You’ve seen the headlines. Elon Musk's net worth is basically a phone number at this point. But if you look past the "Musk vs. Bezos" cage match, the actual list of the top 100 wealthiest people in the US is undergoing a weird, almost violent transformation. It's not just about who has the most private jets anymore. It's about who owns the silicon, the power grids, and the proprietary data training the world's next "god-model" AI.

As of January 2026, the combined wealth of these 100 individuals has cleared the $5 trillion mark. That's a staggering jump from just a few years ago. Honestly, it’s getting hard to comprehend these numbers. When we talk about $700 billion for a single human, we’re talking about more than the GDP of entire industrialized nations.

The Top 100 Wealthiest People in the US: Who’s Still on Top?

Let's be real: the top of the leaderboard feels like a game of musical chairs played by the same five guys. Elon Musk remains the undisputed heavyweight champion. His net worth recently crossed the $714 billion threshold according to Forbes and Bloomberg trackers. Why? Because Tesla isn't just a car company anymore; it’s a robotics and energy storage empire. Plus, SpaceX basically owns the orbital economy now.

But look at the runners-up. It’s a tech bloodbath.

🔗 Read more: ESSA Pharma Inc Stock: Why This Biotech Story Just Ended

- Larry Page and Sergey Brin: The Google founders are seeing a massive "second act" surge. Their wealth has hovered around $250 billion to $270 billion each this month. People thought Search was dead because of LLMs. They were wrong.

- Larry Ellison: The Oracle founder is 81 and somehow wealthier than he’s ever been—clocking in at roughly $245 billion. He bet the house on cloud infrastructure for AI, and it paid off.

- Jeff Bezos: Hovering around $240 billion to $250 billion. He’s been selling Amazon stock to fund Blue Origin, but the Amazon Web Services (AWS) cash cow keeps the needle moving up.

- Mark Zuckerberg: Currently sitting around $220 billion. The "Metaverse" punchline of 2022 has been replaced by the "Llama AI" powerhouse of 2026.

The Nvidia Effect: Jensen Huang’s Meteoric Rise

If you want to talk about the biggest "vibe shift" in the top 100 wealthiest people in the US, you have to talk about Jensen Huang. A few years ago, he was a successful CEO known for leather jackets. Now? He’s a global power player with a net worth north of $160 billion.

Nvidia is the "picks and shovels" provider for the entire AI gold rush. Every time a company like OpenAI or Anthropic raises $40 billion, a huge chunk of that goes straight into Jensen's pockets for H200 and Blackwell chips. He’s officially leapfrogged legendary names like Warren Buffett (who’s still doing fine at **$147 billion**, thank you very much).

The Sector Shift: It's Not Just Software Anymore

For a long time, the richest Americans were "software guys" or "finance guys."

That is changing.

We are seeing the rise of the Energy and Infrastructure Billionaires. To run AI, you need electricity. Lots of it. This has breathed new life into the fortunes of energy moguls and even the Walton family. The Waltons (Jim, Rob, and Alice) are still firmly in the top 20, with a combined family wealth that makes them effectively the richest dynasty on Earth. Their wealth is now tied as much to their massive logistical and automated distribution networks as it is to selling groceries.

The "Quiet" Billionaires You Aren't Tracking

While everyone watches Elon's X posts, the "quiet" part of the top 100 is where the real interesting stuff happens.

Take Thomas Peterffy of Interactive Brokers. He’s sitting on over $70 billion. Or Jeff Yass, whose stake in ByteDance (TikTok) has made him one of the most influential—and least talked about—men in Pennsylvania and the US at large, with a net worth around $65 billion. These guys don't want the limelight. They want the compounding interest.

Why These Rankings Feel Different This Year

There’s a growing sense of "wealth escape velocity."

In 2026, the gap between the #1 person and the #100 person is wider than the gap between the #100 person and you. To even crack the top 100 now, you generally need about $12 billion. Ten years ago, $2 billion got you a seat at the table. Inflation is part of it, sure, but the real driver is the concentration of equity in platform monopolies.

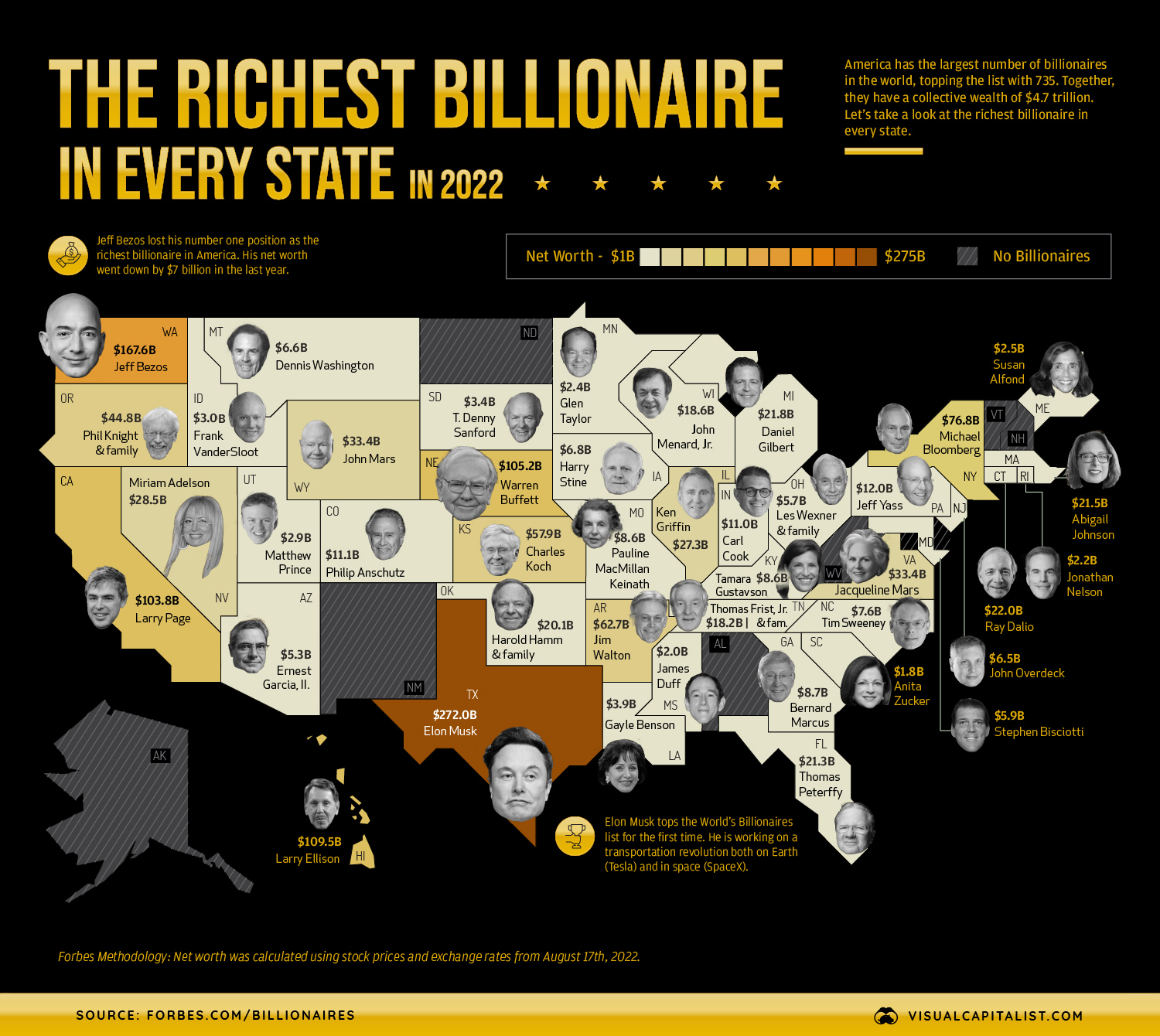

Wealth Concentration by State

- California: Still the undisputed king of billionaire residents. If Silicon Valley were its own country, it would have the highest concentration of wealth in human history.

- Texas: Thanks to Musk’s move and the tech migration to Austin, Texas is closing the gap. No state income tax is a hell of a drug for people with $100 billion.

- Florida: Becoming the "Wall Street South." Ken Griffin and Jeff Bezos moving to Miami wasn't just for the weather; it was a strategic financial play.

The Philanthropy Problem: Are They Giving It Away?

You’ll hear a lot about the Giving Pledge. Most of the people on this list have signed it. But the math is getting weird. When your net worth grows by $50 billion in a single year, giving away $1 billion feels like... well, it’s not even keeping pace with the growth.

MacKenzie Scott is the outlier here. She’s been burning through her Amazon fortune with a speed and efficiency that honestly puts other philanthropists to shame. She’s still in the top 30, but she’s actually trying to exit the list. Most others are just watching their foundations grow as fast as their personal accounts.

Common Misconceptions About the Richest 100

People think these guys have billions in a bank account.

They don't.

Almost all of this wealth is unrealized. It’s stock. If Elon Musk tried to sell $700 billion worth of Tesla and SpaceX tomorrow, the market would crater, and that $700 billion would vanish. They live on "buy, borrow, die" strategies—taking out low-interest loans against their stock to fund their lives without ever triggering a capital gains tax event. It’s a legal loophole you could drive a Cybertruck through.

What This Means for You (The Actionable Part)

Looking at the top 100 wealthiest people in the US isn't just about "rich person porn." It’s a roadmap for where the economy is going.

- Follow the Capex: The wealthy are currently dumping hundreds of billions into AI infrastructure. If you’re looking at career shifts or investments, look at the "boring" side of tech: cooling systems, power grids, and specialized chips.

- Equity is Everything: None of these people got there on a salary. Whether it’s a 401k or a startup, the lesson of the top 100 is that ownership is the only path to generational wealth.

- Geography Matters: Notice where they are moving. They are leaving high-regulation environments for "frontier" states. This affects real estate trends and local economies years before it hits the news.

The list will change by tomorrow. A 2% dip in the Nasdaq can "wipe out" $10 billion of Zuckerberg’s wealth in an afternoon. But the trend is clear: we are entering the era of the trillionaire, and the top 100 are the ones building the ladder.

If you want to stay ahead of these shifts, start tracking the 13F filings of the investment firms these billionaires run. It’s public data. It tells you where the "smart" (or at least the "most") money is flowing before the rest of the market catches on. Focus on the move toward autonomous systems and energy independence; that's where the next 50 names on this list are going to come from.