Money isn't just paper; it's a pulse. If you've looked at the us dollar canadian dollar exchange rate lately, you know that pulse is racing. As of mid-January 2026, the pairing—famously known in trading circles as "the Loonie"—is hovering around the 1.39 mark.

Honestly, it's a bit of a rollercoaster. One day you're planning a cross-border shopping trip to Buffalo, and the next, you're rethinking that $15 cocktail in Manhattan. But why does this specific currency pair act so erratically? Most people think it’s just about which country has a "stronger" economy. That is a massive oversimplification.

The Oil Slick in Your Wallet

Canada is a resource powerhouse. You can’t talk about the Loonie without talking about West Texas Intermediate (WTI). Crude oil is Canada's biggest export, and when global oil prices dip—as they did recently following shifts in US energy policy—the Canadian dollar usually catches a cold.

📖 Related: Why an Income Tax Calculator With 1099 Features Is Your Best Friend This Year

When oil prices slide, global demand for Canadian dollars (to buy that oil) drops. It’s basic supply and demand. Recently, we’ve seen oil prices take a hit of nearly 2% in a single week. Predictably, the us dollar canadian dollar exchange rate climbed toward 1.3920. If you’re a Canadian exporter, you’re kinda smiling. If you’re a Canadian consumer buying imported tech or fresh produce, you’re definitely not.

Interest Rates: The Great Tug-of-War

Central banks are the real puppet masters here. Tiff Macklem at the Bank of Canada and the folks at the US Federal Reserve are currently locked in a delicate dance.

The Fed has been keeping rates steady because US inflation—specifically core CPI—is still "sticky" at around 2.8%. Meanwhile, the Bank of Canada is facing a cooling economy. There’s a growing gap between what you can earn on a US bond versus a Canadian one.

- US Yields: High interest rates in the States attract global investors looking for better returns. This pumps up the Greenback.

- Canadian Yields: If the Bank of Canada has to cut rates to jumpstart a stalling housing market or help struggling retailers, the Loonie loses its luster.

Nick Rees, a macro research expert at Monex Canada, recently pointed out that this divergence is a primary driver for the pair right now. Basically, the US economy is acting like a bodybuilder on protein shakes, while Canada is just trying to make it through a long winter.

What’s Actually Happening in 2026?

It’s easy to get lost in the jargon. Let’s look at the raw numbers. In early January 2026, the rate was sitting at 1.3716. Within just two weeks, it surged to 1.3924. That’s a move of over 1.5% in seventeen days. In the world of currency, that is a lightning strike.

The USMCA Ghost

There is a giant elephant in the room: the US-Mexico-Canada Agreement (USMCA) renegotiation. Trade uncertainty is like poison for a currency. Investors hate not knowing what the rules will be in twelve months.

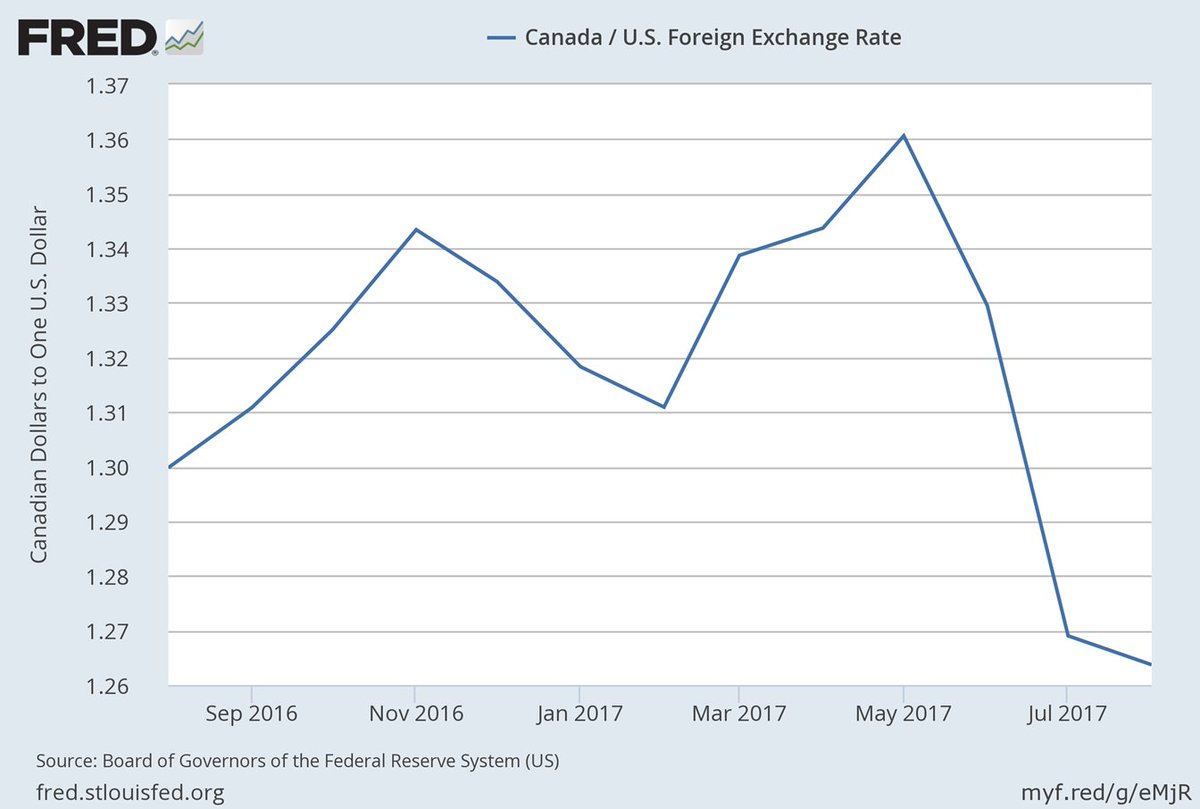

We saw this in 2025. The Loonie actually managed to gain about 5% against the US dollar that year, ending at 1.37. But that was after a terrifying plunge to 1.46 in April following tariff threats. The us dollar canadian dollar exchange rate is incredibly sensitive to political rhetoric. One tweet or official "memorandum" about cross-border trade can send the rate spiraling before the ink is even dry.

The Housing Market Connection

You might wonder what a condo in Toronto has to do with the exchange rate. A lot, actually. The Canadian Real Estate Association (CREA) just updated its 2026 forecast, noting that pent-up demand is finally breaking.

As more Canadians jump back into the housing market, the Bank of Canada has to be careful. If they keep rates too high to protect the currency, they might crush the housing recovery. If they lower them too fast to help homeowners, the us dollar canadian dollar exchange rate could easily blow past 1.40. It is a "damned if you do, damned if you don't" scenario for Canadian policymakers.

Actionable Insights for the "Normal" Person

Stop trying to time the bottom. Professional traders with billion-dollar algorithms get this wrong all the time. Instead, focus on what you can control.

If you are a Canadian heading south, consider "averaging in." Buy your US dollars in smaller chunks over several weeks rather than one big lump sum. This protects you from a sudden spike in the us dollar canadian dollar exchange rate.

For investors, look at commodity-linked equities. As Dale Jackson recently noted in his market analysis, investing in companies that produce oil or lumber can act as a natural hedge. When the Canadian dollar falls, these companies often see their profits rise because they sell their goods in—you guessed it—US dollars.

Check the WTI crude prices and the latest US jobs report. If US employment stays strong (like the 210,000 jobs added in December), expect the US dollar to stay dominant. If oil manages to break back above $80, the Loonie might finally find its footing.

Keep your eye on the 1.40 level. Psychologically, that’s the "line in the sand." If the rate breaks above that, we could see a very different economic landscape for the rest of 2026.

Manage your exposure, stay diversified, and don't let a 2-cent swing ruin your vacation or your business plan. Knowledge is the only real hedge you have.