You’re between jobs. Or maybe you just missed the Open Enrollment window and you're staring at a "coverage ended" notice with a pit in your stomach. It happens. Life is messy, and the standard healthcare system doesn’t always move at the speed of a job change or a sudden move across state lines. This is usually when people start Googling united short term health insurance to see if it’s a legit way to keep from going bankrupt if they trip on a curb.

Honestly? It's a polarizing topic. Some people call these "junk plans" because they don't cover everything. Others see them as a literal financial lifesaver when the alternative is having zero protection. If you’re looking into these plans, specifically the ones underwritten by Golden Rule Insurance Company (which is the UnitedHealthcare company that handles this stuff), you need to know exactly what you’re buying. It’s not the same as the plan you had at your old 9-to-5. Not even close.

Why the Rules Just Changed for Short-Term Plans

Before we get into the weeds, we have to talk about the 2024 federal ruling. This is huge. For a few years there, you could basically string short-term plans together for up to three years. It was a loophole. The Biden-Harris administration clamped down on that because they wanted people in "comprehensive" ACA plans.

Now, if you buy united short term health insurance, the initial term is capped at three months. You can renew it for a total of four months, but after that, you're done. You can’t just live on short-term insurance forever anymore. This change was designed to protect consumers from realizing too late that their plan doesn't cover pre-existing conditions or maternity care, but it also made things way more complicated for people who just need a bridge for six months.

The Reality of Coverage (and What’s Missing)

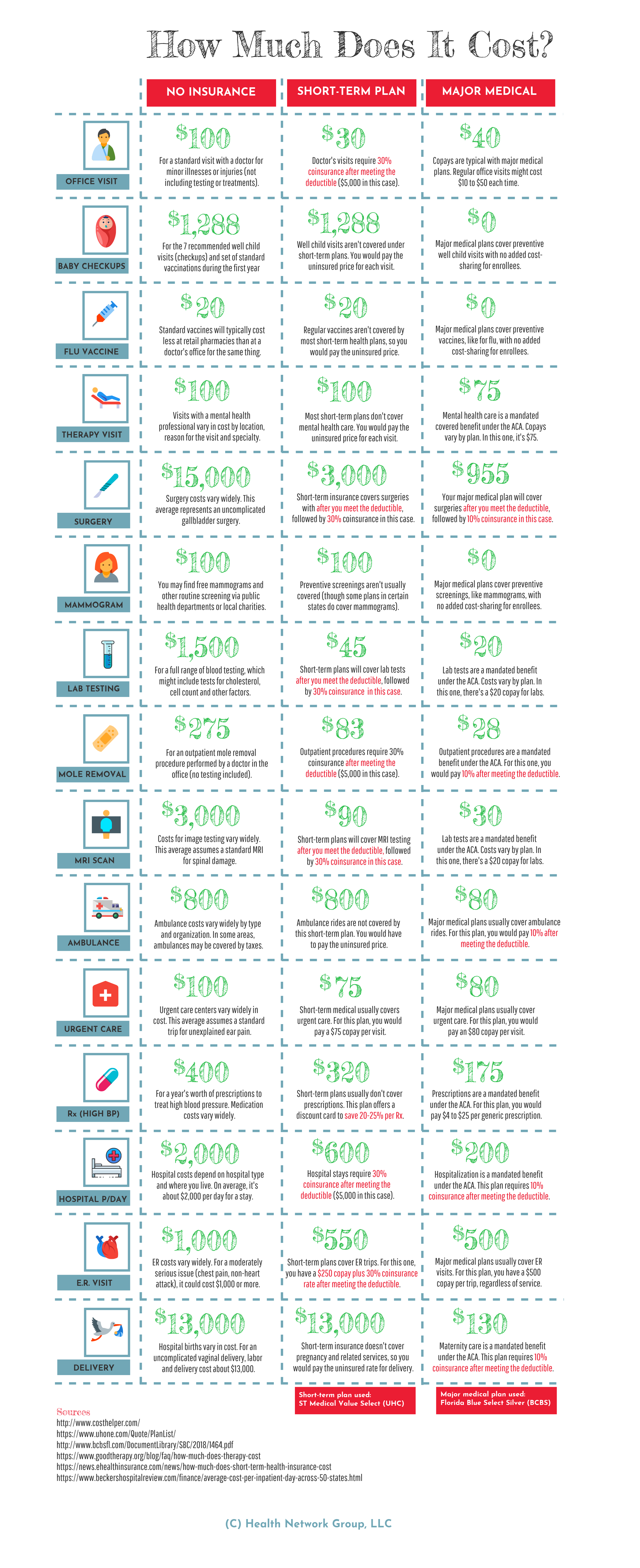

Let’s be real: these plans are affordable because they’re picky.

Unlike the "Obamacare" plans you find on the exchange, United’s short-term options are medically underwritten. That means they’re going to ask you questions. Have you had cancer? Do you have diabetes? Are you pregnant? If the answer is yes, they might just say "no thanks" and deny your application entirely. It feels harsh, but that's the trade-off for a premium that might be half the cost of a COBRA payment.

What you usually get:

- Emergency Room Visits: If you break an arm or get a nasty infection, you're covered after your deductible.

- Inpatient Hospital Stays: The big-ticket stuff that costs $50,000.

- Doctor Visits: Most United plans include some level of coverage for a standard office visit, though you might have a copay or need to hit a deductible first.

- Access to the UnitedHealthcare Choice Plus Network: This is actually the biggest selling point. You get access to a massive network of doctors and hospitals, which means you’re paying the negotiated "insurance rate" rather than the "cash price" the hospital sends to uninsured people.

What you almost certainly won't get:

- Maternity Care: If you’re planning a family, stay away. These plans do not cover pregnancy or childbirth.

- Mental Health Services: Often excluded or very limited.

- Pre-existing Conditions: If you’re already treating a chronic illness, the plan won't pay for anything related to that condition. They look back at your medical records.

- Prescription Drugs: Some plans have a "discount card," but true pharmacy coverage is rare in the base-level short-term products.

The Deductible Trap

One thing people miss when looking at united short term health insurance is the "per term" vs. "per year" deductible.

💡 You might also like: How to take out IUD: What your doctor might not tell you about the process

Since these plans only last a few months, your deductible resets every time you start a new policy. If you have a $5,000 deductible on a three-month plan and you hit it in month two, that's great for that month. But if you start a new three-month plan right after, you start back at zero. You’re effectively paying a massive amount of out-of-pocket costs if you have multiple small issues across different terms.

It’s meant for the "catastrophic" stuff. The "I got hit by a bus" scenario. If you’re going to the doctor every two weeks for a sinus infection, the math probably won't work in your favor.

Is it Better Than COBRA?

Usually, when people look for this, they're comparing it to COBRA. COBRA is basically your old job's insurance, but you pay the whole bill yourself plus a 2% admin fee. It’s incredibly expensive—often $600 to $2,000 a month depending on your family size.

United short term health insurance is often a third of that price.

But—and this is a big "but"—COBRA covers everything. If you have an expensive prescription or a therapist you see weekly, COBRA might actually be cheaper in the long run because it actually pays for those things. Short-term insurance is a gamble that you’ll stay healthy for 90 days.

How to Actually Apply Without Getting Scammed

There are a lot of "ghost" sites out there that look like insurance companies but are actually just lead-generation machines. They’ll sell your phone number to twenty different brokers who will call you until your phone explodes.

📖 Related: How Much Sugar Are in Apples: What Most People Get Wrong

If you want the actual United product, you go through UnitedHealthcare’s official portal or a licensed broker who specifically mentions Golden Rule Insurance Company.

You’ll pick a "Max Out-of-Pocket" limit. Don't just look at the monthly premium. A $100/month plan looks amazing until you realize the deductible is $12,500 and the insurance only pays 70% after that. Look for the "Coinsurance" percentage. You want a plan where the insurance pays 80% or 100% after you hit that deductible.

The Weird Specifics of United’s Network

UnitedHealthcare has one of the best networks in the country. This is the "Choice Plus" network. If you find a short-term plan that uses this network, you can generally see almost any specialist in a major city.

However, make sure you check if the specific short-term plan requires a "Primary Care Physician" (PCP) referral. Some of the newer, cheaper tiers are more restrictive. They want you to see a specific doctor before you go to a specialist. It’s a bit of a hassle, but it keeps the premiums down.

Who is This Actually For?

Honestly, it's for a very specific person.

- The Recent Grad: You’re off your parents’ plan, you’re 23, and you don’t have a job yet. You just need to not go bankrupt if you get appendicitis.

- The Job Jumper: You start a new gig in 45 days. You just need a "bridge."

- The Early Retiree: You’re 62, you left your job, and you’re waiting for Medicare to kick in at 65. (Though, be careful here—at 62, you likely have health issues that might get you denied).

- The "Missed Enrollment" Crowd: You forgot to sign up for the ACA in December and now it’s March. You’re stuck until next year, and short-term is the only way to get any coverage at all.

Understanding the "Look-Back" Period

When you file a claim with united short term health insurance, they don't just pay it blindly. They do something called "post-claims underwriting."

👉 See also: No Alcohol 6 Weeks: The Brutally Honest Truth About What Actually Changes

If you go to the hospital for a back injury, they will look at your medical records from the last five years. If they find out you saw a chiropractor for that same back pain three years ago, they might deny the claim, saying it was a pre-existing condition.

This is the "dark side" of short-term insurance. It’s why you have to be incredibly honest on the application. If you hide something, they will find it when you actually try to use the insurance, and you’ll be left holding a $20,000 bill.

Practical Steps to Take Right Now

If you’re leaning toward a short-term plan, don't just click "buy" on the first cheap option you see.

First, check the HealthCare.gov site. Even if it's not Open Enrollment, you might qualify for a "Special Enrollment Period" if you just lost your job or moved. If you qualify for a subsidy, a "real" ACA plan might actually be cheaper than a short-term plan.

Second, if you do go with United, read the "Outline of Coverage." It’s a boring PDF, usually 5-10 pages long. It lists exactly what is excluded. Read the "Exclusions" section twice. If it says "No coverage for outpatient prescriptions," and you take a $400-a-month medication, you’ve just found your answer.

Third, look at the Life Association membership. Often, these short-term plans require you to join a "group" or association to get the rates. It’s usually a few extra dollars a month. It’s not a scam; it’s just the legal structure they use to offer these plans in certain states.

Lastly, confirm your doctors are in the network. Do not trust a verbal "yeah, we take United." Ask for their specific NPI number and check it against the UnitedHealthcare provider search tool specifically for "Short Term" or "Golden Rule" plans. The network for short-term plans is sometimes smaller than the one for employer-sponsored plans.

Short-term insurance is a tool. Like a spare tire. You don't want to drive on it for 500 miles, but it’ll get you to the shop if you’re in a pinch. Just know that it’s built for the healthy and the lucky. If you fall into that category and just need a safety net for 90 days, it’s a viable path.