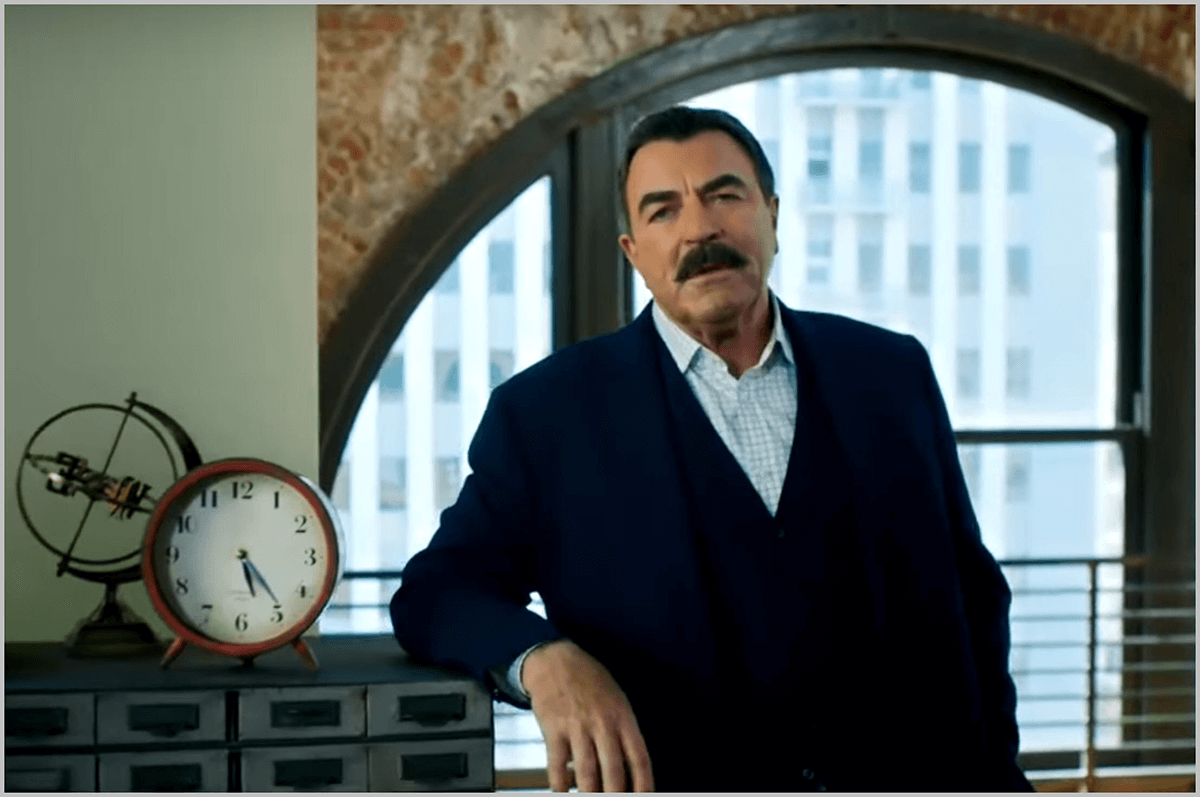

You've probably seen him. He’s standing in a sun-drenched living room or a rustic kitchen, looking directly into the lens with that trademark "trust me" gaze. Tom Selleck isn't chasing bad guys in a Ferrari or leading the NYPD anymore—at least not in these two-minute slots. Instead, he’s talking about home equity. The Tom Selleck commercial for reverse mortgage has become a staple of daytime television, right up there with Medicare supplement ads and personal injury lawyers.

Honestly, it’s a bit jarring at first. Seeing Magnum P.I. pitch a financial product that has a reputation for being, well, kind of "scammy" to some people. But Selleck is smart. In the ads, he often addresses the skepticism head-on. He literally says, "I know what you're thinking," or "I was skeptical, too." It’s a classic marketing move, but it works because it’s Tom Selleck. He’s the guy who did his homework, so you don't have to, right?

💡 You might also like: What Really Happened With Chord Buddy: The Truth About the Shark Tank Guitar Gizmo

Why the Face of Blue Bloods is Talking About Loans

Selleck signed on as the spokesperson for American Advisors Group (AAG) back in 2016. At the time, the industry was trying to clean up its image. Before him, it was Fred Thompson and Robert Wagner. AAG wanted someone who screamed "integrity." They needed a guy whose voice sounded like a warm blanket but also carried the authority of a 10-gallon hat.

They found it in Selleck.

The strategy was simple: Move away from the "emergency money" vibe and toward "retirement planning." The 2016 campaign, specifically the spot titled "Too Good to Be True," was designed to dismantle the idea that the bank just wants to steal your house. Selleck spends a good chunk of airtime explaining that a reverse mortgage is just a loan. It’s a way to get your own money out of the walls of your house while you're still alive to spend it.

But let’s be real. He’s a paid spokesperson. He’s not doing this because he personally needs a reverse mortgage to keep his ranch in Ventura County. He’s doing it because it’s a massive business. By 2024 and 2025, the brand evolved, and even as AAG was acquired by Finance of America Reverse, Selleck stayed the face of the operation. He’s been doing these for nearly a decade now.

The Reality Check: What the Commercial Doesn’t Say

Selleck says he "did his homework." He probably did. But his homework and your financial reality might be two different things. A reverse mortgage—technically a Home Equity Conversion Mortgage (HECM)—is a complex beast.

Here is what the commercial usually breezes over:

✨ Don't miss: Pak Rupee Saudi Riyal: What Most People Get Wrong About the Exchange Rate

- The Fees are Hefty: You aren't just getting a check. You’re paying an upfront mortgage insurance premium, origination fees, and closing costs. These can add up to thousands of dollars before you see a dime.

- The Debt Grows: In a normal mortgage, your balance goes down every month. In a reverse mortgage, you aren't making payments, so the interest is added to the loan balance. Your debt gets bigger while your equity gets smaller.

- The Tax and Insurance Trap: Selleck mentions you "keep the title." This is true. But he often follows that with a small asterisk: You must keep paying your property taxes and homeowners insurance. If a senior on a fixed income misses those payments, the lender can actually foreclose. This is where the "bank took the house" horror stories usually come from.

- The Heirs' Dilemma: When the owner passes away, the kids have a choice: pay off the loan (often by selling the house) or turn the keys over to the lender. If the house value has dropped or the loan balance has ballooned, there might be nothing left for the family to inherit.

It's not a scam, but it’s definitely not "free money." It’s a high-cost financial tool. For some, it’s a lifesaver that keeps them in their home. For others, it’s an expensive way to drain their biggest asset.

Changing the Script: From AAG to Finance of America

If you’ve noticed the commercials look a little different lately, it’s because the company behind them changed. In 2023, Finance of America (FOA) bought AAG. They kept the AAG brand name for a while because it was so recognizable, but eventually, the branding shifted.

Selleck’s newer spots, like the ones airing into 2026, focus even more on the "retirement lifestyle" angle. They use words like "stability" and "flexibility." They want you to think of your home equity as a 401(k) you can live in. The vibe has moved from "help I'm broke" to "I want to travel and fix the roof."

Is it Right for You? (The Expert Nuance)

Look, Tom Selleck isn't your financial advisor. He’s an actor with a great mustache. If you’re actually considering this, you have to look past the cinematic lighting.

✨ Don't miss: 1 US Dollar to Singaporean Dollar: Why the Rates Are Moving This Way in 2026

A reverse mortgage makes sense if:

- You plan to stay in that house until the day you die.

- You have enough income to cover taxes, insurance, and HOA fees.

- You don’t have heirs who are counting on inheriting the house.

- You’ve exhausted other, cheaper options like downsizing or a traditional HELOC.

It’s a bad idea if:

- You might move to a condo or assisted living in three years.

- You’re struggling to pay your current property taxes.

- You want to leave the family home to your children debt-free.

The federal government actually requires you to meet with a HUD-approved counselor before you can even get one of these loans. That’s a good thing. They’ll tell you the stuff Selleck doesn’t have time to fit into a 60-second spot.

Actionable Next Steps

If the Tom Selleck commercial for reverse mortgage has you curious, don't start by calling the number on the screen. Start by doing your own independent research away from the marketing materials.

- Check Your Equity: Use a site like Zillow or talk to a local realtor to get a realistic idea of what your home is worth today. Most reverse mortgages only let you tap into about 40% to 60% of that value.

- Calculate the "Burn Rate": Use an online reverse mortgage calculator to see how fast the interest will eat into your equity over 10 or 15 years. It’s often eye-opening.

- Talk to Your Family: If you have kids or heirs, tell them what you're thinking. They might prefer to help you out financially now rather than lose the family home later.

- Find a HUD Counselor: Search the HUD website for a list of local housing counseling agencies. They provide unbiased information for a very small fee (or sometimes for free).

The "Magnum" seal of approval is great for TV, but your retirement deserves a more critical look than a celebrity endorsement can provide.