Ever looked at a number so big your brain just kinda stops working? That's the current state of the united states stock market capitalization. As of early 2026, we are looking at a total value for the S&P 500 alone that has crossed the $62 trillion mark. If you include the entire U.S. equity market—thousands of smaller companies—the figure is even more staggering.

It's a lot. Honestly, it’s more than a lot.

Most people hear "market cap" and think it’s just a scorecard for who’s winning. But right now, these numbers are telling a story about a massive shift in how the American economy actually functions. We've reached a point where the stock market isn't just a part of the economy; it’s basically swallowing it.

The Massive Scale of United States Stock Market Capitalization

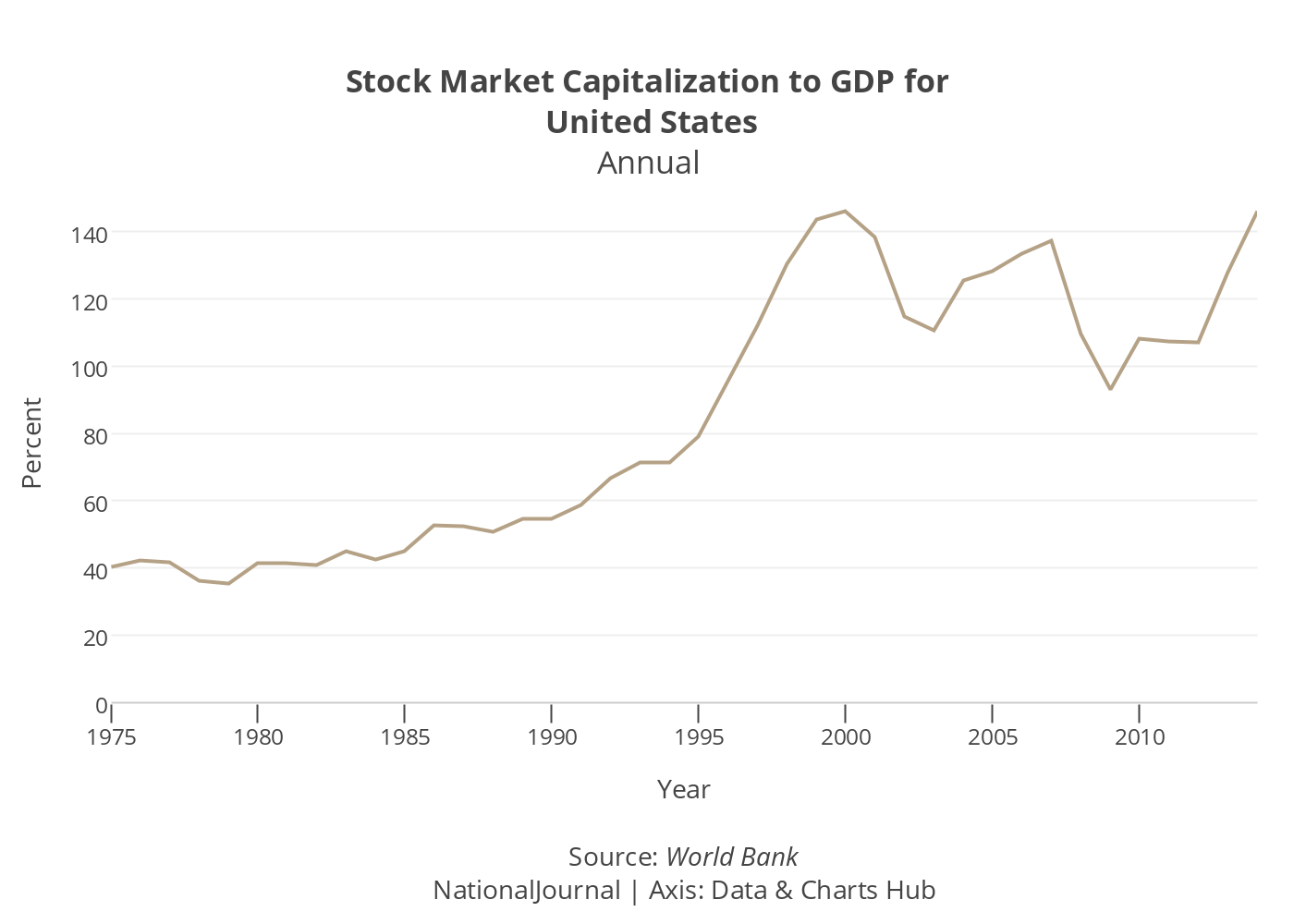

To get why people are a little freaked out (or very excited), you have to look at the "Buffett Indicator." This is basically the ratio of the total united states stock market capitalization to the country's Gross Domestic Product (GDP). Historically, Warren Buffett argued that if this ratio is around 75% to 90%, things are priced fairly. If it hits 120%, you’re in the "danger zone."

As of January 2026, the ratio is sitting at roughly 224%.

✨ Don't miss: Forestry Industry in BC: What Most People Get Wrong

That is not a typo. The market is valued at more than double the entire annual economic output of the United States.

Why the concentration matters

You’ve probably heard of the "Magnificent Seven" or the "AI Hyperscalers." Companies like Nvidia, Microsoft, Apple, and Alphabet (Google) are doing the heavy lifting here. In fact, the concentration is at record levels. We are living through a "winner-takes-all" dynamic where a handful of tech giants represent a huge chunk of the total U.S. value.

- Nvidia and the AI supercycle have pushed valuations to levels that make the dot-com bubble look modest in comparison.

- Microsoft and Amazon are spending billions on data centers—literally hundreds of billions—to keep the growth engine humming.

- Eli Lilly has joined the trillion-dollar conversation, driven by the massive demand for GLP-1 (weight loss) drugs.

It’s a lopsided world. While the big guys are hitting all-time highs, many smaller companies in the Russell 2000 are still struggling with high interest rates and "sticky" inflation that hasn't quite gone away.

Is This a Bubble or Just the New Normal?

Goldman Sachs strategists are out here projecting a 12% total return for the S&P 500 in 2026. Morgan Stanley is even more bullish, eyeing a 14% gain. They argue that this isn't 2000 all over again because these companies actually make money. Lots of it.

Unlike the Pets.com era, today's leaders have massive cash flows. But—and it's a big "but"—the forward price-to-earnings (P/E) ratios are hovering around 22x to 26x. That means you’re paying $26 for every $1 of profit these companies earn. It's expensive.

The "One Big Beautiful Act" and Other Tailwinds

Part of what's keeping the united states stock market capitalization so high is policy. The "One Big Beautiful Act" (a major fiscal package) is expected to slash corporate tax bills by about $129 billion over the next two years. When companies pay less in taxes, they have more for stock buybacks. More buybacks means higher stock prices.

💡 You might also like: BofA active managers quarterly sector rotation: Why the "Air Pocket" in Tech is Changing Everything

Also, the Federal Reserve is finally playing nice. After years of hiking rates to kill inflation, they’ve shifted to "policy normalization." Lower rates usually act like rocket fuel for stock valuations because they make future earnings worth more today.

What Could Actually Break This?

Nothing goes up forever. Even the most optimistic analysts at J.P. Morgan admit there’s about a 35% chance of a recession in 2026.

The biggest risk? The "Revenue Test."

Big Tech is spending over $500 billion on AI infrastructure this year. At some point, the shareholders are going to stop asking "how much AI do you have?" and start asking "where is the money?" If the productivity gains from AI don't show up in the bottom line soon, that $62 trillion market cap could see a very painful haircut.

- Labor Market Softness: Unemployment has been inching up, reaching its highest level since 2021 recently.

- Sticky Inflation: It’s hovering around 3%, refusing to drop to that 2% target the Fed loves so much.

- Geopolitical Friction: Trade wars and tariffs (especially with China) remain a wildcard that can disrupt the supply chains these tech giants rely on.

Practical Steps for Navigating This Market

If you're looking at these numbers and wondering what to do with your own portfolio, don't panic. But don't be asleep at the wheel either.

Watch the concentration. If your "diversified" index fund is actually 35% invested in just five tech companies, you aren't as diversified as you think. Consider looking at "equal-weighted" versions of the S&P 500 to spread out the risk.

Focus on "Quality" Small-Caps. Many experts, including those at Oppenheimer, think 2026 might finally be the year that high-quality small and mid-cap stocks catch up. They were left behind during the AI frenzy, and many are trading at their cheapest valuations in years.

Keep an eye on the "Data Center" play. It’s not just about the chips. Companies involved in power management, cooling, and electrical infrastructure are the "picks and shovels" of this era. They often have more reasonable valuations than the software giants.

Rebalance aggressively. If your winners have grown so much that they now make up 80% of your account, it might be time to take some chips off the table. Selling high and moving money into "value" sectors like healthcare or utilities isn't boring; it’s smart.

📖 Related: What Is the Price of Apple Shares Today: The Numbers Investors Are Watching

The united states stock market capitalization is a reflection of a world where software and AI are the new oil. It’s a high-stakes environment where the giants are getting bigger and the barrier to entry is getting higher. Stay informed, stay skeptical of the "infinite growth" narrative, and always keep enough cash on hand so a 10% dip doesn't ruin your life.