You've probably heard the S&P 500 called the "stock market" more times than you can count. It’s the big one. The benchmark. The thing your 401(k) basically lives and breathes. But honestly, when you look at the top 20 stocks in S&P 500, you aren't looking at a cross-section of the American economy anymore.

You’re looking at a tech-heavy powerhouse that is increasingly lopsided.

📖 Related: How to Make an Introductory Paragraph That Actually Sticks the Landing

By January 2026, the concentration at the top has reached levels that would make a 1990s hedge fund manager sweat. It’s wild. We’re talking about a handful of companies—Nvidia, Apple, Microsoft—that now carry more weight than entire European countries' stock exchanges combined. If you own an index fund, you aren't just "diversified." You are heavily bet on a few AI giants and a couple of retailers.

The Heavyweights Holding Up the Sky

Market cap is a funny thing. It’s basically just the price of a single share multiplied by how many shares are out there. Simple math, right? But in the S&P 500, which is "market-cap weighted," the bigger a company gets, the more it moves the entire needle.

The Trillion-Dollar Club

Right now, Nvidia (NVDA) is the undisputed king. It’s sitting at a staggering market cap of roughly $4.5 trillion. Think about that number. In September 2025, they even threw $100 billion into OpenAI just to keep the lead. They aren't just a chip company anymore; they are the infrastructure of the entire future.

Then you have the usual suspects. Apple (AAPL) and Alphabet (GOOGL) are constantly neck-and-neck for that second and third spot, hovering around $3.8 to $4.0 trillion. Microsoft (MSFT) isn't far behind at $3.4 trillion. These four companies alone dictate whether your "diversified" portfolio has a good or bad Tuesday.

The Shift in the Top 10

It's not just "Big Tech" anymore, though. Broadcom (AVGO) has officially shoved its way into the elite circle, recently surpassing Tesla (TSLA) in total value. While Tesla is still massive—worth about $1.5 trillion—its dominance has been challenged by the sheer demand for Broadcom’s networking hardware and software.

- Nvidia (Information Technology)

- Alphabet (Communication Services)

- Apple (Information Technology)

- Microsoft (Information Technology)

- Amazon (Consumer Discretionary)

- Broadcom (Information Technology)

- Meta Platforms (Communication Services)

- Tesla (Consumer Discretionary)

- Taiwan Semiconductor (Information Technology)

- Berkshire Hathaway (Financials)

Funny enough, Warren Buffett’s Berkshire Hathaway remains the only "old school" value play in that top ten. It’s the rock. Everything else is basically a bet on how much we’ll be using algorithms and cloud storage by next Christmas.

📖 Related: Finding Your TD Bank Routing Number for NY (and Why It Actually Matters)

Exploring the Top 20 Stocks in S&P 500 Right Now

If we keep going down the list, things get a bit more varied, but only just. You start seeing the "real world" stuff—the stores where you actually buy milk or the banks that hold your mortgage.

Retail and Healthcare Powerhouses

Walmart (WMT) has had a killer year. They’re sitting around $940 billion to $950 billion. People used to think Amazon would kill them, but Walmart basically said, "Hold my beer," and turned their 4,000+ stores into a massive delivery network.

Eli Lilly (LLY) is another monster. Thanks to the absolute explosion of GLP-1 (weight loss) drugs, they’ve shot up the rankings. They are currently worth nearly $940 billion. Healthcare used to be boring. Now, it’s one of the most volatile and high-growth sectors in the entire index.

The Financials and Energy Giants

- JPMorgan Chase (JPM): The "fortress balance sheet" king. Jamie Dimon’s baby is worth roughly $850 billion.

- Visa (V) & Mastercard (MA): These aren't just credit card companies; they're global toll booths for money. They consistently sit in the top 15 to 20.

- ExxonMobil (XOM): Even with the push for green energy, Exxon stays in the top 20 because, well, the world still runs on oil. They’re hovering around $547 billion.

The rest of the top 20 is rounded out by names like Oracle (ORCL), which has seen a massive resurgence due to cloud AI, Johnson & Johnson (JNJ), and Costco (COST). Costco is a beast. They have a cult following and a membership model that investors just adore.

Why This Concentration Matters for You

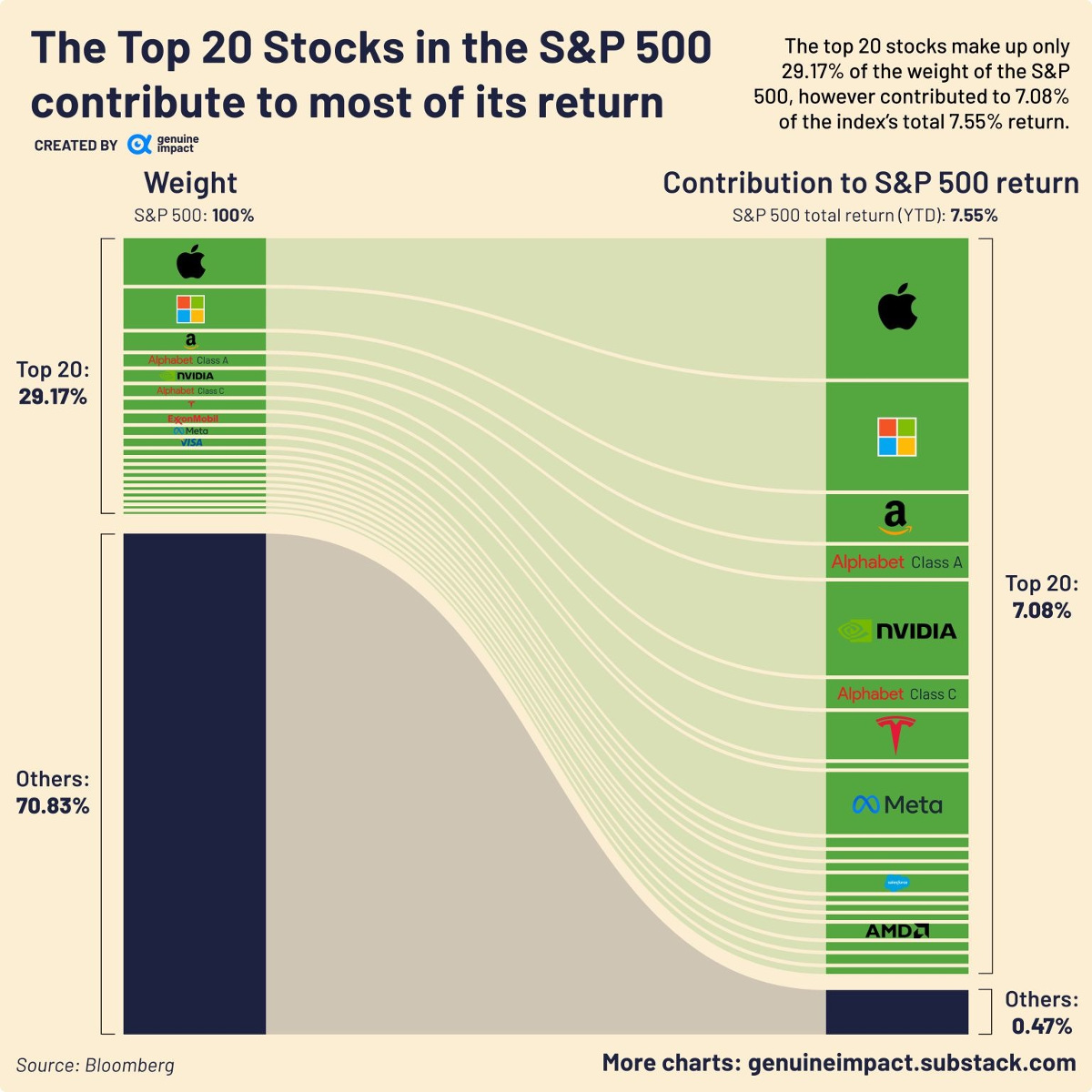

Here is the thing most people get wrong. They think that because they own 500 stocks, they are safe. But the top 20 stocks in S&P 500 make up nearly 40% of the entire index's value.

That is crazy.

If Nvidia has a bad day, the whole market feels like it’s in a recession, even if 400 other companies are doing just fine. In 2025, seven stocks represented over half of the entire index's gains. We call this "narrow breadth." It means the "average" stock isn't actually doing that well; it’s just the giants carrying the team on their backs.

The Risk of a "Winner Takes All" Market

J.P. Morgan’s researchers have been pointing out that this "winner-takes-all" dynamic is at record extremes. While they expect the AI supercycle to keep driving 13-15% earnings growth through 2026, it creates a fragile floor. If the AI hype cycle even slightly cools off, the S&P 500 doesn't just dip—it could crater.

On the flip side, Goldman Sachs is forecasting 11% returns for 2026. They think the market will "broaden out," meaning the other 480 stocks will finally start contributing to the gains. That would be a relief for everyone who isn't 100% all-in on tech.

Actionable Insights for Your Portfolio

So, what do you actually do with this information? Don't just stare at the tickers.

- Check your "Overlap": If you own an S&P 500 fund and a "Growth" ETF or a "Tech" ETF, you likely own the exact same five stocks twice. You're less diversified than you think.

- Watch the P/E Ratios: Companies like Nvidia and Eli Lilly have high valuations. They aren't "cheap." If you're a value investor, you might want to look at the sectors that are not in the top 20, like Utilities or Materials, which traded lower in 2025.

- Rebalance or Hold? If you've ridden the AI wave, your portfolio is probably heavily tilted toward the top 10. It might be time to take some profits and move them into the "laggards" that Goldman Sachs thinks will catch up in 2026.

- Understand the "Weight": When you see "S&P 500 up 1%," look at the "Equal Weight" S&P 500 (ticker: RSP). If the equal-weight version is flat or down, it means only the big guys are winning.

The top 20 stocks in S&P 500 are essentially the engines of the global economy right now. They are high-octane, high-risk, and currently high-reward. Whether they can keep this pace up through the rest of 2026 depends entirely on whether those massive AI investments finally start showing up as real, hard cash on the bottom line.

Keep an eye on the earnings reports for Microsoft and Amazon later this quarter. Those will tell you if the "magnificent" run has more legs or if the top 20 is about to see a serious reshuffle.

Next Steps for You:

- Log into your brokerage and see what percentage of your total wealth is tied to the top 10 S&P stocks.

- Compare your portfolio's performance against the Invesco S&P 500 Equal Weight ETF (RSP) to see if you're actually beating the average company or just riding the tech giants.

- Review the current "Strong Buy" ratings from analysts at Jefferies and Morgan Stanley, specifically focusing on the non-tech names in the top 20 like Walmart or JPMorgan to balance out your risk.