The market's a funny beast. Honestly, if you spent Friday watching the today Dow Jones average ticker, you probably felt that slow, itchy kind of frustration. The blue-chip index slipped by 83.11 points, closing the week at 49,359.33. That's a 0.2% drop. It isn't a crash. It isn't a rally. It’s basically the financial equivalent of a "shrug."

We're sitting right at the edge of the 50,000 mark. It’s a psychological wall that feels like it should be made of granite, but in reality, it's just a number. Most people see a red day and assume the sky is falling, but when you look at the nuance of what actually happened this week, the story is more about a tug-of-war between boring banks and shiny AI chips.

Why the Dow is Stuttering at the Finish Line

Wall Street just wrapped up a "wobbly" week, as the Associated Press aptly put it. We're in the thick of the first corporate earnings season of 2026. While the S&P 500 and Nasdaq are also hovering near record levels, the Dow is feeling the weight of a mixed banking sector.

Take PNC Financial. Their stock hit a four-year high on Friday, jumping nearly 4% because they crushed their fourth-quarter targets. But then you have Regions Financial (RF), which stumbled over 2.6% after missing the mark. When the "big old" companies that make up the Dow can't agree on a direction, the average just kind of drifts.

It’s also about the Federal Reserve. Or rather, the drama surrounding it. President Trump has been hinting that he might skip over Kevin Hassett—a favorite for those wanting aggressive rate cuts—to replace Jerome Powell in May. This uncertainty sent the 10-year Treasury yield climbing to 4.23%. When yields go up, the Dow often takes a breather because borrowing gets pricier and those steady dividends look a little less attractive compared to "safe" government debt.

The Great AI Chasm

There’s a massive divide happening right now that the today Dow Jones average doesn't always show on the surface. On one side, you have the "old world" companies. On the other, the AI-driven monsters.

💡 You might also like: Social Security Tax Documents: What Most People Get Wrong Every January

While the Dow was down, chipmakers like Micron Technology (MU) were absolutely soaring—up nearly 8% on Friday alone. Broadcom rose 2.5%. These companies are basically the shovel-sellers in the AI gold rush. If you're only looking at the Dow's final number, you're missing the fact that tech is still trying to carry the entire market on its back.

Doug Beath, a strategist over at Wells Fargo, noted recently that we shouldn't be surprised by this volatility. We have geopolitical tensions and a government that just recently reopened after a 43-day shutdown. Investors are basically waiting for a reason to be truly bullish again.

What’s Actually Happening with Your Money?

If you’re checking the today Dow Jones average because you’re worried about your 401(k), here is the reality: the index is still up significantly from where it started the year. We saw a 0.3% loss for the week, which is basically noise in the long run.

📖 Related: Cómo está el dólar peso mexicano: Lo que nadie te explica sobre el tipo de cambio hoy

What's more interesting is the "Clarity Act" stalling in D.C. This piece of legislation was supposed to set the rules for crypto, but it hit a snag when Coinbase's Brian Armstrong pulled support. You might think, "I don't own Bitcoin, why do I care?" Well, the Dow includes companies like Visa and Goldman Sachs that are deeply integrated into the digital payment world. When crypto-regulation stumbles, it ripples into the broader financial sector.

Surprising Facts About This Week's Market

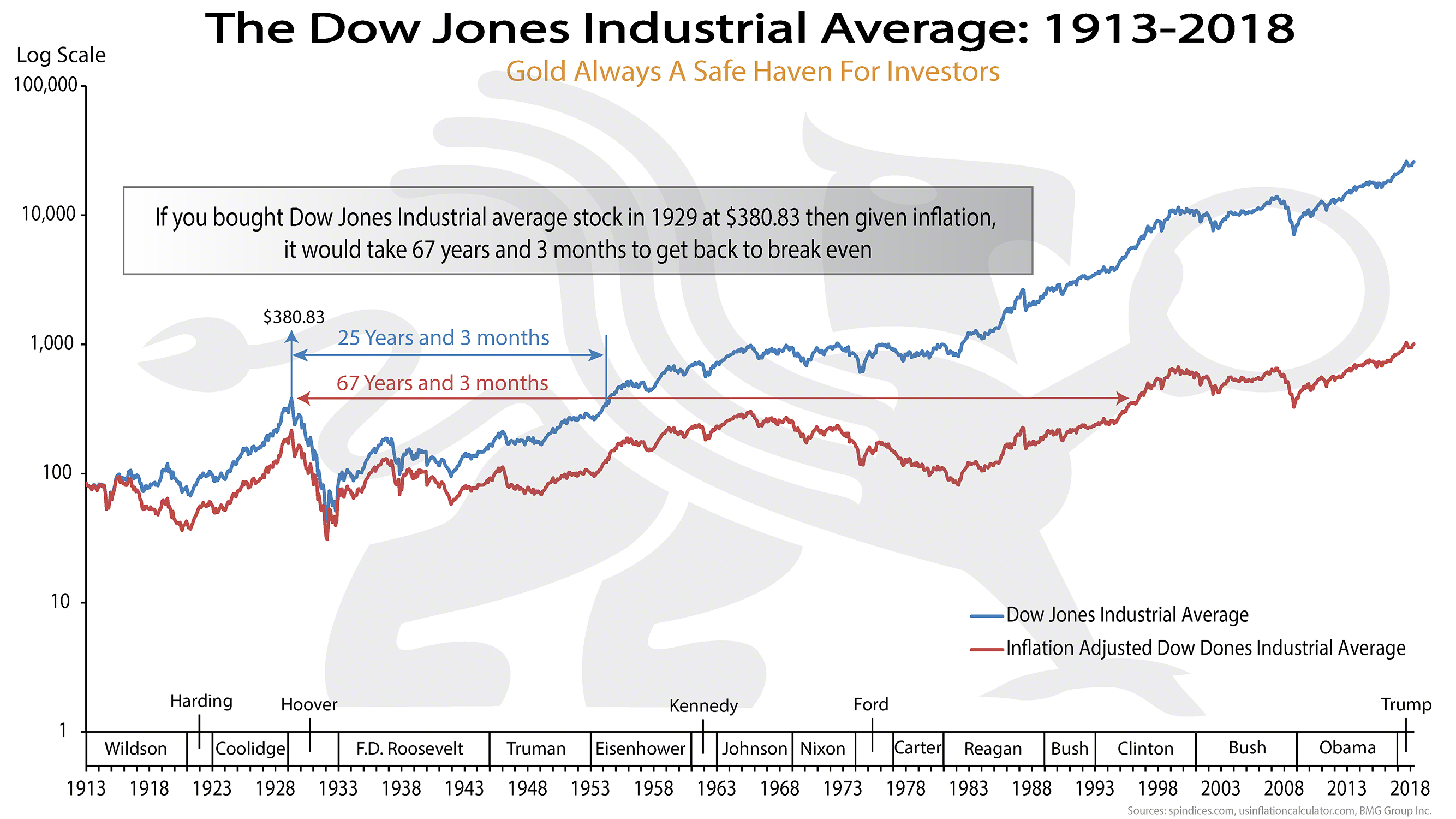

- Gold is the new "Safe House": While the Dow struggled, gold futures hit an all-time high of $4,650 an ounce earlier this week. People are scared of inflation and debt, so they’re buying yellow metal.

- The 50,000 Barrier: We are less than 700 points away from a historic milestone. Every time we get close, "profit-taking" happens—traders sell their winners to lock in cash, which naturally pushes the price back down.

- Small Caps are Winning: Interestingly, while the "big" Dow fell, the Russell 2000 (small companies) actually eked out a gain. It suggests that the "real" economy—the smaller businesses—might be doing okay despite the drama in the mega-cap world.

The "Hulbert" Perspective on the Bubble

Mark Hulbert, a veteran market watcher, has been sounding a bit of an alarm. He points out that while everyone is obsessed with AI earnings growth, valuations are getting stretched. The S&P 500 is trading at a P/E ratio of over 22, while some "boring" value stocks are in the single digits.

If the today Dow Jones average feels heavy, it might be because the "value" part of the index is finally trying to catch up to the "growth" part. It’s a rebalancing act. It’s healthy, even if it makes your screen look red for a few days.

Actionable Insights for Your Portfolio

Don't just stare at the 49,359.33 number and panic. Instead, consider these moves:

- Watch the Yields: Keep an eye on the 10-year Treasury. If it stays above 4.2%, expect the Dow to stay "wobbly." If it drops back toward 4%, the path to 50,000 becomes much smoother.

- Look Beyond the Blue Chips: The Dow is only 30 companies. This week showed that smaller companies (Russell 2000) and specific tech sectors are moving independently. Diversification isn't just a buzzword right now; it’s a survival strategy.

- Check the "January Catch-up": Because of the recent government shutdown, a lot of economic data (like retail sales and housing starts) is delayed. Expect a massive influx of data by the end of January. This will likely cause a "swing" in the today Dow Jones average one way or the other.

- Rebalance into Value: If you've made a killing on AI chips, it might be time to look at those "cheap" stocks Hulbert mentioned—companies like Pfizer or GM—that offer a cushion if the tech bubble decides to hiss a little air.

The market isn't a straight line up. It’s a messy, emotional, and often confusing collection of human decisions. Friday was just a day where the "sell" buttons were pressed slightly more than the "buy" buttons.

Next Steps for You:

Check your portfolio's exposure to the financial sector versus technology. With the "Clarity Act" stalled and bank earnings coming in mixed, you may want to ensure you aren't over-leveraged in regional banks like Regions Financial while the sector stabilizes. Also, set a price alert for the Dow at 50,050—once we break that ceiling, the "FOMO" (fear of missing out) trade will likely kick in hard.