If you had told an energy analyst in 2005 that the United States would one day outproduce Saudi Arabia and Russia, they probably would have laughed you out of the room. Back then, "peak oil" was the phrase on everyone’s lips. People genuinely believed we were running out. Honestly, the vibe was pretty grim.

But then something shifted.

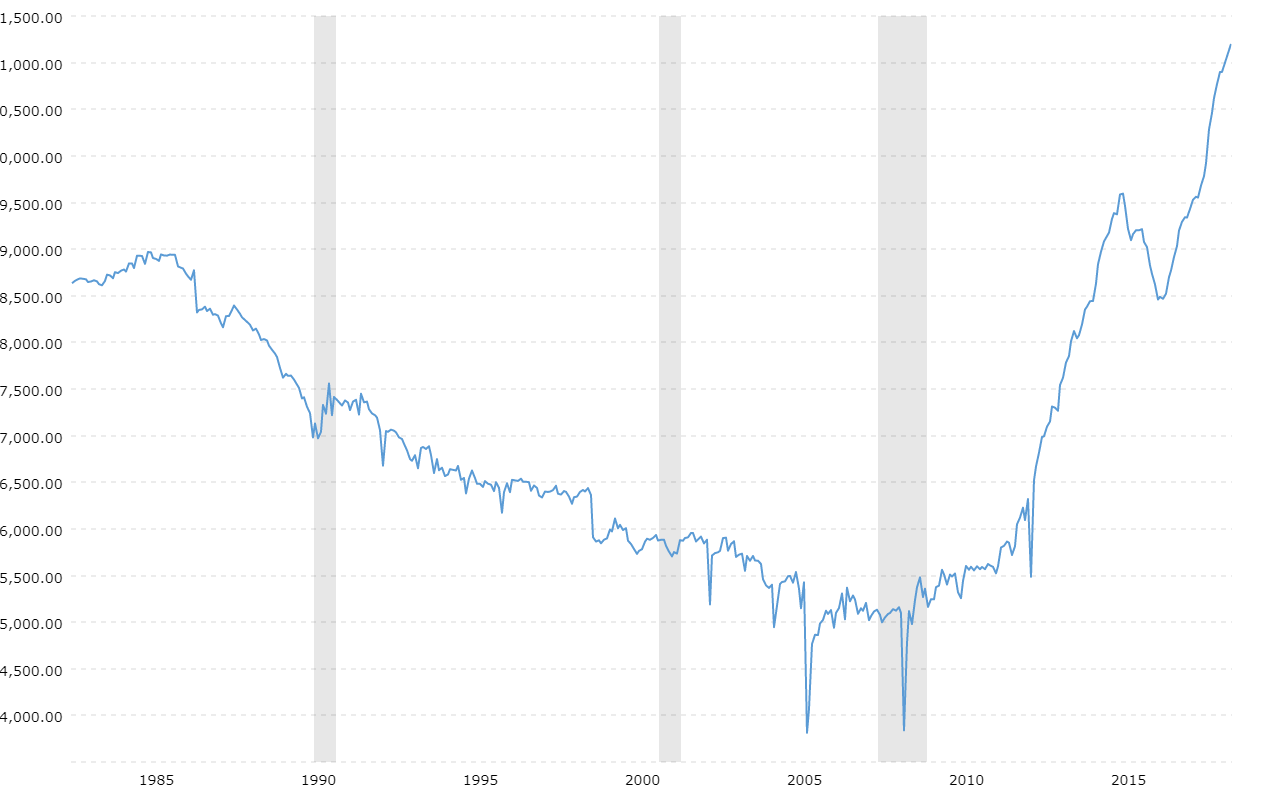

Technological breakthroughs—specifically the marriage of horizontal drilling and hydraulic fracturing—turned the Permian Basin and the Bakken into global powerhouses. We aren't just talking about a minor uptick. We are talking about a total geopolitical earthquake. US crude oil production by year has become the single most important metric in global energy markets, and the numbers from the last decade are almost hard to believe.

The Wild Ride: Breaking Down the Yearly Numbers

To understand where we are in 2026, you've gotta look at the trajectory. It wasn't a straight line up. It was more like a rocket ship that occasionally hit some nasty turbulence.

In 2010, the U.S. was pulling up about 5.4 million barrels per day (b/d). It felt like a lot at the time. By 2019, that number had surged to a staggering 12.3 million b/d. Then 2020 happened. The pandemic didn't just slow things down; it cratered demand. Production fell to 11.3 million b/d as rigs were mothballed and crews were sent home.

Recovery was slow but persistent.

By 2023, the U.S. didn't just recover; it shattered records. The Energy Information Administration (EIA) confirmed that the U.S. became the largest producer of crude oil of any nation in history that year. We hit an average of 12.9 million b/d. But the industry wasn't done yet.

📖 Related: Who Bought TikTok After the Ban: What Really Happened

The 2024 data showed another jump to 13.2 million b/d. Even with people talking about the "energy transition," the pumps kept moving. According to the latest 2025 estimates, we likely peaked at an annual average of 13.6 million b/d.

The 2026 Reality Check

Now that we’re sitting in early 2026, the tone is changing. The EIA’s Short-Term Energy Outlook released this January suggests the party might be slowing down. For the first time in years, the forecast for 2026 shows a slight decline—dipping back toward 13.5 million b/d.

Why? Well, it’s basically a math problem.

- Prices are softening: WTI crude is hovering around $52 to $55 a barrel.

- Drilling productivity: The "easy" oil is gone. Operators are having to work harder and spend more to get the same amount of crude out of the ground.

- Capital discipline: Investors aren't interested in "growth at any cost" anymore. They want dividends. They want buybacks.

What Most People Get Wrong About U.S. Oil

There’s this common misconception that the President—whoever happens to be in the Oval Office—has a "dial" on their desk that controls oil production. It doesn't work like that. Not even close.

Production is driven by private companies, mineral rights owners, and global price signals. When prices stayed high in 2022 and 2023 following the invasion of Ukraine, U.S. shale responded because it was profitable. Now that global inventories are rising and OPEC+ is playing a cat-and-mouse game with supply, the incentive to drill new wells is fading.

The Permian Basin Factor

If the U.S. oil industry is a heart, the Permian Basin in West Texas and Southeastern New Mexico is the left ventricle. It is responsible for nearly 40% of all U.S. production.

👉 See also: What People Usually Miss About 1285 6th Avenue NYC

Even in a "down" year, the Permian stays resilient. In 2025, while other regions like the Eagle Ford and the Bakken began to show their age, the Permian actually managed to grow. But even the mighty Permian has limits. Stacy Morris, a lead researcher at TMX VettaFi, recently noted that energy infrastructure is the bottleneck now. If you can't move the oil and the "associated gas" (the stuff that comes up with the oil) out of the basin, you can't drill more.

A Look at the Decade: Yearly Averages (b/d)

| Year | Production (Million Barrels Per Day) |

|---|---|

| 2015 | 9.4 |

| 2017 | 9.4 |

| 2019 | 12.3 |

| 2021 | 11.3 |

| 2023 | 12.9 |

| 2024 | 13.2 |

| 2025 (Est) | 13.6 |

| 2026 (Forecast) | 13.5 |

Source: Compiled from EIA STEO and Trading Economics historical data.

The "Plateau" Nobody Talks About

We are entering what analysts at Goehring & Rozencwajg call "Peak Shale." It’s a controversial take. Some folks think there’s another decade of growth left. But honestly? Look at the rig counts.

In mid-2025, the number of active oil rigs was down significantly compared to the previous year. You can’t keep production at record highs forever if you aren't poking new holes in the ground. The industry is shifting from an "exploration" mindset to a "harvest" mindset.

This has massive implications for your wallet.

When U.S. production is high, it acts as a buffer against global shocks. If the U.S. starts to pull back, OPEC+ regains its seat at the head of the table. That usually means higher prices at the pump for everyone else.

✨ Don't miss: What is the S\&P 500 Doing Today? Why the Record Highs Feel Different

Geopolitics and the 2026 Outlook

Geopolitics is the wild card. While the U.S. is currently the top dog, 2026 is seeing a "recalibration," as Ian Nieboer of Enverus puts it. We’re seeing a shift where capital is moving toward natural gas and LNG exports rather than just raw crude.

The U.S. is expected to add 5 billion cubic feet per day of LNG export capacity this year. This is important because most oil wells in the U.S. also produce gas. If you can't sell the gas, you stop drilling for the oil. Everything is connected.

Actionable Insights for 2026

If you’re tracking this for investment or business planning, don't just look at the headline production number. Keep your eyes on the WTI-Brent spread.

U.S. producers usually need WTI to be above $50 to $60 to justify new "greenfield" projects. If the EIA’s forecast of $52/b for 2026 holds true, expect to see more mergers and acquisitions. Smaller companies will get swallowed by the majors (like Exxon and Chevron) who have the balance sheets to survive lower prices.

Next Steps for Stakeholders:

- Monitor Rig Counts: Watch the weekly Baker Hughes report. A sustained drop below 450 rigs usually signals a production dip six months later.

- Track Inventory Levels: If OECD inventories keep rising despite U.S. production flattening, it means global demand is the real problem, not supply.

- Focus on Efficiencies: In 2026, the "winners" are the companies using AI and better completion techniques to get 10% more oil out of the same well.

The era of explosive growth in U.S. oil is likely in the rearview mirror. We’ve reached the top of the mountain. The view is great, but the path forward looks a lot more like a plateau than a peak.