Money feels solid when you’re holding a crisp twenty. It’s tangible. You can feel the texture of the linen-cotton blend and see the color-shifting ink. But if you’re trying to wrap your head around the total USD in circulation, you’ve got to stop thinking about just the paper.

Most people imagine a giant vault like Scrooge McDuck’s, filled with every dollar ever printed. That’s not how this works. Honestly, the vast majority of "money" doesn't even exist as physical objects. It’s just digital 1s and 0s on a server in some data center.

The Paper Trail: Currency vs. The Money Supply

When we talk about the total USD in circulation, we usually mean "Currency in Circulation." This is the actual physical stuff—the Federal Reserve notes and coins that are clinking around in cash registers or sitting under mattresses. According to the Federal Reserve’s own data, as of late 2024 and heading into 2025, there is roughly $2.3 trillion in physical currency floating around the globe.

That sounds like a lot. It is. But here’s the kicker: more than half of that isn't even in the United States.

Because the US Dollar is the world’s reserve currency, people in countries with unstable economies—think Argentina or parts of the Middle East—hoard $100 bills as a hedge against their own local inflation. Ben Bernanke and subsequent Fed chairs have often pointed out that the demand for physical US cash is often higher abroad than it is at home.

Why the $100 Bill Dominates

If you look at the breakdown of what's actually out there, the $100 bill is the absolute king. It accounts for about 80% of the total value of all currency in circulation. Why? It’s easy to transport. It’s a store of value. It’s also, candidly, the preferred denomination for the "informal economy" (the polite way of saying the black market).

Where the Rest of the Money Lives (M1 and M2)

If physical cash is only $2.3 trillion, where is the rest of the wealth? This is where the total USD in circulation conversation gets a bit murky because of how economists define "money."

👉 See also: Modern Office Furniture Design: What Most People Get Wrong About Productivity

You have these categories called M1 and M2.

- M1 used to just be cash and checking accounts. In 2020, the Fed changed the rules to include savings accounts in M1. Now, M1 sits somewhere around $18 trillion.

- M2 is everything in M1 plus "near money"—things like money market funds and certificates of deposit (CDs). This figure is massive, hovering near $21 trillion.

Think about that gap. $2.3 trillion in paper versus $21 trillion in the broader money supply.

Basically, for every physical dollar you can touch, there are about nine other dollars that exist only as accounting entries. If everyone went to the bank tomorrow to withdraw their balance in cash, the system would collapse instantly. There literally isn't enough paper in the world to cover it. The Federal Reserve Bank of St. Louis tracks this constantly through their FRED database, and the charts from the last five years look like a vertical mountain climb because of the pandemic-era stimulus.

The 2020 Pivot and the "Money Printer" Meme

You've probably seen the memes. "Money printer go brrr."

It’s a funny image, but it’s technically inaccurate. The Fed doesn't just print paper and throw it out of helicopters. When they want to increase the total USD in circulation (the digital kind), they engage in "Open Market Operations." They buy government bonds from big banks. They pay for those bonds by literally typing numbers into the bank's reserve account.

Poof. New money.

✨ Don't miss: US Stock Futures Now: Why the Market is Ignoring the Noise

Between 2020 and 2022, the money supply expanded at a rate we’ve never seen in peace-time history. The M2 money supply grew by about 25% in a single year. That’s why we felt that nasty sting of inflation. Too many dollars chasing too few goods.

What Happens When the Fed Tries to "Delete" Money?

In 2023 and 2024, the Federal Reserve started doing something called Quantitative Tightening (QT). This is the opposite of the printing press. They let those bonds they bought earlier mature without replacing them.

This effectively sucks money out of the system.

It's a delicate dance. If they pull too much out, the "plumbing" of the financial system gets brittle. Banks stop lending. The economy grinds to a halt. If they leave too much in, your groceries keep getting more expensive. Jerome Powell, the current Fed Chair, has been trying to stick a "soft landing," where they reduce the total USD in circulation (relative to the size of the economy) just enough to kill inflation without causing a total meltdown.

Why Can’t We Just Count It All?

You’d think in the age of computers we’d know exactly how many pennies are in the couch cushions. We don't.

The Fed knows how much they've issued. They know how much has been shredded because it got too old and tattered. But they don't know how much has been lost in house fires, buried in backyards, or eaten by dogs. There is a significant "leakage" in the total USD in circulation that is just... gone.

🔗 Read more: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

Then there’s the "Eurodollar" market. These are US dollars held in banks outside the United States. This market is gargantuan—some estimates put it at over $13 trillion—and it’s largely unregulated by the Fed. These dollars aren't "in circulation" in the traditional sense, but they affect global exchange rates and interest rates just as much as the cash in your pocket.

Real-World Impact: Why This Matters to You

So, why should you care about the total USD in circulation?

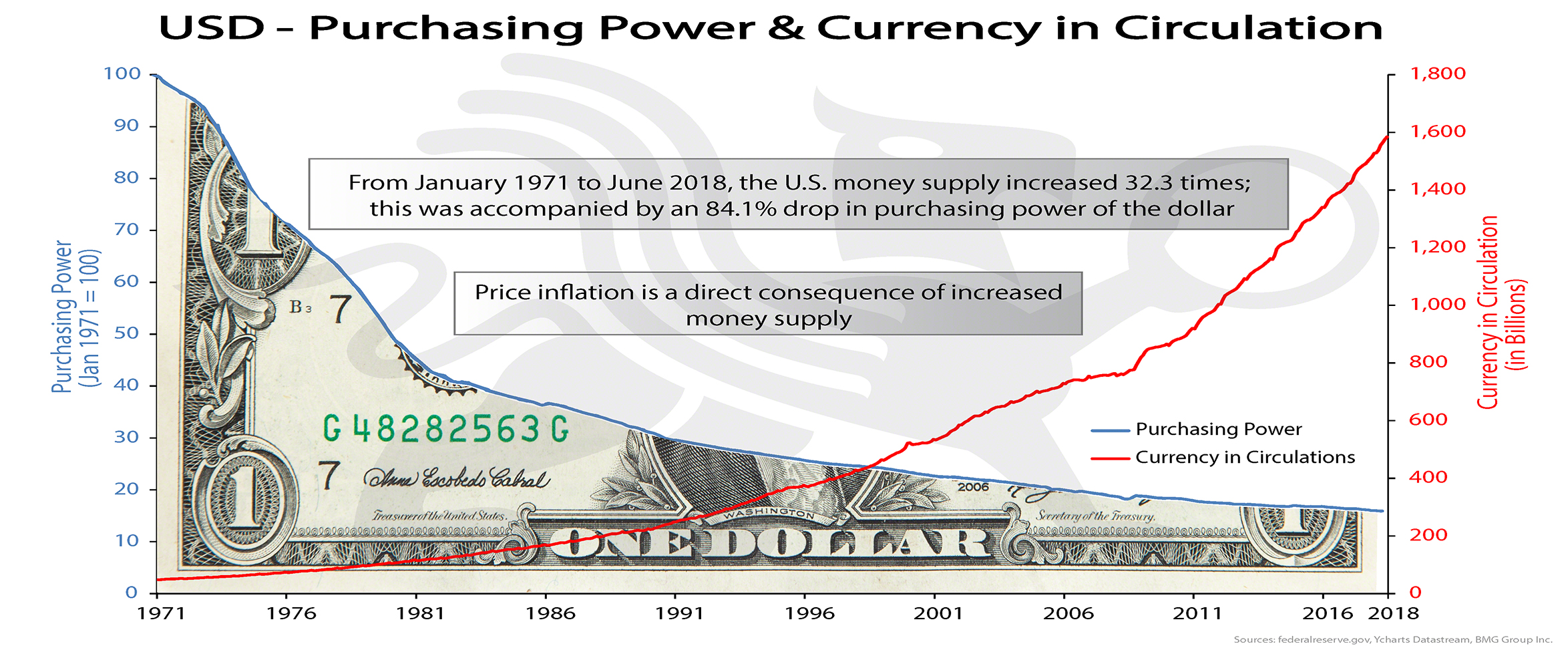

It’s about purchasing power. Money is like any other commodity. If there’s a massive surplus of it, its value drops. When the money supply expands faster than the economy grows, you get "debasement." Your $100 bill still says "$100" on it, but it only buys $80 worth of steak compared to three years ago.

Understanding the money supply also helps you predict interest rates. When there’s too much money in the system, the Fed raises rates to make borrowing more expensive, which slows down the "creation" of new money through bank loans. If you’re looking to buy a house or a car, the total USD in circulation is the invisible hand setting your monthly payment.

Actionable Steps for Navigating the Changing Money Supply

Since the amount of USD in the system is constantly shifting, you can't just park your wealth in a savings account and hope for the best.

- Watch the M2 Trend: Keep an eye on the FRED (Federal Reserve Economic Data) reports for M2. If it starts spiking again, expect inflation to follow in 12–18 months. This is your cue to look at inflation-protected assets.

- Diversify Beyond Cash: Because the total USD in circulation can be expanded at the stroke of a key, holding only cash is risky over the long term. Real estate, gold, and even certain equities act as a "sink" for all that excess liquidity.

- Understand Interest Rate Lag: When the Fed starts reducing the money supply, it takes a long time—sometimes over a year—to actually feel the effects in the "real" economy. Don't make sudden financial moves based on one week's news.

- Monitor the Dollar Index (DXY): This measures the USD against other currencies. If the total USD in circulation is high but other countries are printing even faster, the dollar might actually get stronger, which is a weird paradox but happens often.

The US Dollar isn't going anywhere, but it is changing. It's becoming more digital, more global, and paradoxically, more scarce and more abundant at the same time depending on which metric you use. Stay focused on the M2 supply rather than the physical bills, as that's where the real economic power resides.