Money is weird. We use it every day, but most of us don't really look at it. You hand over a twenty for a sandwich and some coffee, get a five and some ones back, and shove them into your pocket without a second thought. But if you stop to actually look at US dollar denominations, you’re holding a mix of history, security engineering, and a surprising amount of drama.

The Greenback isn't just one thing. It's a suite of specific bills, each with a story. Honestly, the stuff people get wrong about our currency could fill a vault. Some folks think the two-dollar bill is fake or "unlucky." Others are convinced there are million-dollar bills floating around in secret government circles. Spoiler: there aren't. But there used to be $10,000 bills, which is arguably cooler anyway.

The Bills You Actually See Every Day

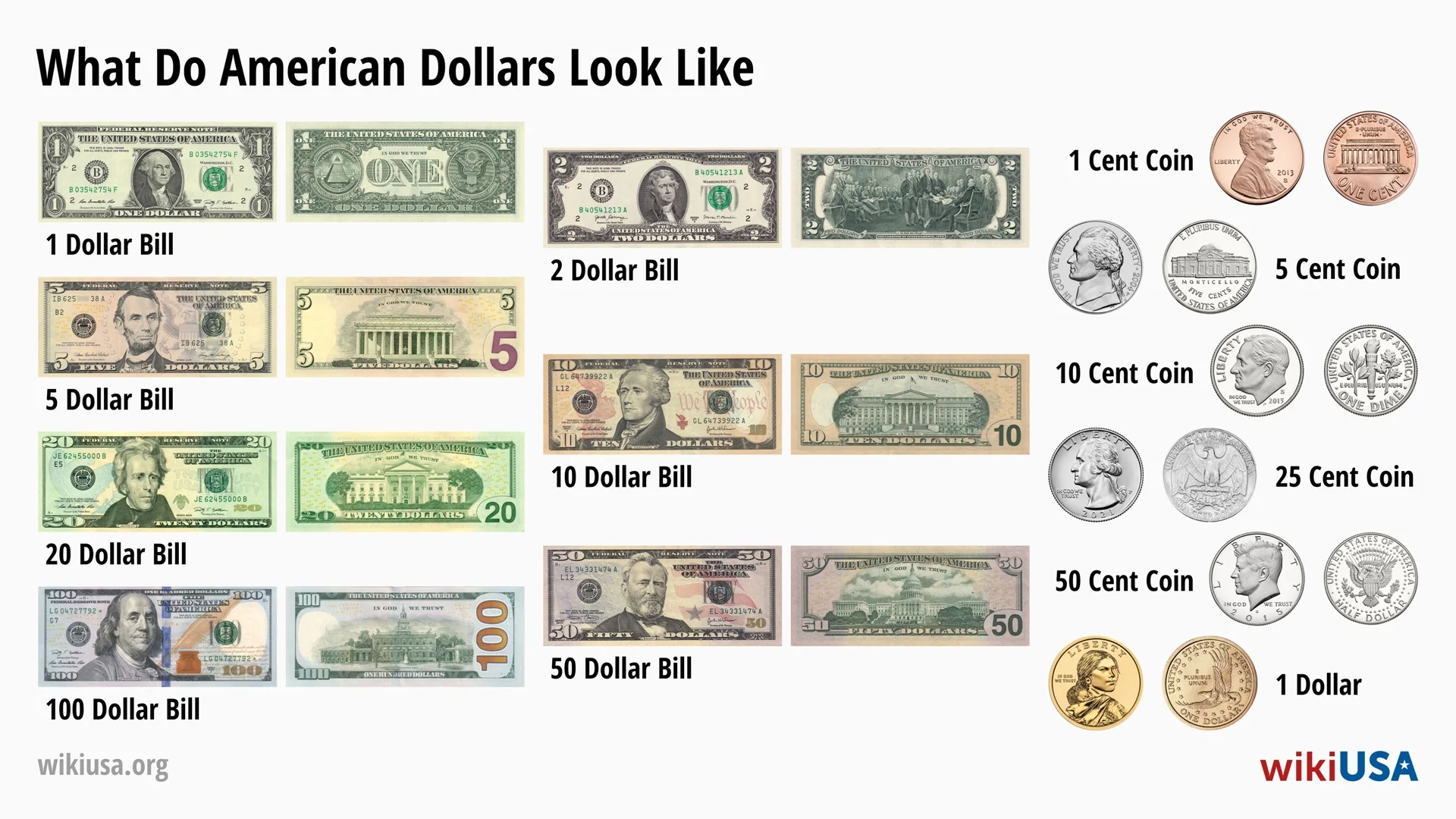

Let’s start with the basics. The United States currently issues seven denominations of Federal Reserve notes. These are the ones the Bureau of Engraving and Printing (BEP) cranks out by the billions.

The Single ($1). It’s the workhorse. George Washington’s face has been on this thing since 1869, and frankly, it doesn't look like he's going anywhere. Interestingly, the $1 bill is the only denomination that doesn't get a "fancy" redesign. Why? Because it’s so cheap to produce and so widely used that adding high-tech security features would just be a logistical nightmare. It’s also the most common bill, making up a massive chunk of the currency in circulation.

The Deuce ($2). This is the one that confuses cashiers. Thomas Jefferson is on the front, and the signing of the Declaration of Independence is on the back. It’s totally legal tender. People often "hoard" them because they think they’re rare, but the Treasury still prints them. If you want a stack of fifty $2 bills, you can literally just walk into a bank and ask for them. They aren't worth more than two bucks, though collectors sometimes pay a premium for "star notes" or older series.

The Five ($5). Abraham Lincoln. The Great Emancipator. This bill got a purple-ish makeover a few years back to help prevent counterfeiting. Did you know the $5 bill has a life expectancy of about 4.7 years? It gets handled a lot.

The Ten ($10). Alexander Hamilton is the star here. He wasn't a president, which is a common trivia trap. He was the first Secretary of the Treasury. There was a big push a few years ago to replace him with a woman from American history, but then a certain Broadway musical made Hamilton a superstar again, and the Treasury decided to keep him.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

The Twenty ($20). Andrew Jackson is currently on the front, though Harriet Tubman is slated to eventually take over the primary portrait. This is the ATM king. If you’ve ever wondered why your wallet is always full of twenties, it’s because banks decided decades ago that this was the most efficient "mid-tier" bill for automated machines.

The Fifty ($50). Ulysses S. Grant. Not as common as the twenty, but very much in circulation. Most people find them slightly annoying because they feel "too big" to spend at a gas station but "too small" for a major purchase.

The Hundred ($100). Benjamin Franklin. The "Benjamin." This is the most technologically advanced bill the US makes. It has a 3D security ribbon and a bell in an inkwell that changes color. Fun fact: more $100 bills exist outside the US than inside it. It’s the world’s favorite way to store value off the grid.

Why Some US Dollar Denominations Disappeared

You might have heard of the "big" bills. We’re talking $500, $1,000, $5,000, and $10,000 notes. There was even a $100,000 Gold Certificate used exclusively for transactions between Federal Reserve banks.

They’re real. Or they were.

In 1969, the Department of the Treasury and the Federal Reserve announced that currency notes in denominations of $500, $1,000, $5,000, and $10,000 would be discontinued. The reason was pretty simple: lack of use. By the late 60s, wire transfers and checks had made carrying a $10,000 bill—which would be worth nearly $80,000 in today's money—unnecessary and incredibly risky.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

Also, they were a gift to organized crime. If you're trying to move a million dollars in illicit cash, it’s much easier to hide a stack of $10,000 bills in a briefcase than it is to haul around pallets of twenties.

If you happen to find one of these in your grandma’s attic, it is still legal tender. You could spend a $500 bill at a grocery store, but you’d be an idiot to do so. These bills are worth significantly more than their face value to collectors. A $10,000 bill in good condition can fetch over $150,000 at auction.

The Mystery of the $100,000 Bill

This is the holy grail of US dollar denominations. It features Woodrow Wilson. It was printed in 1934 during the Great Depression. However, you were never allowed to own one. It was never released to the general public. It was used as a "Gold Certificate" for internal government accounting. Basically, it was a way for one government vault to tell another government vault, "Hey, we owe you a ton of gold."

Today, you can only see them at places like the Smithsonian or the Museum of American Finance. Owning one as a private citizen is actually illegal, though that doesn't stop the occasional counterfeit from popping up on the dark web.

Security Features: How to Spot a Fake

The BEP doesn't just print on paper. It's not even paper, actually. It's a blend of 75% cotton and 25% linen. That’s why your money doesn't fall apart when you accidentally leave it in your jeans and run them through the wash.

When you’re looking at different US dollar denominations, you should check for these specific "tells" to ensure the bill is legit:

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

- The Watermark: Hold the bill up to the light. You should see a faint image of the person on the portrait in the white space to the right. If it’s not there, or if it looks like it was drawn on with a Sharpie, you've got a problem.

- The Security Thread: This is a thin vertical strip that glows a specific color under UV light. On a $5 bill, it glows blue. On a $10, it’s orange. On a $20, it’s green. The $50 glows yellow, and the $100 glows pink.

- Color-Shifting Ink: Tilt the bill. The number in the bottom right corner should change from copper to green. This is incredibly hard for amateur counterfeiters to replicate because the ink itself is highly regulated.

- Microprinting: There are tiny words hidden in the design that look like solid lines to the naked eye. You need a magnifying glass to see them, but they’re crisp and clear on real bills. On fakes, they usually look like blurry, broken lines.

The Future of Physical Cash

People keep saying cash is dying. "We’re going cashless!" "Bitcoin is the new dollar!"

Maybe. But the numbers tell a different story. According to the Federal Reserve's 2024 Diary of Consumer Payment Choice, cash still accounts for a significant portion of all payments, especially for transactions under $25.

There is a psychological weight to physical US dollar denominations that digital numbers on a screen just don't have. Studies consistently show that people spend less when they have to physically hand over a $20 bill than when they just tap a phone.

We’re also seeing a "flight to safety." In times of economic uncertainty, people want cash under the mattress. It’s why the demand for $100 bills keeps skyrocketing. It’s the ultimate insurance policy.

Actionable Insights for Handling Currency

If you’re dealing with cash frequently, whether for a small business or just personal use, here are the practical steps to stay savvy:

- Audit your "rare" bills. If you have old $500 or $1,000 notes, do not take them to a bank to deposit them. They will only give you face value. Take them to a reputable numismatic (coin and currency) dealer.

- Check your $20s. Since the $20 is the most commonly counterfeited bill within the US, get into the habit of feeling the paper. Genuine US currency has "raised printing" that feels slightly rough to the touch. Run your fingernail over the vest of the portrait; you should feel distinct ridges.

- Don't fear the $2. If you’re a business owner, start handing out $2 bills as change. It’s a gimmick that actually works—customers remember the shop that gave them the "cool" bill, and it’s perfectly valid currency.

- Verify large bills immediately. If someone pays you with a $50 or $100, use the "tilt test" for the color-shifting ink. It takes two seconds and is more reliable than those yellow detector pens, which can be fooled by bleached paper.

- Check for "Star Notes." Look at the serial number. If there is a small star at the end of it, that means it’s a replacement bill printed because the original had an error. These are often worth more than face value to collectors, even for $1 bills.

The US dollar remains the global reserve currency for a reason. Its denominations are recognized in every corner of the planet, from the high-rises of Tokyo to the street markets of Cairo. Understanding what you're holding—and why it looks the way it does—is just basic financial literacy.

Next Steps for Currency Management:

- Examine your current cash: Take out a $10 or $20 and find the microprinting and the security thread. Knowing what "real" looks like is your best defense.

- Visit a Federal Reserve Bank: Many locations, like the one in Chicago or Atlanta, have free museums where you can see the rare $10,000 and $100,000 notes in person.

- Monitor the Treasury's redesign schedule: Keep an eye on the "U.S. Currency Education Program" website for announcements regarding the upcoming Harriet Tubman $20, which will introduce even more advanced security features.