Honestly, if you’re looking at your bank app and wondering why the loonie feels like it’s stuck in a tailspin, you aren't alone. It’s been a rough week for the Canadian dollar. As of this morning, Friday, January 16, 2026, the us dollar exchange rate in canada today is hovering right around 1.3894 CAD.

That is a lot of "loonies" for a single greenback.

Just a few weeks ago, there was this sense of cautious optimism. People thought maybe the Bank of Canada and the Fed would move in lockstep. Nope. Not even close. What we’re seeing right now is a classic "divergence." The U.S. economy is acting like it’s had way too much espresso, while Canada is... well, Canada is feeling a bit sluggish.

Why the US Dollar is Winning the Tug-of-War

Markets are basically betting machines. Right now, they’re betting that the U.S. Federal Reserve is going to sit on its hands for a while. Even though the Fed cut rates back in December to a range of 3.5%–3.75%, the latest data shows U.S. retail sales jumped 0.6% in November. People are spending. Inflation is sticky. Because of that, nobody expects Jerome Powell to cut rates at the next meeting on January 28. High rates mean a strong dollar. It's that simple.

✨ Don't miss: Francisco Javier Rodríguez Borgio: What Most People Get Wrong

Canada has a different set of problems.

The Bank of Canada (BoC) is currently sitting at a 2.25% policy rate. While the U.S. is worried about things getting too hot, our central bankers are looking at a 6.8% unemployment rate and wondering if they need to do more to keep the lights on. There is a massive 150-basis-point gap between U.S. and Canadian rates. When investors can get 3.75% in the States versus 2.25% here, they don't buy loonies. They buy greenbacks.

The Oil Factor: A Double-Edged Sword

You've probably noticed gas prices creeping up again. Usually, that’s great for the Canadian dollar because we’re a massive oil exporter. West Texas Intermediate (WTI) is trading near $88 a barrel today due to some serious geopolitical tension in Europe and the Middle East.

Typically, this would send the CAD soaring.

But it’s not happening. Why? Because the "safe haven" trade is winning. When the world gets messy, everyone runs to the US dollar like it’s a reinforced bunker. The "oil boost" we usually get is being completely neutralized by people terrified of global instability. It's a weird spot to be in. We have the commodity strength, but the "fear factor" is keeping the US dollar exchange rate in Canada today much higher than it probably should be based on fundamentals alone.

What Most People Get Wrong About Today's Rate

Most people think the exchange rate is just about "is our economy good or bad?" It’s more about "is our economy better or worse than the U.S.?"

Right now, the U.S. is the outlier. While most of the world is cooling down, the American consumer is still a powerhouse. This makes the us dollar exchange rate in canada today particularly painful for Canadian travelers or businesses importing equipment from south of the border.

If you’re planning a trip to Florida or Arizona right now, you’re basically paying a 39% "tax" on everything you buy. That $100 dinner is actually $139 before you even tip.

💡 You might also like: 7-Eleven Parent Company: What Really Happened Behind the Scenes

What Really Happened with the Recent Forecasts

Earlier this month, some analysts at RBC and TD were actually predicting the loonie might stabilize. They pointed to the fact that Canada’s inflation had dipped to 2.8%, which is pretty close to the 2% target.

But then the U.S. Producer Price Index (PPI) came out higher than expected. It showed a 3.0% year-over-year increase. Suddenly, the "Fed will cut in early 2026" narrative died. If the Fed stays high and the BoC stays low (or cuts further), that 1.40 CAD mark starts looking like a very real possibility. We aren't there yet, but we're knocking on the door.

Actionable Insights for Today

Look, nobody has a crystal ball, but the trend is pretty clear. If you have to move money, you need a strategy.

- If you're a snowbird: Honestly, you might want to look into USD-denominated accounts or "average-in" your currency buys. Don't try to time a massive "dip" in the US dollar that might not come for months.

- For Small Businesses: If you import from the U.S., your margins are getting squeezed right now. It might be time to look at forward contracts to lock in this 1.39 rate before it potentially hits 1.41.

- Watch the January 28 meeting: That is the next big "volatility event." If the BoC hints at a rate cut while the Fed stays hawkish, expect the loonie to take another hit.

The reality of the us dollar exchange rate in canada today is that we are tied to the mast of the U.S. economy. Until the Fed decides it’s officially "mission accomplished" on inflation, the loonie is going to have a hard time finding its wings.

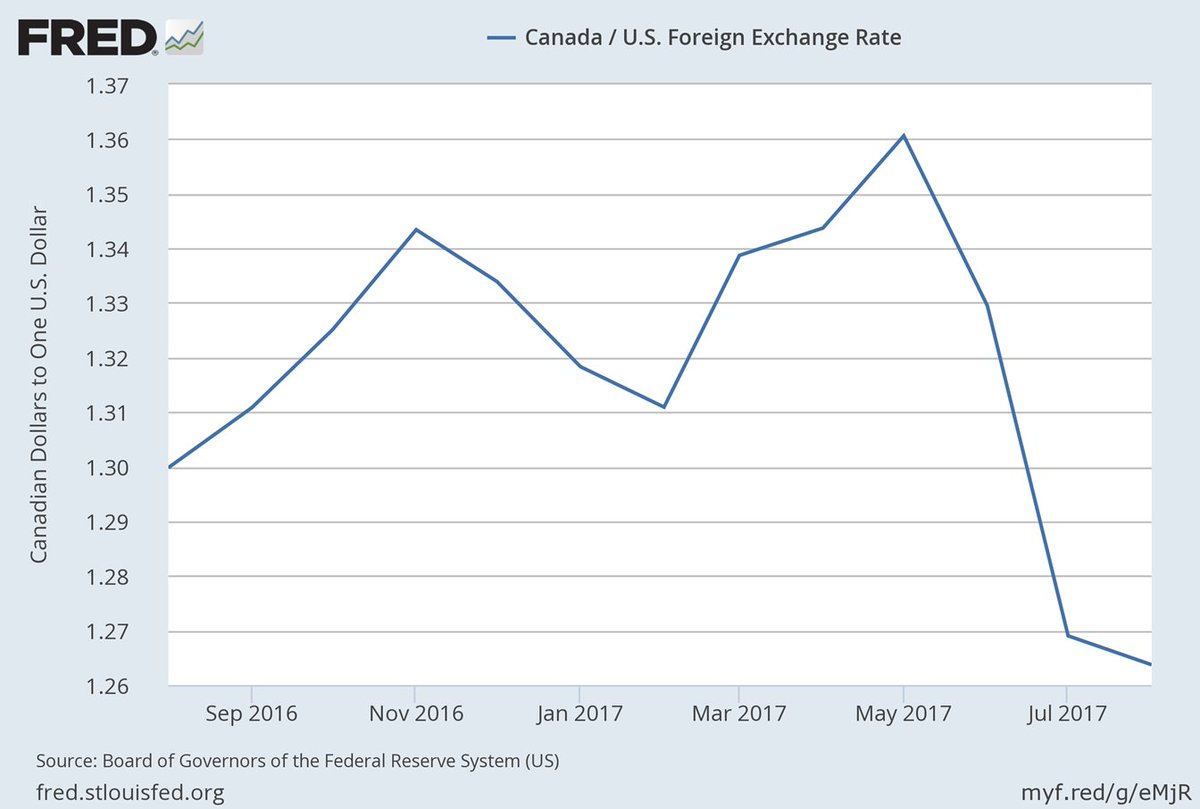

For those waiting for a return to the 1.30 days? You might be waiting a while. The structural gap in interest rates and the "safety" of the U.S. dollar are just too strong right now. Keep an eye on the oil charts, but don't expect them to save us unless the Fed starts blinking.