Honestly, if you’re waiting for the Bank of England to just "flick a switch" and bring back the ultra-low interest rates of 2021, I’ve got some bad news for you. That era is dead. But that doesn’t mean the outlook is grim—it’s just complicated.

Right now, the uk base rate forecast for 2026 is the hottest topic in the City, and for good reason. After the Bank of England nudged the rate down to 3.75% in December 2025, everyone started asking: how much lower can we actually go?

The vibe in the markets is "cautious optimism," which is basically code for "we think rates are falling, but we're terrified of a surprise inflation spike."

The 3.25% Magic Number?

Most of the big brains at places like Deutsche Bank and Oxford Economics are clustering around a similar prediction. They reckon we’ll see the base rate land somewhere between 3.25% and 3.5% by the time we’re putting up Christmas decorations in 2026.

It sounds like a safe bet. Inflation has finally behaved itself, hovering around 3.2% in late 2025 and expected to dip toward 2.5% later this year. But here’s the kicker: the Monetary Policy Committee (MPC) is split. Like, really split.

Last time they voted, it was a 5-4 nail-biter. That tells you everything you need to know.

Why the Bank is Dragging Its Feet

Andrew Bailey and his crew are haunted by the "ghost of 2022." They don't want to cut rates too fast, trigger a spending spree, and find themselves back in an inflation death spiral.

- Wage growth is still "sticky." People are still getting decent pay rises, which sounds great for us, but it makes the Bank nervous about service-sector inflation.

- The Jobs Market. Unemployment is creeping up toward 5.3%, which usually screams "CUT RATES NOW," but the Bank is playing it cool.

- Global Chaos. Between trade tensions and energy price wobbles, there’s always something ready to ruin the party.

Real Talk for Mortgage Prisoners

If you’ve got a fixed-rate deal ending this year, you’re probably refreshing your browser every ten minutes looking for a deal.

💡 You might also like: How Much Is a Bitcoin Worth: The Truth About the $95,000 Mark

Here's the reality: the uk base rate forecast is already "priced in" to most fixed-rate mortgages. That’s why you’re seeing lenders like Nationwide and HSBC offering 2-year fixes at 3.5% even though the base rate is higher than that. They’re betting on those future cuts happening.

Don't expect a "cliff-edge" drop where rates suddenly plummet to 2%. It’s going to be a slow, grinding decline.

"Lenders are in a price war, but they aren't charities. They've already moved their rates down in anticipation of the Bank's next moves." — That's the consensus from brokers right now.

What Happens in 2027?

Looking further ahead is a bit like trying to predict the British weather in three months' time. Pure guesswork.

However, some optimistic forecasters, including those at Goldman Sachs, think the "neutral rate"—where the economy is just ticking over perfectly—is around 3%. If they're right, we could see the base rate settle there or even hit 2.5% by 2027.

💡 You might also like: South Carolina Bar Lawyer Referral Service: How to Actually Find a Legitimate Lawyer Without Getting Scammed

But let's be real. A lot can happen in eighteen months.

Actionable Insights for Your Wallet

If you’re trying to navigate this mess, here’s how to actually use the current uk base rate forecast to your advantage:

- Don't wait for the "bottom." If you find a mortgage deal that fits your budget, grab it. Chasing that last 0.1% drop is a dangerous game if the market suddenly turns hawkish.

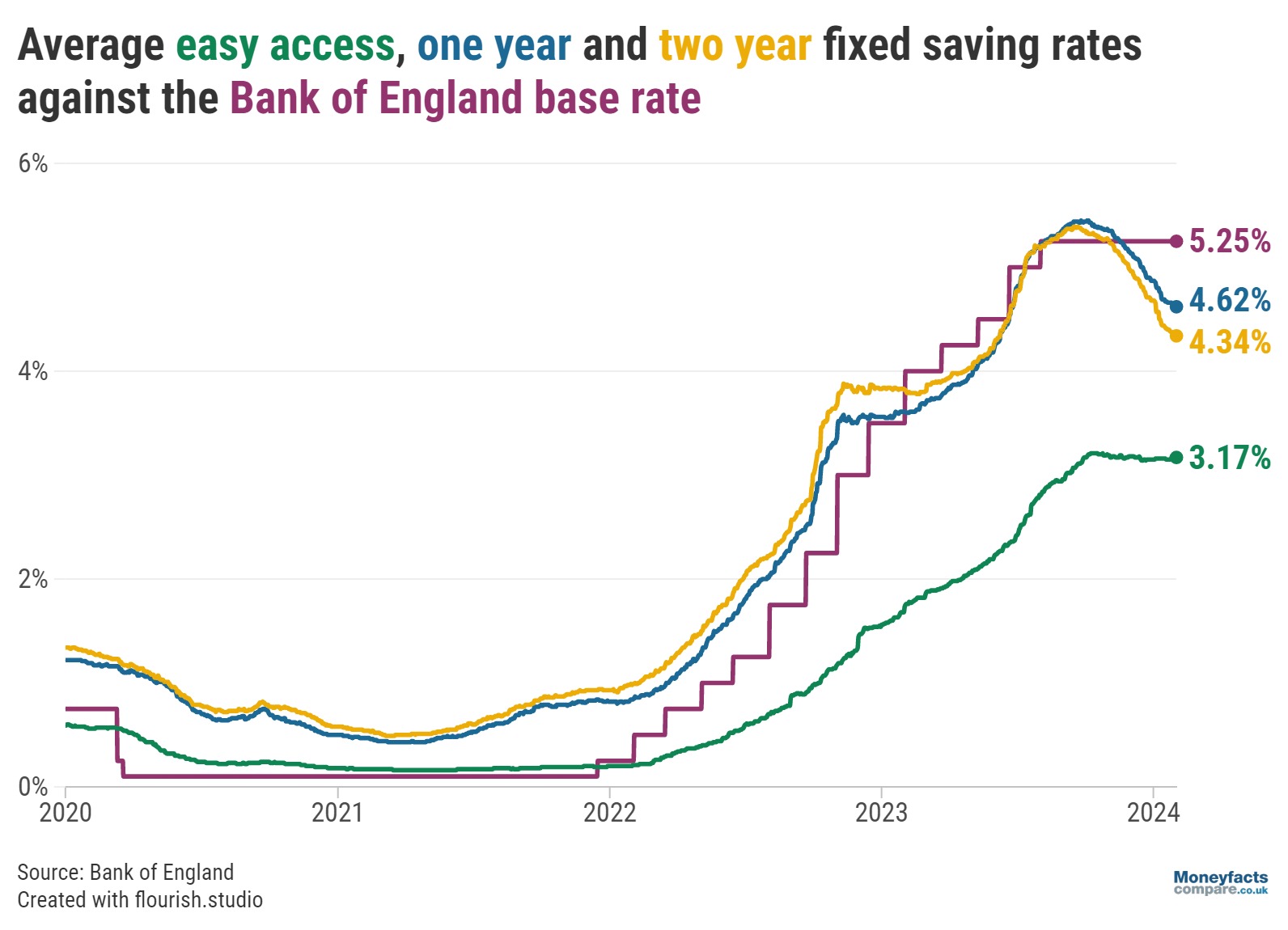

- Review your savings. As the base rate falls, so do the returns on your easy-access accounts. If you’ve got cash sitting around, consider locking it into a fixed-rate bond now before the Bank cuts again in February or April.

- Watch the February 5th meeting. This is the first big test of 2026. If the MPC holds at 3.75%, expect the "higher for longer" narrative to gain steam, potentially pushing mortgage deals back up.

- Inflation data is king. Keep an eye on the ONS releases. If inflation drops faster than the 2% target, the Bank will be forced to accelerate cuts.

The era of 5% interest rates is likely behind us, but the road to 3% is going to be bumpy, slow, and full of "data-dependent" excuses from Threadneedle Street.

💡 You might also like: The Truth About United States Stock Market Holidays and Why Your Trade Might Not Clear

What to do next

Check your current mortgage expiry date immediately. If you're within six months of your deal ending, you can usually lock in a new rate now. If rates fall further before you switch, many lenders will let you ditch that offer for a better one, giving you a "win-win" safety net while the Bank of England makes up its mind.