Ever look at the clock? No, not the one on your wall. The one in Midtown Manhattan—the National Debt Clock. It’s a blur. The digits fly by so fast you can’t even read the millions, let alone the thousands. Seeing US national debt by year visualized like that is honestly kind of terrifying. It’s a number so large it feels fake. Like Monopoly money, but with much higher stakes for your grocery bill and your mortgage rate.

People love to argue about this. One side says we’re borrowing ourselves into a grave. The other says it doesn't matter because we own the printing press. The truth is usually somewhere in the messy middle.

The Big Picture: How We Got Here

If you go back to the early 1900s, the debt was basically a rounding error. Then World War I happened. Then the Great Depression. Then World War II. That’s when things got real. In 1946, the debt was about 119% of the entire US economy. We spent a fortune to save the world, and honestly, it worked. For the next few decades, the debt actually shrank relative to the size of the economy. We were growing faster than we were borrowing. It was a golden era of sorts.

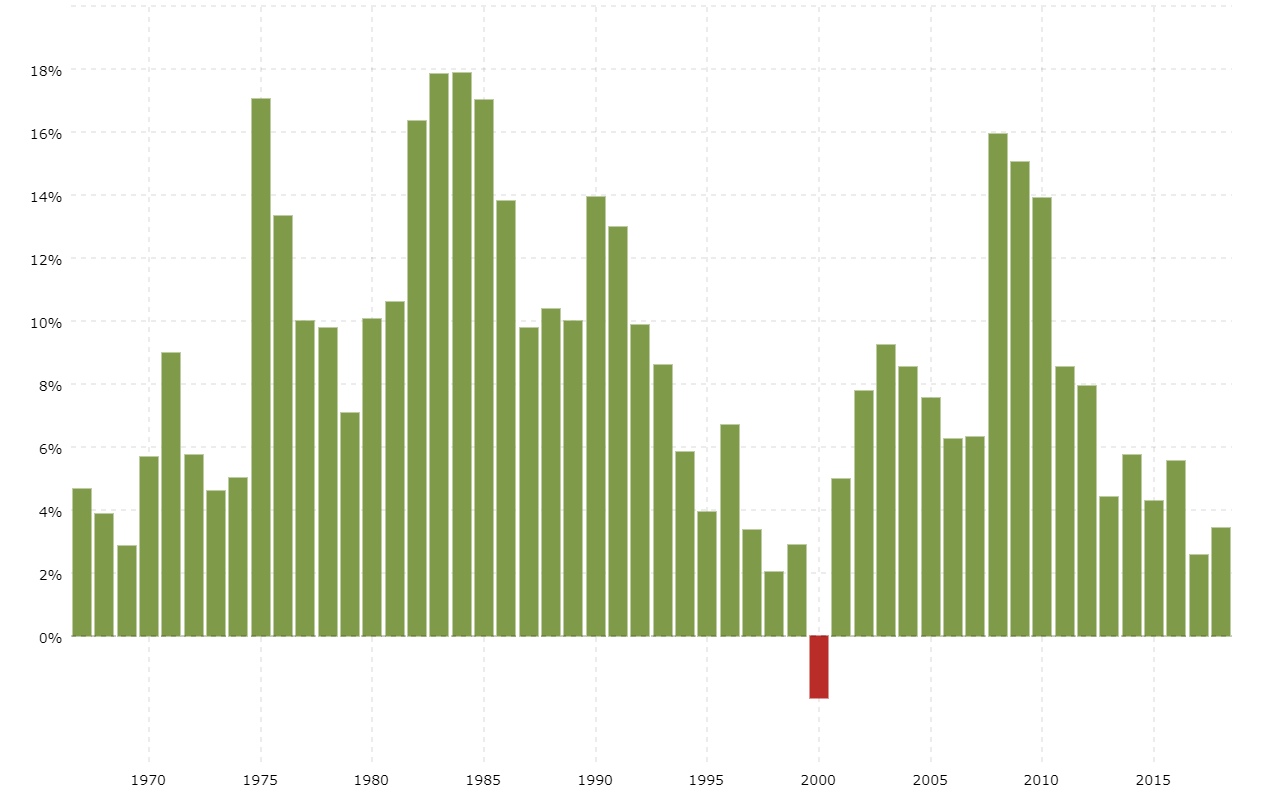

Then came the 1980s. Tax cuts combined with increased military spending under Reagan started a trend that never really stopped. By the time we hit the 2000s, things shifted into overdrive.

Think about it this way: 2001. We had a surplus. People were actually worried about what would happen if the US paid off all its debt. Fast forward through two wars, a massive tax cut in 2001 and 2003, and then the 2008 financial crisis. Suddenly, the "surplus" talk sounded like a fairy tale.

Why 2008 Was the Turning Point

When the housing bubble popped, the government stepped in with the Troubled Asset Relief Program (TARP). They had to. Or at least, they felt they had to. The debt jumped from about $9 trillion in 2007 to nearly $12 trillion by 2009. That was a massive leap.

But wait.

It didn't stop.

📖 Related: Yangshan Deep Water Port: The Engineering Gamble That Keeps Global Shipping From Collapsing

The US national debt by year since 2010 has looked like a steep mountain climb. We stayed in a "low interest rate environment" for a decade. This made borrowing cheap. It was like having a credit card with 0% APR; you just keep swiping because, hey, it’s free money, right? Except it isn't. Not forever.

The COVID-19 Explosion

If 2008 was a shock, 2020 was an earthquake. When the world shut down, the US government pumped trillions into the economy. Stimulus checks. PPP loans. Expanded unemployment. In 2019, the national debt was around $22.7 trillion. By the end of 2020? It was over $27.7 trillion.

That is five trillion dollars in a single year.

To put that in perspective, if you spent one dollar every second, it would take you about 32,000 years to spend one trillion. We did five of those in twelve months. It’s a staggering amount of liquidity. This is why we saw inflation go nuts in 2021 and 2022. Too much money chasing too few goods. It's basic economics, even if the politicians tried to act surprised.

Does the Debt Actually Matter?

Here is where the experts fight.

Economists like Stephanie Kelton, author of The Deficit Myth, argue for Modern Monetary Theory (MMT). She basically says that since the US prints its own currency, it can’t go bankrupt. The only real limit is inflation. On the other side, you’ve got folks at the Committee for a Responsible Federal Budget (CRFB) who are sounding the alarm. They point out that we’re now spending more on interest payments than we are on our entire military budget.

Think about that.

👉 See also: Why the Tractor Supply Company Survey Actually Matters for Your Next Visit

We aren't even paying down the principle. We're just paying the "rent" on the money we already spent. As of 2024 and 2025, interest costs are eating up a huge chunk of the federal budget. When interest rates rose to fight inflation, the cost of carrying that debt skyrocketed. It’s a vicious cycle.

A Year-by-Year Look at the Recent Chaos

Looking at the US national debt by year over the last decade shows a relentless trend.

- 2015: $18.1 trillion. The post-recession recovery was supposed to trim the fat. It didn't.

- 2017: $20.2 trillion. Tax cuts and Jobs Act (TCJA) added fuel to the fire.

- 2021: $28.4 trillion. The peak of the pandemic response.

- 2023: $33.1 trillion. Debt ceiling battles became a seasonal sport in D.C.

- 2025: Surpassing $36 trillion.

We are adding about $1 trillion to the debt every 100 days or so lately. It's becoming the new normal.

The Misconception of "China Owns Us"

You’ve probably heard someone at a BBQ say that China owns the US because they hold our debt. Not really. While foreign countries do own a lot of Treasury bonds, the biggest owner of US debt is actually... the US.

The Social Security Trust Fund, the Federal Reserve, and American investors (like you, if you have a 401k with bond funds) own the vast majority of it. We basically owe ourselves money. That doesn't make it "free," but it does mean the "China is going to repossess the White House" narrative is mostly nonsense.

What This Means for Your Wallet

High debt levels usually lead to a few things. First: higher interest rates for longer. The government has to compete with other borrowers, which can push rates up for everyone else. Second: potential for higher taxes down the road. Someone has to pay for this, eventually. Third: currency devaluation. If we keep printing to cover the gap, your dollar buys less at the grocery store.

We're already seeing this. Look at the price of eggs. Look at the price of a Ford F-150. These aren't just supply chain issues anymore; they are symptoms of a diluted currency.

✨ Don't miss: Why the Elon Musk Doge Treasury Block Injunction is Shaking Up Washington

Real Talk: Is There a Solution?

There are only three ways out of this.

You can grow the economy so fast that the debt becomes small by comparison. That’s hard when you’re already the biggest economy on Earth. You can cut spending and raise taxes. That’s political suicide. Or, you can "inflate" your way out. You let inflation run, making the debt worth less in real terms.

Most people think we're choosing option three by default.

What You Should Actually Do Now

Waiting for Congress to balance the budget is a losing game. It’s not going to happen anytime soon. Both parties love to spend; they just love to spend on different things. Here’s how you actually protect yourself.

Diversify your assets immediately. Don't just sit on cash. Cash is the biggest loser in a high-debt, high-inflation environment. Look into hard assets. Real estate usually holds its value. Some people swear by gold; others like Bitcoin. The point is to own things that the government can’t just print more of.

Fix your debt. If the national debt is causing interest rates to stay high, your credit card debt is going to kill you. Pay off high-interest loans now. If you have a fixed-rate mortgage, hold onto it like it's gold. You’re paying back the bank with "cheaper" dollars every year inflation stays up.

Watch the Treasury auctions. It sounds boring, but keep an eye on how well the US is selling its bonds. If investors start demanding much higher yields to buy US debt, that’s the signal that the "debt doesn't matter" era is officially over. That's when things get bumpy for the stock market.

Stay informed on tax shifts. Keep an eye on changes to capital gains and income tax brackets. As the debt grows, the "tax-free" windows usually start to close. Maximizing Roth IRAs now might be a very smart move before tax rates have to rise to cover the interest on the US national debt by year.

Protect your own "national debt" first. Stop worrying about the trillion-dollar headlines you can't control and start focusing on the balance sheet inside your own house.