Honestly, if you looked at your portfolio this morning and felt a bit of whiplash, you aren't alone. Gold and silver are doing something weird. Usually, when the world feels like it's holding its breath, these metals just go up in a straight line. But today, January 15, 2026, we’re seeing a massive tug-of-war between record-breaking highs and some very aggressive profit-taking.

Basically, gold has been flirting with the $4,650 mark, but as of this morning, it's sitting closer to **$4,590 per ounce**.

Silver is a whole different beast. It’s been absolutely screaming lately, briefly touching over $93 earlier this week. Right now, you're looking at today's gold and silver prices per ounce hovering around **$87.63 for silver** and $4,589 for gold. It's a slight dip from the absolute peaks we saw forty-eight hours ago, but let’s be real: compared to where we were a year ago, these numbers are still astronomical.

Why the sudden "dip" in a bull market?

It’s easy to panic when you see a red candle on a chart. But the reality is that the market is just exhaling. After gold notched fresh records on Wednesday—hitting $4,641—investors did what they always do when they're sitting on a mountain of cash: they clicked the sell button to lock in gains.

Trump also threw a bit of a curveball. He mentioned that the situation in Iran might be cooling off slightly, or at least that he’s taking a "wait-and-see" approach. In the world of precious metals, "less war" usually means "less panic buying."

Then there’s the Federal Reserve drama. Everyone is obsessed with whether Chair Powell is actually going to get indicted or replaced. It sounds like a movie plot, but it’s a real thing people are trading on. If the Fed loses its independence, the dollar potentially tanks. If the dollar tanks, gold goes to the moon. Right now, the market is trying to price in that chaos, and it's messy.

Silver is the real story nobody talks about enough

While everyone stares at gold, silver has been the absolute overachiever.

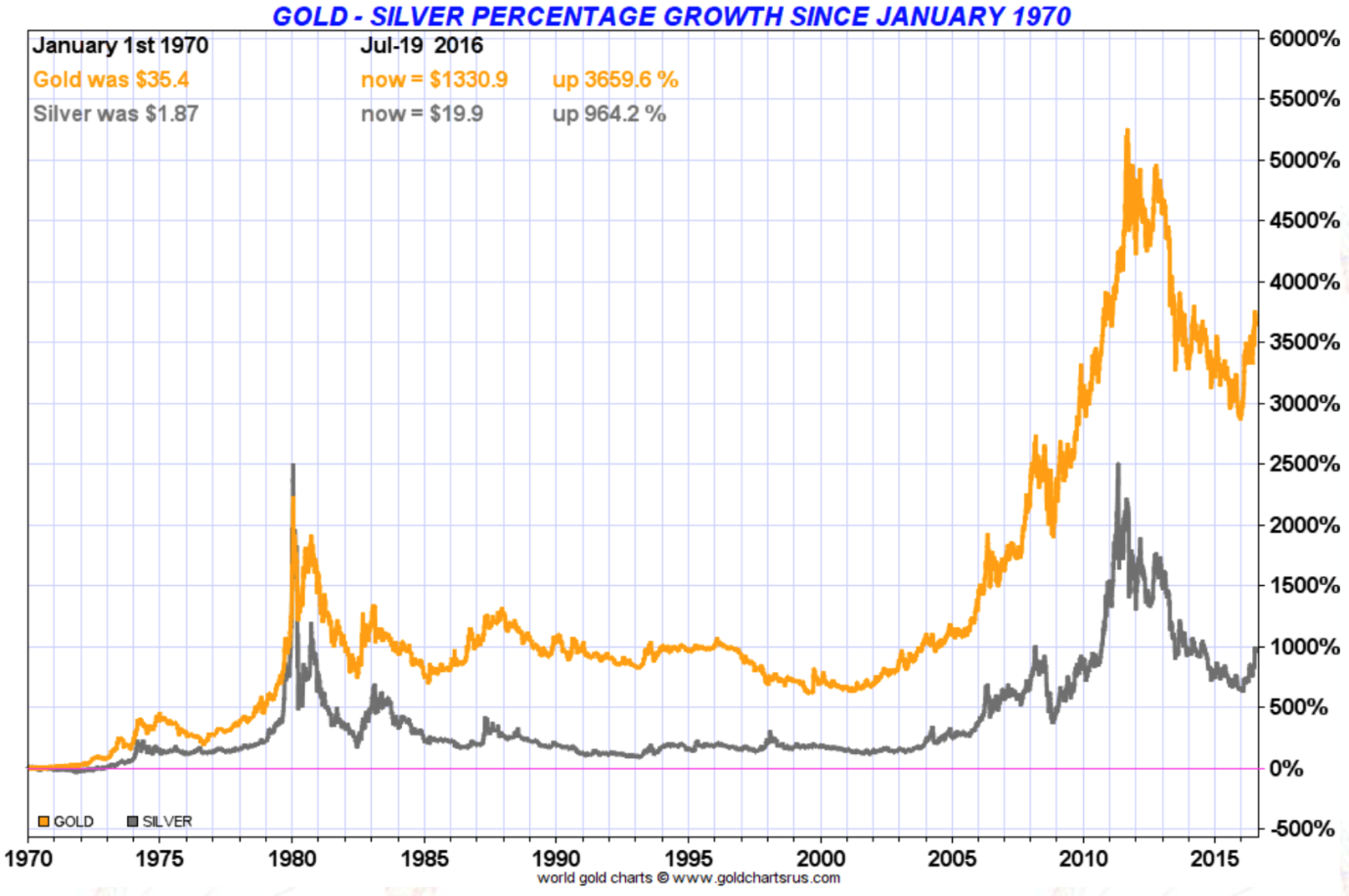

In 2025, silver basically lapped gold twice. We started 2026 with the gold-to-silver ratio compressed down to about 57:1. To put that in perspective, a couple of years ago it was closer to 80:1 or even 100:1. Silver is finally acting like an industrial metal again, not just gold's "cheaper cousin."

Think about it. AI is everywhere now. You can't build the massive data centers required for 2026-level processing without a ton of silver. You can't hit the green energy targets for the new solar arrays without it either. We’re facing a structural deficit where we simply aren't pulling enough silver out of the ground to keep up with how much we're using in electronics.

The "Debasement Trade" is real

You might have heard analysts like J.P. Steiner or firms like Citi talking about the "debasement trade."

It’s a fancy way of saying people don't trust paper money right now. With global debt levels hitting "this shouldn't be possible" heights, big funds are moving into "hard" assets. It's not just "doomsdayers" in bunkers anymore. It’s pension funds and sovereign wealth funds.

J.P. Morgan actually put out a forecast suggesting gold could average $5,055 by the end of the year. Some people, like Todd “Bubba” Horwitz, are even calling for $6,000. Is that crazy? Maybe. But three years ago, $4,500 gold sounded like science fiction, and here we are.

📖 Related: Why Investing in This Thriving Land 2025 Isn't What You Expected

What you should actually do with this information

If you’re looking at today's gold and silver prices per ounce and wondering if you missed the boat, you have to look at your timeline.

If you're a day trader, today is a nightmare of volatility. If you're looking at the next five years, the supply-demand gap in silver and the geopolitical instability backing gold haven't gone away just because the price dropped 1% this morning.

Actionable Steps for Today:

- Watch the $4,770 Resistance: The World Gold Council says gold isn't even "overbought" until it hits $4,770. If it breaks that, expect a fast move to $5,000.

- Monitor the $100 Silver Call Options: There is a massive amount of betting going on for silver to hit $100 by March. If silver drops below $84, that bullish thesis might take a break.

- Check the US Dollar Index (DXY): If the dollar stays weak despite the Fed's confusion, metals will likely find a floor very quickly.

- Don't ignore the premiums: If you're buying physical coins or bars, remember the "spot price" isn't what you pay. Premiums on silver eagles and maples are still elevated because everyone is trying to get their hands on physical metal at the same time.

The market is currently digesting a lot of news. Between the Trump administration's stance on the Fed and the cooling (or simmering) tensions in the Middle East, volatility is the only guarantee. Gold and silver are still the primary hedges against a world that feels increasingly unpredictable.