You wake up at 5:00 AM, stumble toward the coffee maker, and squint at your phone. Red. Everything is red. The US Dow Jones futures are down 400 points, and suddenly that "safe" blue-chip portfolio you’ve been building feels like a house of cards in a hurricane. We’ve all been there. It’s that visceral, gut-punch feeling of seeing numbers move before the New York Stock Exchange even rings the opening bell. But here is the thing: most people treat these futures like a crystal ball. They aren't. They’re a thermometer, and sometimes the thermometer is just sitting too close to a heat lamp.

The Reality of US Dow Jones Futures

Futures are essentially contracts. You are agreeing to buy or sell the value of the Dow Jones Industrial Average (DJIA) at a specific date in the future. Because the E-mini Dow and the Micro E-mini Dow trade nearly 24 hours a day, they become the "overnight" barometer for global sentiment. When a major chipmaker in Taiwan misses earnings or a central bank in Europe hints at a rate hike, the US Dow Jones futures react instantly. The regular stock market is asleep, so the futures market does the heavy lifting.

It's chaotic. Volume is often thin in the middle of the night, which means a single large sell order can send the "price" screaming lower, even if nothing fundamentally changed for companies like Coca-Cola or Goldman Sachs. You have to understand that "fair value" is a moving target. If the futures are down 1% but the "fair value" calculation (based on interest rates and dividends) suggests they should be down 1.2%, the market might actually open up. It’s counterintuitive. It’s messy.

💡 You might also like: Dollar Tree Gilmer TX Explained: What Most People Get Wrong

Why 30 Stocks Move the Whole World

The Dow is weird. Let's be honest about that. Unlike the S&P 500, which is market-cap weighted (meaning Apple and Microsoft carry the team), the Dow is price-weighted. If UnitedHealth Group (UNH) has a bad day, it drags the Dow down way more than a company with a lower stock price, regardless of their actual size. This quirk bleeds directly into how US Dow Jones futures trade.

Traders often watch the "Magnificent Seven," but for the Dow futures, you really need to watch the heavy hitters like Caterpillar, Boeing, and the big banks. When Boeing has a technical snafu with a 737, the futures can tank. Does that mean the entire US economy is failing? No. It means one-thirtieth of a very specific index is having a rough Tuesday.

The Leverage Trap

Let’s talk about money. Real money. One of the reasons US Dow Jones futures are so volatile is leverage. In the spot market, you buy a stock, you own the stock. In futures, you’re playing with borrowed power. For a few thousand dollars in margin, you can control a contract worth hundreds of thousands.

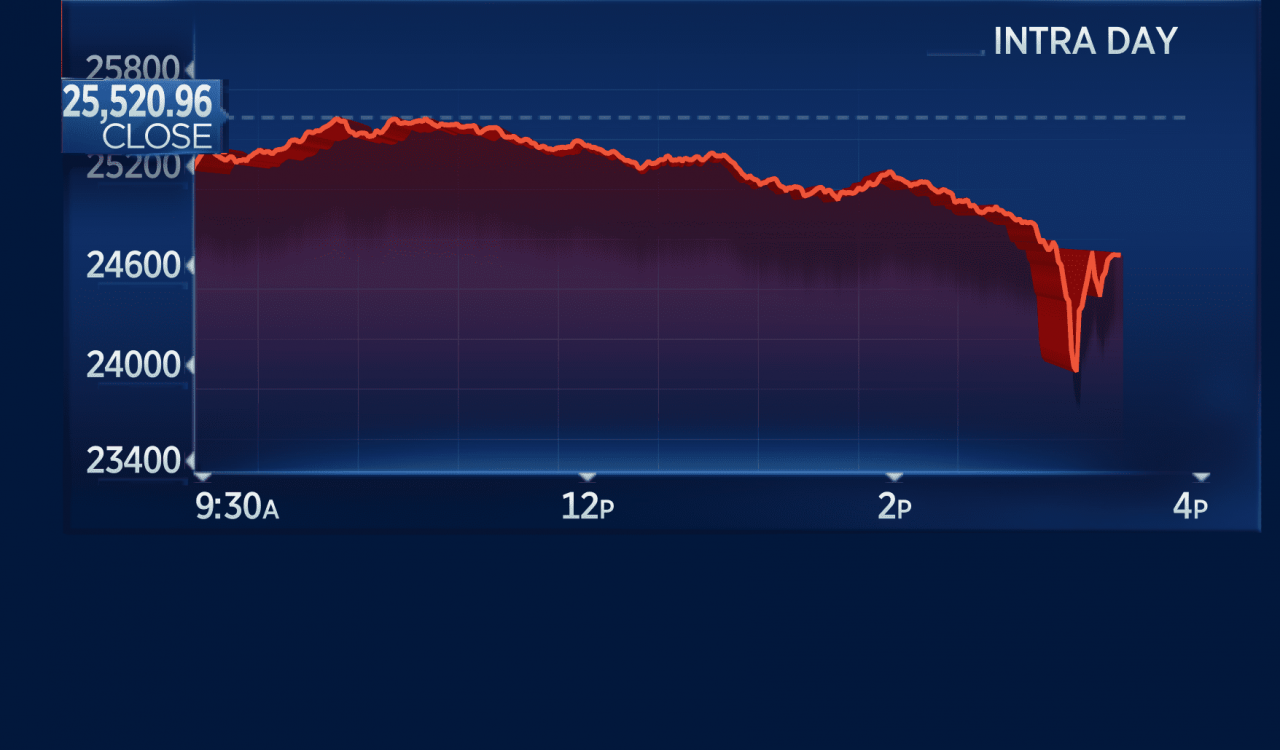

This is where the "human" element of the market gets scary. When prices start to dip at 3:00 AM, traders who are over-leveraged get margin calls. They are forced to sell. This creates a cascade—a "liquidation event"—where the price drops not because of bad news, but because people are being forced out of their positions. If you're looking at your app and seeing the Dow down 500 points at dawn, you might be seeing a panic-induced fire sale rather than a rational valuation of American industry.

How to Read the Pre-Market Noise

If you want to actually use US Dow Jones futures to make better decisions, you have to stop looking at the raw number. The number is a lie. Or at least, it’s a partial truth.

- Check the Volume: If the futures are down 200 points on low volume, ignore it. It’s noise. It’s a ghost in the machine.

- Look for Cross-Asset Confirmation: Are bond yields spiking? Is the Dollar Index (DXY) screaming higher? If futures are moving in a vacuum without the bond market or currency market backing them up, the move usually fades by 10:30 AM EST.

- The 8:30 AM Pivot: This is the "Goldilocks" zone. Major economic data—CPI, Payrolls, GDP—usually drops at 8:30 AM Eastern Time. This is when the US Dow Jones futures stop playing around and start reflecting reality. The gap between 8:30 and the 9:30 open is the most honest the market will be all day.

The Psychology of the Gap

Stocks love to fill gaps. If the US Dow Jones futures indicate a massive "gap down" at the open, there is a statistical tendency for the market to at least try to trade back up to where it closed the previous day. This is the "gap and trap." Amateurs see a red opening and sell everything. Professionals wait for the initial panic to subside, watch the "gap fill" attempt, and then decide their move.

Honestly, the biggest mistake is reacting to the 7:00 AM headlines. Headlines are designed to get clicks; futures are designed to manage risk. Those are two very different goals. If CNBC is screaming about a "Bloodlight in the Futures," take a breath. Look at the VIX (the volatility index). If the VIX isn't also spiking, the move in the Dow futures might just be a temporary rebalancing by institutional algos.

Actionable Steps for the Modern Investor

You don't need to be a day trader to benefit from watching the US Dow Jones futures, but you do need a strategy so they don't drive you crazy.

- Set "Alerts," Not "Orders": Never set a market order to sell at the open based on overnight futures. Use alerts to notify you of big moves, but wait at least 30 minutes after the 9:30 AM bell before clicking a button. This lets the "amateur hour" volatility wash out.

- Watch the "Big Three" Correlation: Compare the Dow futures to S&P 500 (ES) and Nasdaq 100 (NQ) futures. If the Dow is down but the Nasdaq is green, it’s a "rotation," not a market crash. Money is just moving from "Value" to "Growth."

- Utilize the Micro Contracts: If you actually want to trade these, start with the Micro E-mini Dow. The tick value is $0.50. It’s the best way to learn the rhythm of the market without losing your shirt. You get to feel the heat of the fire without getting third-degree burns.

- Ignore the "Point" Total: Focus on percentages. A 300-point drop sounds terrifying, but with the Dow at its current levels, that's a drop of less than 1%. In the 1990s, 300 points was a national emergency. Today, it's a rounding error. Keep your perspective proportional to the index's total value.

The market is a giant voting machine in the short term and a weighing machine in the long term. US Dow Jones futures are just the early morning votes. They represent the opinions of traders in London, Tokyo, and New York who are trying to get ahead of the curve. Sometimes they're right, but often, they're just reacting to the same morning coffee jitters as everyone else. Watch the trend, respect the volume, but never let a pre-market print dictate your long-term financial health.