Trade wars are messy. Honestly, if you’ve been trying to keep track of every Section 301 investigation or the specific percentage hikes on electric vehicle batteries, your head is probably spinning. It’s not just you. The landscape of the total tariff on china has morphed from a temporary negotiation tactic into a permanent fixture of global trade. We aren't just talking about a few extra cents on a plastic toy anymore. This is a structural shift in how the world’s two largest economies talk to each other—or don't.

What people often miss is that "total" is a bit of a misnomer. There isn't one single "total" tax. Instead, it’s a layering of legacy Trump-era duties and the newer, more surgical Biden-Harris hikes. If you're buying a shirt, the tariff might be one thing; if you're a company importing high-capacity semiconductors, you're looking at a completely different financial reality. It’s complicated. It’s expensive. And for many American businesses, it’s unavoidable.

Why the Total Tariff on China Isn't Going Anywhere

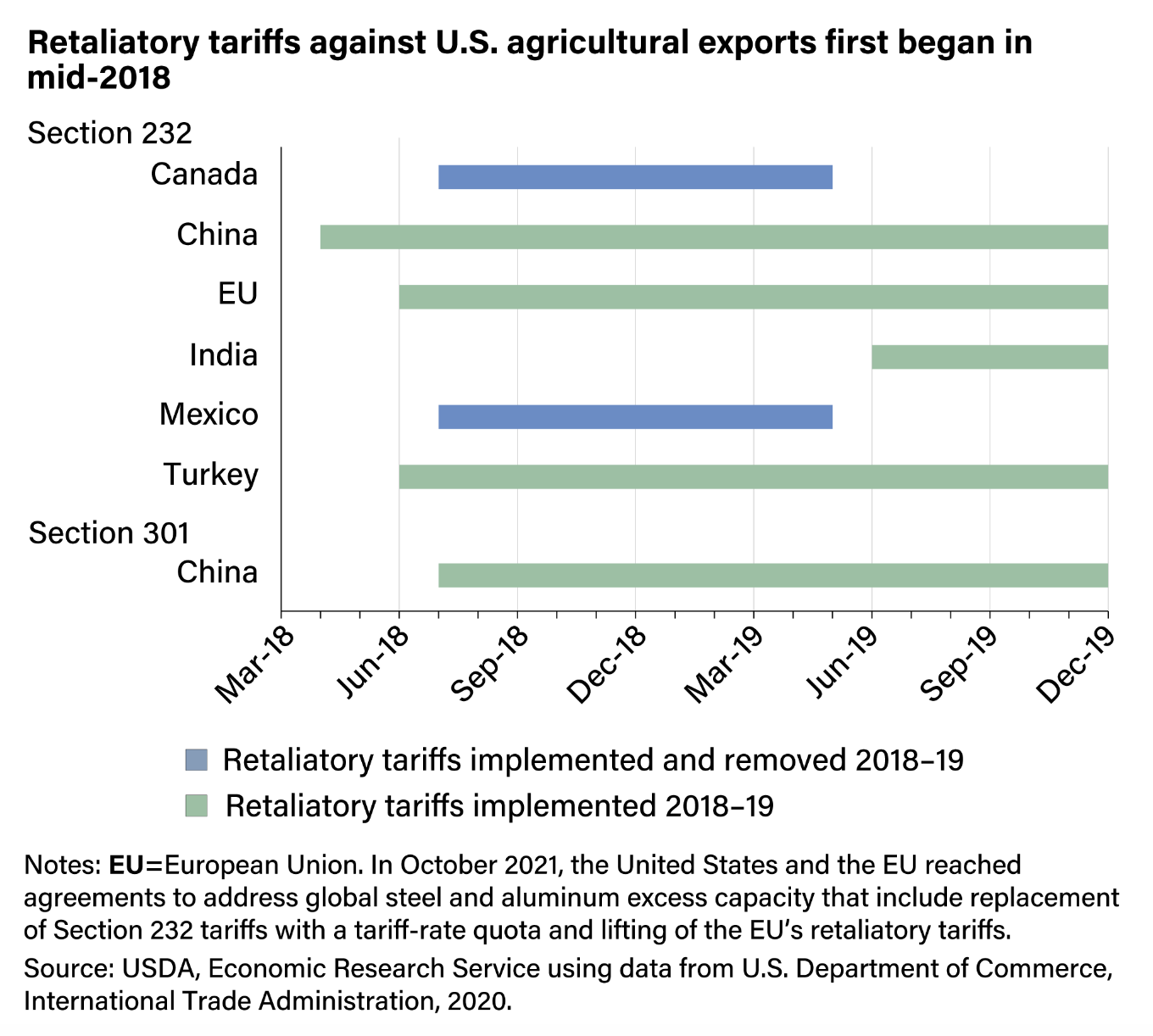

Politics is the easy answer, but the reality is deeper. Both sides of the aisle in Washington have basically agreed that the old way of doing business with Beijing is over. You might remember back in 2018 when the first major salvos were fired. Fast forward to 2024 and 2025, and the U.S. Trade Representative (USTR) has only doubled down. The goal? Protecting "strategic sectors."

The logic is simple enough on paper. The U.S. wants to stop China from dominating the green energy and tech markets through what it calls "non-market practices." Think heavy state subsidies. By slapping a total tariff on china for things like EVs—which saw duties jump to 100%—the government is trying to create a moat.

But moats are expensive for the people inside them too.

The Numbers That Actually Matter

Let’s get into the weeds. We’re looking at a multi-tiered system. First, you have the "Most Favored Nation" (MFN) rates that apply to almost everyone. Then, you layer on the Section 301 duties. According to data from the Tax Foundation and the USTR, these tariffs cover roughly $300 billion to $450 billion worth of annual imports.

It’s a massive chunk of change.

Specific sectors are getting hit way harder than others. While consumer electronics like certain laptops have occasionally dodged the heaviest blows to avoid upsetting voters, industrial components haven't been so lucky.

- Electric Vehicles: 100% (Basically a "keep out" sign).

- Solar Cells: 50%.

- Syringes and Needles: 50% (A move to protect medical supply chains).

- Lithium-ion Batteries: 25%.

It’s weird to think about a syringe being a matter of national security, but that’s the world we live in now. The pandemic taught the U.S. a hard lesson about depending on a single source for critical goods.

Who Pays? (Hint: It’s Usually You)

There’s this persistent myth that China pays the tariffs. They don't. A tariff is a tax collected by U.S. Customs and Border Protection at the port of entry. The American company importing the goods pays the bill.

Then they have a choice.

They can eat the cost and see their profits shrink. They can try to find a new supplier in Vietnam or Mexico (which takes years and millions of dollars). Or, most likely, they just raise the price for you. A study by the National Bureau of Economic Research (NBER) found that the costs of these tariffs were almost entirely passed through to U.S. consumers and firms.

👉 See also: Maruti Ltd Share Price: What Most People Get Wrong About This Auto Giant

The "China Plus One" Strategy

Businesses aren't sitting still. They’re exhausted. Managing the total tariff on china has led to the rise of "China Plus One." Basically, companies keep some production in China for their domestic market but move the "export to USA" portion of their manufacturing to places like India or Thailand.

But here is the kicker: many of those factories in Vietnam or Mexico are still owned by Chinese companies. Or they use Chinese raw materials. It’s a game of geographical shell cards. You might see a "Made in Vietnam" tag, but the value-added chain often still leads back to the mainland. The U.S. government knows this, which is why we’re seeing more "anti-circumvention" investigations. It’s a game of cat and mouse that never ends.

Misconceptions About Trade Balances

People love to point at the trade deficit as proof the tariffs are failing. "The deficit is still huge!" they shout.

Well, yeah.

Trade deficits are driven by macroeconomics—specifically, how much Americans save versus how much we spend. You can’t tax your way out of a trade deficit if the underlying consumer behavior doesn't change. The total tariff on china was never really going to "fix" the deficit. It was meant to change what we buy and where it’s made. On that front, the results are mixed. We’re buying fewer Chinese-made solar panels, sure, but we’re also paying more for the ones we do buy, which slows down the transition to clean energy.

It’s a trade-off. There are no free lunches in global economics.

The Human Element: Small Business Struggles

I talked to a guy who runs a small bicycle shop in the Midwest. He doesn't care about geopolitics. He cares that the steel frames he imports have seen a 25% price hike. He can’t just "move his factory" to Ohio. There isn't a factory in Ohio making the specific lightweight frames he needs at a price point people will pay.

For him, the total tariff on china isn't a strategic lever. It’s a monthly bill that keeps him from hiring a new mechanic.

This is the nuance that gets lost in the "tough on China" rhetoric. While the policy might protect a nascent EV industry in the U.S., it simultaneously hammers thousands of small businesses that rely on Chinese components for products that aren't even remotely related to national security.

Looking Ahead: The 2026 Landscape

As we move through 2026, don't expect a rollback. No one wants to look "soft." In fact, we’re seeing a shift toward "friend-shoring." This is the idea that we should only trade with countries that share our values.

The problem? Most of the world’s rare earth minerals and battery components are processed in China. You can’t just "friend-shore" a mineral deposit that doesn't exist in a friendly country.

We are seeing a massive push in the U.S. to build up domestic processing, but that’s a decade-long project. Until then, the tariffs act as a sort of painful bridge.

Actionable Steps for Navigating the Tariff Reality

If you’re a business owner or an investor, you can't just wait for the tariffs to go away. They are the new "normal." Here is how you actually handle it:

- Audit Your HTS Codes: The Harmonized Tariff Schedule is a beast. Sometimes, a slight change in how a product is described can move it from a 25% tariff bracket to a 0% bracket. This isn't "cheating"—it's legal classification. Get a good trade lawyer.

- Look for Exclusions: The USTR occasionally opens windows for "product exclusions." If you can prove that a product can only be sourced from China and that the tariff is causing "severe economic harm," you might get a reprieve. It’s a long shot, but for some, it’s been a lifesaver.

- Diversify, Don't Exit: Don't pull out of China entirely if you have a good setup there. Instead, look at "final assembly" in a third country. This helps mitigate some of the duty risk while maintaining the efficiency of the Chinese supply chain for components.

- Price Transparency: If you’re a retailer, be honest with your customers. Many brands are now adding a "tariff surcharge" line item rather than just hiding it in the price. It helps consumers understand why that toaster suddenly costs $15 more.

The total tariff on china is more than just a tax. It’s a signal that the era of hyper-globalization is dead. We are moving into a world of "managed trade," where the government has a much louder voice in where your stuff comes from. It’s going to be bumpy, it’s going to be expensive, and honestly, it’s probably just the beginning.

Stay flexible. The companies that survive this aren't the ones waiting for 2015 to come back; they’re the ones building supply chains that can survive a world where trade is a weapon.

Keep an eye on the USTR Federal Register notices. They are dry, boring, and written in legalese, but that is where the real news happens. If a new list of codes drops, you need to know within hours, not weeks. Your margin depends on it.