If you’ve walked through a department store lately and wondered why a basic toaster suddenly costs as much as a fancy dinner, you’re feeling the math of international trade in real-time. It’s messy. The u.s. average tariff rate on china has become one of those economic numbers that sounds boring in a textbook but hits like a freight train at the cash register.

Honestly, the last couple of years have been a total roller coaster for anyone trying to track these numbers. We went from a relatively stable, albeit high, tariff environment to a period of absolute chaos in early 2025. At one point, we were looking at "reciprocal" tariffs that theoretically pushed rates into the triple digits. It was wild.

But as of early 2026, things have settled—sorta.

The Numbers Nobody Can Agree On

Depending on who you ask, the u.s. average tariff rate on china is either a strategic necessity or an inflationary nightmare. Let’s look at the actual data. According to the Peterson Institute for International Economics (PIIE), the average U.S. tariff on Chinese exports stood at about 47.5 percent by late 2025. This covers basically 100 percent of goods coming from the mainland.

Think about that for a second.

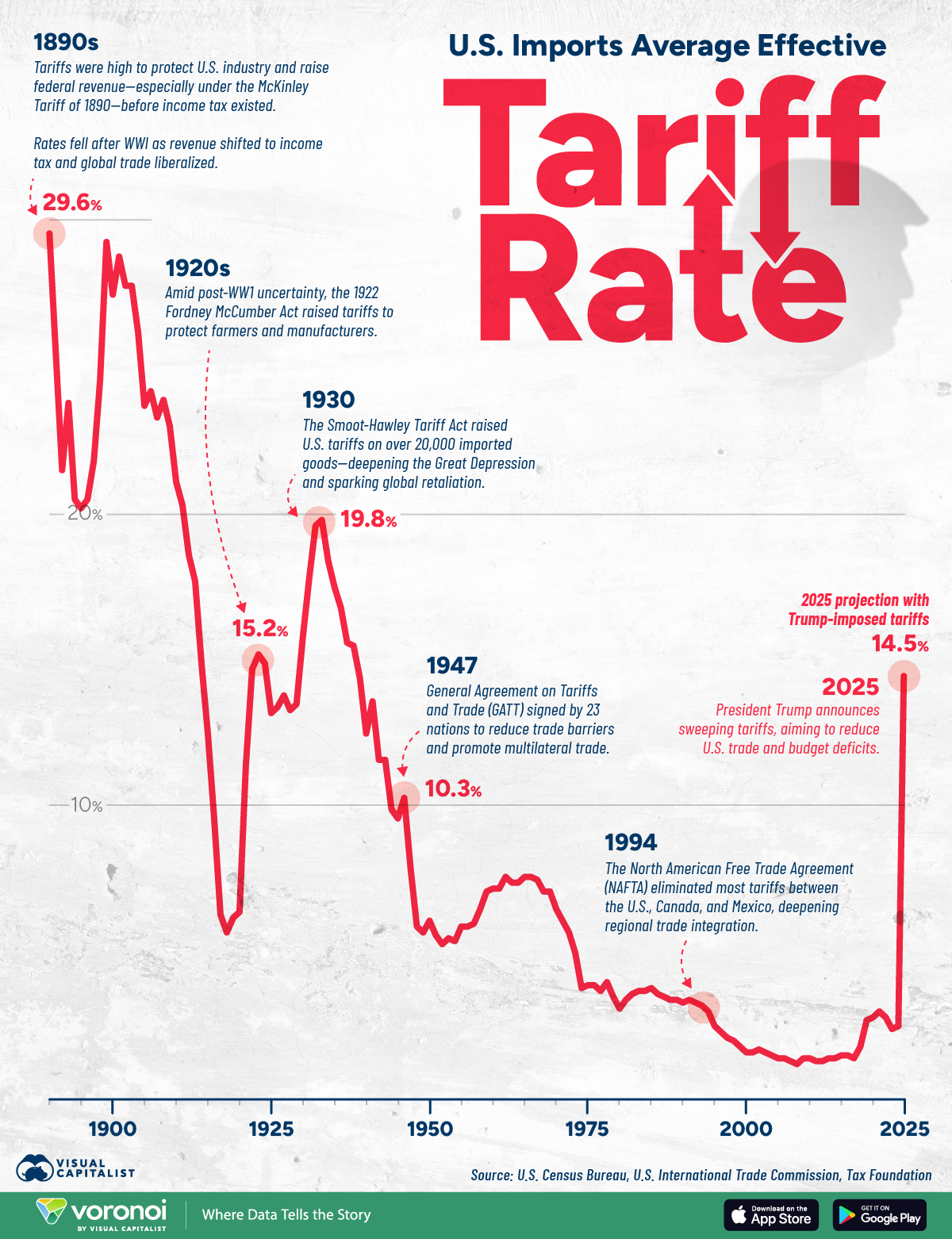

Before the trade war kicked off back in 2018, that average was hovering around a measly 3 percent. We’ve seen a 15-fold increase in the "tax" paid at the border. Now, if you look at "effective" rates—what importers actually end up paying after exemptions and shifting their sourcing to other countries—the number looks a bit different. The Budget Lab at Yale recently pegged the effective rate on Chinese goods at roughly 30 percent as we entered 2026.

📖 Related: 1 UAE DHS to INR: Why Your Remittance App Is Giving You a Bad Deal

Why the gap?

Companies aren't stupid. When a 100 percent tariff hits a specific type of Chinese steel, they don't just keep buying it and go bankrupt. They find a guy in Vietnam or Malaysia to sell it to them instead. Or they pray for a "Product Exclusion."

Why the Rate Swings Like a Pendulum

The story of 2025 was basically one long game of chicken. In April of last year, the administration briefly threatened and even implemented tariffs that spiked the average to over 125 percent. It was a "maximum pressure" tactic that nearly froze trans-Pacific shipping.

Then came the Geneva and Korea meetings.

In a surprising bit of detente, both Washington and Beijing agreed to a massive de-escalation in May 2025. They basically chopped those massive 120-plus percent rates back down to a 10 percent "baseline" for a 90-day truce. That truce has mostly held, though it’s been layered with "Section 301" duties and new "Section 232" levies on things like medium-duty trucks and aluminum derivatives.

👉 See also: Who Owns pOpshelf? The Massive Retail Powerhouse Behind the Fun Branding

What This Actually Costs You

We can talk about percentages all day, but what does the u.s. average tariff rate on china mean for a normal household? It's not great news for the wallet.

Tax Foundation estimates suggest these trade barriers amount to an average tax increase of about $1,500 per U.S. household in 2026. This isn't just on stuff labeled "Made in China." Because Chinese components are in everything—from the sensors in your car to the vitamins in your cereal—the cost creeps into every corner of the economy.

Specifically, look at these sectors:

- Metals and Aluminum: Facing consistent 25 to 50 percent duties.

- Consumer Electronics: Still caught in the 10 to 25 percent range despite some carve-outs for smartphones.

- Apparel and Leather: Hit with some of the highest effective price increases, sometimes up to 40 percent in the short run.

The 2026 Reality: A "Tense Peace"

As we sit here in January 2026, the u.s. average tariff rate on china is in a state of "managed volatility." The "fentanyl tariff"—a specific 20 percent levy targeting Chinese imports due to precursor chemical flows—was actually halved to 10 percent in November 2025 as part of a cooperation deal.

It’s a weird vibe.

On one hand, the U.S. is still using tariffs as a primary tool of foreign policy. On the other, there’s a clear fear of triggering a full-blown inflationary spike that could wreck the domestic economy. China, for its part, has hit back with its own tariffs—averaging around 31.9 percent on American goods—but they’ve also been diversifying. They’re trading more with ASEAN countries and Latin America now, trying to blunt the impact of the U.S. market closing off.

How Businesses Are Surviving the Chaos

If you're running a business that relies on these imports, you've probably realized that "waiting for things to go back to normal" isn't a strategy. It's a fantasy.

Most successful importers have moved toward a "China Plus One" model. They keep some production in China for the efficiency and scale but move the critical "final assembly" to places like Mexico or Vietnam to try and dodge the worst of the u.s. average tariff rate on china.

But even that is getting harder.

The U.S. has started looking at "circumvention," where they track if a product is actually made in Vietnam or just a Chinese product with a new sticker. It's a high-stakes game of cat and mouse that adds layers of legal fees and compliance costs to every shipment.

Actionable Insights for Navigating 2026

The trade landscape isn't going to get simpler. Here is what you should actually do to handle the current tariff environment:

Audit Your HTS Codes with Extreme Prejudice

Don't just trust the code you used three years ago. Customs and Border Protection (CBP) is cracking down on "misclassification" as a way to avoid the 301 duties. A single wrong digit could mean the difference between a 0 percent duty and a 25 percent disaster.

Check the Exclusion Expiration Dates

Many of the current exclusions for medical supplies and certain machinery are set to expire throughout 2026. If your supply chain relies on a specific waiver, you need a Plan B (and probably a Plan C) for when that waiver vanishes.

Watch the "De Minimis" Rules

The $800 threshold for duty-free shipments (the "de minimis" rule) has been a massive loophole for e-commerce. However, new executive orders have significantly tightened this. If you’re importing small parcels, expect more "informal entries" and surprise bills from your carrier.

Diversify Beyond "Assembly"

If you're moving production to Southeast Asia, make sure it's real manufacturing. The U.S. is increasingly using "melt and pour" or "smelt and cast" requirements for metals. Just putting the pieces together in a different country won't save you from the high u.s. average tariff rate on china if the raw materials are still coming from the mainland.

Leverage FTZs (Foreign Trade Zones)

If you're re-exporting goods, using a Foreign Trade Zone can allow you to defer or even avoid duties entirely. It’s a lot of paperwork, but at a 30 to 47 percent tax rate, the math finally starts to make sense for smaller players.

The bottom line is that the "beautiful" world of tariffs is here to stay for the foreseeable future. The u.s. average tariff rate on china isn't just a number; it's the new baseline for doing business in a fractured global economy.