Honestly, if you've been watching the us dollar index live chart lately, you’ve probably noticed things are getting a little weird. It’s January 2026, and the old "safe haven" rules aren't exactly playing out like the textbooks said they would.

While the DXY is hovering around the 99.17 mark today, the narrative behind that number is messier than a Monday morning commute. We’re seeing a tug-of-war between a Federal Reserve that’s trying to manage a cooling labor market and a global economy that’s basically reinventing itself through AI and shifting trade blocks.

Why the US Dollar Index Live Chart is More Than Just a Number

The DXY isn't just "the dollar." It's a benchmark. It measures the greenback against six other big players: the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc.

Most people forget that the Euro makes up over 57% of this index. So, when you see the us dollar index live chart spiking or crashing, you're often just seeing a reflection of what's happening in Brussels or Frankfurt, not just Washington.

✨ Don't miss: Chipotle Mexican Grill Reports First-Quarter Earnings: What Really Happened With Those Numbers

The math is actually pretty intense. It’s a weighted geometric mean that looks something like this:

$$DXY = 50.14348112 \times EURUSD^{-0.576} \times USDJPY^{0.136} \times GBPUSD^{-0.119} \times USDCAD^{0.091} \times USDSEK^{0.042} \times USDCHF^{0.036}$$

If that looks like alphabet soup, don't sweat it. Basically, it means the dollar is compared to these currencies in a way that gives the Euro a massive voice and the Swiss Franc a tiny whisper.

The Fed's Tightrope Walk in 2026

Right now, the big talk in the markets—and what's driving the volatility on your us dollar index live chart—is the Federal Reserve’s "data-dependent" stance.

Jerome Powell (who is currently facing some pretty wild political pressure and legal drama, by the way) has been dealing with a "low-hiring, low-firing" economy. Inflation is cooling—the latest December CPI came in at 2.7%—but it’s sticky.

- The "One Big Beautiful Bill": This fiscal stimulus is keeping the US economy afloat, with GDP growth expected to hit around 2.4% this year.

- Rate Cuts: Markets are currently betting on at least two rate cuts in 2026, likely in June and July.

- The Jobs Gap: While the headline numbers look okay, some analysts, like those at MUFG, think the real employment data is actually weaker than reported.

If the Fed cuts rates faster than the rest of the world, the dollar usually drops. But here’s the kicker: other central banks are in even worse shape. The ECB is basically paralyzed, and the Bank of Japan is moving at a snail's pace. This "least-dirty-shirt-in-the-laundry" effect is what's keeping the DXY from falling off a cliff.

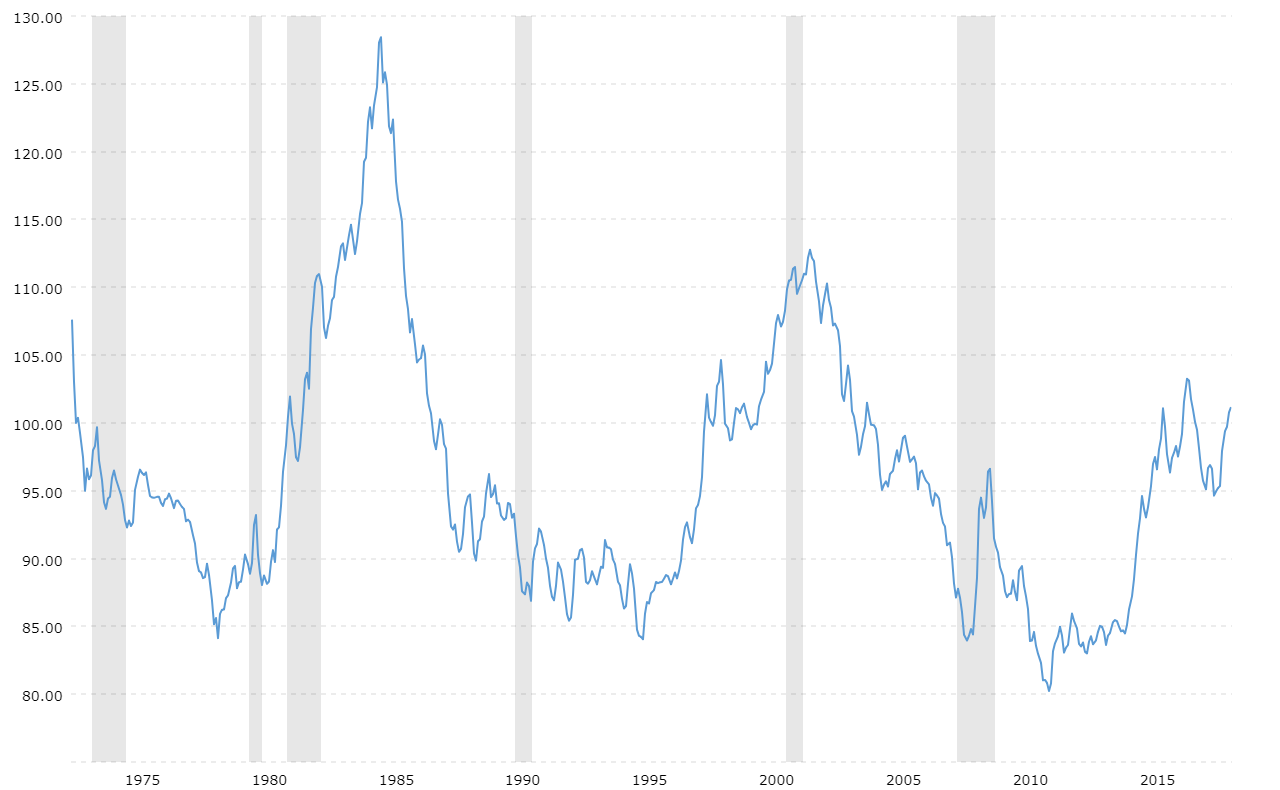

Reading the Charts: Support, Resistance, and Reality

When you pull up a us dollar index live chart, you aren't just looking for lines; you're looking for psychological battlegrounds.

Currently, the index has been finding a lot of resistance near the 100 level. That’s a massive psychological barrier. Every time it gets close, sellers seem to jump in. On the flip side, we've seen solid support around the 94 to 95 range.

"The dollar index should fall from its current level of around 100 to 94 in the second quarter of 2026, the lowest since 2021." — Morgan Stanley Research

🔗 Read more: Why 200 South Wacker Chicago IL is the sleeper hit of the Loop office scene

Is Morgan Stanley right? Kinda depends on who you ask. JP Morgan is a bit more bearish, citing "policy uncertainty" and the impact of tariffs that might actually be deflationary for the rest of the world but inflationary for the US.

What Actually Moves the Needle?

It’s not just one thing. It’s a cocktail of factors that shift every single day.

- Interest Rate Differentials: This is the big one. If US rates are higher than Europe’s, investors flock to the dollar to get a better return on their bonds.

- Safe Haven Status: Traditionally, when the world goes to hell, people buy dollars. But lately, we've seen a shift. Gold has been the preferred "panic button" asset in 2025 and early 2026, leaving the DXY a bit more exposed.

- Trade Policy: The "Plan B" tariffs from the current administration are a wild card. Section 201 moves—15% tariffs for 150 days—could shock the system at any moment.

How to Actually Use This Information

If you're just staring at the us dollar index live chart hoping it tells you the future, you're gonna have a bad time. You need to use it as a compass, not a crystal ball.

For example, if the DXY is ripping higher, it’s usually a signal that US tech stocks might feel some pressure (because their overseas earnings are worth less when converted back to dollars). It also usually means commodities like oil and copper will get more expensive for everyone else, which can slow down global growth.

Actionable Insights for Your Strategy

Don't just watch the numbers; watch the "why."

📖 Related: The Fifth Trial of AQL: Why This Specific Sampling Stage Changes Everything for Manufacturers

- Monitor the 2-Year Yield: The spread between US 2-year yields and the DXY-weighted yields of other countries is a leading indicator. If that spread narrows, the DXY is likely to follow it down.

- Watch the Euro (EUR/USD): Since it's the biggest chunk of the index, the DXY is basically the "Anti-Euro." If the ECB stays on hold while the Fed cuts, the Euro rises and the DXY falls.

- Look at the "DOGE" Effect: The Department of Government Efficiency (DOGE) resignations and administrative shifts are creating "noise" in the economic data. Take the NFP (Non-Farm Payroll) numbers with a grain of salt for a few months until the data stabilizes.

The dollar isn't "dying"—that’s a headline for people who don't trade. But it is definitely in a period of transition. The bull run that started years ago is tired. Whether it recovers or slides down to that 94-level depends entirely on whether the US can keep its "exceptionalism" narrative alive while the rest of the world tries to catch up.

Keep your eye on the us dollar index live chart during the next FOMC press conference. That's where the real moves happen. If Powell hints at a third cut or expresses more worry about the jobs market than inflation, expect that 99 support level to turn into a ceiling very quickly.

Next Steps for Traders:

- Verify the 99.00 support level: Check if the index holds this floor during the upcoming PPI and retail sales data releases this week.

- Analyze the EUR/USD 1.1650 zone: Since the Euro is the primary driver of the DXY, a breakout above 1.1700 in the Euro will almost certainly trigger a sharp decline in the Dollar Index.

- Track Gold vs. DXY correlation: If both are rising simultaneously, it signals extreme global macro anxiety; if they diverge, it’s business as usual.