Picking a prescription drug plan is usually the part of Medicare that makes people want to pull their hair out. It’s dense. It's confusing. Honestly, it feels a bit like gambling on your own health. When you start looking at United Healthcare Part D, you’re looking at one of the biggest players in the game, mostly because of their massive partnership with AARP. But just because their name is everywhere doesn't mean every plan they offer is a slam dunk for your specific medicine cabinet.

Most folks think "Part D is Part D." They assume if they sign up with a big name, everything is covered. That's a mistake. A big one.

Medicare Part D is private insurance that helps you pay for brand-name and generic drugs. United Healthcare (UHC) offers these as "stand-alone" plans if you have Original Medicare, or tucked inside a Medicare Advantage plan. But here’s the kicker: the "best" plan changes every single year because your medications change and their "formularies"—that's just the fancy insurance word for the list of drugs they cover—shift like sand.

Why United Healthcare Part D is Different (And Why It Isn’t)

You’ve probably seen the AARP logo plastered all over UHC’s marketing. This partnership is huge. It gives them a certain level of trust, sure, but it also gives them the scale to negotiate some pretty decent preferred pharmacy networks.

If you're using United Healthcare Part D, you aren't just buying insurance; you're buying into a specific ecosystem of pharmacies like Walgreens or CVS, depending on the specific year and plan structure. If you go to the "wrong" pharmacy, your co-pay might double. It’s a game of logistics.

The Tier System is Where They Get You

Every drug plan, including those from UHC, ranks drugs into "tiers."

- Tier 1 is usually your "bread and butter" generics. Cheap. Sometimes $0.

- Tier 2 is preferred generics.

- Tier 3 is preferred brands. This is where the price starts to bite.

- Tier 4 and 5? That’s the "non-preferred" and "specialty" stuff. If your med is here, you’re likely paying a percentage of the total cost, not just a flat fee.

People often look at the monthly premium—maybe it’s $15, maybe it’s $100—and pick the cheapest one. That is a trap. A $0 premium plan might end up costing you $2,000 more over the course of a year if your specific asthma inhaler or blood thinner is sitting in Tier 4 instead of Tier 2. You have to do the math on the total annual cost, not the monthly bill. It’s annoying, but it’s the only way to stay ahead.

The 2025-2026 Shift: The $2,000 Cap

This is the part that actually matters right now. Thanks to the Inflation Reduction Act, there’s a massive change in how all Part D plans, including United Healthcare Part D, actually function.

🔗 Read more: Why Doing Leg Lifts on a Pull Up Bar is Harder Than You Think

Starting recently, there is a $2,000 out-of-pocket cap on covered drugs.

In the old days—like, two years ago—you could get stuck in the "donut hole" or face massive costs in "catastrophic coverage" if you had cancer or rheumatoid arthritis. That’s gone. Once you hit that $2,000 mark in 2026, your plan picks up 100% of the cost for covered drugs for the rest of the year.

This sounds like a pure win. And it is for people with high drug costs. But for the insurance companies? It’s a headache. They are looking for ways to make up that money, which means they might get stricter about "Prior Authorizations" or "Step Therapy."

Real-world example: You might want the brand-name drug your doctor suggested, but UHC might tell you that you must try two different generics first. If those fail, only then will they pay for the brand name. It’s called Step Therapy, and UHC uses it frequently to keep their own costs down under the new cap.

Avoiding the "Late Enrollment" Tax

Medicare is obsessed with deadlines. If you miss your Initial Enrollment Period when you first turn 65, and you don’t have "creditable coverage" from a job or a spouse, Medicare will slap a penalty on you.

The penalty for United Healthcare Part D—or any drug plan—is 1% of the "national base beneficiary premium" for every month you waited. And here’s the catch: you pay that penalty for life. It never goes away.

Even if you don’t take any pills right now, get the cheapest plan available. It’s basically "penalty insurance." You’re paying a few bucks a month now so that if you need a $5,000-a-month drug in ten years, you aren't paying an extra 120% penalty on top of your premium.

💡 You might also like: Why That Reddit Blackhead on Nose That Won’t Pop Might Not Actually Be a Blackhead

Which UHC Plan Actually Fits?

United Healthcare usually offers three main flavors of stand-alone Part D plans:

- AARP MedicareRx Basic: This is usually the budget-friendly option. It has a deductible, and it’s meant for people who just take a few generics or want to avoid the penalty.

- AARP MedicareRx Walgreens/CVS: These are co-branded. They offer lower prices if you stick specifically to those pharmacy chains. If you’re a loyalist to a local mom-and-pop pharmacy, these plans will probably bankrupt you.

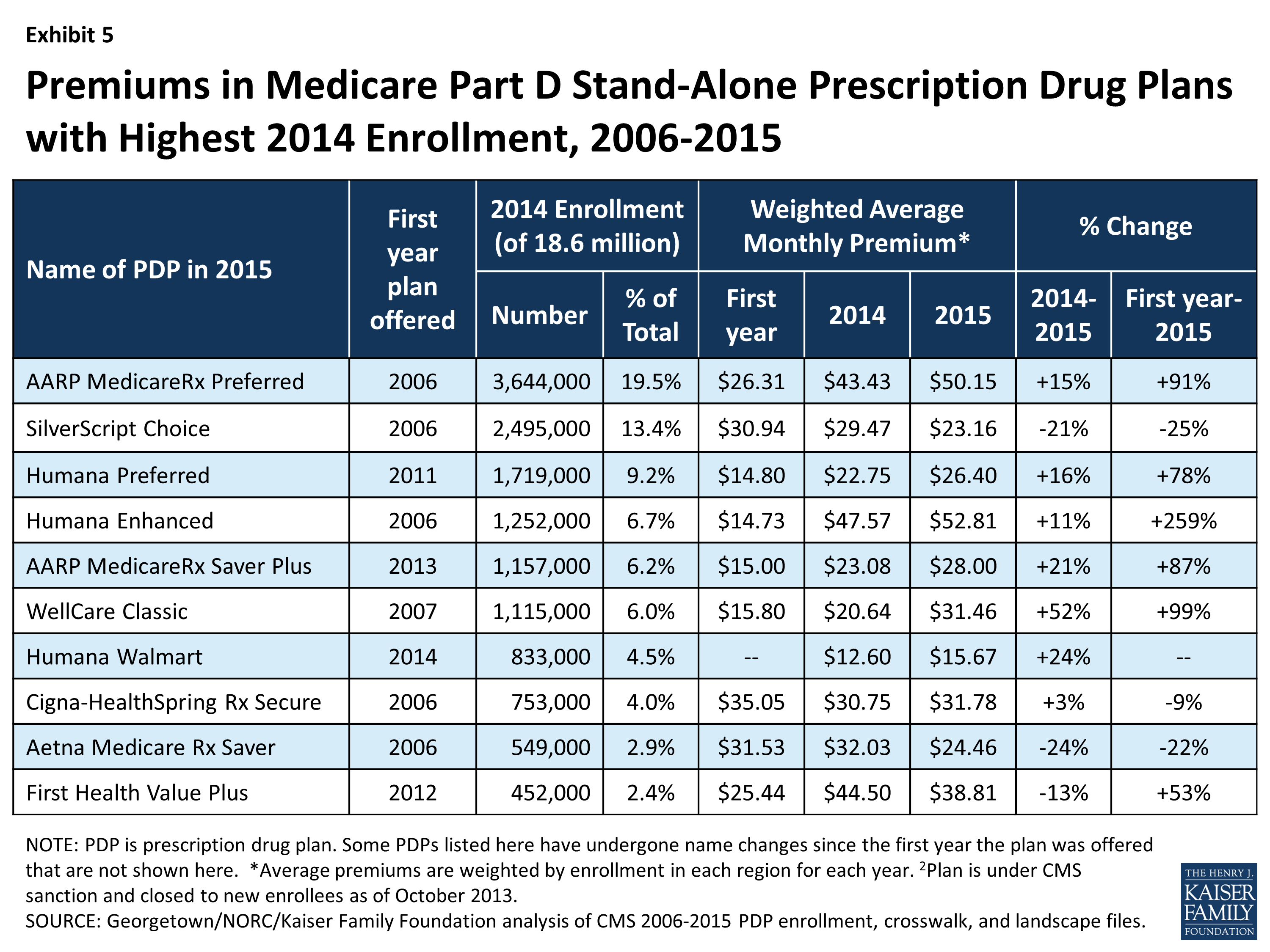

- AARP MedicareRx Preferred: This is the "big guns" plan. Higher premium, but usually a $0 deductible on Tiers 1 and 2. If you take multiple brand-name drugs, the math usually favors this one even though the monthly bill looks scarier.

The Pharmacy Network Trap

You’ve got to check the network. I can't stress this enough. United Healthcare has "preferred" and "standard" pharmacies.

Let's say you take a generic statin. At a preferred pharmacy like Walgreens, it might be $0. At a "standard" pharmacy—maybe the grocery store pharmacy down the street that’s still in-network but not preferred—it might be $15. That’s $180 a year just for the "convenience" of not driving an extra mile.

Now, multiply that by five different medications. You’re literally throwing money away.

The Weird Stuff: Mail Order and Insulin

UHC really wants you to use Optum Rx. That’s their own mail-order pharmacy. They own it. Because they own it, they can often offer 90-day supplies for way less than the local pharmacy.

And then there's insulin.

The law now caps insulin at $35 a month for all Part D plans. If you’re paying more than $35 for a month’s supply of a covered insulin on a United Healthcare Part D plan, something is wrong. Call them. It shouldn't happen.

📖 Related: Egg Supplement Facts: Why Powdered Yolks Are Actually Taking Over

How to Actually Shop Without Losing Your Mind

Don't just go to the UHC website. Go to Medicare.gov and use their Plan Finder tool.

You type in your exact drugs. You type in your exact dosages. You pick your preferred pharmacies. The tool will then rank every plan—United Healthcare, Humana, Aetna, all of them—by the Total Annual Cost.

Total Annual Cost = (Monthly Premium x 12) + (Annual Deductible) + (Estimated Co-pays).

That is the only number that matters. If UHC comes out on top, great. If they don't, don't let the AARP branding sway you. Loyalty to an insurance company is a one-way street; they aren't loyal to you.

What if your drug isn't on the list?

If you're already on a UHC plan and they drop your drug for next year, you have options.

- The Transition Fill: UHC is usually required to give you a one-time, 30-day "temporary" supply of a non-covered drug during the first 90 days of the year. This gives you time to talk to your doctor about an alternative.

- The Formulary Exception: Your doctor can write a letter saying you must have this specific drug because the generics caused a bad reaction. If UHC approves it, they’ll cover it even if it’s not on their list. It’s a hassle, but it works.

Next Steps for Your Coverage

Right now, the most important thing you can do is pull out your current pill bottles and look at the labels. Don't guess.

- Verify your 2026 formulary: Log into the United Healthcare portal or use the Medicare.gov tool to see if your drugs have moved tiers. A move from Tier 2 to Tier 3 can triple your costs overnight.

- Check your pharmacy's status: Confirm your local pharmacy is still "Preferred" for 2026. These contracts change annually, and a "Preferred" pharmacy this year might be "Standard" next year.

- Audit your "Auto-Refill": If you use Optum Rx, ensure your payment methods are updated so you don't hit a gap in coverage because of an expired credit card.

- Compare the Deductible: Many UHC plans have a deductible (around $590 in 2026 for some) that applies only to Tiers 3, 4, and 5. If you only take Tier 1 drugs, the deductible might not even matter to you—don't let a "High Deductible" label scare you off if you don't take expensive meds.

The goal isn't to find the "best" insurance company. It's to find the plan that treats your specific list of medications the most kindly for the next twelve months. In the world of United Healthcare Part D, the math always beats the brand.