If you’ve spent any time looking at elite liberal arts colleges lately, the numbers are enough to make your head spin. It’s a bit of a paradox. On one hand, you have these historic, leafy campuses in places like Lexington, Virginia, promising the kind of education that opens every door in the world. On the other hand, you have a sticker price that looks like the cost of a luxury condo. Tuition at Washington and Lee has officially crossed into territory that feels a little surreal for many families.

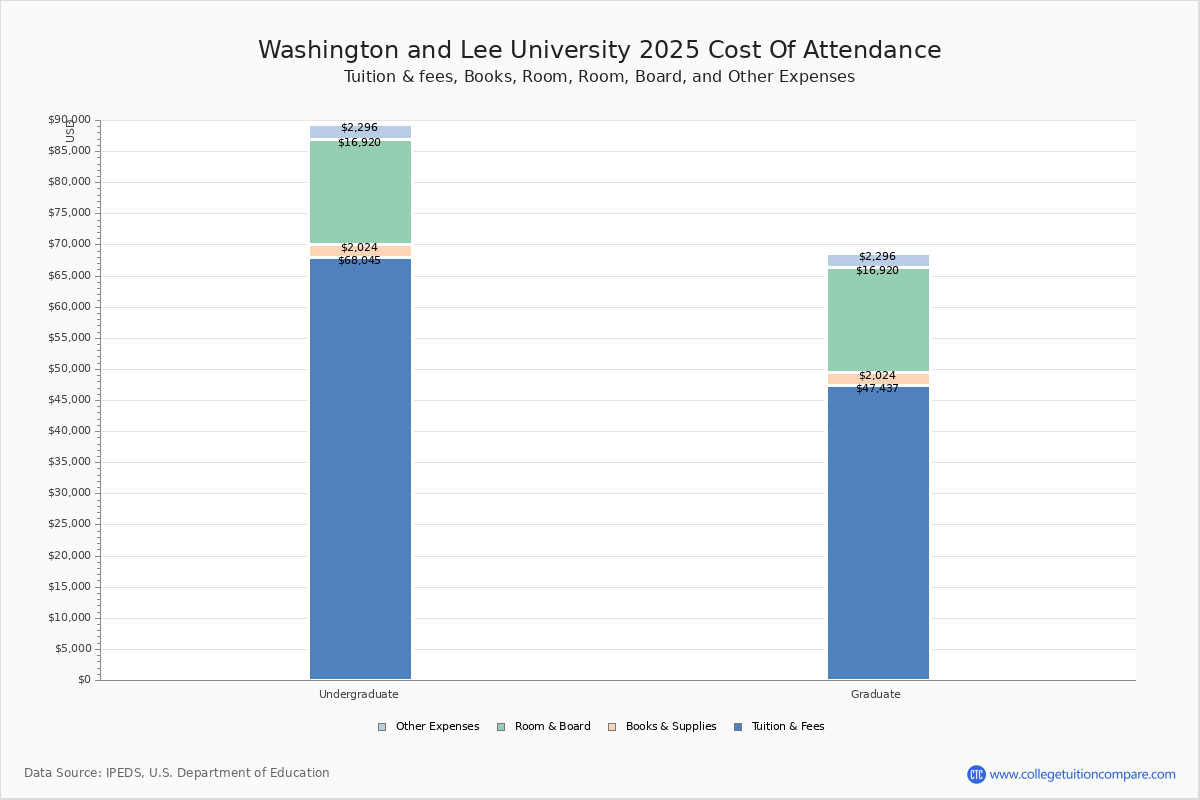

For the 2025-2026 academic year, the university set undergraduate tuition at $70,100.

When you add in room, board, and those mandatory student fees, the total direct cost of attendance hits $90,970. Honestly, if you include books, travel, and the occasional late-night pizza in town, you are effectively looking at a nearly $95,500 annual commitment. That’s a big pill to swallow. But here is the thing: almost nobody actually pays that.

The "sticker price" is basically a ghost. It exists on paper, but for the majority of the student body, the real price tag is hidden behind one of the most aggressive financial aid programs in the country.

Why the Sticker Price for Tuition at Washington and Lee is Misleading

Most people see a ninety-thousand-dollar price tag and close the tab. That's a mistake. W&L operates on a "no-loan" policy. This means if the school decides you need help, they give you grants—money you never, ever have to pay back—instead of stuffing your backpack with federal loans.

They also practice need-blind admissions. Basically, the people deciding if you’re smart enough to get in have no clue if you’re a billionaire or if you’re working three jobs to help your parents with rent. They want the talent first. The bill comes later.

🔗 Read more: Why an Under Armour Grey Sweater Is Still the Most Reliable Thing in Your Closet

The W&L Promise

This is the heavy hitter. If your family makes less than $150,000 a year and has typical assets, W&L guarantees you pay $0 in tuition.

Let that sink in.

If you're from a family making $70,000, they usually cover your housing and food, too. It’s kind of wild that an elite private school can actually end up being cheaper than a local state university once the dust settles. Even families making between $200,000 and $250,000—which is definitely "comfortable" but not "private jet" wealthy—often see university grants that knock tens of thousands off the bill.

A Breakdown of the 2025-2026 Costs

If you aren't receiving aid, or if you're just trying to budget, you need to see where the money actually goes. It isn't just one big lump sum.

- Tuition: $70,100.

- Housing: $10,125.

- Food (The Dining Hall): $9,480.

- Student Activity Fee: $695.

- Technology & Health Fees: Around $570 combined.

Then you have the "indirect" costs. These are things the school doesn't bill you for directly, but you still have to pay for them. Books and supplies are estimated at $1,900. Personal expenses—think laundry detergent, clothes, and movies—are pegged at $2,630.

If you live in California and you're flying back to Virginia three times a year, your travel costs are going to be way higher than someone driving in from Roanoke. The school factors this in when they calculate your aid, which is a nice touch.

The Johnson Scholarship: The "Holy Grail" of Aid

You can't talk about the cost of this school without mentioning the Johnson Scholarship. It is named after Rupert Johnson Jr., an alum who clearly wanted to make sure the school remained a powerhouse.

Every year, about 10% of the incoming class—roughly 44 students—gets the "full ride" treatment. We aren't just talking about tuition. The Johnson covers tuition, room, board, and even provides a $10,000 stipend for summer experiences. Want to go study marine biology in the Galapagos or intern at a tech firm in London? The school cuts you a check.

The catch? It’s incredibly competitive. You have to submit a separate essay by December 1st. They look for "intellect, leadership, and integrity." Basically, they want the kids who are going to be the next CEOs or world-changing researchers.

The Reality of Middle-Class "Sticker Shock"

There is a specific group of people who get squeezed: the "upper-middle" class.

If your family earns $300,000 a year, you probably won't qualify for the W&L Promise. But after taxes and mortgage payments, $95,000 a year for one kid is still a massive burden. W&L acknowledges this. They claim that about 57% of first-year students receive aid, with the average award being over **$64,000**.

Even if you don't get a full ride, the "net price" is the only number that matters. For a family in that $110k+ bracket, the average net price often hovers around **$42,000**. Still expensive? Yes. But it’s a far cry from the $95,000 "sticker" that scares everyone off.

What Most People Get Wrong

One big misconception is that being a Virginia resident saves you money.

Nope.

Washington and Lee is a private university. Unlike UVA or Virginia Tech, there is no "in-state" discount. A kid from Lexington pays the same as a kid from Luxembourg.

👉 See also: Daisy Marc Jacobs: What Most People Get Wrong About This Cult Classic

Another thing: the endowment. W&L has one of the largest endowments per student in the country. They use it. Every single student's education is actually subsidized by about $21,000 per year through endowment returns and gifts. Even the "full-pay" students are technically getting a discount on the actual cost of running the university.

How to Manage the Financial Load

If you’re serious about attending, you have to play the game correctly.

- Use the Calculators Early: Don’t guess. W&L has a "MyinTuition" tool and a Net Price Calculator. Spend twenty minutes with your parents' tax returns and get a real estimate.

- The December 1st Deadline: If you miss the Johnson Scholarship deadline, you’re leaving the biggest pot of money on the table. There are no "do-overs" for this.

- The CSS Profile: Unlike public schools that just want the FAFSA, W&L requires the CSS Profile. It is way more detailed. It asks about your home equity, your medical bills, and even if your siblings go to private K-12 schools. Be honest and thorough.

- Appeal if Necessary: If a parent loses a job or there’s a medical emergency after you apply, tell them. The financial aid office at a small school like this is actually run by human beings who answer their phones.

The cost of tuition at Washington and Lee is a reflection of the intense resources they pour into students. With a student-to-faculty ratio of 8:1, you’re paying for access. You’re paying for the fact that a professor, not a grad student, is grading your papers. Whether that’s worth $90k is up to you, but for most people who get in, the university makes sure the "real" price is something they can actually handle.

Actionable Next Steps:

- Run the MyinTuition Calculator: Get your personalized estimate in under 5 minutes to see your actual "net price."

- Mark December 1st: Set a calendar alert now if you intend to apply for the Johnson Scholarship.

- Gather the CSS Profile Documents: Start collecting 2024 tax returns and asset information, as W&L requires more depth than the standard FAFSA.