Money feels weird right now, doesn't it? You go to the checkout, tap your card, and somehow £40 only buys you three bags of groceries and a tired-looking basil plant. Honestly, keeping up with the headlines is a full-time job. One day we’re told things are "cooling," and the next, your energy bill takes another jump.

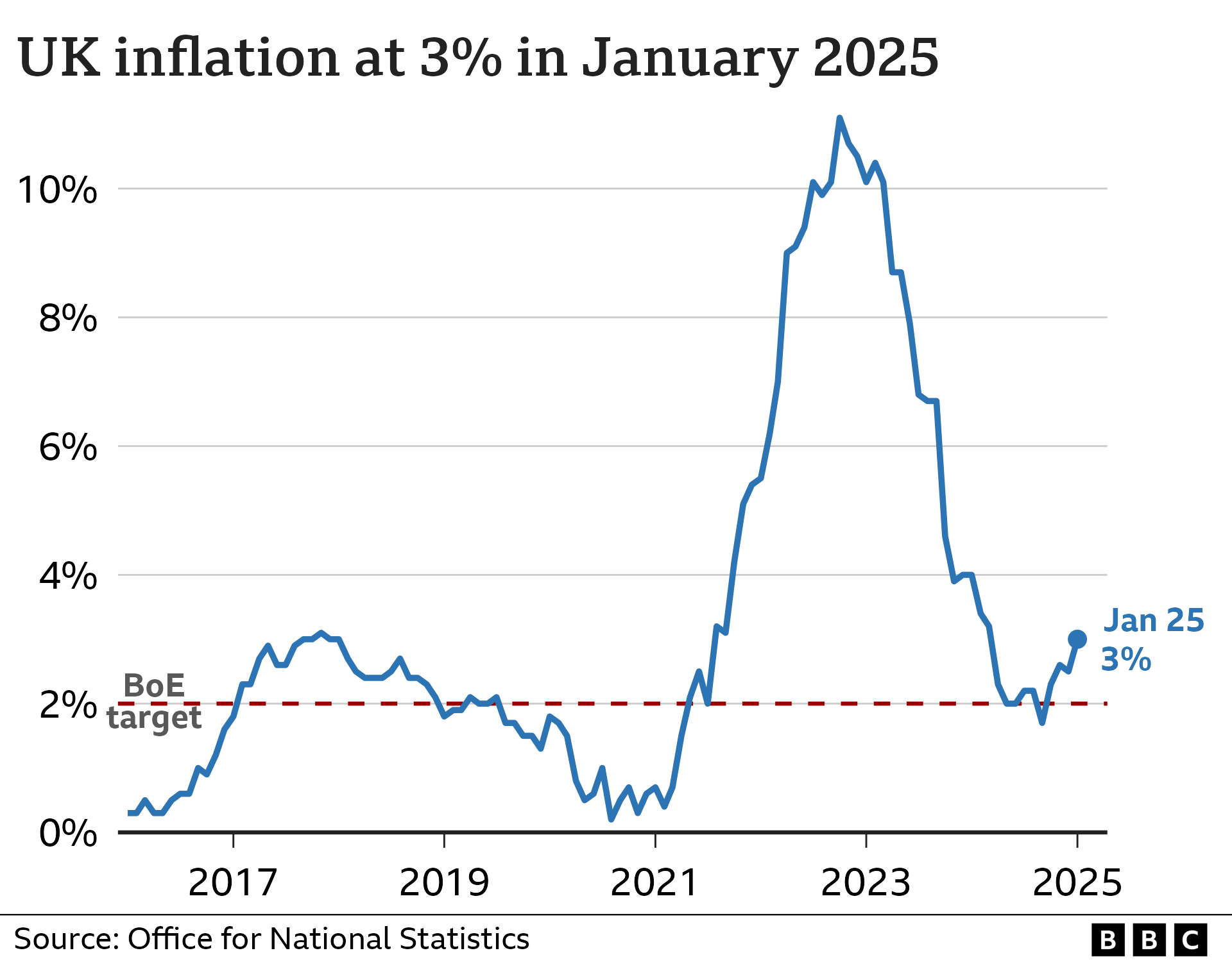

So, let's look at the hard numbers. As of today, January 13, 2026, the official UK inflation rate is sitting at 3.2%. That’s the most recent Consumer Prices Index (CPI) figure released by the Office for National Statistics (ONS). It’s a bit of a mixed bag. On one hand, it’s a massive relief compared to the double-digit nightmare of 2022. On the other, it’s still stubbornly above that 2% target the Bank of England obsessed over.

The "Hidden" Inflation in Your Cupboard

People often think a 3.2% inflation rate means prices are only going up by a tiny bit. I wish. That number is an average. It’s like saying the average temperature of a person with their head in the freezer and their feet in the oven is "fine."

If you look at food specifically, the story is way more intense. Food and drink inflation has been hovering much higher than the headline rate, recently trending around 4.2% to 5.7% depending on which data set you trust. The Food and Drink Federation (FDF) has been sounding the alarm about regulatory costs. Basically, even though the price of grain or energy might stabilize, new rules and red tape are keeping the price of your loaf of bread higher for longer.

✨ Don't miss: Is US Stock Market Open Tomorrow? What to Know for the MLK Holiday Weekend

- Olive Oil: Prices have basically doubled in some spots.

- Dairy: Eggs and butter are still way up—sometimes 50% higher than a few years back.

- Energy: The Ofgem price cap just shifted again on January 1st to £1,758 for a typical household. It’s a tiny increase (about 0.2%), but it’s still 40% higher than what we paid before the crisis.

Why the Bank of England is Playing Chicken

The folks in Threadneedle Street are in a tough spot. Last month, on December 18, 2025, the Monetary Policy Committee (MPC) actually cut interest rates to 3.75%. It was a 5-4 vote. That is a razor-thin margin.

Half the committee thinks the economy is sluggish and needs a boost. The other half—people like Catherine Mann and Huw Pill—are terrified that if they cut rates too fast, today's inflation rate uk will just bounce right back up. They call this "sticky" inflation. It’s the kind that gets stuck in the system because workers demand higher wages to pay for that expensive butter, which then makes companies raise prices again.

Is 2026 the Year Things Actually Get Normal?

Most economists, including those at Goldman Sachs and Oxford Economics, are betting on a "gradual" slide. They expect inflation to hit that 2% sweet spot somewhere in the second quarter of this year.

🔗 Read more: Big Lots in Potsdam NY: What Really Happened to Our Store

But there’s a catch.

Energy costs are the wildcard. The government recently decided to move some environmental levies off your energy bill and into general taxation starting in April. That’s a bit of a shell game, really. Your bill might go down by 3% or so, but you’re still paying for it—just through a different pocket.

What You Should Actually Do About It

Knowing the percentage is one thing. Actually protecting your wallet is another. Here’s the reality of how to handle the current 3.2% environment.

💡 You might also like: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

Check your savings. If your bank is still paying you 1% or 2% interest, you are effectively losing money every single day. Since inflation is at 3.2%, your "real" return is negative if your interest rate doesn't beat it. Look for high-yield easy-access accounts which are currently hovering around 4% or higher.

Lock in your mortgage early. If your fixed rate is ending in 2026, don't wait until the last minute. The markets are volatile. While rates are expected to drop to maybe 3.25% by the end of the year, there's no guarantee.

Audit your "lazy" subscriptions. We all have them. That streaming service you haven't watched since 2024? The gym membership you used twice? In a 3.2% world, every tenner counts. Companies are using "index-linked" price rises, meaning your phone and broadband bills are likely about to jump by inflation plus an extra 3.9% this spring.

The Bottom Line

Inflation isn't "gone"—it's just moving slower. We've moved from the emergency room to the recovery ward. You'll likely see the Bank of England hold steady at their next meeting on February 5th to see if the January energy cap changes cause a spike. Until then, keep an eye on the "core" inflation numbers, which strip out energy and food. That’s the real signal of whether the UK economy is actually healing or just faking it.

Next Steps for Your Finances:

- Review your cash: Move any savings earning less than 3.5% into a top-paying account immediately to beat the current inflation rate.

- Spring Price Hikes: Mark your calendar for April. Most telecom and water companies will hike prices then based on today's figures; it’s the best time to haggle for a new contract.

- Energy Efficiency: With the price cap stuck at nearly £1,800, small home improvements like draft proofing still have a massive ROI compared to previous years.