Honestly, if you're looking at your portfolio today, you've probably noticed that the "vibe" of the market has shifted. It’s not just about the numbers anymore; it's about this weird, high-stakes game of musical chairs between tech giants and the rest of the economy. Tomorrow share market news is going to be dominated by one big question: Can the rest of the market actually keep up with the AI hype, or are we just living in a Big Tech bubble?

Right now, we are seeing a massive "broadening" of the market. Basically, investors are finally starting to look at stocks that don’t have "Nvidia" or "Microsoft" in their names. It's kinda refreshing, but also super nerve-wracking because the safety net of the "Magnificent Seven" feels like it's fraying at the edges.

What to Watch for in Tomorrow Share Market News

Saturday, January 17, 2026, isn't a typical trading day for most, but the "news" doesn't stop just because the New York Stock Exchange is closed. For one, we are waiting on a massive batch of earnings from the banking sector. ICICI Bank is scheduled to drop its Q3 results, and everyone is staring at their screens to see if the 24.91% net margin they posted last time was a fluke or the new normal.

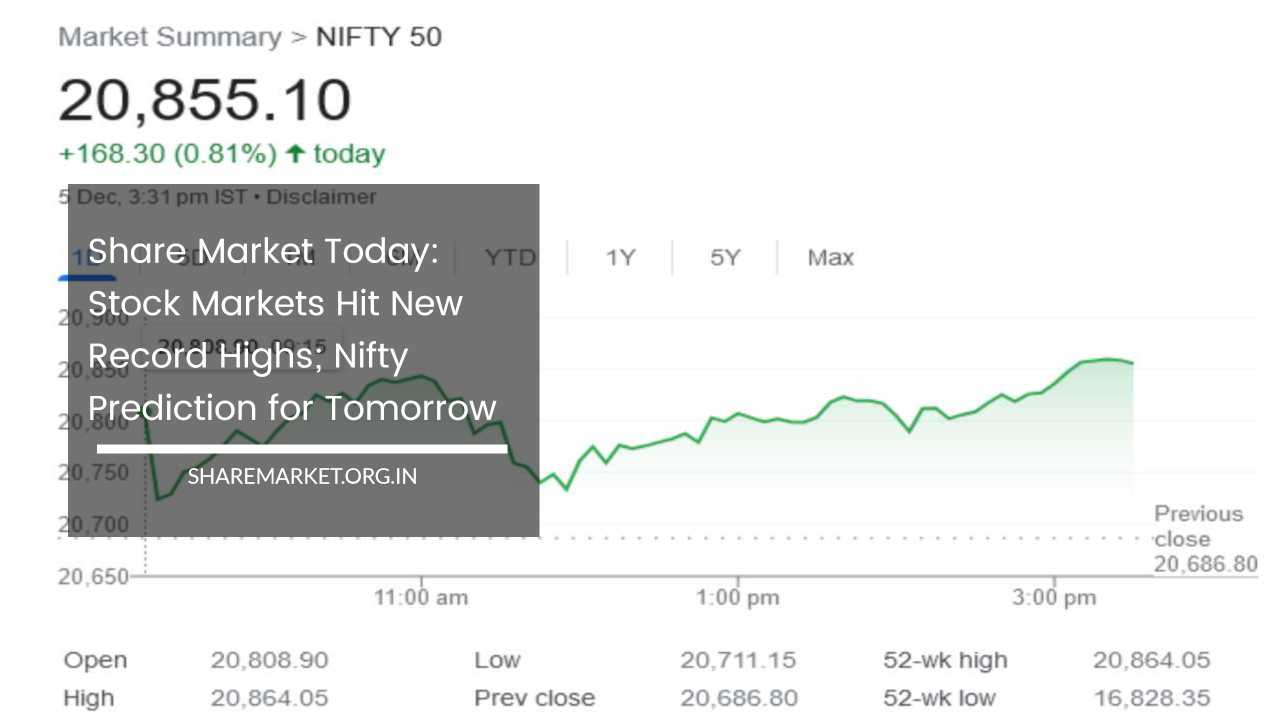

If you're tracking the tomorrow share market news for India, you've got to keep an eye on those results. The market is basically flat right now. The Nifty 50 only moved 0.11% on Friday. It's like the whole index is holding its breath. Why? Because foreign institutional investors (FIIs) have dumped about $2.1 billion of Indian stocks just this month.

✨ Don't miss: Online Associate's Degree in Business: What Most People Get Wrong

The AI Fatigue and the "Vera Rubin" Gamble

We can't talk about the market without talking about Nvidia. They’ve been up 1,150% since 2023. That is a stupidly high number. But Wall Street is still calling it "cheap" because of the upcoming Vera Rubin superchip. They're saying it'll run AI training 4x faster than the current Blackwell chips.

But here is the catch: China. The Trump administration recently eased some export restrictions for H200 GPUs, but Beijing is currently blocking them as a "negotiating tactic." If the tomorrow share market news includes any leaks about a trade deal (or a trade war) with China, expect the semiconductor index to go haywire.

The Fed is the Elephant in the Room

Everyone is obsessed with interest rates. It's almost annoying. But the data from the CME FedWatch tool is pretty clear: there is a 95% chance the Fed keeps rates exactly where they are in January.

🔗 Read more: Wegmans Meat Seafood Theft: Why Ribeyes and Lobster Are Disappearing

The "low hire, low fire" labor market is the big culprit here. We only added 50,000 jobs in December, which is... not great. Historically, that would mean a recession is coming. But since immigration flows have dropped so much, experts like Michael Feroli at J.P. Morgan are saying 50k might actually be the "new stable."

- 10-year Treasury Yield: Currently hovering around 4.17%.

- VIX Index: Watching for a spike if geopolitical tensions in Latin America (Venezuela) boil over.

- Earnings: ICICI Bank (Jan 17) and Reliance Industries (upcoming) will define the next week.

Why Small Caps Are Suddenly the Cool Kids

For the first time in a long time, the Russell 2000—which tracks small companies—is outperforming the big guys. It’s up over 6% in the last week. This is huge. It means people are betting on the actual U.S. economy, not just the "AI cloud."

If you're digging through tomorrow share market news, look for mentions of "market breadth." If the small-cap rally continues, it means the bull market is healthy. If it dies out and everyone runs back to Nvidia, we're back in "bubble territory."

💡 You might also like: Modern Office Furniture Design: What Most People Get Wrong About Productivity

Geopolitical Wildcards You Can't Ignore

Geopolitics in 2026 has become... intense. The U.S. seizing Venezuelan President Nicolás Maduro has created a power vacuum that is making energy markets very jumpy. Oil prices slipped a bit recently, but any hint of a supply disruption in Latin America will send Brent crude back over $90 faster than you can check your Robinhood app.

And then there's the "One Big Beautiful Bill Act" (OBBBA) health care cuts. These started hitting on January 1st, and we're just now starting to see how they're affecting consumer spending. If people are paying more for health insurance, they’re spending less at Amazon and Walmart. That’s a slow-burn disaster for retail stocks.

Actionable Insights for Your Portfolio

So, what do you actually do with all this? Don't just sit there. The market in 2026 is a "stock picker's market." You can't just buy an index fund and hope for the best anymore.

- Check your Tech Exposure: If more than 30% of your portfolio is in the "Magnificent Seven," you might want to trim. The rotation into small-caps and financials (like Goldman Sachs and Morgan Stanley) is real.

- Watch the 4.20% Ceiling: Keep an eye on the 10-year Treasury yield. If it breaks above 4.20%, tech stocks are going to get crushed. If it stays below, the rally has room to run.

- Dividend Reinvestment: Companies like TCS just announced massive dividends (₹57 per share). In a flat market, cash is king. Look for companies with high "cash generation" rather than just "growth potential."

- Hedge for Volatility: With the U.S. midterm elections approaching and global tensions rising, adding some "market neutral" strategies or even a bit of gold/silver (even though silver dipped to $90 recently) isn't a bad idea.

The tomorrow share market news is going to be a mix of earnings anxiety and geopolitical drama. Stay sharp, watch the volume, and for heaven's sake, don't FOMO into a stock just because it's up 1,000% already. The easy money has been made; now it's time to be smart.