If you’ve walked into a Tesco lately and felt like your wallet just got mugged, you aren't alone. It’s a weird time. For years, we’ve been told that things would "return to normal," but "normal" in 2026 feels a lot like we’re just running faster to stay in the same place.

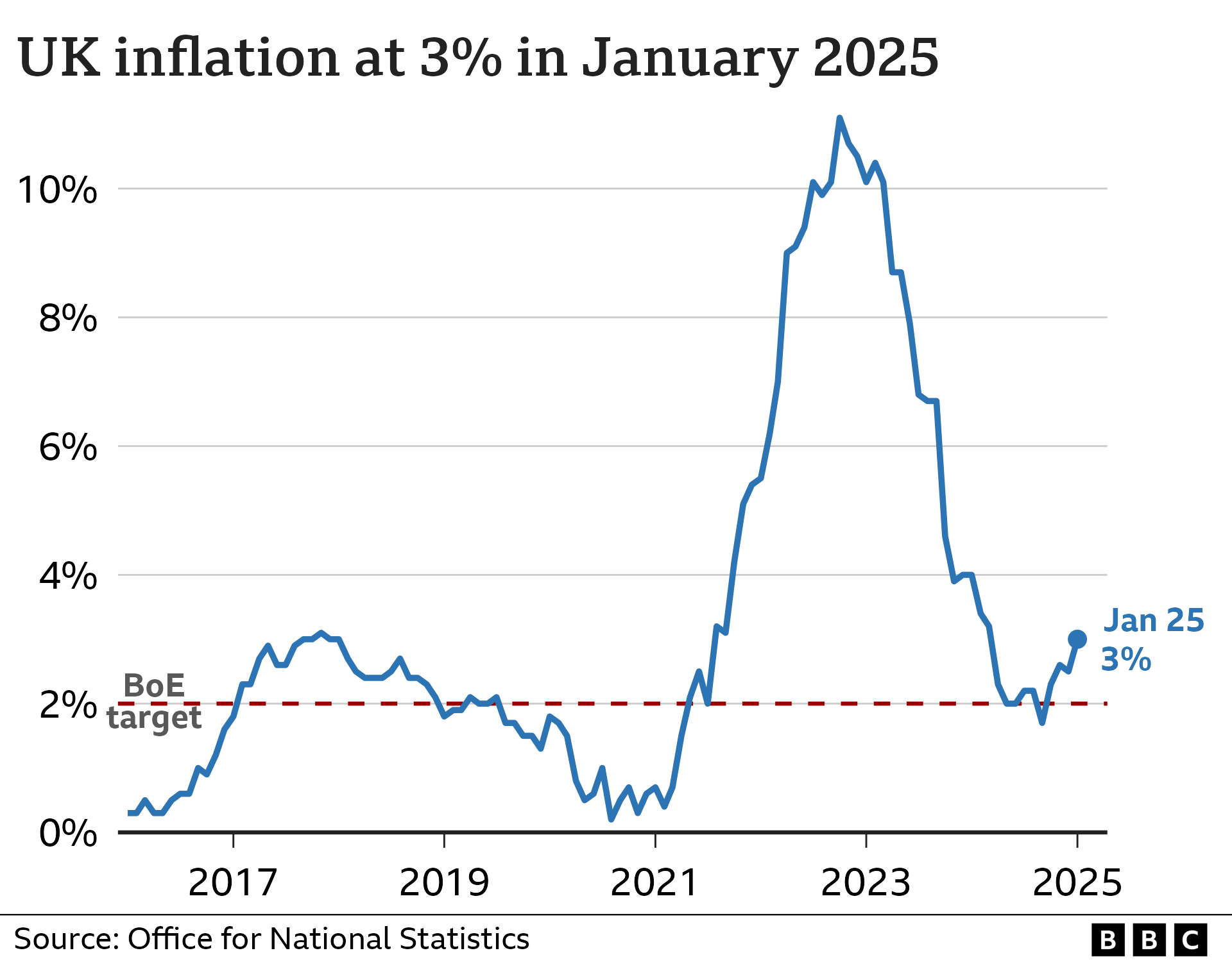

So, let's look at the hard numbers. The UK inflation rate now sits at 3.2%, according to the latest figures from the Office for National Statistics (ONS). That’s the Consumer Prices Index (CPI) reading for the year to November 2025, which is the most recent "official" snapshot we have as we kick off January.

It’s down from the scary double digits of 2022, sure. But 3.2% is still a long way from that "magic" 2% target the Bank of England (BoE) is obsessed with.

Why the UK inflation rate now is stuck in the "sticky" zone

Honestly, the term "sticky" is the only way economists describe this. It basically means that while the big shocks—like the energy price explosions after the Ukraine invasion—have faded, the price of everyday stuff is refusing to budge.

Think about your Friday night takeaway or a haircut. These are services. And services are where the real battle is happening. While the price of a loaf of bread might have stabilized because wheat costs settled, the person making that bread or cutting your hair needs a higher wage to survive their own rent hikes.

📖 Related: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

- Wage Growth: It’s cooling, but not fast enough for the BoE.

- The Budget Effect: Last year's Autumn Budget introduced shifts in National Insurance and the National Minimum Wage. Businesses are now passing those costs directly to you.

- Energy Bills: We're expecting a bit of a breather in April 2026 when energy price caps are predicted to shift downward, but until then, it's a squeeze.

The Alan Taylor factor

Recently, Alan Taylor—a key member of the Bank of England’s Monetary Policy Committee—dropped a bit of a bombshell. He’s much more optimistic than his colleagues. Speaking in Singapore this January, he suggested that the UK might hit that 2% target by mid-2026.

That’s a big deal. Why? Because the previous forecast didn't see us hitting 2% until well into 2027. If Taylor is right, we might see interest rates fall faster than the markets currently expect.

What’s actually getting cheaper (and what isn’t)?

It’s a mixed bag. Total chaos, really.

Food inflation has actually been one of the "good" stories lately. It fell to 4.2% in late 2025, down from nearly 5%. We’re seeing actual price drops in things like cereals and biscuits. It’s not much, but when you’re feeding a family, a few pence off a box of Cornflakes matters.

👉 See also: Getting a Mortgage on a 300k Home Without Overpaying

On the flip side, housing and utilities are still the heavy hitters. Rents are up. Mortgage renewals are still stinging people who are coming off those "golden" 2% fixed-rate deals from five years ago.

The "Hidden" drivers: Trade and Tariffs

There's something else bubbling under the surface that nobody really talked about a year ago: trade diversion.

Because of shifting global trade policies—especially the latest rounds of US tariffs—trade routes are changing. Curiously, some experts think this might actually help UK inflation. If goods intended for the US get diverted elsewhere, it can lead to a surplus that lowers import prices for us. Alan Taylor reckoned this could shave about 0.2 percentage points off our inflation rate this year.

Interest rates: The 3.75% Reality

The Bank of England cut the base rate to 3.75% in December. It was the sixth cut since the summer of 2024.

✨ Don't miss: Class A Berkshire Hathaway Stock Price: Why $740,000 Is Only Half the Story

Most people expect two more cuts this year. We’re likely looking at a "neutral" rate of around 3.25% by the time we hit the autumn. But don't expect a return to the 0.1% days. Those are gone. Dead and buried.

What this means for your pocket

If you have savings, 2026 is the year to stop being lazy. With inflation at 3.2% and some savings accounts still offering 4% or more, you can actually make a "real" return. That hasn't been true for most of the last decade.

If you’re a first-time buyer? It’s still brutal. House prices in London are flatlining, but the "North-South divide" is wider than ever. Prices in the North East and Scotland are actually climbing faster because people are fleeing the high costs of the South.

Actionable steps for the "new normal"

Waiting for 2% inflation won't solve your budget problems tomorrow. Here is what you should actually do right now:

- Audit your fixed costs. If you’re one of the millions whose mortgage is renewing in 2026, talk to a broker now. Don't wait for the letter from your bank.

- Lock in savings rates. If you have cash sitting in a 0.5% current account, you are actively losing money. The window for 4.5%+ fixed-rate bonds is closing as the BoE prepares to cut further.

- Watch the April "cliff." April is when many "administered" prices—like rail fares and council tax—tend to jump. Build a buffer in your budget now for that spring surge.

- Ignore the "Headline" number. Your personal inflation rate depends on what you buy. If you don't drive and you don't eat out, your 2026 might actually feel quite stable. If you're renting and commuting? Your personal inflation is likely way higher than 3.2%.

The UK economy is "anaemic," as the ICAEW put it. We're growing at maybe 1% this year. It's not a boom, and it's not quite a bust. It’s just... a grind. Keeping a close eye on the monthly ONS releases (the next one is January 21st) will tell you if Alan Taylor's optimism is a pipe dream or a pending reality.