Honestly, if you're looking at todays gold rate for 22 carat, you've probably noticed something wild is happening. The prices aren't just "inching up" anymore. They are practically sprinting.

As of Sunday, January 18, 2026, the market is sitting in a very strange, very lucrative spot. In major Indian hubs like Delhi and Mumbai, todays gold rate for 22 carat has stabilized around ₹1,31,800 to ₹1,32,200 per 10 grams. That’s a massive jump from where we were even just a year ago.

Gold is acting like a frantic safe haven right now.

Why? Basically, everyone is nervous. Between the criminal investigation into the Federal Reserve Chair Jerome Powell and the absolute chaos of global debt hitting $340 trillion, people are ditching paper for metal. It's not just the "gold bugs" anymore; it's your neighbor, your local jeweler, and central banks from China to Brazil.

Breaking Down Todays Gold Rate for 22 Carat

If you’re heading to the shop today, the number on the board is going to look different depending on where you stand.

In Delhi, the rate for 10 grams of 22-carat gold is hovering at ₹1,31,800. If you're in the south, say Chennai or Bangalore, you might see slight variations due to local taxes and transportation costs, but the baseline is firm.

We saw a tiny dip earlier this week, a "correction" as the suits on Wall Street call it. But it didn't last. Gold regained about ₹350 per 10 grams in just the last 24 hours.

✨ Don't miss: Why People Search How to Leave the Union NYT and What Happens Next

It’s resilient.

Why 22 Carat Matters More Than 24 Carat for You

Most people search for the 24-carat price because it's the "pure" standard, currently sitting near ₹1,43,890. But unless you're buying bars for a vault, 24K is sort of useless. It’s too soft for jewelry.

22-carat gold is the real-world MVP. It’s 91.6% gold mixed with alloys like zinc or copper to make it tough enough to wear. When we talk about todays gold rate for 22 carat, we’re talking about the price of the wedding bangles, the anniversary chains, and the heirlooms.

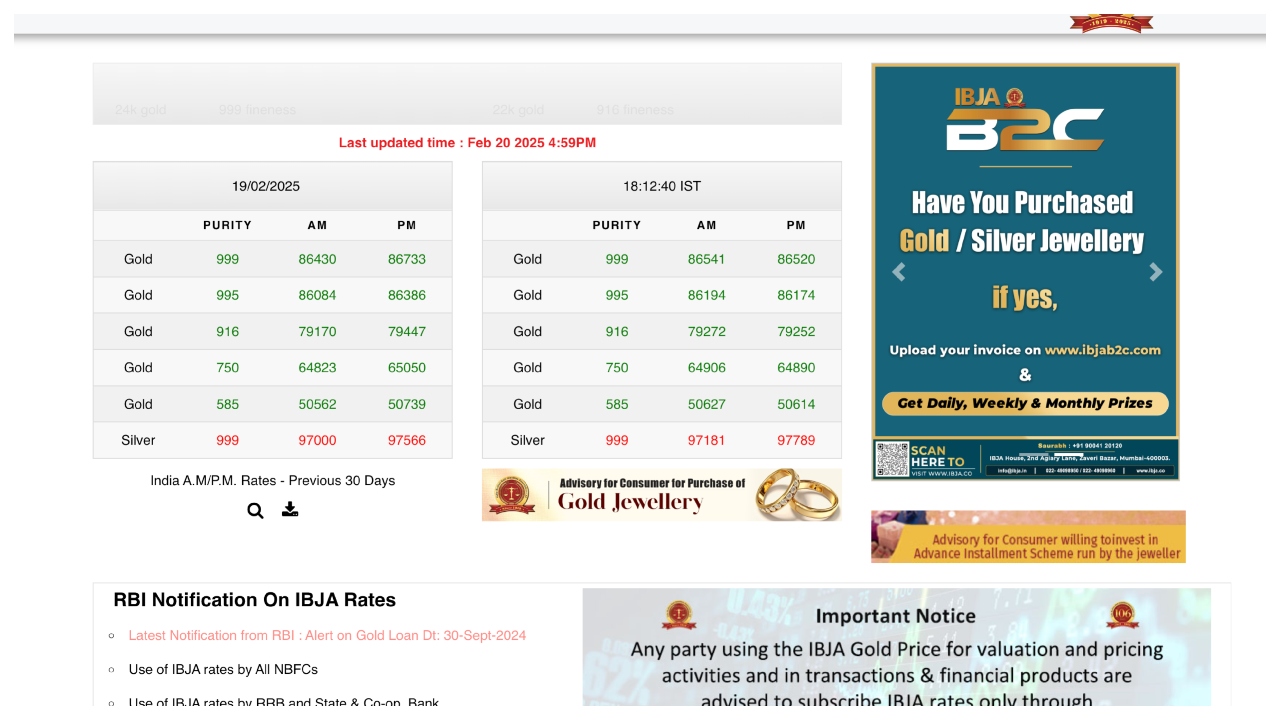

Current Prices Across Major Metrics (Jan 18, 2026)

- 1 Gram: ₹13,180 to ₹13,220

- 8 Grams (one sovereign): Approximately ₹1,05,440

- 10 Grams: ₹1,31,800 to ₹1,32,200

- 100 Grams: ₹13,18,000

These prices are record-breaking. Just to put this in perspective, Goldman Sachs and UBS are already whispering about gold hitting $5,000 an ounce globally by mid-year. If that happens, these "high" prices today are going to look like a bargain by July.

What is Driving This Madness?

You can't talk about gold without talking about the mess in the US. There is a literal criminal probe into the Fed Chair right now. That has never happened.

Investors are terrified that the Federal Reserve—the guys who control the world's money—is losing its independence. When people stop trusting the dollar, they start buying gold. It’s a knee-jerk reaction that has worked for 5,000 years.

🔗 Read more: TT Ltd Stock Price Explained: What Most Investors Get Wrong About This Textile Pivot

Central Banks are Hoarding

It isn't just retail buyers. Central banks in emerging markets have increased their gold purchases fivefold since 2022. China holds less than 10% of its reserves in gold compared to 70% in countries like Germany or France. They are playing catch-up, and they are buying in bulk.

When a central bank buys 60 tons of gold in a single month, the price for your 22-carat ring goes up. Simple as that.

Geopolitics and the "Greenland Factor"

Then there’s the weird stuff. Tensions over Greenland, US involvement in Iran, and political instability in South America. Each headline acts like a shot of adrenaline for gold prices.

In a world that feels like it’s leaning toward a "reshuffling" of global policy, gold is the only thing that doesn't require a government's promise to be valuable.

The 20% Rule: What Experts Are Saying

Michael Widmer from Bank of America is leaning heavily into the "alpha" status of gold for 2026. He’s projecting that retail investors should probably have 20% to 30% of their portfolio in gold right now.

That is huge.

💡 You might also like: Disney Stock: What the Numbers Really Mean for Your Portfolio

Usually, financial advisors tell you to keep 5% in gold just in case the world ends. Now? They’re saying it’s a primary performance driver.

However, the World Gold Council (WGC) has issued a slight warning. They think there is a 20% risk of a "crash" or a significant pullback if inflation suddenly cools down or if the US dollar regains its footing. It’s a tug-of-war.

Actionable Tips for Buying Gold Today

If you're looking at todays gold rate for 22 carat because you actually need to buy something, don't just look at the spot price.

- Check the Making Charges: Jewelry isn't just gold. You’re paying for the craftsmanship. In 2026, making charges can range from 8% to 25%. Always negotiate this. The gold price is fixed, but the labor cost isn't.

- The Hallmarking Factor: Never, ever buy gold without the BIS Hallmark. With prices this high, the temptation for "under-karat" gold is real. Make sure that 22K stamp is visible.

- Digital Gold vs. Physical: If you just want to make money and don't care about wearing it, look at digital gold or Gold ETFs. You avoid the making charges and the storage headache.

- The "Wedding Season" Trap: Rates usually spike during the Indian wedding season. If you can wait a few weeks after a major festival, you might catch a "correction" dip.

The trend for 2026 is clearly bullish. While the volatility might give you a minor heart attack every other Tuesday, the structural demand from central banks provides a very solid floor.

Next Steps for You:

Monitor the global spot price closely over the next 48 hours. If the price stays above $4,600 an ounce, we are likely heading for another leg up toward $4,800. If you are planning a large purchase for a wedding later this year, consider "locking in" your price now through a jeweler's gold scheme to hedge against the predicted climb toward ₹1,50,000 per 10 grams.