You've probably heard the "6% rule" your entire life. It’s basically common knowledge—or at least it was. If you’re selling a house in 2026, relying on that old number might actually cost you a small fortune or, conversely, make you miss out on the best help.

Honestly, the real estate world just went through a massive earthquake. The dust is still settling from the National Association of Realtors (NAR) settlement that changed everything about how agents get paid.

So, what is the typical commission for a real estate agent right now? The national average is sitting right around 5.57%. But that’s just a math average. In the real world, it’s messy. You might pay 4.5% in a hot Seattle suburb or find yourself sticking to 6% in a slower rural market where agents have to work twice as hard to find a buyer.

The 6% Myth and the New Reality

For decades, the standard play was simple: the seller paid 6%, and that fee was split down the middle between the person listing the home and the person bringing the buyer. Simple. Clean. And, according to a lot of lawyers, a bit too "fixed."

Fast forward to today. The "standard" is officially dead.

Since the NAR settlement took effect, listing agents can’t even advertise buyer-agent commissions on the Multiple Listing Service (MLS) anymore. This was a huge shift. It basically forced everyone to start actually talking about money upfront.

Currently, listing agent fees usually hover between 2.5% and 3%. Buyer agent commissions have been a bit more volatile. They dipped to about 2.5% right after the legal changes but have recently ticked back up to around 2.75% in many regions because, frankly, sellers realized that if they didn't help cover the buyer's agent, their house just sat on the market.

Does the Seller Still Pay Everything?

Mostly, yes. But it’s not a guarantee anymore.

You’ll hear some people say buyers are now responsible for their own agents. Technically, that’s true—buyers now have to sign a written agreement with their agent before they even tour a home. This contract says exactly how much the agent gets paid.

However, in a typical transaction, the buyer usually asks the seller to cover that fee as a "concession." If the seller says no, the buyer has to come up with the cash out of pocket. In a world where people are already struggling with high interest rates and massive down payments, most sellers find it’s easier to just pay the fee to keep the deal alive.

Why Geography Changes the Math

Location matters more than you’d think. If you’re in West Virginia, you’re looking at an average closer to 5.65%. If you’re in Washington state, you might see averages as low as 4.86%.

Why the gap? Volume and home prices.

An agent in a high-priced market like California can afford to take a 2% or 2.5% commission because 2% of a $1.2 million home is still a massive payday. An agent in a market where the median home price is $200,000 can’t really survive on those same percentages. The "typical" rate is often a reflection of the local cost of living and how much competition there is among brokers.

What You’re Actually Paying For

It’s easy to look at a $25,000 commission check and feel a bit sick. I get it. But it’s rarely just one person pocketing that money.

- The Brokerage Split: Most agents aren't solo. They work for brands like RE/MAX, Coldwell Banker, or local boutiques. The brokerage usually takes anywhere from 5% to 50% of that commission.

- Marketing Costs: High-end photography, 3D tours, drone footage, and targeted social media ads aren't free.

- Taxes and Insurance: Agents are independent contractors. They pay their own self-employment taxes, health insurance, and "errors and omissions" insurance.

- The "Invisible" Hours: For every house that sells in a weekend, there’s another one where the agent spent forty hours dealing with a flaky buyer, a failed inspection, and a nightmare appraiser.

How to Negotiate Without Being a Jerk

Everything is negotiable. You’ve probably heard that a thousand times, but in 2026, it’s actually true.

If you want to lower the typical commission for a real estate agent, you need leverage. If your home is "turn-key" (meaning it's beautiful and needs zero work), tell the agent. It’ll be an easy sell for them, so they might be more willing to drop their rate.

Alternatively, you could look at discount brokers. Companies like Clever or Redfin often offer listing fees as low as 1.5%. Just keep in mind that "discount" sometimes means you're doing more of the legwork yourself. You have to decide if saving 1% is worth the extra stress of handling your own open houses or paperwork.

👉 See also: Direct from China Fireworks: What You Actually Need to Know Before Placing That Order

Strategy: The Tiered Commission

One tactic that’s gaining steam is the tiered model. You tell the agent, "I'll pay you 2.5% if you sell the house for $500,000, but if you get me $525,000, I'll bump your commission to 3%." It aligns your goals. They get a bonus for over-performing, and you get more money in your pocket.

Real Numbers: A $500,000 Example

Let’s look at a $500,000 home sale with a 5.5% total commission.

The total cost is $27,500.

If the listing agent takes 2.75% ($13,750) and the buyer's agent takes 2.75% ($13,750), the seller walks away with $472,500 (minus other closing costs like taxes and title fees).

If you're the buyer and the seller refuses to pay your agent, you’d need that $13,750 in cash on top of your down payment. This is why most buyers are still insisting that sellers cover the cost. It’s a lot of money to find under the couch cushions.

The "Dual Agency" Trap

Sometimes, a seller's agent will find the buyer themselves. This is called dual agency. In some states, it’s actually illegal. In others, the agent just handles both sides and keeps the whole commission.

🔗 Read more: Converting 20 Lakh to USD: What Most People Get Wrong About Exchange Rates

Be careful here. It’s hard for one person to look out for the best interests of two people with opposing goals (the seller wants the highest price; the buyer wants the lowest). If you're in this situation, you should definitely negotiate a lower total fee. The agent is doing more work, but they aren't splitting the check with anyone else.

Final Insights for 2026

The landscape is definitely more transparent now, which is a win for everyone. You aren't stuck with a 6% bill just because "that's how it's done."

If you're selling, interview three agents. Ask them specifically about their fee structure and what they’ll do if a buyer asks for a commission concession. If you're buying, don't just assume the seller is paying your agent. Read that representation agreement carefully before you sign it.

The "typical" rate is a moving target. The best way to handle it is to stay flexible, do the math based on your specific zip code, and remember that the cheapest agent isn't always the one who nets you the most money.

Your Next Steps

- Check your local state average: Look up recent sales data in your specific county to see what the prevailing "concessions" look like.

- Interview multiple brokers: Specifically ask for a breakdown of their marketing budget so you know exactly what that 2.5% or 3% listing fee covers.

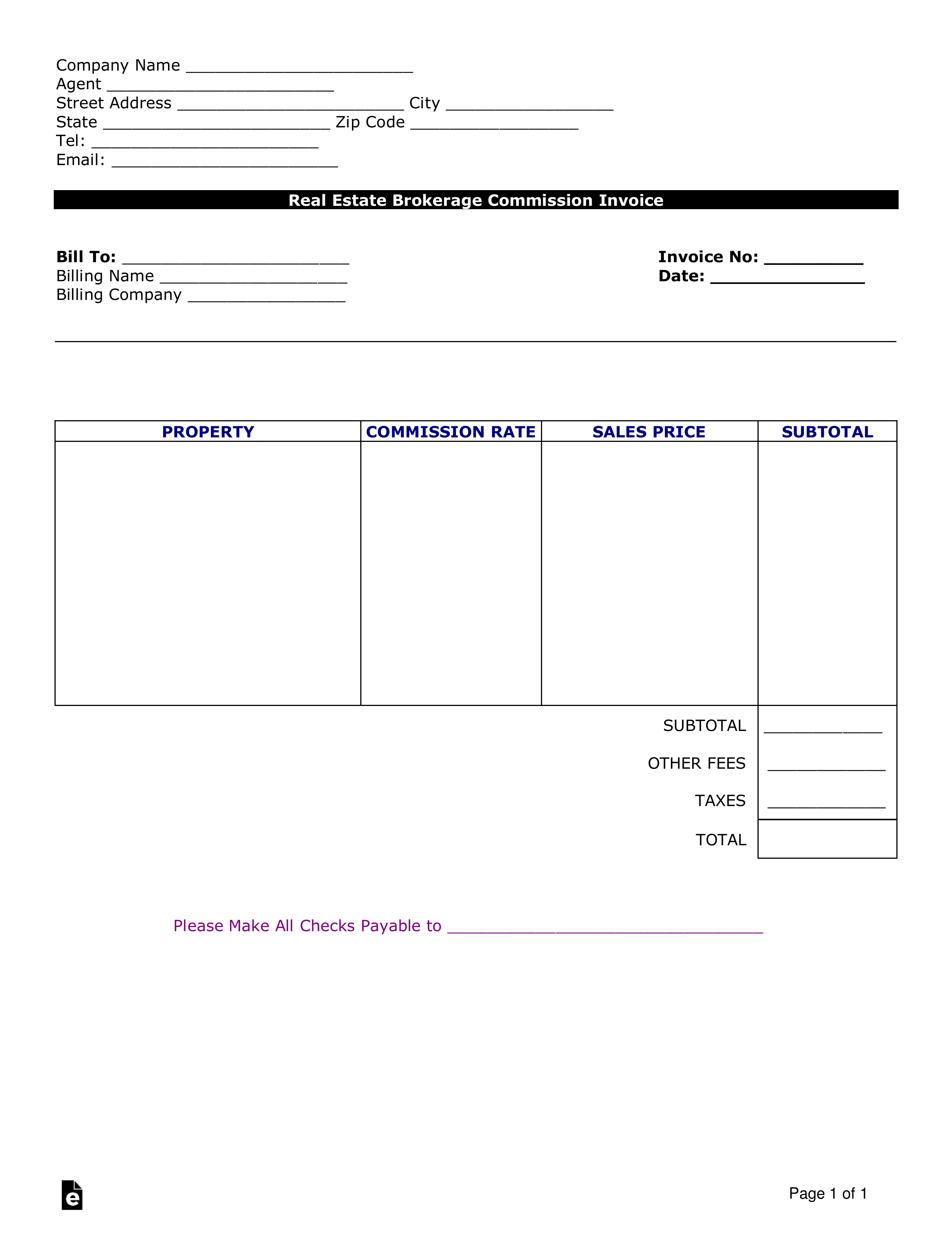

- Draft a "Net Sheet": Ask any agent you interview to provide a document showing your "take-home" pay after all commissions and fees at different price points.

- Confirm the Buyer Agent Agreement: If you are buying, ensure your agent’s fee is clearly defined in writing before you start looking at homes so there are no surprises at the closing table.