So, the dollar is back. Kind of.

For months, the talking heads on financial news couldn't stop chatting about the "inevitable" collapse of the US Dollar Index. They pointed to the Federal Reserve’s rate cuts in late 2025, the messy government shutdown, and the rise of other currencies. But look at the charts today, mid-January 2026. The DXY—the basket that measures the dollar against six major peers—is showing some serious teeth.

After dipping toward the 98.00 handle at the start of the year, we’ve seen a steady climb back toward 99.13 and even 100.00. It turns out, betting against the world's reserve currency is a lot harder than it looks in a PowerPoint presentation.

What is Driving the US Dollar Index Rebound?

The reality is that "US Exceptionalism" isn't just a buzzword. It's basically a structural reality. While Europe struggles with growth and Japan tries (and fails) to make its interest rate hikes stick, the US economy is acting like a tank.

💡 You might also like: 1 Lakh Rupees in Dollars: Why the Math is Changing and What it Actually Buys You

Recent data has been surprisingly firm. We saw initial jobless claims drop below 200,000 recently, which pulled the four-week average down to its lowest level in two years. That’s not what a "cooling" economy looks like. It’s what a resilient one looks like.

The Fed Pause and Hawkish Whispers

Most people expected the Fed to just keep hacking away at interest rates until they hit the floor.

Wrong.

The market has drastically pared back its bets for a rate cut in the first quarter of 2026. Odds for a January cut? Only about 16-20% now. Fed Vice Chair Jefferson recently gave a speech emphasizing a "cautiously optimistic" view, essentially signaling that while they want to balance risks, they aren't in a rush to dump rates if growth remains this solid.

When the Fed doesn't cut as fast as the market expects, the dollar wins. Every single time.

Global Comparison: The "Ugly Contest"

The dollar doesn't have to be perfect; it just has to be better than the Euro and the Yen.

- The Euro: EUR/USD has been slipping from its late December highs. There is a total lack of fresh catalysts in the Eurozone. Without growth, the Euro is just a sitting duck.

- The Yen: This is the big one. USD/JPY is creeping back toward 160.00. Despite the Bank of Japan’s (BoJ) tiny rate hikes, the interest rate gap between the US and Japan is still a canyon.

- Safe Haven Flows: With the geopolitical tensions in the Middle East and the DOJ's weird investigation into Chair Powell earlier this month, investors naturally scurried back to the greenback.

The Technical Breakout: 100.00 is the Line in the Sand

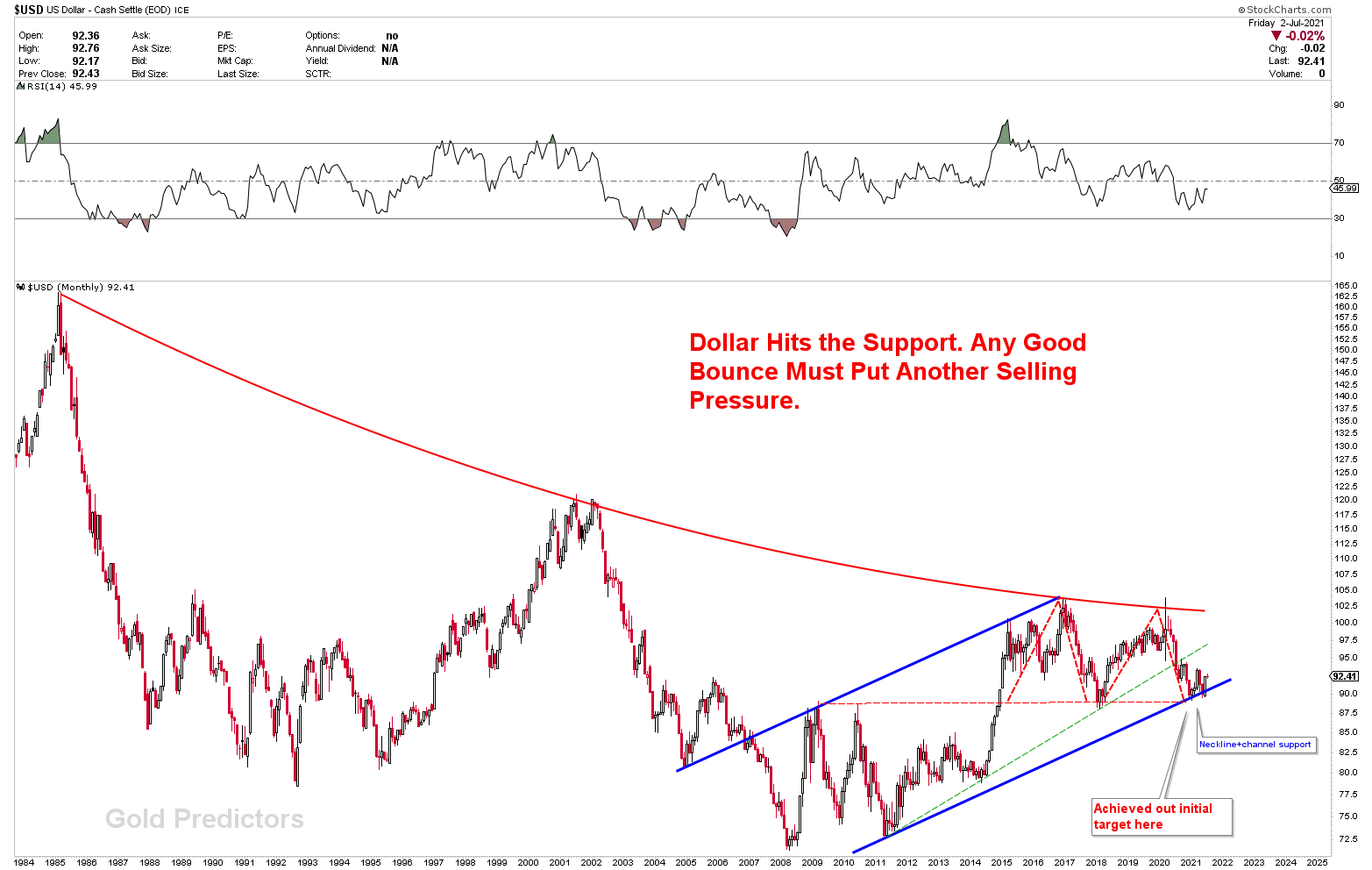

If you look at the technicals, the US dollar index rebound actually started with a "double-bottom" on the Relative Strength Index (RSI). Basically, the sellers got exhausted.

We broke out of a descending channel that had been weighing on the dollar since late November 2025. Now, everyone is watching the 100.00 to 100.22 zone. If the DXY can decisively close above 100, we aren't just looking at a "dead cat bounce." We’re looking at a potential run back to 102.00.

Honestly, a lot of asset managers were caught offsides. They were positioned for a weak dollar and a global rally. Now, they're having to cover those positions, which only fuels the fire.

Misconceptions About the Dollar’s Decline

Many analysts argued that the "One Big Beautiful Bill"—the massive fiscal stimulus package—would devalue the dollar by increasing debt.

It’s actually done the opposite.

The stimulus has boosted US GDP growth toward the 2.6% mark, far outpacing the 1.3% growth we're seeing in the Euro area. Money goes where the growth is. If the US is the only major economy providing a real return on capital, the dollar will stay strong regardless of the debt levels.

Actionable Insights for Investors

This isn't just about numbers on a screen. This rebound changes how you should handle your money right now.

- Stop Shorting the Dollar: The trend has shifted. Betting on a "dollar crash" in early 2026 is a recipe for losing money. Wait for a clear break below 98.00 before even thinking about it.

- Watch USD/JPY Levels: If the pair hits 160.00, keep an eye out for intervention from the Japanese Ministry of Finance. They’ve done it before, and they’ll do it again. That’s the only thing that might temporarily blunt the dollar's strength.

- Focus on US Large Caps: Companies with heavy domestic revenue are benefiting. A strong dollar can hurt exporters, so look for "US-centric" stocks that thrive when the domestic consumer is healthy and the currency is king.

- Re-evaluate Emerging Markets: A rising US dollar index rebound is usually bad news for EM. If you’re heavily invested in overseas markets, ensure those countries have enough dollar reserves to weather the storm.

The bottom line is that the US dollar isn't going anywhere. The reports of its demise were, as they say, greatly exaggerated.