When people argue about the national debt or tax hikes at the dinner table, they usually think they’re talking about the whole pie. They aren't. Most of the money the government spends is basically on autopilot. Social Security and Medicare? That’s mandatory stuff. It happens whether Congress votes on it or not. But then you have United States discretionary spending, and that is where the real drama happens every single year.

It's the part of the budget that Congress actually has to sit down and debate. If they don't pass the bills, the government shuts down. Simple as that.

The $1.7 Trillion Tug-of-War

To understand United States discretionary spending, you have to look at the sheer scale of it compared to the rest of the federal ledger. In fiscal year 2023, we were looking at roughly $1.7 trillion. Sounds like a lot, right? It is. But it’s actually less than a third of the total federal budget. The rest is eaten up by mandatory spending and the interest on our debt, which is getting scarily expensive lately.

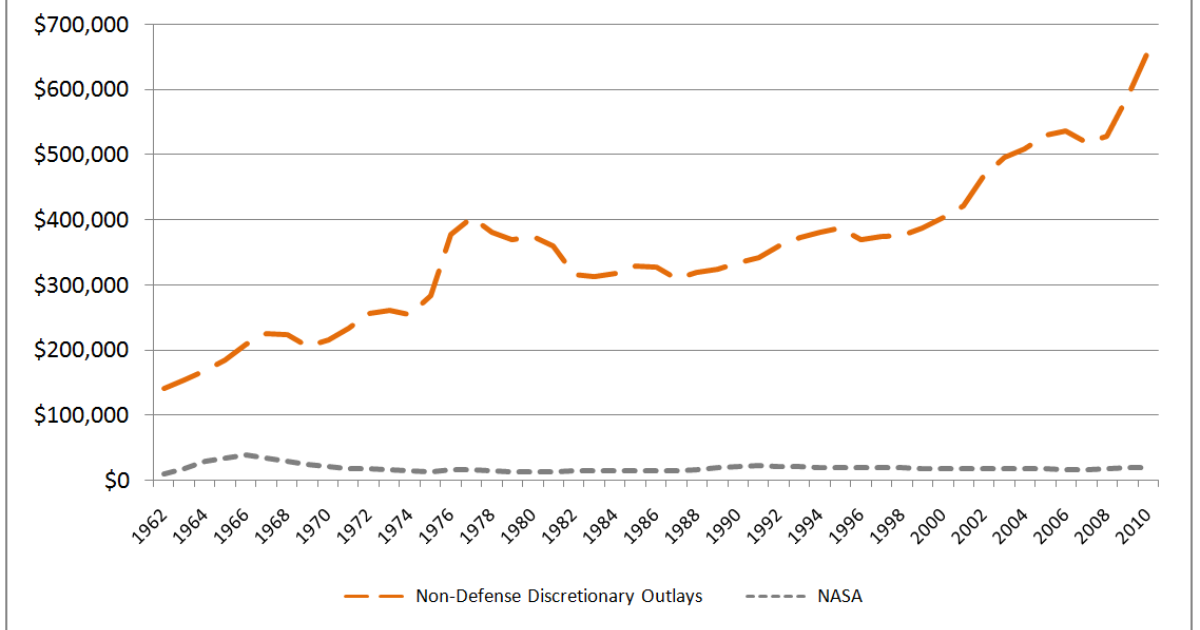

The big elephant in the room is defense. Always has been. Roughly half of all discretionary dollars go to the Pentagon. We're talking about everything from fighter jets to the salaries of the troops stationed in Germany or Japan. The other half—the "non-defense" side—is a chaotic mix of literally everything else. It’s the FBI. It’s NASA. It’s the person inspecting your meat at the grocery store and the grants that keep rural airports running.

Why the "Discretionary" Label is Kinda Misleading

Politicians love to act like this money is "optional" because of the name. Technically, it is. Congress could decide to spend zero dollars on the Department of Education tomorrow. But they won't. If they did, the national infrastructure would basically crumble within a month.

When people talk about "cutting the fat," they usually point to United States discretionary spending because it’s the only part they can easily touch without changing permanent laws. But here's the kicker: even if you eliminated every single non-defense discretionary program—no more national parks, no more cancer research at the NIH, no more border patrol—the U.S. would still be running a deficit. The math just doesn't add up otherwise.

The Defense vs. Everything Else Split

If you look at the breakdown provided by the Congressional Budget Office (CBO), the numbers are pretty stark. In recent years, defense spending has hovered around $800 billion to $900 billion. The remaining "Non-Defense Discretionary" (NDD) funding covers a massive range of agencies.

- The Big Agencies: This includes Health and Human Services (HHS), Veterans Affairs (VA), and the Department of Education. Note that while the VA gets discretionary money, many of its actual benefits are locked in.

- The "Small" Stuff: This is where you find the Smithsonian, the Peace Corps, and the EPA. These are often the first targets during budget brawls because they're politically easy to pick on, even though they represent a tiny fraction of the total.

The VA is actually a fascinating case study in how these categories blur. Over the last decade, VA spending has skyrocketed. Why? Because the cost of healthcare for aging veterans is rising, and Congress has largely agreed that this is a priority that shouldn't be cut. It’s one of the few areas where both parties usually agree to keep the spigot open.

📖 Related: Dollar Against Saudi Riyal: Why the 3.75 Peg Refuses to Break

The Debt Ceiling and the Caps

You’ve probably heard about the Fiscal Responsibility Act of 2023. This was the big deal struck between President Biden and then-Speaker Kevin McCarthy. It basically put a "cap" on United States discretionary spending for a few years.

The idea was to freeze spending to get the deficit under control. But there's a loophole big enough to drive a tank through: "emergency" funding. Whenever there’s a war in Ukraine, a hurricane in Florida, or a sudden border surge, Congress just passes a "supplemental" bill. This money doesn't count toward the caps. It’s like telling your spouse you won't spend more than $100 on groceries but then saying the $50 case of wine was an "emergency" purchase. It's how the budget actually functions in the real world.

Why Social Programs Often Get the Squeeze

When the budget gets tight, the non-defense side usually takes the hit. Why? Because the Pentagon has a massive lobbying wing and a huge footprint in almost every congressional district. If you cut a submarine program, you're cutting jobs in Connecticut or Virginia.

But if you cut Head Start programs or Pell Grants? The impact is more diffused. You don't see it immediately in the form of a factory closing down. This is why United States discretionary spending on social programs has actually shrunk as a percentage of the economy over the last several decades, even as the "sticker price" has gone up due to inflation.

The Role of Appropriators

Most people think the President sets the budget. He doesn't. He sends a "request" to Congress, which is basically a giant wish list that usually gets ignored. The real power lies with the House and Senate Appropriations Committees. These are the folks who actually write the checks.

They divide the money into 12 separate bills. Agriculture, Defense, Interior, Transportation—each has its own sub-committee. If they don't finish all 12 by October 1st (the start of the fiscal year), they have to pass a "Continuing Resolution" (CR). A CR just keeps the lights on at last year's spending levels. It's a lazy way to govern, but it’s become the standard over the last twenty years.

The Myth of Foreign Aid

Ask the average person on the street how much we spend on foreign aid, and they’ll often guess 20% or 25% of the budget. They think we’re just sending pallets of cash overseas while our bridges fall down.

👉 See also: Cox Tech Support Business Needs: What Actually Happens When the Internet Quits

In reality? Foreign aid is a tiny slice of United States discretionary spending. It’s usually less than 1% of the total federal budget. Most of it is actually tied to security—giving countries money so they can buy American-made weapons. It’s basically a subsidy for the U.S. defense industry wrapped in a diplomatic bow.

Infrastructure: The Hybrid Category

Infrastructure is another area where people get confused. You hear about "The Infrastructure Bill" (the IIJA), and you think that's all discretionary. Sorta. A lot of that was "one-time" spending spread over several years. But the day-to-day maintenance of highways comes from the Highway Trust Fund, which is funded by gas taxes. When that runs dry—and it frequently does because the gas tax hasn't been raised since 1993—Congress has to bail it out with discretionary money.

How Inflation Erode the "Real" Budget

One thing that gets lost in the headlines is "real" vs. "nominal" spending. If Congress keeps United States discretionary spending at $1.7 trillion for three years straight, they haven't actually kept spending flat. They’ve cut it.

Inflation means a dollar buys less jet fuel for the Air Force and fewer desks for a school today than it did in 2021. When you adjust for inflation and population growth, non-defense discretionary spending is actually lower now than it was during the late 1970s. That’s a fact that surprises most people who think the government is just constantly ballooning in size.

The "Use It or Lose It" Problem

Ever wonder why government agencies go on a shopping spree in September? It's a quirk of how United States discretionary spending is legally structured. If an agency has $1 million left in its budget on September 30th and they don't spend it, that money goes back to the Treasury.

Even worse? If they don't spend it, Congress assumes they didn't need it in the first place and will likely cut their budget next year. This creates a perverse incentive to buy high-end office furniture or new computers at the end of every fiscal year. It’s inefficient, but it’s the logical result of the rules we’ve created.

Looking Ahead: The 2026 Cliff

As we move through 2026, the budget caps from the previous years are expiring or being renegotiated. The "interest on the debt" is now rivaling the defense budget in size. This puts immense pressure on United States discretionary spending.

✨ Don't miss: Canada Tariffs on US Goods Before Trump: What Most People Get Wrong

We are reaching a point where there is very little "room" left to maneuver. If interest rates stay high, the government has to pay more just to service the debt it already has. That money has to come from somewhere. Usually, it comes out of the discretionary pot because, again, you can't easily cut Social Security without a massive political uprising.

Real-World Impacts of Spending Shifts

When we talk about these numbers, it's easy to lose sight of the people. Take the WIC program (Women, Infants, and Children). It's discretionary. In 2024, there was a major scare that it wouldn't be fully funded for the first time in decades.

If that had happened, hundreds of thousands of new moms would have been put on waiting lists for milk and formula. That’s the "discretionary" reality. It’s not just abstract numbers; it’s the difference between a child having breakfast or not, or a bridge being inspected for cracks versus being ignored for another year.

Actionable Insights: How to Track the Money

If you actually want to know where your tax dollars are going instead of listening to talking heads, you have to look at the source.

- Check USAspending.gov: This is a surprisingly good website. You can see exactly which companies in your specific zip code are getting federal contracts. It’s the most transparent look at United States discretionary spending available to the public.

- Watch the "CR" Deadlines: Every time you hear about a "Continuing Resolution" on the news, look at which agencies are being funded. Usually, the "sticky" points are things like border security or climate change initiatives.

- Follow the CBO's 10-Year Outlook: The Congressional Budget Office is non-partisan and brutally honest. Their reports show that discretionary spending is actually the only part of the budget that is projected to shrink as a percentage of the economy over the next decade.

The real budget problem isn't the "discretionary" side—it's the fact that the "mandatory" side and interest payments are growing so fast they’re eventually going to crowd everything else out. If you care about education, parks, or defense, that should worry you.

The math is simple: as the "autopilot" spending grows, the "voted-on" spending gets squeezed. Understanding this distinction is the first step to having an honest conversation about the country's financial future. Stop looking at the whole pie and start looking at the slice that Congress actually controls. That's where the future of American infrastructure and security is actually decided.

---