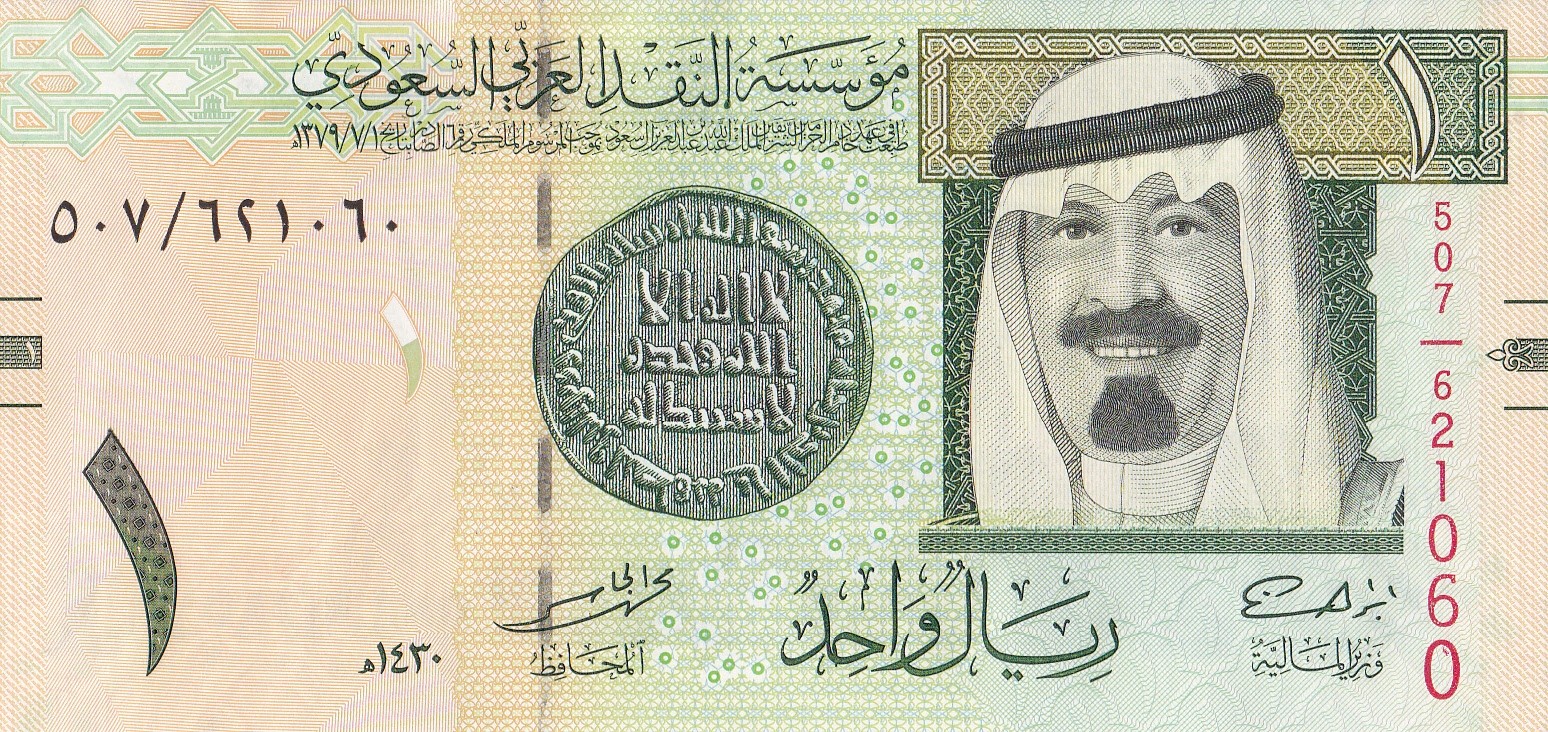

You might have noticed something weird if you’ve been watching the charts. For decades, the us dollar to sar exchange rate hasn't really moved. It sits there, stubbornly stuck at 3.75 Saudi Riyals (SAR) for every 1 US Dollar (USD). Most currency pairs dance around every second, like a caffeinated heart rate monitor. This one? It’s a flatline.

But why?

Honestly, it’s not an accident or a lack of market interest. It’s a deliberate, high-stakes choice by the Saudi Central Bank (SAMA). Since 1986, the Kingdom has pegged its currency to the dollar. They decided that stability was worth more than the flexibility of a floating rate.

The Secret Behind the 3.75 Magic Number

If you walk into a bank in Riyadh today—January 17, 2026—you’ll likely get that same 3.75 rate, maybe with a tiny fee tacked on. SAMA (the Saudi Central Bank) basically guarantees this. They have hundreds of billions in foreign reserves to back it up. If the market starts selling off riyals, the central bank just steps in and buys them back with their mountain of dollars.

📖 Related: Bob Wondries Ford Alhambra CA: What Really Happened to the Iconic Dealership

It's a simple system. Effective, too.

Actually, it’s more than just a convenience for travelers. Most of Saudi Arabia’s money comes from oil. Oil is priced in dollars globally. By keeping the us dollar to sar exchange rate fixed, the Saudi government ensures that their budget stays predictable. If the riyal fluctuated, a drop in the dollar would mean they couldn't pay their domestic bills, like salaries for teachers or soldiers, even if oil prices stayed the same.

Is the Peg Ever in Danger?

Speculators have tried to "break" the riyal before. Back in 2016 and again in 2020, during huge oil price crashes, some hedge funds bet that Saudi Arabia would have to devalue the currency. They thought the Kingdom would run out of dollars to defend the peg.

They were wrong.

The Saudi Central Bank has a "fortress balance sheet." Even when things look grim, they have enough cash to keep the us dollar to sar exchange rate exactly where it is for years, if not decades. For the peg to break, you’d need a catastrophic, long-term collapse in oil demand or a massive shift in global geopolitics.

What You Get Wrong About Exchange Fees

"But I saw 3.78 at the airport!"

Yeah, you probably did. While the interbank rate is 3.75, nobody gives you that for free. Banks and exchange houses like Al Rajhi or Western Union need to make a profit. They’ll usually charge you a spread.

If you're moving a lot of money, even a 0.01 difference feels like a punch in the gut.

- Avoid Airport Booths: They have the worst spreads because they know you're in a rush.

- Use Local Apps: STC Pay or specialized remittance apps in Saudi usually offer rates much closer to the 3.75 official mark.

- Watch the Forward Market: If you’re a business owner, look at "SAR Forwards." This is where traders bet on what the rate will be in 12 months. If the forward rate hits 3.85, it means the market is getting nervous about the peg.

The Petro-Dollar Connection

There’s a lot of talk lately about "de-dollarization" and BRICS. You’ve probably seen the headlines. Some people think Saudi Arabia will start pricing oil in Chinese Yuan.

If that happens, the us dollar to sar exchange rate might finally lose its anchor.

But don't hold your breath. Most of the Kingdom's investments are still in US Treasuries and American assets. Switching the currency peg is like changing the engine of a plane while it's mid-flight. It’s incredibly risky. For now, the riyal and the dollar are joined at the hip.

Actionable Steps for Navigating the Rate

If you are dealing with USD and SAR, don't just wait for the "right time" to exchange. Since the rate is fixed, the "right time" is mostly whenever you need the money. Instead, focus on minimizing fees.

💡 You might also like: How Many Yuan to a Dollar: Why the Number You See Online Isn't What You Actually Get

- Check the SAMA Daily Bulletin: If a local bank is offering you 3.80, they are ripping you off. The official rate is public.

- Negotiate for Large Transfers: If you are moving over $50,000, don't accept the retail rate. Call the bank’s treasury desk. They can often give you 3.7505 or something very close to the peg.

- Hedging is Rarely Needed: Unlike the Euro or Yen, you don't need complex insurance against the riyal dropping 10% tomorrow. It just doesn't happen.

The us dollar to sar exchange rate remains one of the most stable fixtures in the global financial world. It represents a "handshake" between the world’s biggest economy and its most influential oil producer. Until that relationship fundamentally shifts, 3.75 is the only number that matters.