Wall Street can be a cold place. One day you’re the high-flying challenger taking a bite out of Nike, and the next, you’re trading for the price of a fancy latte. Honestly, looking at the under armour price stock right now feels a bit like watching a veteran athlete try to make a comeback after a devastating ACL tear. You want to believe in the grit, but the scoreboard—or in this case, the ticker—doesn't lie.

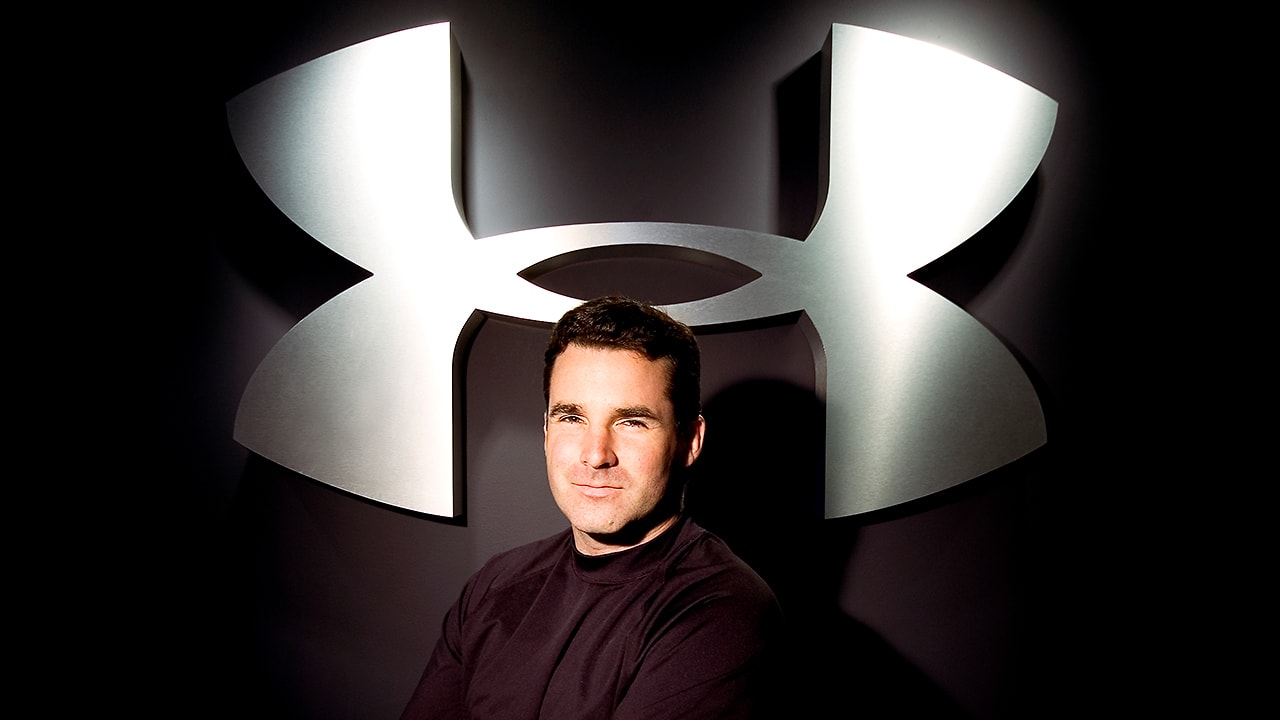

As of mid-January 2026, Under Armour’s Class A shares (UAA) are hovering around the $5.70 to $5.80 mark. It’s a far cry from those glory days in 2015 when the stock was splitting and everyone thought Kevin Plank was the next Phil Knight. If you’ve been holding on since then, my condolences. But for those looking at it today, the question isn't about the past. It’s about whether this $2.4 billion market cap company is actually a coiled spring or just a fading memory in a world obsessed with Lululemon and Hoka.

The Reality of the Under Armour Price Stock Today

Basically, the market is in a "wait and see" mode. There’s a lot of noise. You’ve got a 52-week range that’s been as low as $4.13 and as high as $8.72. That kind of volatility tells you everything you need to know: nobody is quite sure if the turnaround is working.

Kevin Plank is back in the driver’s seat as CEO. He’s trying to "premiumize" the brand. That’s a corporate way of saying they want to stop being the brand you only buy when it's 40% off at an outlet mall. It's a tough sell.

Right now, the consensus among the 23 or so analysts tracking the stock is a "Hold." The average 12-month price target is sitting around $6.37. Some optimists think it could hit $10.00, while the bears are bracing for a drop back to $4.00. It’s a wide gap.

Why the Price is Stuck in the Mud

- Revenue Slumps: In late 2025, North American revenue took a double-digit hit. That hurts. North America is the heart of the business, and if the heart isn't pumping, the rest of the body struggles.

- The Curry Factor: We have to talk about Steph. The partnership is ending in 2026 after the Curry 13 drops in February. Losing a generational talent like that is a blow to cultural relevance, even if they’ve launched the "Curry Brand" as a standalone.

- Restructuring Fatigue: The company is currently hacking away at costs—trying to save about $140 million to $160 million. Restructuring is necessary, but it’s also expensive and distracting.

The under armour price stock reflects a company that is fundamentally rebuilding its identity. They’re moving away from being "the gym brand" to focusing on team sports like American football. It’s a return to roots. But roots don't always grow back overnight.

👉 See also: Indigo Unsecured Credit Card: Why People Still Get It (and the Catch)

What the Analysts Aren't Telling You

You’ve probably seen the "Buy" or "Sell" ratings, but there's a nuance here that gets lost in the charts. Under Armour is actually seeing some wins in gross margins. They hit 46.7% to 47.5% recently. That’s because they’re discounting less. They are choosing to sell fewer items if it means they can sell them at a higher price.

Plank’s mantra right now is "selling more of less." It sounds counterintuitive. Why would you want to sell less? Because the "pile 'em high and sell 'em cheap" strategy was killing the brand’s soul. By tightening assortments and focusing on "pinnacle" products—think the Velocity Elite 3 or the Stealthform hats—they’re trying to claw back some of that "cool" factor.

The Insider Move

Here is something interesting. Major shareholder V. Prem Watsa recently went on a buying spree, picking up over 13 million shares at an average of $5.12. When the big money starts doubling down during the dark days, it usually means they see a floor. Insiders now own about 15.6% of the company. They’re in the trenches with the retail investors.

Is there a Bull Case for 2026?

If you’re a contrarian, you might see opportunity. The stock is trading at a price-to-sales ratio of about 0.5x. Compare that to Nike, which usually trades way higher. Under Armour is objectively "cheap" by almost any metric. But cheap can stay cheap for a long time if there's no catalyst.

🔗 Read more: How much to invest in S\&P 500: The Numbers Most People Get Wrong

The catalyst might be the "un-sportswear-ing" of the brand. They’re finally acknowledging that 16-to-22-year-old athletes are their core. They aren't trying to be Lululemon anymore. They want to be the brand you wear when you’re actually sweating, not just getting brunch.

The next earnings report is slated for February 5, 2026. That’s the big one. If they can show that the North American decline has finally bottomed out, we might see the under armour price stock finally break out of its current slump. If not? Well, that $4.00 floor starts looking a lot more likely.

Actionable Insights for Investors

Look, nobody has a crystal ball. But if you're watching the under armour price stock, here’s how to play it:

- Watch the Gross Margin: If it stays above 47%, the strategy of "premiumizing" the brand is actually working, regardless of what the total revenue says.

- Monitor the Wholesale Partnerships: Under Armour needs to win back shelf space at places like Dick’s Sporting Goods. If you start seeing more UA gear at full price in retail stores, that’s a lead indicator of a recovery.

- The $5.00 Support Level: Historically, the stock has found a lot of buyers around the $4.50 to $5.15 range. If it dips back there, it has historically been a decent entry point for a swing trade, though not necessarily a long-term "set it and forget it" investment.

- Ignore the Noise Around Steph Curry: The market has already priced in the end of the partnership. The real story is whether they can find the next "big thing" in the NIL (Name, Image, Likeness) era of college sports.

The bottom line? Under Armour isn't going bankrupt, but it isn't winning the race either. It's a grind. If you have the stomach for a multi-year turnaround led by a founder who is clearly taking this personally, keep it on your watchlist. If you're looking for quick gains, you might be looking at the wrong jersey.

🔗 Read more: Del choque al cheque: Why Your Car Accident Settlement Isn't Happening Faster

Check the technicals before you jump in. The RSI (Relative Strength Index) is currently sitting near 67, which means it’s getting close to "overbought" territory in the short term. Wait for a pullback or a definitive earnings beat before making a move.