The national debt is basically the world's most terrifying scoreboard. As of early 2026, the total gross national debt of the United States has officially climbed past $38.4 trillion. It's a number so large it feels fake. If you try to visualize it, you'll probably just get a headache.

Everyone loves to point fingers. If you’re at a Thanksgiving dinner, someone is eventually going to claim their favorite president was a fiscal saint while the "other guy" spent like a drunken sailor. Honestly, though? The u.s. national debt by president chart is way more complicated than just "Red vs. Blue."

It’s about wars, global pandemics, and massive tax overhauls that didn't always pay for themselves. It’s also about the weird way we track the "debt clock," where a president's first year is usually stuck with the previous guy’s budget.

Who Actually Added the Most?

If you look at raw dollar amounts, the numbers get scary fast once you hit the 2000s. Joe Biden and Donald Trump are at the top of the "most dollars added" list, but that’s a bit of a trick. $1 trillion in 1980 bought a lot more than $1 trillion does in 2026.

By the time Joe Biden finished his term, he had added roughly $8.5 trillion to the pile. Donald Trump was right behind him, adding about $7.8 trillion in just four years. But wait—you’ve gotta look at the why. For Trump, about $3.6 trillion of that was a direct result of emergency COVID-19 relief. For Biden, it was a mix of continued pandemic recovery, the Inflation Reduction Act, and massive infrastructure spending.

Now, look at Barack Obama. Over eight years, he added roughly $7.7 trillion. He walked into the 2008 Great Recession, which meant tax revenue cratered while spending on the "safety net" spiked.

Percentage Gains Tell a Different Story

Raw dollars are one thing, but percentage increases show who really shifted the gears of the economy. If we go way back, the record-holder isn't even a modern name.

- Franklin D. Roosevelt: Increased the debt by over 1,000%. Why? The New Deal and, you know, World War II.

- Woodrow Wilson: Saw a nearly 800% jump because of World War I.

- Ronald Reagan: He’s the modern outlier. Under Reagan, the debt grew by about 186%. He combined massive tax cuts with a huge buildup in military spending.

The Current 2026 Landscape

We’re sitting in January 2026, and the fiscal situation feels... heavy. The Treasury Department just reported that we’re adding about $6 billion a day to the debt. That is $4.29 million every single minute.

Total gross national debt hit $38.43 trillion on January 7, 2026. Here is the breakdown of where we stand right now:

- Debt held by the public: $30.81 trillion (This is what we owe to investors, foreign countries, and you, if you own savings bonds).

- Intragovernmental debt: $7.62 trillion (This is basically the government borrowing from its own Social Security and Medicare trust funds).

The Congressional Budget Office (CBO) is currently projecting a $1.7 trillion deficit for the 2026 fiscal year. One of the biggest drivers right now isn't even "new" spending—it's interest. Because interest rates stayed elevated for so long, the cost of just servicing the debt has become one of the largest items in the federal budget, right up there with defense.

Does the President Even Control the Chart?

Kinda. But not really.

✨ Don't miss: Ray J Scooter Bike Explained: Why the Scoot-E-Bike Faded but Changed Everything

There’s a huge misconception that a president walks into the Oval Office, opens a checkbook, and starts writing. In reality, the budget is a messy tug-of-war with Congress. Plus, about two-thirds of all federal spending is "mandatory." That means Social Security, Medicare, and Veterans’ benefits happen automatically based on laws passed decades ago.

A president really only has "discretionary" control over about a third of the budget.

The Lag Effect

When a president takes office on January 20th, they are operating under the budget signed by the previous president for at least the first eight months. This is why many economists argue that a president's fiscal legacy shouldn't even start being measured until their second year in office.

For instance, the massive 2009 deficit is often blamed on Obama, but the budget for that year was largely set by George W. Bush before the handoff. Similarly, much of the 2021 spending was baked in before the Biden administration really got their hands on the wheel.

🔗 Read more: How Much Is a Pound of Gold Worth Today: Why the Answer Isn't What You Think

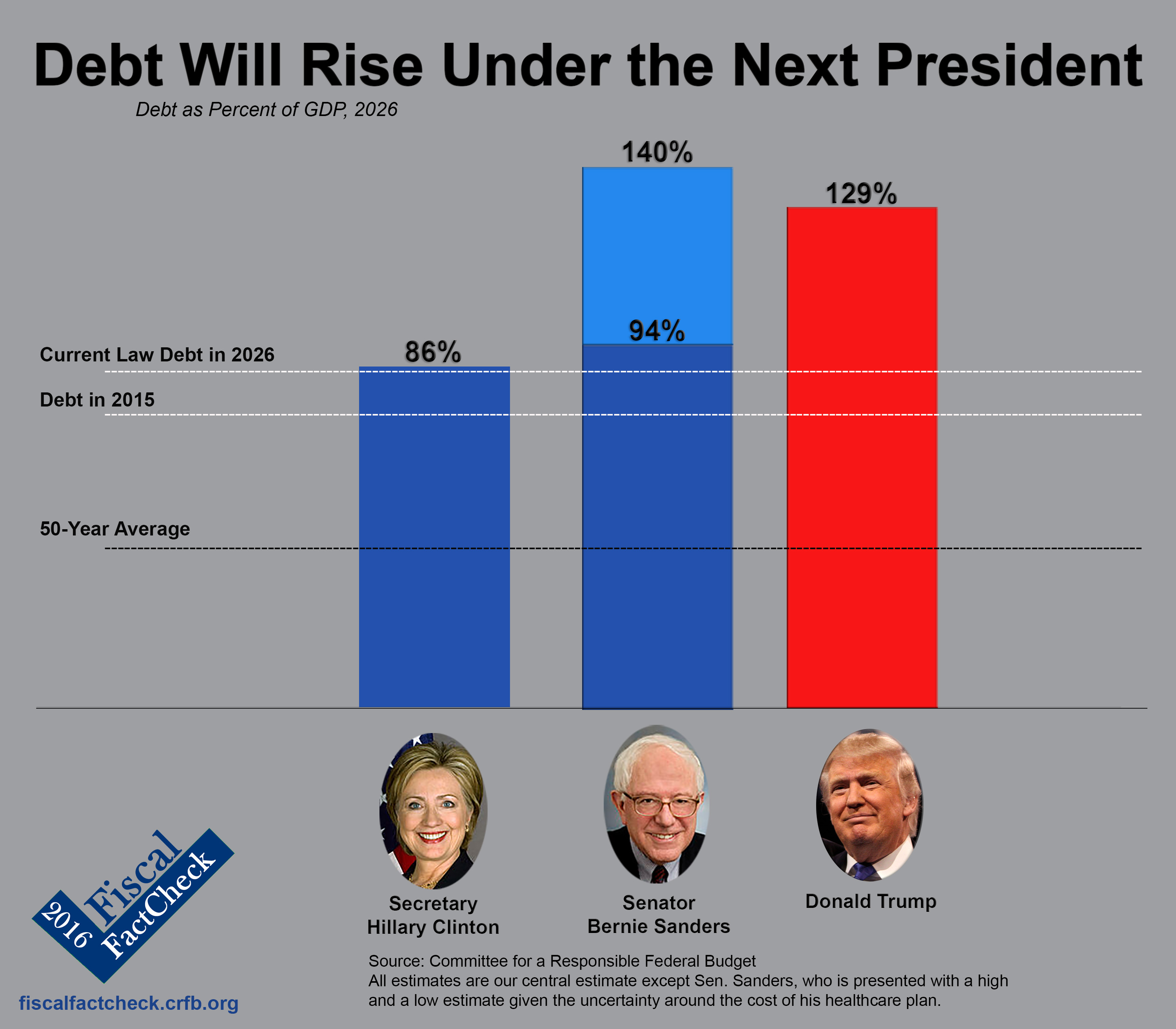

Debt as a Percentage of GDP: The "Real" Metric

Most economists will tell you that the dollar amount doesn't matter as much as the Debt-to-GDP ratio. Basically, how much do we owe compared to how much we produce?

- World War II Era: We hit about 106% of GDP. We paid that down significantly over the following decades.

- The 1970s: We were doing great, bottoming out around 33% of GDP.

- 2026 Projections: We are hovering around 126% of GDP.

This is the part that keeps the CBO up at night. When the debt grows faster than the economy, it gets harder to pay back. We aren't in a "crisis" yet because people still trust the U.S. dollar, but the margin for error is getting thinner every year.

What Happens Next?

Looking at the u.s. national debt by president chart, you see a clear trend: the debt rarely goes down. The last time we had a surplus was under Bill Clinton in the late 90s, thanks to a tech boom and some serious spending caps.

Since then, it’s been a vertical climb.

If you want to keep an eye on this, don't just look at the big scary total. Watch the Net Interest Outlays. In 2026, interest is expected to eat up nearly 14% of all federal spending. When we spend more on interest than we do on education or infrastructure, the "scoreboard" starts to have real-world consequences for your wallet.

Actionable Insights for the Curious:

- Check the Treasury's "Debt to the Penny" tool: It updates daily and shows the exact split between public and intragovernmental debt.

- Follow the CBO's Monthly Budget Review: This is where the "boring" but vital data lives. It tells you if we are actually collecting more in taxes (revenue) than we thought, which can offset some of the debt growth.

- Watch the "X-Date": Even with a $5 trillion debt limit increase signed in 2025, the 2026 projections suggest we'll be debating the debt ceiling again sooner than anyone wants.

- Understand your own "share": As of today, the national debt represents roughly $285,127 per U.S. household. Knowing that helps put the political debates into a much more personal context.