Let's be real—trying to figure out what you’re actually going to pay for college feels like trying to read a menu where the prices are written in code. You see one number on the brochure, but then your neighbor’s kid says they paid something totally different. If you’re looking at the University of Mississippi cost of attendance, you’ve probably noticed the numbers can swing wildly depending on where you grew up and whether you're planning to live in a traditional dorm or a fancy apartment off the Square.

Basically, "Cost of Attendance" (COA) isn't just a bill you get in the mail. It’s an estimate. It’s the university’s way of saying, "Hey, if you live a typical student life, this is what you’ll likely spend on everything from tuition to toothpaste."

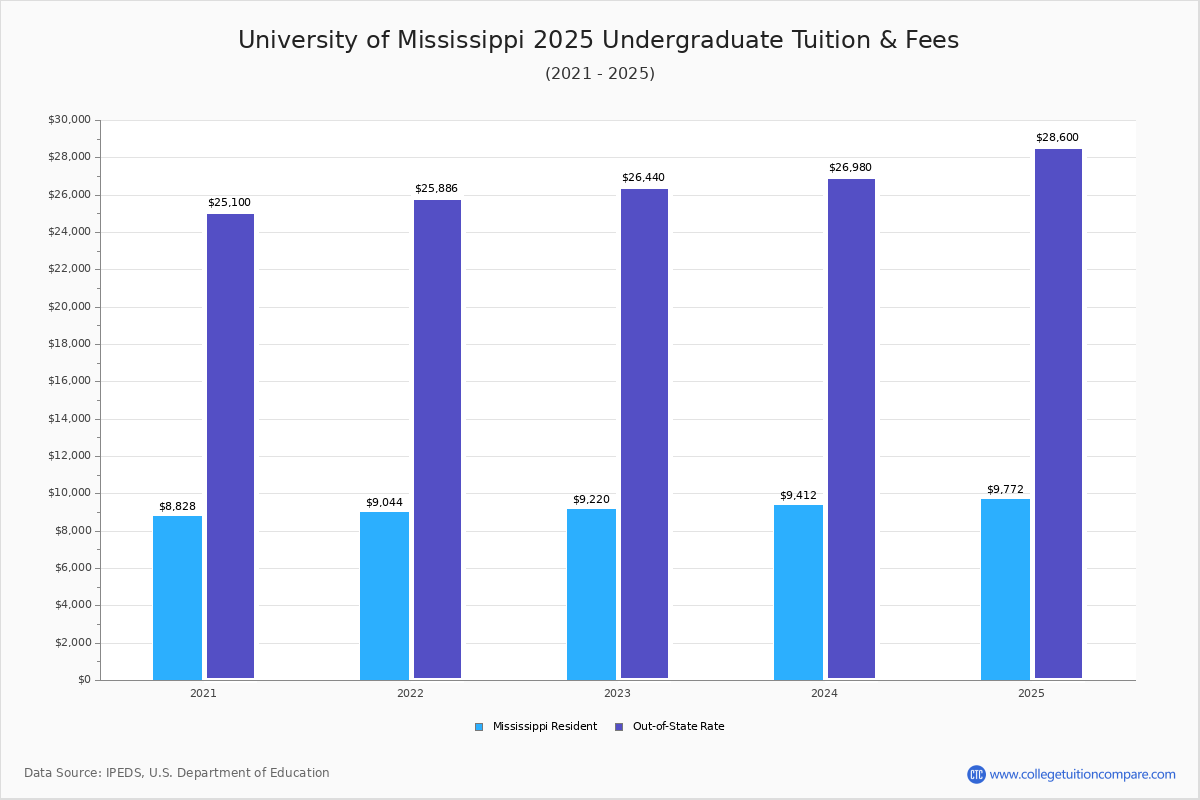

For the 2025-2026 academic year, if you’re a Mississippi resident, your base tuition and mandatory fees are hitting right around $9,772. That sounds decent, honestly, compared to some other big state schools. But if you're coming from out of state—maybe you're from Memphis, Dallas, or Chicago—that number jumps up significantly to about $28,600. Why? Because of the non-resident fee. It’s the "extra" price tag for not being a local, and it’s the biggest hurdle for a lot of families looking at Ole Miss.

Breaking Down the Big Numbers

When people talk about the University of Mississippi cost of attendance, they usually focus on the "sticker price." For an out-of-state freshman living on campus, the total estimated COA is sitting near $49,100. If you’re a local Mississippi resident, that total estimate is closer to $30,272.

Wait. Don’t close the tab yet.

✨ Don't miss: Am I Gay Buzzfeed Quizzes and the Quest for Identity Online

Hardly anyone actually pays that full sticker price. About 72% of students at Ole Miss get some kind of grant or scholarship. The average aid package is around $12,887, which can chop a massive hole in that tuition bill.

What’s Actually in That Total?

It isn't just tuition. The university builds in a lot of "indirect" costs that you might not even think about until you’re staring at an empty bank account in November.

- Housing: This is a big variable. Traditional residence halls like Stockard or Martin cost about $3,251 per semester. If you want something newer, like the contemporary halls (think Residence Hall 1, 2, or 3), you're looking at $3,806.

- Food: Most freshmen are required to have a meal plan. The standard "Rebel All Access Plus 1" gives you unlimited meals and some flex dollars for about $2,958 per semester.

- Books and Supplies: They estimate about $1,200 a year. Pro tip: Don’t buy every book brand new from the bookstore on day one. Rent them or find used copies online. Your wallet will thank you.

- Personal and Travel: They budget roughly $3,152 for personal stuff and $2,653 for transportation. If you live close enough to drive home every weekend, your gas bill might be higher. If you stay in Oxford and walk everywhere, you might actually spend less than their estimate.

Living Off-Campus: Does It Save Money?

Kinda. But it's complicated.

Once you hit your sophomore year, most students head out to apartments. The university’s estimate for off-campus living costs is actually slightly higher in some categories—around $20,400 for total living expenses. Oxford isn't a cheap town to live in anymore. Rent for a bedroom in a shared 4-bedroom apartment at places like The Flatts or Taylor Bend can range from $600 to over $1,000 a month depending on how close you are to campus.

🔗 Read more: Easy recipes dinner for two: Why you are probably overcomplicating date night

If you live off-campus, you’re in charge of your own groceries. You might save money by ditching the meal plan and cooking at home, but you’ll also have to account for utilities and that inevitable parking pass, which can cost anywhere from $75 up to $600 depending on the lot.

The "Special" Fees Nobody Tells You About

You’ll see "Mandatory Fees" on your bill. These cover the stuff that makes campus life work—like the Student Activities Fee ($2 per credit hour) and the Capital Improvement Fee.

But then there are the program-specific fees. If you’re a nursing student, an engineer, or an accountancy major, expect to pay more. For example:

- Pharmacy: Out-of-state professional pharmacy students actually got a break recently, with non-resident fees reduced to $3,502.

- Law School: In-state tuition is about $20,340, while non-residents pay roughly $27,340.

- Course Fees: Some classes have "lab fees" or "software fees." Taking an art class? You might see an $80 Adobe software fee. A biology lab? Tack on another $20-$65 for manuals.

It’s these little $50 and $100 charges that nibble away at your budget if you aren't careful.

💡 You might also like: How is gum made? The sticky truth about what you are actually chewing

Scholarships: The Real Way to Lower the University of Mississippi Cost of Attendance

If you have a solid GPA and decent test scores, Ole Miss is pretty generous with merit scholarships. They have "automatic" scholarships for non-residents that can cover a huge chunk of that non-resident fee.

Then there's the Ole Miss Opportunity (OMO) program. This is a game-changer for Mississippi residents. If your family income is $40,000 or less and you qualify for a Pell Grant, the university basically guarantees your base tuition, housing, and a meal allowance will be covered. They even threw in an extra $500 for books recently.

For out-of-state students, look into the Stamps Scholarship or the competitive freshman awards. These are tough to get, but they can bring the cost of attendance down to almost zero if you're a high-achiever.

How to Handle the Bill

The University doesn't just demand all the money on day one and wish you luck. They have payment plans. Generally, your Fall bill is due in September and the Spring bill is due in February. If you miss those dates, you're looking at a $150 late fee, which is basically like setting a pair of nice sneakers on fire for no reason.

Actionable Next Steps to Save Money

- File the FAFSA early. Use the school code 002440. Even if you think you won't qualify for "need-based" aid, some scholarships require it to be on file.

- Apply for the "Special Programs" application. This is separate from your main admission app and is the key to the Honors College and the big-money scholarships.

- Check the "Net Price Calculator." Go to the Ole Miss Financial Aid website and plug in your real numbers. It’s way more accurate than just looking at the general COA.

- Look for departmental scholarships. If you're in the Patterson School of Accountancy or the School of Engineering, they have their own pots of money that aren't part of the general pool.

- Don't ignore the "small" state grants. If you're a Mississippi resident, apply for MTAG or MESG. It might "only" be a few hundred or a thousand dollars, but that covers your books and a lot of pizza.

Ultimately, the University of Mississippi cost of attendance is a starting point, not a final verdict. Between scholarships, smart housing choices, and staying on top of deadlines, most students find a way to make the "Rebel life" work without drowning in debt. Just make sure you're looking at the 2025-2026 numbers so you don't get hit with any surprises when the first bill drops in August.