Money talks. In the world of higher education, it doesn't just talk; it shouts from the rooftops of ivy-covered Gothic towers. If you’ve ever wondered why some colleges seem to have a never-ending supply of new research labs and "no-loan" financial aid packages while others are hiking tuition just to keep the lights on, the answer is usually sitting in a giant investment account. We call it an endowment.

Honestly, the numbers are getting a bit surreal. As we move into 2026, the gap between the "haves" and the "have-mores" in academia has reached a breaking point. We’re not just talking about millions anymore. We are talking about tens of billions of dollars managed like elite hedge funds.

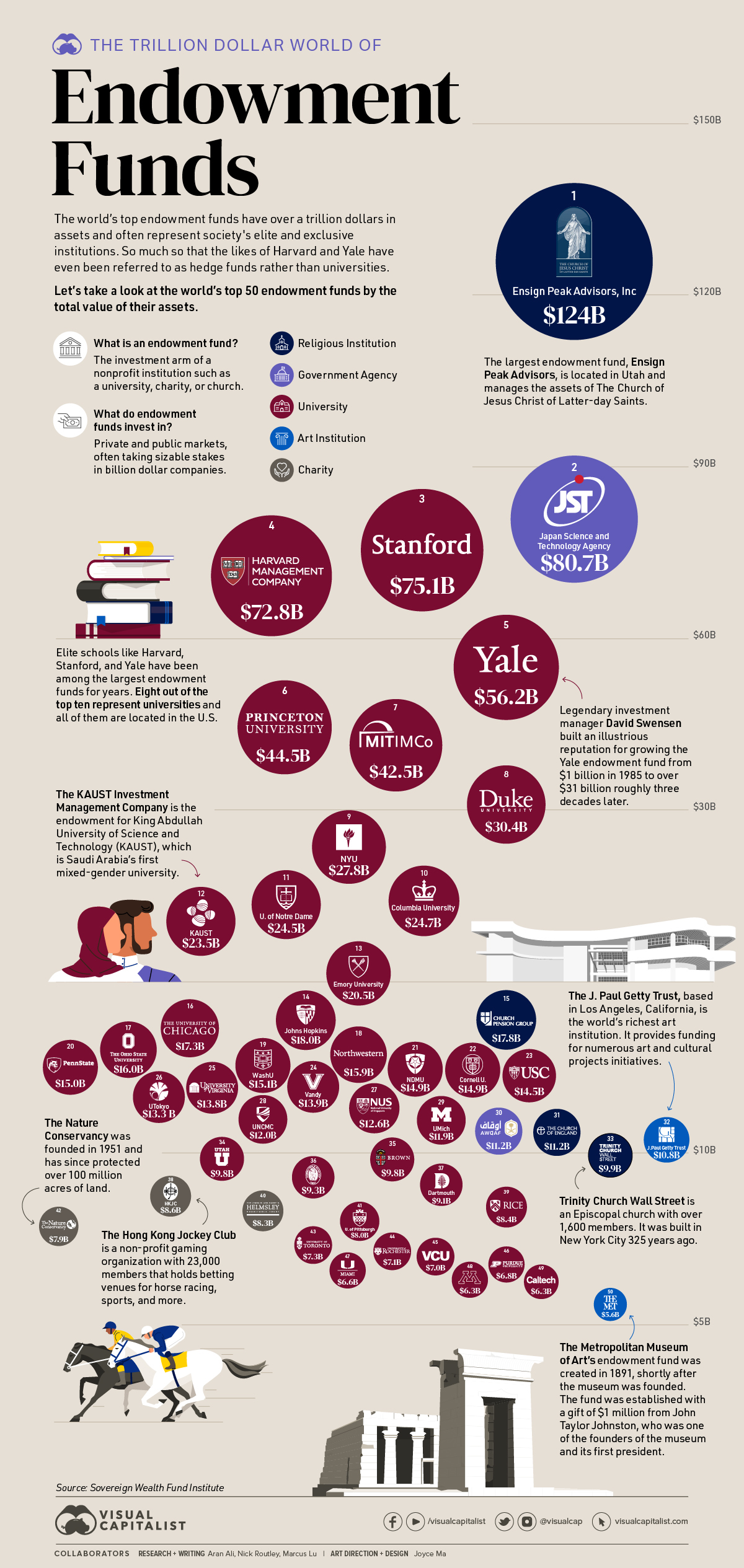

Universities Ranked by Endowment: The Heavy Hitters of 2026

When you look at universities ranked by endowment, one name stays glued to the top. Harvard University remains the wealthiest academic institution on the planet. By the end of fiscal year 2025, Harvard’s endowment sat at approximately $56.9 billion. To put that in perspective, that is larger than the GDP of several small countries.

But Harvard isn't alone at the top of the mountain. The usual suspects in the Ivy League and a few massive public systems have seen their coffers swell thanks to a wild ride in the markets over the last couple of years.

Here is how the top of the leaderboard looks right now based on the most recent fiscal reports and 2026 projections:

👉 See also: Why The Magnificent Seven Stocks Are Still Eating The World

- Harvard University: ~$56.9 billion. They recently logged their best performance since 2021, though they are bracing for a massive tax bill.

- University of Texas System: ~$47.5 billion. People forget the Longhorns are sitting on a gold mine, literally. Their Permanent University Fund (PUF) gets a massive boost from oil and gas royalties on 2.1 million acres in West Texas.

- Yale University: ~$44.1 billion. Yale famously pioneered the "Yale Model," shifting heavily into private equity and venture capital under the late David Swensen.

- Stanford University: ~$42.8 billion. Being in the backyard of Silicon Valley has its perks. Stanford’s ties to the tech world keep its investment returns—and donor list—very healthy.

- Princeton University: ~$36.4 billion. Princeton is an interesting case because it has a massive endowment but a relatively small student body compared to UT or Harvard.

The Public System Surprise

You might have noticed the University of Texas sitting there at number two. It’s a bit of a shocker if you assume only private Ivies are rich. Public systems like Texas A&M (roughly $20 billion) and the University of Michigan ($19.2 billion) are also major players. Michigan, in particular, has been a standout performer lately, posting a 15.5% return in the last fiscal year.

Why Does This Money Actually Matter?

You might think this is just a high-stakes game of Monopoly for deans and trustees. It isn't. These funds are the engines behind modern scientific breakthroughs and social mobility.

Take financial aid. Schools like Princeton, Harvard, and Stanford meet 100% of the demonstrated financial need for every single student they admit. They can afford to tell a kid from a low-income family, "Don't worry about the $85,000 price tag; we've got you." Without that $30+ billion safety net, that's impossible.

But it's not all sunshine and free tuition. There is a growing "endowment tax" that is starting to bite. In 2026, many of these elite schools are facing a new reality where they have to pay the government up to 8% on certain investment gains if their endowment-per-student ratio is high enough. Harvard’s CFO, Ritu Kalra, noted that the university expects a tax bill of around $300 million this year. That’s a lot of scholarships.

The Strategy Behind the Billions

How do they get this rich? They don't just stick the money in a savings account.

Most large endowments are incredibly aggressive. While your local community college might keep its small fund in boring bonds and index funds, the big dogs are playing a different game. We’re seeing a huge shift toward Alternative Investments. This includes:

✨ Don't miss: AMZN Stock Price Today: Why This Run-Up Feels Different

- Private Equity: Buying pieces of companies before they go public.

- Venture Capital: Funding the next OpenAI or SpaceX.

- Real Estate: Owning everything from apartment complexes to timberlands.

In 2025 and 2026, mid-sized endowments—those around the $1 billion mark—have actually been the ones to watch. They are "scaling up" their venture programs. Schools like Fordham or Soka University of America (which has an insane endowment-per-student ratio) are trying to mimic the Yale model to jump into the big leagues.

The Divestment Drama

It's not just about returns, though. It’s about politics. Students are increasingly demanding that their schools pull money out of fossil fuels or companies involved in global conflicts. Princeton and Yale have both had to navigate intense pressure to move toward "Green Investing." It's a tightrope walk: how do you save the planet without shrinking the scholarship fund?

The Hidden Metric: Endowment Per Student

If you want to know who is really rich, look at the endowment per student. This is the "wealth density."

Princeton is arguably the wealthiest school in the world by this metric. They have over $3.7 million sitting in the bank for every single student on campus. Compare that to a massive public school where the total endowment might be $2 billion, but they have 50,000 students. The math just doesn't hit the same way.

Small liberal arts colleges often dominate this list. Williams College, Amherst, and Pomona have smaller total pots than Harvard, but because they only have a couple thousand students, they can provide a level of luxury and support that is frankly mind-blowing.

What This Means for You

If you are a student, parent, or just an observer of the economy, there are a few things you should take away from the current state of universities ranked by endowment.

First, the rich are getting richer, but they are also under more scrutiny than ever. Expect to see more "no-loan" policies as these schools try to justify their tax-exempt status. If you are applying to college, check the endowment. It’s a direct indicator of how much help you can get with the bill.

Second, the "Endowment Tax" is a major story for 2026. If the government keeps hiking these rates, these schools might start getting more conservative with their spending, which could eventually trickle down to research budgets and faculty hiring.

💡 You might also like: USD to Bangla Taka Explained: What Most People Get Wrong

Actionable Insights for 2026:

- Research the "Net Price": Don't look at the sticker price of a school like Yale. If they are in the top 10 for endowment, your actual cost might be lower than a state school if your family income is under $150k.

- Watch the Public Leaders: Keep an eye on the University of Texas and Michigan. They are proving that public institutions can compete with the Ivies if they manage their land and investments aggressively.

- Check the Investment Disclosures: If you care about ESG (Environmental, Social, and Governance) issues, many of these top-ranked schools are now required to be more transparent about where their billions are parked.

The era of the "University as a Hedge Fund with a Teaching Wing" isn't ending anytime soon. As long as the markets stay hot and alumni keep writing checks, those totals at the top of the list are only going to keep climbing.