It’s a massive, glowing number in Midtown Manhattan that just keeps spinning. Most people see the national debt clock and feel a pit in their stomach, but honestly, they don't really know what the numbers mean for their own wallets. We’ve been hearing about the fiscal cliff for decades. Yet, the lights stay on. The checks (mostly) keep clearing.

If you look at US national debt through the years, you aren't just looking at a balance sheet. You’re looking at a map of every war, every recession, and every massive political gamble the United States has ever taken. It started with the American Revolution. We owed about $75 million back then. To a modern ear, that sounds like the price of a single luxury condo in Miami, but in 1791, it was a mountain.

Alexander Hamilton thought this debt was a "national blessing" if it wasn't excessive. He wanted the federal government to prove it could pay its bills so it could borrow more later. Boy, did we take that advice to heart.

The Early Days and the Only Time We Hit Zero

History buffs love to bring up 1835. It was the only time in our entire history that the US was debt-free. Andrew Jackson hated the idea of a national bank and hated debt even more. He sold off vast amounts of government-owned land in the West and vetoed every spending bill he could get his hands on.

For one brief moment, the balance was $0.00.

It didn't last. A massive financial panic hit in 1837, the economy cratered, and the government started borrowing again just to keep the doors open. We haven't seen a zero balance since.

The Civil War changed everything. Before the 1860s, the debt was manageable. Then, the cost of the conflict exploded. By 1866, the debt hit $2.7 billion. That was a staggering amount of money for a country that was still mostly agricultural. To pay for it, the government did something it hadn't done before: it created the Internal Revenue Service and issued the first paper currency, known as "greenbacks."

World War II and the Birth of the Modern Deficit

If you want to understand why the US national debt through the years looks like a hockey stick on a graph, you have to look at the 1940s.

👉 See also: Modern Office Furniture Design: What Most People Get Wrong About Productivity

World War II was the most expensive endeavor in human history. To fund the fight against the Axis powers, the US government borrowed on a scale that would have made the Founding Fathers faint. By 1946, the debt-to-GDP ratio—basically the country's debt compared to its entire economic output—was over 106%.

Think about that. We owed more than we produced in an entire year.

People often ask why we didn't go bankrupt then. The answer is growth. After the war, the US economy absolutely surged. We didn't necessarily pay back the "principal" of the debt in the way you'd pay off a car loan. Instead, the economy grew so fast that the debt became a smaller and smaller percentage of our total wealth. By the 1970s, the debt-to-GDP ratio had dropped to around 23%.

It felt like we had figured out a magic trick. Borrow for an emergency, grow your way out of the hole.

The Pivot Point: The 1980s and "Reaganomics"

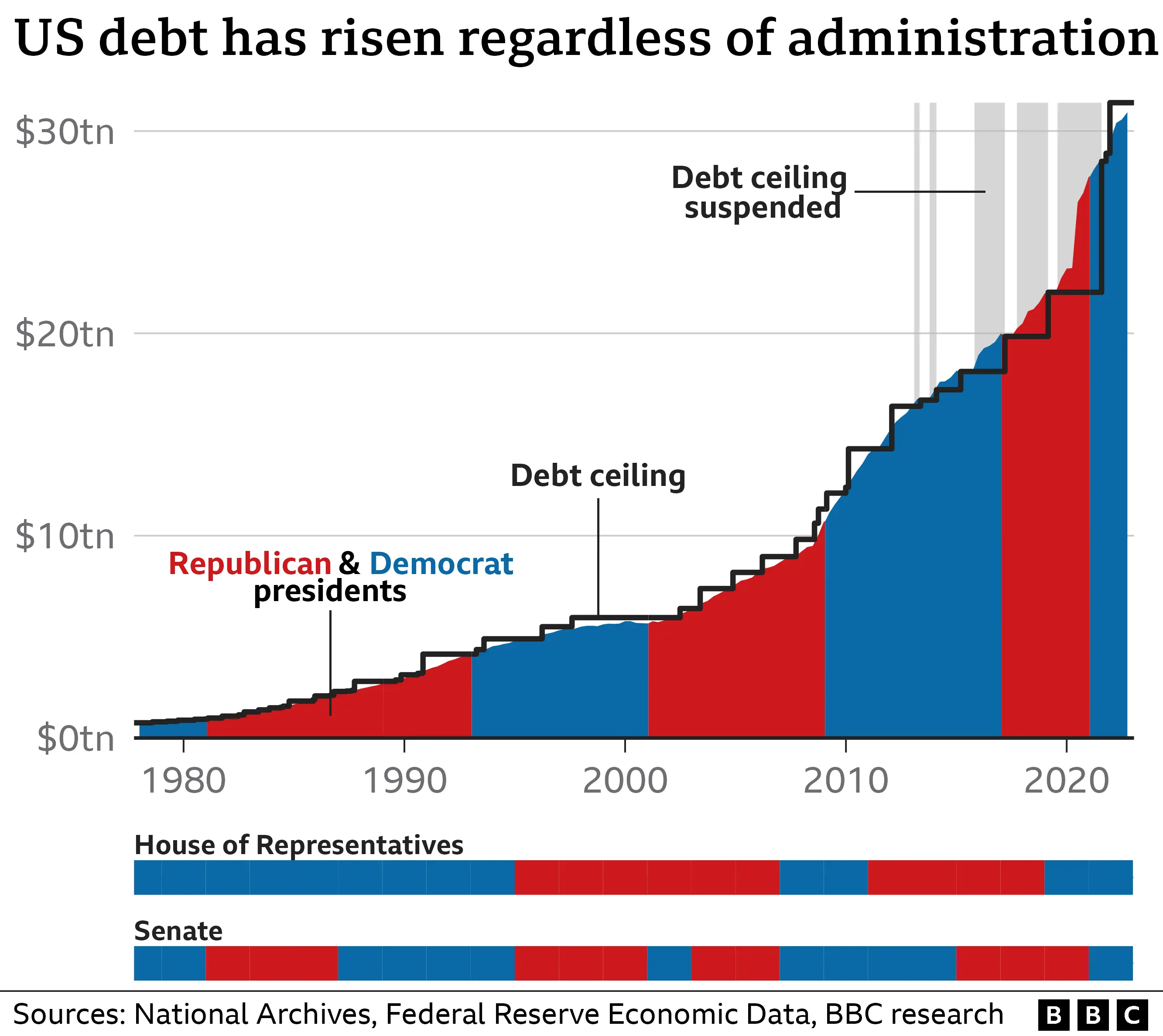

The 1980s broke the post-war pattern. Usually, debt goes up during wars or depressions and down during peace and prosperity. Under President Ronald Reagan, that changed. We had a period of relative peace and economic growth, but the debt started climbing anyway.

Why? A combination of massive tax cuts (the Economic Recovery Tax Act of 1981) and a huge spike in military spending.

The idea was "supply-side economics." The theory suggested that tax cuts would spark so much growth that the government would actually end up with more tax revenue. It didn't quite work out that way. The debt tripled during Reagan's tenure, moving from about $900 billion to $2.7 trillion.

✨ Don't miss: US Stock Futures Now: Why the Market is Ignoring the Noise

This was the era when the "National Debt Clock" was first installed near Times Square. People were starting to get nervous.

Then came the 90s. This is the part of the story that sounds like a fairy tale today. Under Bill Clinton and a GOP-led Congress, the US actually ran budget surpluses from 1998 to 2001. For a second, it looked like we might actually pay the whole thing off. The CBO (Congressional Budget Office) even projected that the entire national debt could be eliminated by 2011.

Obviously, that didn't happen.

Two Decades of "Perma-Crisis"

What went wrong? Everything.

First, the dot-com bubble burst. Then came the September 11 attacks, which led to two incredibly expensive wars in Iraq and Afghanistan. According to the Watson Institute at Brown University, those wars cost over $8 trillion when you factor in long-term care for veterans.

Then 2008 happened. The Great Recession forced the government to bail out banks and pass massive stimulus packages to prevent a total global collapse.

By the time the economy recovered, we were already in the trillions. Then came 2020. COVID-19 was a fiscal nuke. The government pumped trillions of dollars into the economy via the CARES Act and other relief measures to keep businesses and households afloat during lockdowns.

🔗 Read more: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

The debt didn't just grow; it teleported.

In early 2020, the debt was around $23 trillion. By 2024, it had cleared $34 trillion. As we move through 2026, the trajectory remains steep. We are now seeing interest payments alone—just the "rent" we pay on the money we borrowed—exceeding the entire defense budget. That is a massive milestone that most economists find deeply unsettling.

Who Actually Owns All This Money?

There is a huge misconception that China "owns" the US. That’s not really how it works.

While foreign countries do hold a lot of our debt (Japan and China are the big ones), the biggest owner of US debt is actually... us.

- The Social Security Trust Fund: The government borrows from its own programs.

- The Federal Reserve: They buy Treasury bonds to manage the money supply.

- Private Investors: Maybe you have a 401(k) or a pension fund. If you own a bond fund, you probably own a piece of the national debt.

- State and Local Governments: They buy Treasuries because they are considered the safest asset in the world.

If the US ever defaulted, it wouldn't just be a "government" problem. It would destroy the retirement accounts of millions of regular people.

Why Should You Care? (The Actionable Part)

It's easy to tune this out. $34 trillion or $35 trillion—it all sounds like "Monopoly money." But the US national debt through the years has a direct impact on your life, even if you don't see it on your receipt at the grocery store.

High debt leads to higher interest rates. When the government has to borrow trillions, it competes with you for capital. This pushes up the rates on mortgages, car loans, and credit cards. It also limits what the government can spend on things people actually like, like fixing roads or funding medical research, because more of your tax dollars are going toward interest payments.

What you can actually do:

- Hedge against inflation. Historically, when governments are deep in debt, they are tempted to "inflate their way out" by printing more money. This makes each dollar you save worth less. Diversifying into assets that hold value—like real estate, certain stocks, or even small amounts of gold—is a classic move.

- Monitor the "Interest-to-Revenue" ratio. This is a better metric than the total debt number. It tells you how much of the government's "paycheck" is going to interest. If this keeps rising, expect higher taxes or fewer services in the future.

- Vote on fiscal policy, not just social issues. Politicians usually win by promising "free" stuff or "tax cuts." Both increase the debt. Look for candidates who actually discuss the debt-to-GDP ratio with some level of nuance.

- Re-evaluate your bond exposure. If you are nearing retirement, talk to a financial advisor about how a potential "debt crisis" or a credit rating downgrade (like the one we saw from Fitch in 2023) could affect the value of your government bonds.

The US is in uncharted territory. We have never had this much debt during a period of relative economic health. The "blessing" Hamilton talked about has become a massive, complex burden that every generation is passing to the next. Understanding the history doesn't fix the problem, but it stops you from being surprised when the bill finally comes due.

Next Steps for Your Financial Health:

Review your current investment portfolio to ensure you aren't over-exposed to "interest rate risk." As the national debt grows and interest payments climb, the volatility in the bond market can have a "ripple effect" on even the most conservative portfolios. Check your 401(k) allocations today to see how much of your wealth is tied directly to government-backed securities.