Honestly, if you've been watching Under Armour lately, it feels like watching a star athlete try to play through a Grade 2 hamstring pull. You want them to sprint, but every time they accelerate, they winince. This isn't just about gym clothes anymore. It's a high-stakes corporate drama.

The under armour stock forecast for 2026 is currently a mix of cautious optimism and "wait-and-see" skepticism. Wall Street isn't exactly throwing a parade. Right now, the consensus among the big-shot analysts—about 23 of them if you're counting—is a lukewarm Hold.

✨ Don't miss: Employee Birthday Gift Ideas: Why Most Companies Get It Totally Wrong

What the Numbers Actually Say

Let's get real for a second. The price targets are all over the place. We’re looking at an average forecast of $6.37 per share.

Some optimists think it could hit $10.00.

On the flip side, the bears are bracing for a drop to $4.00.

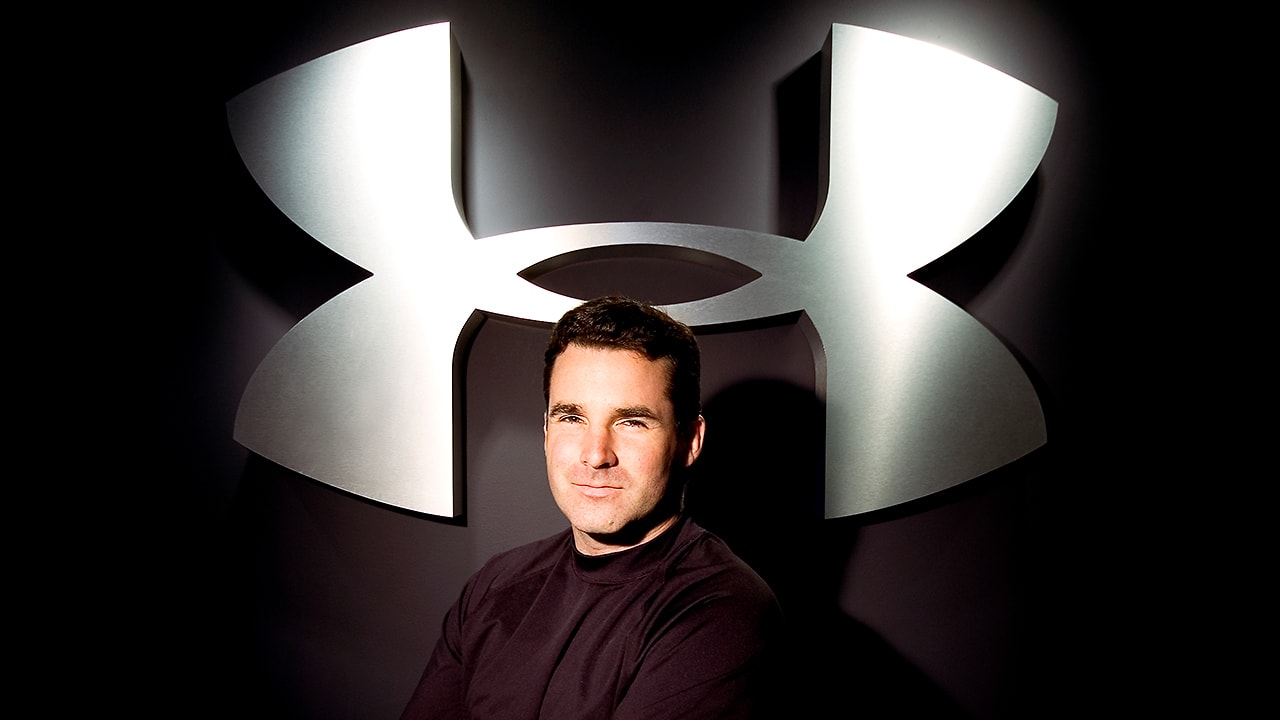

That’s a massive gap. It basically tells you that nobody is 100% sure if the "Plank Plan" is going to stick the landing or faceplant. Kevin Plank, the founder who stepped back into the CEO seat in early 2024, is basically trying to rebuild the engine while the car is doing 60 on the highway.

Revenue for fiscal 2026 is expected to drop by 4% to 5%. That sounds bad, and sort of is, but management says it’s "on purpose." They are killing off low-quality, discounted sales to try and make the brand feel "premium" again. Basically, they're tired of being the brand you only buy because it was 40% off at the outlet mall.

The Kevin Plank Turnaround Strategy

Plank is leaning into a "quiet company, loud brand" mantra.

It’s a bold move.

In November 2025, they actually expanded their restructuring plan, adding another $95 million in charges to the pile. Why? Because they’re separating the Curry Brand into its own thing and cutting loose contracts that aren't working.

They are also hacking away at their SKU count (that's "Stock Keeping Units" for the non-retail nerds) by about 25%. They want fewer shirts, but better shirts.

Key Headwinds for 2026:

- Tariff Troubles: This is a big one. Management warned that higher U.S. tariffs are going to eat into their margins. They’re expecting gross margins to drop by 190 to 210 basis points.

- The Footwear Problem: While apparel is holding its own (kinda), footwear sales fell 16% in late 2025. It’s hard to be a top-tier sports brand if people aren't wearing your shoes.

- North American Slump: Revenue in their home turf is expected to see "high-single-digit" declines. You can’t ignore your biggest market forever.

Why Some People are Still Buying

It’s not all doom and gloom.

If you look at the under armour stock forecast through a value investor's lens, there are some nuggets of hope. For one, they’re buying back their own stock. As of late 2025, they’ve retired millions of shares as part of a $500 million program.

Also, the EMEA region (Europe, Middle East, and Africa) is actually growing. While the US is struggling to find its vibe, international fans are still picking up the gear.

Adjusted operating income for 2026 is projected between $95 million and $110 million. That's a slight bump from earlier estimates. It suggests that even though they are selling less stuff, they are getting much more efficient at how they run the business.

The Reality Check

We have to talk about the competition. Nike is struggling too, but Lululemon and Hoka are eating everyone's lunch. Under Armour used to be the "hungry underdog." Now, they’re the middle-aged incumbent trying to remember what made them cool in the first place.

Most analysts, like those at Truist Financial and Wells Fargo, have recently lowered their targets or kept them steady at that $6.00 range. They want to see proof that the Fall/Winter 2025 collection—which Plank says is the real "reset"—actually flies off the shelves before they tell anyone to buy the stock.

If you’re looking at the under armour stock forecast as a short-term play, it’s probably going to be a bumpy ride. But if Plank can actually turn the Curry Brand into a standalone powerhouse and get people to pay full price for a hoodie again, the 2027 outlook might look a lot brighter than 2026.

Actionable Steps for Investors

- Watch the February Earnings: The next big check-in is estimated for early February 2026. Look for whether they beat the $0.03-$0.05 adjusted EPS guidance.

- Monitor the Gross Margin: If that 47% margin starts dipping toward 44% because of tariffs, the stock will likely take a hit regardless of what Plank says.

- Check the Footwear Trajectory: Until Under Armour proves they can compete with Nike and On Running in the shoe aisle, the "premium" rebrand is just talk.

- Track the Share Buybacks: Continued aggressive buybacks at these low prices ($5.00 - $6.00 range) could provide a floor for the stock price.