You probably don't wake up thinking about the US 30 year bond yield. Most people don't. It’s a dry, dusty number tucked away on the back pages of the Wall Street Journal or buried in a fast-moving ticker on CNBC. But honestly? You should care. This single percentage point is basically the "Godzilla" of the financial markets. When it moves, everything else—your mortgage, your 401(k), the price of that tech stock you bought on a whim—starts to shake.

Let’s get real for a second. The 30-year Treasury bond, often called the "long bond," is the US government’s way of asking for a three-decade loan. In exchange for your cash, Uncle Sam promises to pay you back with a little extra on top. That "extra" is the yield. It sounds simple, but it’s actually a complex cocktail of inflation fears, growth bets, and global panic levels.

The Weird Physics of the US 30 Year Bond Yield

If you want to understand how this works, you have to embrace a bit of "upside-down" logic. When bond prices go up, yields go down. Think of it like a seesaw. If everyone is terrified of a recession and rushes to buy bonds because they’re "safe," the price of those bonds gets bid up. Because the government is only paying a fixed amount of interest, that fixed payment represents a smaller percentage of the new, higher price. Boom. Yields drop.

Conversely, when the economy is screaming ahead and inflation is eating the value of a dollar, nobody wants to be locked into a 30-year loan at a low rate. They sell. Prices crater. The US 30 year bond yield spikes to entice new buyers. It’s a brutal, relentless cycle.

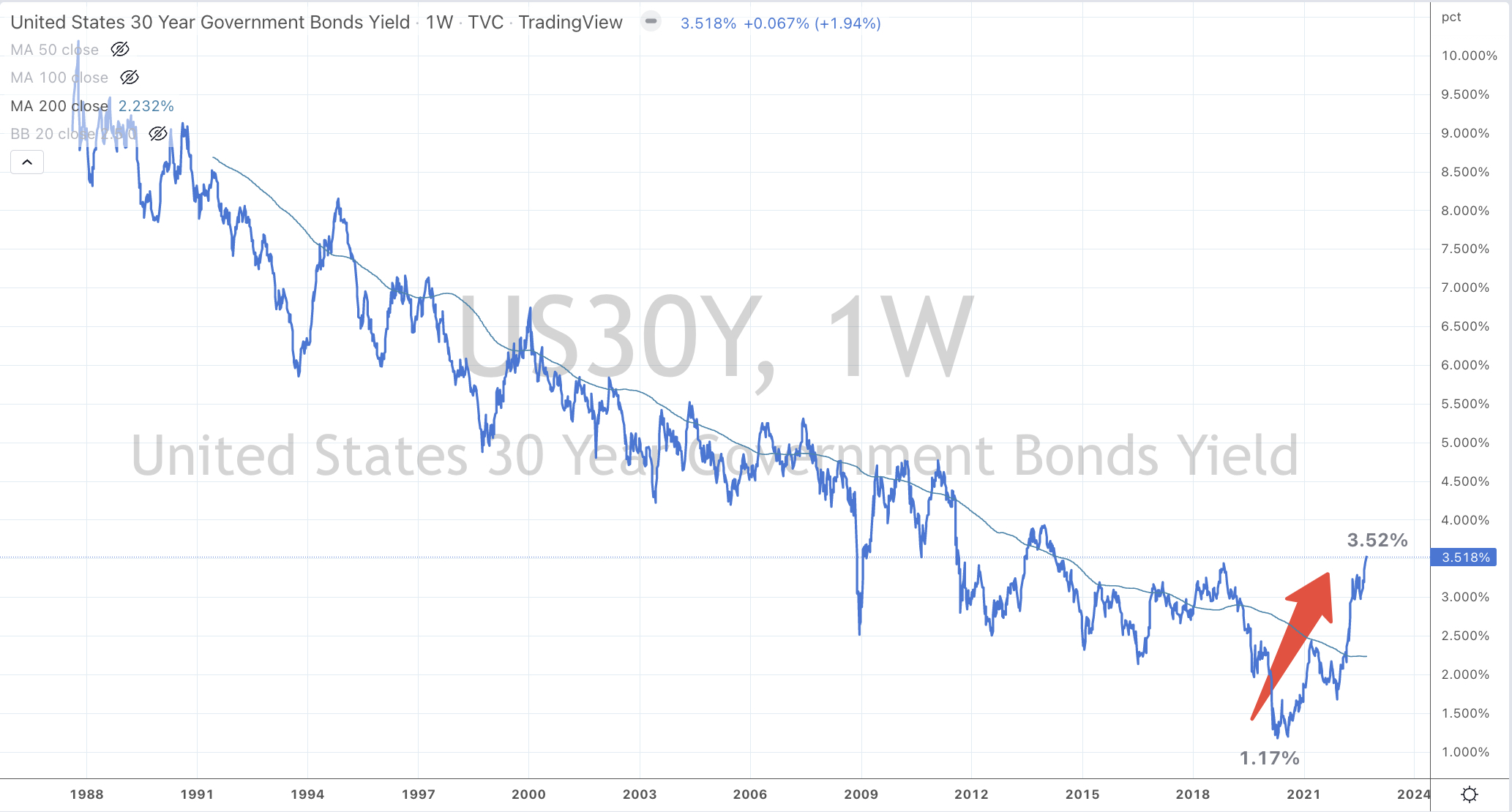

History is littered with moments where this yield told us the truth before anyone else realized it. Back in the early 1980s, Paul Volcker—the legendary Fed Chair with the giant cigars—pushed rates so high to kill inflation that the 30-year yield touched 15%. Can you imagine? Getting 15% guaranteed by the government for thirty years? That’s the stuff of legends now. Contrast that with the "zero-bound" era of 2020, where the yield dipped below 1% during the height of the pandemic panic. It was a wild ride that changed how we think about "safe" money.

Why Your Mortgage Cares About This Number

You’ve likely noticed that mortgage rates don't move in a perfect line with the Federal Funds Rate. That’s because the Fed only controls the short end of the stick—the overnight rates banks charge each other. But banks aren't lending you money for your house overnight. They’re thinking long-term.

Most 30-year fixed-rate mortgages are priced based on the US 30 year bond yield plus a "spread." If the yield on the long bond jumps because investors are worried about future inflation, your local bank is going to raise the rate on that colonial in the suburbs instantly. It’s a direct transmission belt from the trading floors in Manhattan to your monthly bank statement.

The Term Premium Mystery

There is this thing called the "term premium." It’s basically the extra "hazard pay" investors demand for locking their money up for 30 years instead of just two or five. Think about it. A lot can happen in three decades. Wars, technological revolutions, pandemics, or the government just deciding to print money like it’s Monopoly paper.

For a long time after the 2008 financial crisis, the term premium basically vanished. Investors were so desperate for any kind of yield that they stopped asking for that extra hazard pay. But lately? The term premium is back with a vengeance. We’re seeing a shift where the US 30 year bond yield is rising not just because the Fed is hiking rates, but because people are genuinely worried about the sheer volume of US debt.

When the Treasury has to auction off trillions of dollars in new bonds to fund the budget deficit, someone has to buy them. If the buyers (like foreign central banks or massive pension funds) start feeling overwhelmed by the supply, they demand a higher yield to take on the risk. It's basic supply and demand, but on a scale that involves twelve zeros.

The Real-World Players

Who actually moves this market? It’s not just "the algorithm."

- The Japanese Pension Funds: For decades, Japan has had such low interest rates that their institutional investors flooded the US Treasury market. When their own rates start to creep up, they might "come home," pulling billions out of the US and sending our yields higher.

- The "Bond Vigilantes": This is a term coined by Ed Yardeni in the 1980s. It refers to investors who sell bonds to protest inflationary government policies. They’re like the neighborhood watch of the economy.

- Insurance Companies: They need to match their long-term liabilities (like paying out life insurance policies in 2050) with long-term assets. They are the bedrock of the 30-year market.

What Happens When the Yield Curve Inverts?

You’ve probably heard the talking heads on TV screaming about an "inverted yield curve." This is when short-term rates (like the 2-year) are higher than the US 30 year bond yield. It’s weird. It’s like a bank charging you more for a one-week loan than a 30-year loan.

In a "normal" world, the 30-year yield should be the highest because of that risk we talked about. When it isn't, it usually means the market is betting that a recession is coming and the Fed will have to slash rates in the future. It’s been one of the most reliable recession indicators in history, though in the post-2020 world, it’s been acting a bit wonky.

Some analysts, like those at Goldman Sachs or BlackRock, argue that the old rules don't apply the same way because of how much "QE" (Quantitative Easing) distorted the market. But others, the old-school hawks, say ignore the inversion at your own peril.

The Inflation Connection

Inflation is the mortal enemy of the bondholder. If you buy a bond today yielding 4.5% and inflation kicks up to 6%, you are effectively losing 1.5% of your purchasing power every single year. You’re paying for the privilege of lending the government money.

This is why the US 30 year bond yield is often seen as the market’s "inflation expectations" gauge. If it starts climbing while the short-term rates stay steady, the market is telling the Fed: "Hey, we don't think you have a handle on rising prices."

Actionable Insights for the Average Person

So, what do you actually do with this information? It’s not just trivia.

If you see the US 30 year bond yield start to climb rapidly over a period of weeks, it's a signal to check your exposure to growth stocks. Companies that promise profits ten years from now (tech, biotech, AI startups) get hit hard when long-term rates rise. Why? Because the "present value" of those future profits is worth less when you can get a decent, guaranteed return from a Treasury bond today.

Keep an eye on the "Real Yield." This is the yield of the 30-year bond minus the expected inflation rate (often measured by TIPS). If real yields are positive and high, it’s a massive headwind for gold and silver. Why hold a bar of gold that pays zero interest when you can get a 2% "real" return from Uncle Sam?

If you are looking to refinance your home, don't wait for the Fed to move. Watch the 30-year yield. Often, mortgage rates will jump before the Fed even holds their meeting because the bond market is forward-looking.

💡 You might also like: The History of the Dow Jones Industrial Average: Why It Still Rules Wall Street

Lastly, understand the diversification trap. In 2022, we saw something rare: both stocks and bonds crashed at the same time. Usually, they move in opposite directions. But when the US 30 year bond yield spikes because of runaway inflation, the "60/40" portfolio (60% stocks, 40% bonds) can get absolutely shredded. It’s a reminder that nothing is truly "safe" if the price isn't right.

The 30-year yield isn't just a number. It's the heartbeat of global capitalism. It tells us what we think the world will look like in 2055. And right now? The heartbeat is getting a little faster.

Key Steps to Take Now:

- Audit your "Long Duration" assets: Check if your portfolio is too heavily weighted in tech or non-dividend stocks that suffer when long-term rates rise.

- Monitor the 4.5% to 5.0% range: Historically, when the 30-year yield crosses certain "psychological" thresholds, it triggers automated selling in the stock market.

- Look at "I Bonds" or TIPS: if you’re worried about the inflation side of the yield equation, these specific government products are designed to protect you where the standard 30-year might fail.

- Fixed-rate check: If you have any variable-rate debt, consider that the long-term trend for yields has shifted from a 40-year decline to what looks like a new era of "higher for longer." Moving to fixed rates now might save your skin later.