You might've heard that cash is dead. Between Apple Pay, Venmo, and those "card only" coffee shops popping up in every city, it honestly feels like paper money is becoming a relic. But if you look at the actual data from the Federal Reserve, the reality is the exact opposite. There is more US currency in circulation right now than at almost any point in history.

As of January 14, 2026, there is approximately $2.433 trillion in US currency circulating globally.

Think about that number. It’s a "2" followed by twelve zeros. While we’re all swiping plastic and tapping phones, the physical supply of greenbacks has been quietly climbing. In fact, that $2.43 trillion figure is up about 2.86% from where it sat just one year ago. Even though the rate of growth has slowed down compared to the wild spike we saw during the 2020 pandemic, the mountain of cash just keeps getting taller.

Why There’s So Much Cash Under the Bed

It’s kinda weird, right? If we aren’t using it to buy groceries as much, where is it all going?

Well, a huge chunk of it isn't even in the United States. Experts at the Federal Reserve Board estimate that over $1 trillion in US banknotes are currently held by people outside the country. In many parts of the world, the dollar is basically the ultimate insurance policy. When a local currency gets shaky or a government becomes unstable, people stuff $100 bills into safes, walls, or literal mattresses.

Domestically, we’re seeing a "store of value" trend. People hold onto cash not to spend it, but because it feels safe. It's the ultimate liquid asset. If the power goes out or the banking system has a glitch, that paper in your drawer still works.

The $100 Bill is King

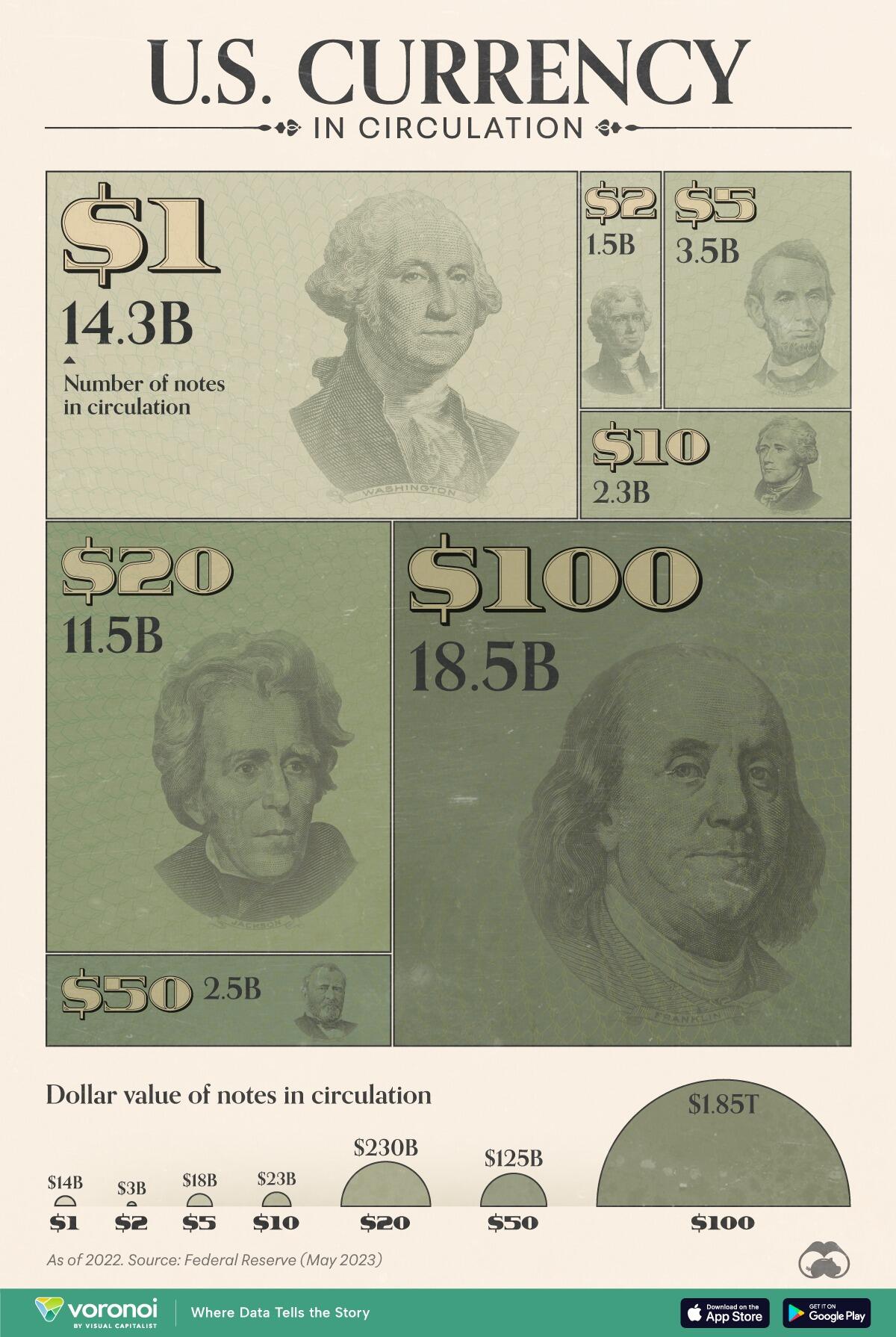

If you looked at a pile of every US bill in existence, it wouldn't be dominated by singles. Not even close. The $100 bill is actually the most common denomination in circulation.

- $100 notes: Roughly 18.5 billion pieces.

- $1 notes: About 14.3 billion pieces.

- $20 notes: Sitting around 11.5 billion pieces.

The $100 bill has a much longer lifespan than a $1 or $5 bill. A "Benjamin" usually lasts over 20 years because it doesn't get traded back and forth at a gas station five times a day. Your average $1 bill is lucky to survive 7 years before it gets so ragged the Fed has to shred it.

The 2026 Print Order and the Death of the Penny

Every year, the Fed tells the Bureau of Engraving and Printing (BEP) exactly how much new money to make. For the 2026 calendar year, they’ve ordered between 3.8 billion and 5.1 billion new notes.

The total value of this new batch? Anywhere from $108.9 billion to $139.6 billion.

But here’s the kicker: most of that isn't "new" money in the sense of increasing the total supply. It’s mostly replacement. They are constantly pulling old, torn, and taped-up bills out of circulation and swapping them for fresh ones.

📖 Related: Revival Gold Stock Price: What Most People Get Wrong

Goodbye, Copper

The biggest news in the world of physical money right now isn't about paper—it’s about the penny. Honestly, it was a long time coming. By early 2026, the US Treasury is expected to stop producing new pennies for circulation.

It simply costs too much. In 2024, the government lost over $85 million just making pennies. It costs about 3 cents to make a 1-cent coin. That's a bad business model. While you’ll still see pennies in the wild for years, they’re effectively being phased out. Businesses are already starting to round cash transactions to the nearest 5 cents, a move that researchers at the Richmond Fed estimate might cost consumers a collective $6 million a year in "rounding taxes."

Redesigning the $10 Bill

If you’re lucky enough to snag a brand-new bill later this year, it might look a little different. The $10 note is the first in line for a major security redesign scheduled for 2026.

The Advanced Counterfeit Deterrence Committee has been working on this for over a decade. The goal isn't just to make it look pretty; it's to stay ahead of high-tech counterfeiters. After the $10 bill, we’re looking at a new $50 in 2028 and a new $20 in 2030.

💡 You might also like: Converting 590 Euros to Dollars: What You Actually Get After the Fees

The Digital Dollar vs. Physical Cash

There is a lot of talk about a "Central Bank Digital Currency" or CBDC. Some people are terrified it means the end of cash.

But looking at the $2.433 trillion currently circulating, that seems unlikely. The Federal Reserve has been pretty clear that any digital version of the dollar would be a complement to physical cash, not a replacement. Cash offers a level of anonymity and "off-grid" utility that a digital system just can't match.

The US dollar still makes up about 58% of global foreign exchange reserves. Even as countries like China or groups like the BRICS nations try to diversify, the world is still deeply addicted to the greenback.

Actionable Insights for the Cash-Curious

If you’re looking at these numbers and wondering what it means for your own wallet, here are a few things to keep in mind:

- Check your change: With the penny being phased out, 2026 "dual-dated" coins (celebrating the 250th anniversary of the US) might actually become minor collectibles. Keep an eye out for the "1776 ~ 2026" stamps.

- Cash is still a valid emergency fund: While digital is convenient, keeping a small amount of physical "walking around money" or emergency cash is still recommended by financial experts for times when the grid fails.

- Don't fear the "cashless society" just yet: The sheer volume of currency in circulation proves that physical money isn't going anywhere. The infrastructure required to remove $2.4 trillion from the global economy is massive.

The US currency system is a beast. It’s huge, it’s complicated, and despite the rise of crypto and credit cards, it’s still growing. Whether it’s a $100 bill in a Swiss bank vault or a $5 bill in your pocket, physical cash remains the backbone of the global economy.