You're sitting there, staring at a spreadsheet of GMAT scores and tuition costs, wondering if a $200,000 investment is actually going to change your life. It’s a lot. Honestly, the world of "top-tier" business education is kind of a mess of prestige, debt, and networking events that feel like high-speed dating for overachievers.

But here’s the thing: everyone talks about the top MBA schools in the us as if they’re some monolithic group of ivory towers. They aren’t. Choosing between Wharton and Stanford isn’t just about which logo looks better on your LinkedIn. It’s about whether you want to be a quant-heavy finance wizard in Philly or a "lead-from-the-heart" tech disruptor in Palo Alto.

Let's cut through the marketing fluff.

The 2026 Power Players: Who’s Actually Winning?

If you look at the latest data for 2026, the usual suspects are still brawling for the #1 spot. The Wharton School at the University of Pennsylvania is having a serious moment right now. They basically reclaimed the throne in the QS Global Rankings and held a tie for first in U.S. News. Why? Because they’ve gone all-in on AI. While other schools were still debating if ChatGPT was a threat, Wharton was dumping resources into data analytics and "thought leadership" metrics that recruiters actually care about.

Then you’ve got Stanford Graduate School of Business (GSB). It’s still the hardest nut to crack. With an acceptance rate hovering around 4% to 6%, it’s less of a school and more of an elite club. People go there to find their co-founders, not just a job at McKinsey.

💡 You might also like: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

The "M7" Hierarchy

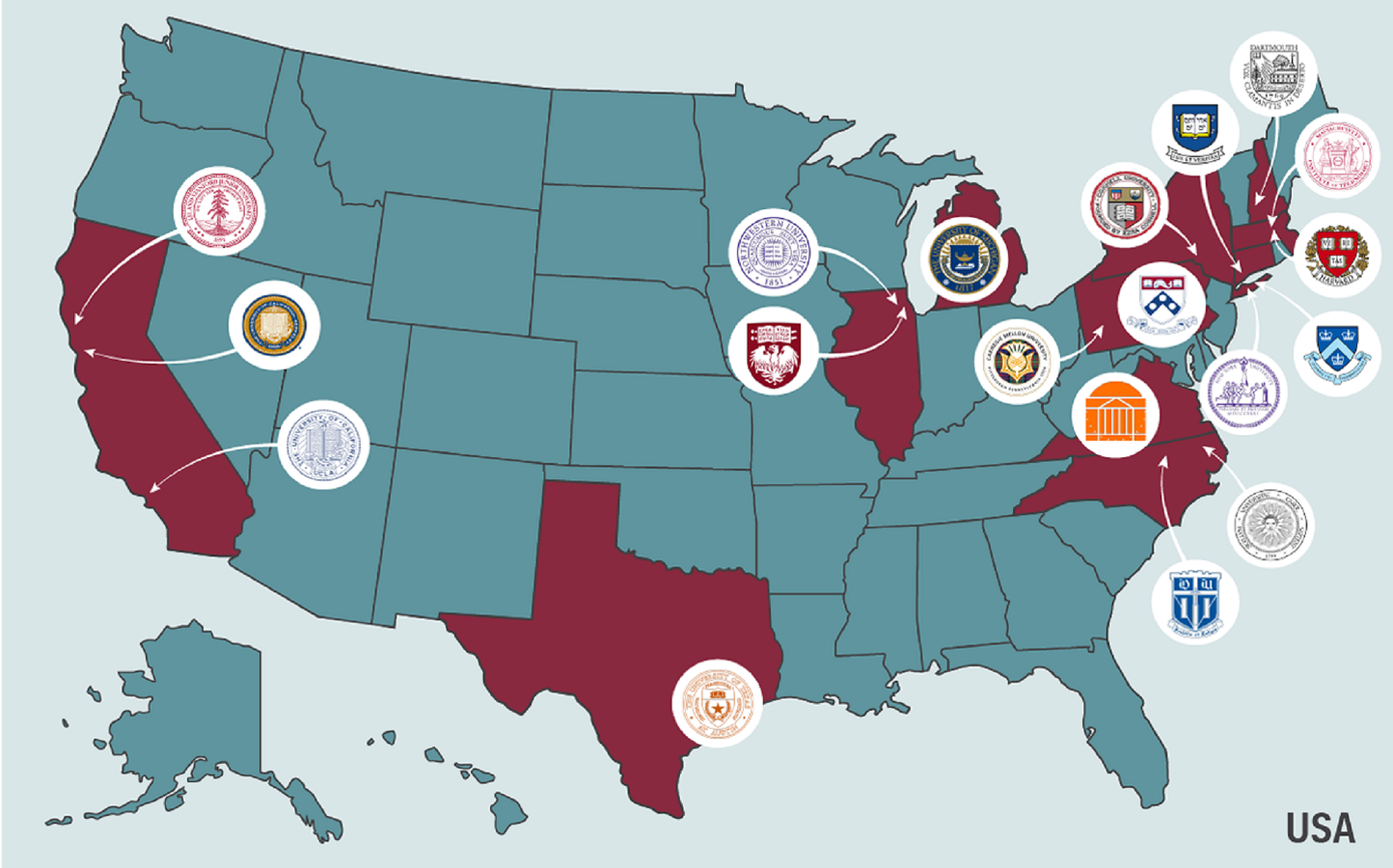

For the uninitiated, the "Magnificent Seven" (M7) is an unofficial group of the elite programs that supposedly never lose their luster.

- Wharton (UPenn): The finance king. If you want to run a hedge fund, you start here.

- Stanford GSB: The Silicon Valley darling. High focus on entrepreneurship and "soft" leadership.

- Harvard Business School (HBS): The Case Method factory. You’ll read 500+ cases and learn to make decisions with zero data.

- Chicago Booth: The intellectual's choice. Flexible curriculum, very analytical, very "Chicago School" economics.

- MIT Sloan: Where tech meets management. It’s the place for people who think in systems and operations.

- Northwestern Kellogg: The marketing and collaboration hub. They literally invented the "teamwork" vibe in B-schools.

- Columbia Business School: The NYC advantage. You’re in the heart of Manhattan. Guest lecturers are often literal CEOs who walked over from their offices.

The AI Shift: It’s Not Just About "Business" Anymore

We’re in 2026. If a school isn't teaching you how to integrate LLMs into supply chain management, they’re failing you. MIT Sloan and Wharton have been the most aggressive here. Sloan has been leveraging its connection to MIT’s engineering power to create "Action Learning" labs specifically for AI strategy.

It’s interesting—older applicants (we're talking 35+) are actually more obsessed with AI coursework than the 22-year-olds. According to recent GMAC surveys, nearly 60% of older candidates want AI education. They see the writing on the wall. They know their jobs are changing. The top MBA schools in the us are responding by launching specialized AI certificates and shifting core curriculums. Arizona State (W.P. Carey) even launched a degree fully dedicated to AI in business. It’s a wild time.

Why Rankings Are Kinda Lying to You

Look, I love a good list as much as anyone. But the gap between #1 and #15 is often a total illusion.

📖 Related: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

Take UVA Darden or Dartmouth Tuck. These schools often hover just outside the top 5, but their alumni networks are notoriously fierce. Tuck is in the middle of nowhere (Hanover, NH), which sounds like a downside. But because there’s nothing else to do, the students bond like crazy. When a Tuckie calls another Tuckie for a job, they pick up the phone. You don’t always get that same "ride or die" energy at a massive city school like NYU Stern.

The Recruitment Reality Check

Recruitment in 2026 is getting... specific. Companies aren't just hiring "MBAs" in bulk anymore. They want people who can lead through "polycrisis"—geopolitical shifts, energy transitions, and tech upheaval.

- Consulting (MBB): Still the biggest shark in the room. McKinsey, BCG, and Bain still love the M7, but they’re looking deeper at Duke Fuqua and Michigan Ross for "high DQ" (Decency Quotient) leaders.

- Tech: It’s stabilizing. They don't want the "move fast and break things" types as much as the "how do we make this profitable and ethical" types. Berkeley Haas is the gold standard here for its focus on "Beyond Self" leadership.

- Finance: Wall Street is still Wall Street. Wharton, Columbia, and Booth remain the primary feeders.

The "Trump Bump" and International Shifting

There's a weird dynamic happening with international students. With shifting visa policies and a "Trump Bump" in global interest toward European schools like INSEAD or HEC Paris, some US schools are seeing a slight dip in international apps.

This is actually a secret win for domestic applicants. If international interest softens even by 5%, your odds at a place like Yale SOM or Cornell Johnson might actually improve. Schools are working harder than ever to prove their ROI. The University of Texas at Austin (McCombs) is a great example—it’s significantly cheaper than the M7 but has a massive pipeline into the booming Austin tech scene.

👉 See also: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

What it Costs (And What You Get)

Let's talk money. It's gross, but necessary.

A top-tier MBA is now pushing $85,000 to $90,000 per year just for tuition. Add in living expenses in NYC or Palo Alto, and you’re looking at a quarter-million-dollar hole.

- Wharton: ~$85,822 (Tuition)

- Columbia: ~$87,495 (Tuition)

- UT Austin: ~$58,342 (A relative "bargain")

Is it worth it?

Average starting salaries for the Class of 2026 at these schools are hitting $175,000 to $190,000, plus signing bonuses. If you're coming from a $70k job, the math works. If you're already making $140k in tech, the ROI becomes a lot murkier. You're paying for the "pivot."

How to Actually Get In

Admissions committees are getting bored of "perfect" candidates. They’re seeing too many AI-generated essays that sound like corporate press releases. In 2026, the "authentic voice" is the only thing that moves the needle.

Stop trying to be the person you think they want. If you spent three years failing at a startup, tell them why it crashed and burned. They value "learning agility" over a flawless record. Chicago Booth, for instance, loves a "rebellious" thinker who isn't afraid to challenge the status quo in their data-driven environment.

Actionable Next Steps for Your Application

- Audit your "Human" factor: Since AI is handling the technical "perfect" writing, your personal stories need to be raw. Where have you actually struggled?

- Niche down your ROI: Don't just say "I want to lead." Say "I want to use an MBA from MIT Sloan to bridge the gap between generative AI and healthcare logistics in rural America."

- Talk to current students: Not the ambassadors—the real students. Ask them what they hate about the program. That’s how you find the "fit."

- Prep for the Video: More schools are using unscripted video assessments to bypass AI-polished essays. Practice talking to a camera for 60 seconds without sounding like a robot.

The top mba schools in the us aren't just about the degree anymore. They’re about surviving the next decade of disruption. Whether you choose the finance-heavy halls of Wharton or the tech-forward labs of Sloan, make sure you're buying a network, not just a line on a resume.