You’ve probably seen the memes or the shouting matches on social media. One side posts a chart showing the debt skyrocketing under a specific president, and the other side fires back with a different graph that makes the first one look like a lie. It's exhausting. Honestly, looking at a US national debt graph by president is kinda like looking at a Rorschach test—people see exactly what they want to see based on their political leanings.

But if we strip away the spin, the numbers tell a story that isn't as simple as "this party good, that party bad." As of January 2026, the gross national debt has surged past $38.4 trillion. To put that in perspective, that’s over $114,000 for every single person in the United States.

We aren't just talking about a few extra billion here and there. We are talking about a compounding mountain of obligations that has been built, brick by brick, by every administration since the 1980s.

The Reagan Pivot and the Birth of Modern Debt

Before the 1980s, the US debt mostly spiked during wars (like WWII) and then leveled off or dropped as a percentage of the economy during peacetime. That changed with Ronald Reagan. When he took office in 1981, the debt was around $994 billion. By the time he left in 1989, it was $2.8 trillion.

Basically, Reagan tripled the debt. He pushed a "supply-side" economic model that combined massive tax cuts with a huge buildup in military spending. The idea was that the tax cuts would spark so much growth that the debt would pay for itself. It didn't quite work out that way. While the economy did grow, the "twin deficits" (trade and budget) became a permanent fixture of the American landscape.

George H.W. Bush followed suit, and the debt hit $4.4 trillion by 1993. It's worth noting that he actually broke his "no new taxes" pledge to try and rein in the deficit, which many historians think cost him his re-election but actually set the stage for the next guy's success.

The Clinton Surplus and the Post-9/11 Spike

Bill Clinton is often the "gotcha" example in these debates. He’s the only modern president to oversee actual budget surpluses in his final years. By the time he left, the debt was about $5.8 trillion. If you look at a US national debt graph by president focusing on the 90s, you see the line start to flatten out significantly.

Then came the 2000s.

George W. Bush inherited a surplus and left with a massive deficit. Why? Two main things: the 2001 and 2003 tax cuts, and the incredibly expensive wars in Iraq and Afghanistan. Then, right at the end of his term, the 2008 financial crisis hit. The government had to step in with the TARP bank bailouts, and the debt jumped to $11.9 trillion by the time Barack Obama took the oath.

The Trillion-Dollar Era: Obama, Trump, and Biden

If you look at the raw dollar amounts, the graph starts to look like a hockey stick during the Obama years. He added about $8 trillion, bringing the total to nearly $20 trillion. Critics point to the American Recovery and Reinvestment Act, but supporters argue this was necessary to prevent a second Great Depression.

Then came Donald Trump’s first term. Even before the pandemic, the debt was climbing due to the 2017 Tax Cuts and Jobs Act. But 2020 changed everything. The COVID-19 stimulus packages—passed with massive bipartisan support—poured trillions into the economy. By the time Trump left in early 2021, the debt was roughly $27.7 trillion.

Joe Biden's term saw a continuation of this trend. Between the American Rescue Plan and the Inflation Reduction Act, along with rising interest rates that made servicing the old debt more expensive, the total climbed to roughly $36 trillion by the end of 2024.

👉 See also: Getting Your Cargo Through 2801 NW 79th Ave Doral FL 33122 Without the Headache

Where We Stand in 2026

We’re now in the second Trump administration, and the numbers are staggering. In early 2025, the "One Big Beautiful Bill" was signed, which extended many of the 2017 tax cuts. While the administration points to revenues from new tariffs and savings from the Department of Government Efficiency (DOGE), the debt hasn't stopped its upward march.

As of January 7, 2026, the debt is $38.43 trillion.

The most alarming part isn't even the total number; it's the interest. For the first time, the US is spending more on interest payments—over $1 trillion annually—than it spends on the entire national defense budget. We are essentially paying for the "credit card" of previous generations while still charging more to the current one.

Does the President Actually Control the Debt?

This is the big misconception. People love to blame the person in the Oval Office, but the President doesn't have a "debt dial" on their desk.

- Congress holds the purse strings. Every dime spent has to be appropriated by the House and Senate.

- Mandatory spending is the real driver. About two-thirds of the budget goes to "autopilot" programs like Social Security and Medicare. No president can change these without an act of Congress that would be politically suicidal.

- The Economy has a vote. If a recession hits, tax revenue drops and safety net spending goes up. This happens regardless of who is in charge.

- Interest rates are set by the Fed. When the Federal Reserve raises rates to fight inflation, the cost of the national debt goes up automatically.

Actionable Insights: How to Read the Debt Data

If you’re looking at a US national debt graph by president and trying to make sense of it, keep these three tips in mind:

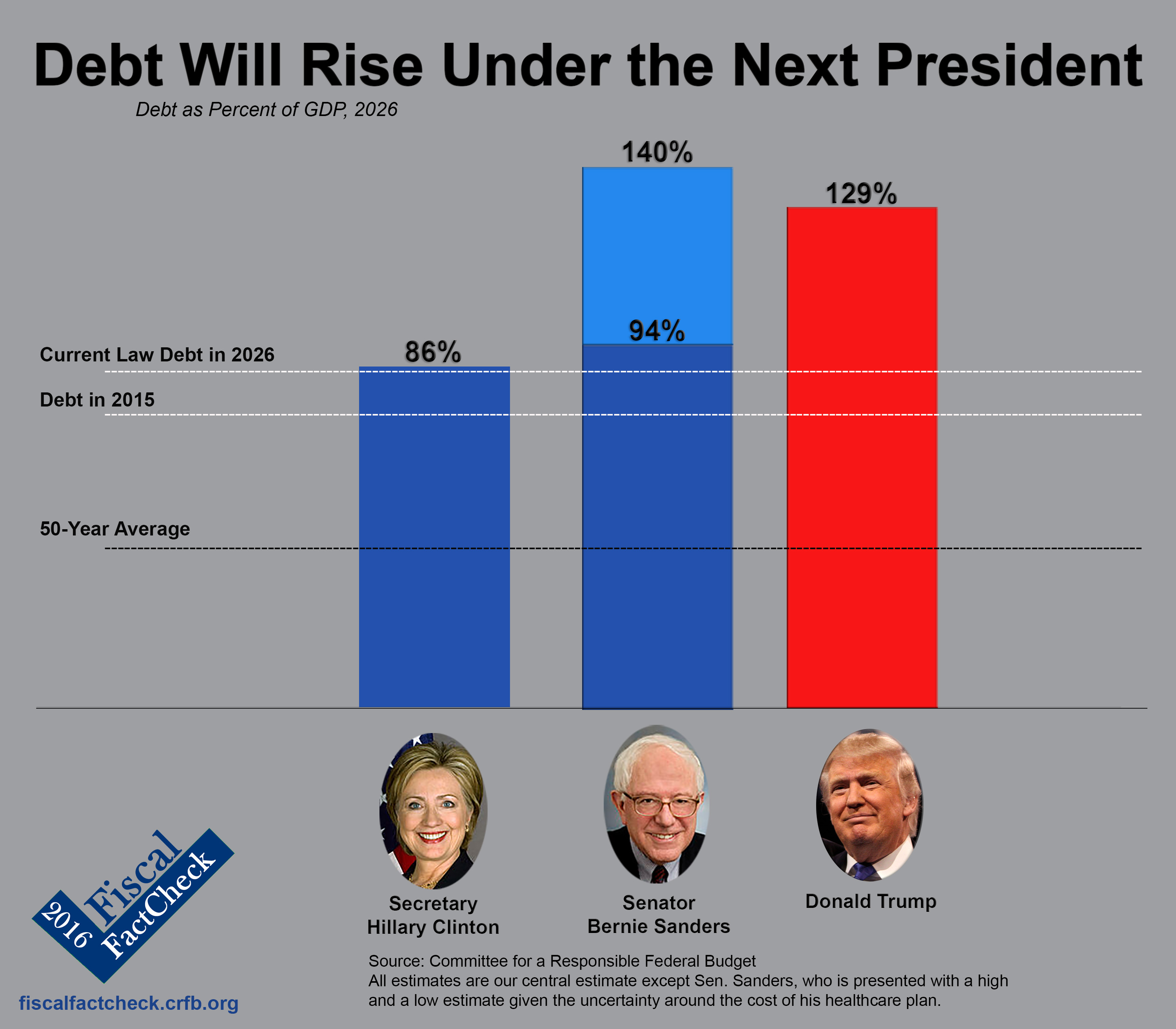

- Look at Debt-to-GDP, not just dollars. Nominal dollars are misleading because of inflation. $1 trillion in 1980 is not the same as $1 trillion in 2026. The Debt-to-GDP ratio tells you if the debt is growing faster than the economy's ability to pay it back. Currently, that ratio is hovering around 124%.

- Check the "Inherited" Budget. A president's first year is almost entirely governed by the budget passed by the previous administration. For example, the 2009 deficit was largely a result of policies and economic conditions from 2008.

- Distinguish between Deficit and Debt. The deficit is how much we overspend in a single year. The debt is the cumulative total of all those years of overspending. A president can "reduce the deficit" while the "national debt" still goes up.

The trajectory we’re on isn't a "Republican" or "Democratic" problem—it’s a structural one. We have a system that demands high spending and low taxes, a combination that works great for winning elections but is mathematically impossible to sustain forever.

Moving forward, the focus will likely shift from "how much is the debt" to "can we afford the interest?" If interest rates stay high, the squeeze on the rest of the federal budget—from roads to research—will become the defining political struggle of the late 2020s.

To stay informed, you can monitor the daily updates on the Treasury’s official Fiscal Data site or follow the Congressional Budget Office (CBO) long-term projections. Understanding the math behind the memes is the first step in actually solving the problem.