no longer the wild frontier.

The Stealth Giants: New Mexico and the Gulf of Mexico

New Mexico is the one that catches people off guard. Because the Permian Basin doesn't care about state lines, the eastern side of New Mexico has exploded. Lea and Eddy counties are now some of the highest-producing areas in the entire country. If you’re looking at a us oil reserves map and ignoring the New Mexico side of the border, you’re missing half the story.

Then there is the offshore stuff.

The Gulf of Mexico is a different beast entirely. We are talking about massive platforms in thousands of feet of water. These aren't the quick "drill and frack" wells you see in the Permian. These are multi-billion dollar projects that take a decade to bring online. The reserves here are massive, but they are concentrated in deep-water blocks like the Mississippi Canyon or the Green Canyon areas.

🔗 Read more: South Korea Corporate Governance News Today: Why the 2026 Reforms Actually Matter

Proved reserves in the Gulf of Mexico are actually quite resilient. Even when land-based drilling slows down, these massive offshore projects keep humming along because once you’ve spent $5 billion on a platform, you don’t just turn it off because the price of gas dropped ten cents.

The Map Features You Can't Actually Drill (Yet)

Here is where it gets controversial. If you look at a map of "Technically Recoverable Resources" versus "Proved Reserves," you’ll see huge circles over places like the Arctic National Wildlife Refuge (ANWR) in Alaska or the Atlantic coast.

The oil is there. The USGS has confirmed it.

But it’s not on the "Proved Reserves" map. Why? Because of politics, environmental regulations, and economics. Alaska’s North Slope is a prime example. The Prudhoe Bay field was a legend, but production there has been declining for decades. There is a ton of oil further east in 1002 Area, but it’s tied up in a perpetual legal tug-of-war.

A map of where the oil is isn't the same as a map of where we can get the oil.

What Most People Get Wrong About the Map

People see a us oil reserves map and think it’s a finite gas tank. "We have 48 billion barrels left, we use 20 million a day, do the math!"

The math is wrong.

Technology changes the map. In the 1970s, the shale reserves we rely on today wouldn't have even been colored in on a map. They were considered "unconventional" and impossible to extract. Tomorrow, some kid in a lab might figure out a way to get oil out of a rock we currently think is bone dry.

Also, we have the Strategic Petroleum Reserve (SPR). These are actual physical maps of salt caverns in Louisiana and Texas—sites like Bryan Mound and West Hackberry. This isn't oil in the ground; it's oil in the "cupboard." It’s a different kind of reserve that acts as a buffer for the whole system.

Practical Steps for Tracking Energy Trends

If you're trying to use this information for investing, business planning, or just to win an argument at dinner, don't just look at a static image from a Google search.

First, go to the EIA (Energy Information Administration) website and look for their "State Energy Profiles." They update these regularly. A map from 2018 is basically ancient history in the oil business. You want the latest "Proved Reserves by Area" report.

Second, pay attention to the "Rig Count." Baker Hughes releases this every Friday. It’s a map of where the rigs are actually working. If the reserves are high but the rig count is zero, that oil is staying in the ground.

Third, look at infrastructure. A map of oil reserves is useless without a map of pipelines. If you have a billion barrels of oil in the middle of nowhere but no pipeline to get it to a refinery on the Gulf Coast, that oil is effectively worthless. The Cushing, Oklahoma hub is the "pipeline crossroads of the world" for a reason. Everything on the map eventually tries to flow through there or toward the massive refineries in Port Arthur and Houston.

The us oil reserves map is a living document. It expands when prices go up and shrinks when they go down. It shifts as we invent new ways to crack open rocks. It’s less of a fixed treasure map and more of a snapshot of what we can afford to reach at this exact moment in time.

To get a true sense of the landscape, cross-reference the USGS resource assessments with the EIA's monthly production reports. This shows you the gap between what's possible and what's actually happening. Monitor the permit filings in the Delaware Basin specifically, as that remains the most reliable indicator of near-term reserve growth.