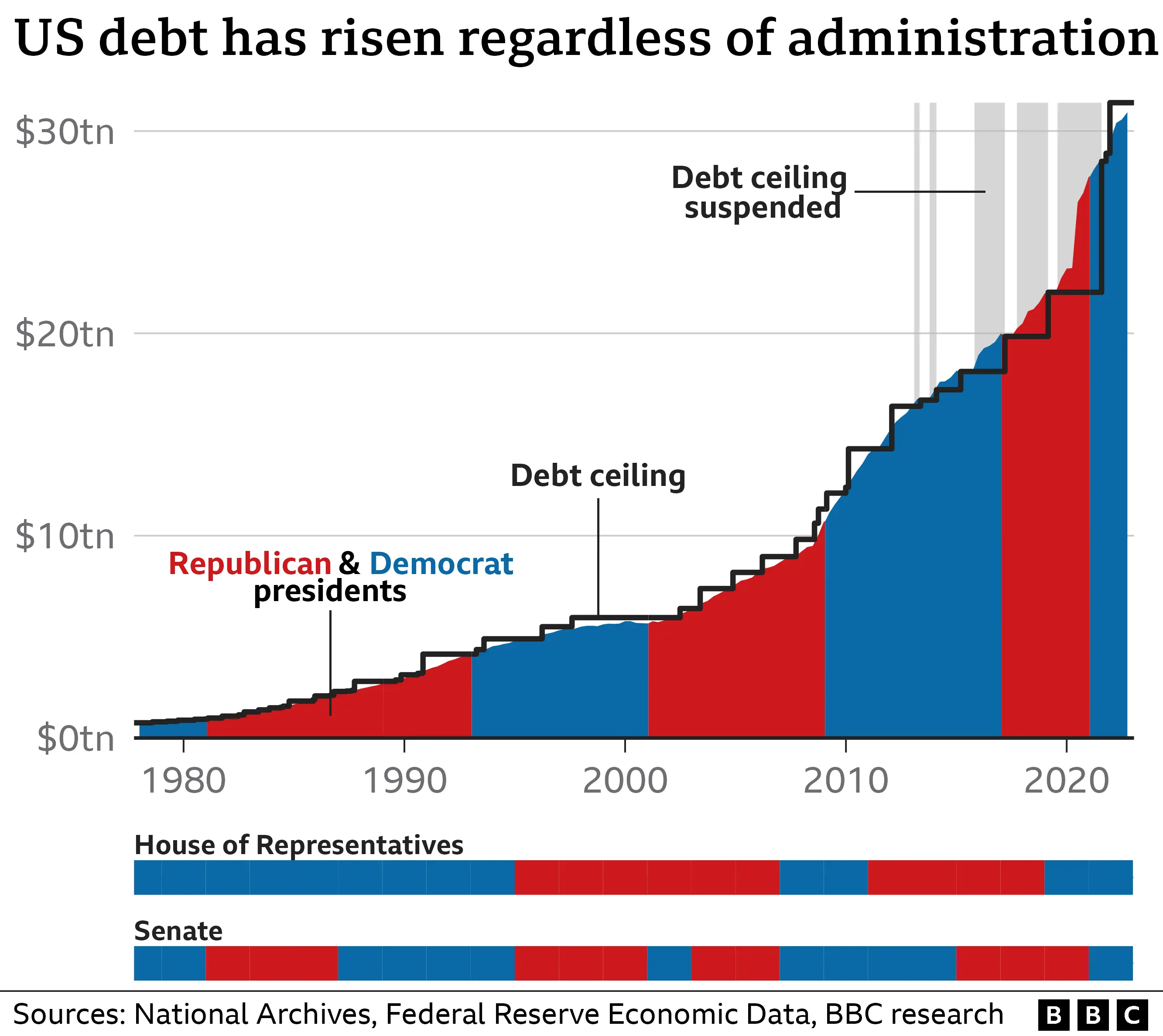

If you’ve ever scrolled through a heated political thread, you’ve probably seen it. Someone posts a us deficit by president graph with jagged red lines climbing toward the moon, usually accompanied by a caption blaming whoever is currently in the Oval Office. It’s the ultimate "gotcha" tool. But honestly? Most of those graphs are missing half the story.

Looking at a raw chart of federal deficits is like looking at a photo of a car crash without knowing if the driver was speeding or if someone else blew through a red light. The numbers are real, sure. But the why is where things get messy. As we sit here in 2026, looking back at the fiscal wreckage of the last few decades, it’s clear that a president’s "deficit score" is often a mix of their own choices and some really bad luck they inherited from the person who sat in the chair before them.

The Difference Between Debt and Deficit (Basically)

Before we get into who spent what, let’s clear up the jargon because people mix these up constantly. The deficit is how much extra the government spends in a single year. If the Treasury brings in $4 trillion but spends $5 trillion, the deficit is $1 trillion. The debt is the total of all those yearly deficits added together over time.

Think of it like a credit card. The deficit is how much you overspent this month. The debt is the total balance you owe the bank. When you look at a us deficit by president graph, you’re looking at the monthly overspending, not the total balance.

Why the Graph Spikes Where it Does

If you look at a chart covering the last 40 years, you’ll notice a few massive towers that make the rest of the lines look like speed bumps. These aren't just "spending sprees." They are usually the result of three specific things: wars, recessions, and tax policy.

The Reagan and Bush Years: The Shift to Red Ink

Ronald Reagan is often credited with the modern deficit era. Before the 1980s, deficits were mostly a "war thing." You’d run a deficit for WWII, then pay it down. Reagan changed the math with a combination of massive defense spending and the 1981 tax cuts. By the time George H.W. Bush took over, the annual deficit was a permanent fixture of the American economy.

📖 Related: Crude Oil News Today: Why the Massive 3% Price Drop Just Changed Everything

The Clinton "Surplus" Miracle

Believe it or not, there’s a dip in the graph in the late 90s where the line actually goes above zero. Bill Clinton’s term saw the last federal budget surpluses we’ve had. It wasn't just "good management"—it was a perfect storm of the dot-com boom, tax increases from 1993, and the "peace dividend" after the Cold War ended. It was a brief moment of breathing room before the world changed.

The Post-9/11 Explosion under W. Bush

George W. Bush inherited a surplus but left with a massive deficit. Two things happened: the 2001 and 2003 tax cuts and the wars in Iraq and Afghanistan. Then, right at the end of his term, the 2008 financial crisis hit. The deficit skyrocketed because the government had to bail out the banking system and the economy basically stopped producing tax revenue.

The Modern Era: Trillion-Dollar Norms

The era of Barack Obama and Donald Trump is where the graph starts to look truly scary. Obama’s early years were dominated by the Great Recession recovery. The deficit hit $1.4 trillion in 2009. Critics blamed him, but a huge chunk of that was actually baked in before he even took the oath of office.

Then came Donald Trump. Even before the pandemic, the deficit was growing due to the 2017 Tax Cuts and Jobs Act. But 2020? That’s the outlier of all outliers. The COVID-19 response sent the deficit to over $3 trillion. It was a "do whatever it takes" moment, but it fundamentally shifted what we consider a "normal" deficit.

Where We Stand in 2026

Fast forward to today. The Peterson Foundation and the Bipartisan Policy Center have been tracking the FY2026 numbers closely. As of January 2026, the cumulative deficit for the fiscal year is sitting around $601 billion. That’s actually a bit lower than this time last year, mostly because of a massive 300% spike in customs duties—basically, tariff revenue is pouring in.

But here’s the kicker: interest on the debt is now one of our biggest expenses. We are literally paying for the deficits of the 1990s and 2000s right now. In 2024, interest costs hit $880 billion. That’s more than we spent on Medicare or the entire Department of Defense. When you look at a us deficit by president graph now, you have to realize a huge chunk of that spending isn't for new programs—it's just paying the "interest only" minimum on the national credit card.

What the Graphs Get Wrong

If you want to be a savvy reader of these charts, you have to look for "Deficit as a % of GDP."

A $1 trillion deficit in 1980 would have ended the world. Today, it’s a Tuesday. Because our economy (the GDP) is so much bigger, the relative burden of the deficit changes. Most experts, like those at the CBO, argue that looking at raw dollar amounts is basically useless for long-term comparisons. You have to see how much of the total economic "pie" that deficit represents.

🔗 Read more: Ratnakar Bank Stock Price: What Most People Get Wrong

Also, timing shifts are a nightmare. Sometimes a president looks like a big spender because a payment for October (the new fiscal year) got pushed into September (the old one). The Bipartisan Policy Center recently noted that "timing effects" for Medicare payments made the December 2025 deficit look way higher than it actually was.

Actionable Insights: How to Read the Data

Don't let a colorful chart tell you what to think. If you're trying to understand the real fiscal health of the country, do these three things:

- Check the denominator: Always look for "percentage of GDP" charts. If the line is going up faster than the economy is growing, that’s the real red flag.

- Look for "Mandatory vs. Discretionary" spending: Most of the deficit isn't caused by "new" spending. It’s Social Security, Medicare, and interest. A president has very little control over these without a massive act of Congress.

- Separate the "One-Offs": Did the deficit spike because of a once-in-a-century pandemic or a 20-year war? Or is it a structural issue with the tax code?

The us deficit by president graph is a useful tool, but it's only the start of the conversation. If you really want to see where the money is going, look at the interest rates. As long as those stay high, the graph is going to keep climbing, no matter who is sitting in the White House.

To get the most accurate, non-partisan view of this data, you should check the monthly "Treasury Statements" directly from the U.S. Fiscal Data website. They break down exactly where the revenue is coming from—like the recent surge in customs duties—and where it’s leaking out. Understanding the nuance is the only way to move past the political talking points and see the actual math.

Next Steps for You:

If you want to dig deeper into the current numbers, I can help you break down the Congressional Budget Office's latest 10-year outlook or explain how the recent 2025-2026 tariff changes are specifically impacting the revenue side of the ledger.