Money changes. Not just the physical design of the bills or the numbers on a screen, but the actual power those numbers hold over the world. If you found a $100 bill tucked into an old pair of jeans from 2010, you’d probably be stoked. But honestly? That bill is a ghost of its former self. It buys significantly less gas, fewer groceries, and definitely less tech than it did back then. This isn't just a "back in my day" complaint from your grandpa. It’s a core law of the financial universe known as the time value of money.

The concept is deceptively simple. A dollar in your hand right now is worth more than a dollar promised to you a year from today. Why? Because you can do something with it now. You can invest it. You can put it in a high-yield savings account. Or, at the very least, you can spend it before inflation eats another chunk of its purchasing power.

The Opportunity Cost of Doing Nothing

Most people think of "cost" as money leaving their bank account. If you buy a coffee, it costs five bucks. Simple. But the time value of money introduces a silent cost: the opportunity cost.

Imagine your friend owes you $1,000. They offer to pay you today or exactly one year from now. If you take it today and stick it into a boring index fund returning a modest 7%, you’ll have $1,070 in a year. By choosing to wait, you didn't just "not have the money"—you effectively lost $70. That’s the "time" part of the equation. Time is a multiplier. When you let time pass without putting your capital to work, you are actively losing ground to the math of the markets.

It’s about potential.

Economists like Irving Fisher, who really pioneered these ideas in the early 20th century, argued that "income" isn't just a flow of money; it's the realization of a service over time. If you delay that realization, you need to be compensated for the wait. This is exactly why interest rates exist. Interest is the "bribe" someone pays you to convince you to give up your liquidity today for the promise of more liquidity later.

👉 See also: Why Saying Sorry We Are Closed on Friday is Actually Good for Your Business

Why the Time Value of Money Is Secretly Running Your Life

You see this everywhere once you start looking. It’s in your mortgage, your 401(k) projections, and even those "buy now, pay later" schemes that have taken over retail apps.

The Formula That Rules the World

Financial pros use a specific set of math to figure this out. It’s not just vibes. They look at Present Value (PV) and Future Value (FV).

To find out what a future sum is worth today, we use the formula:

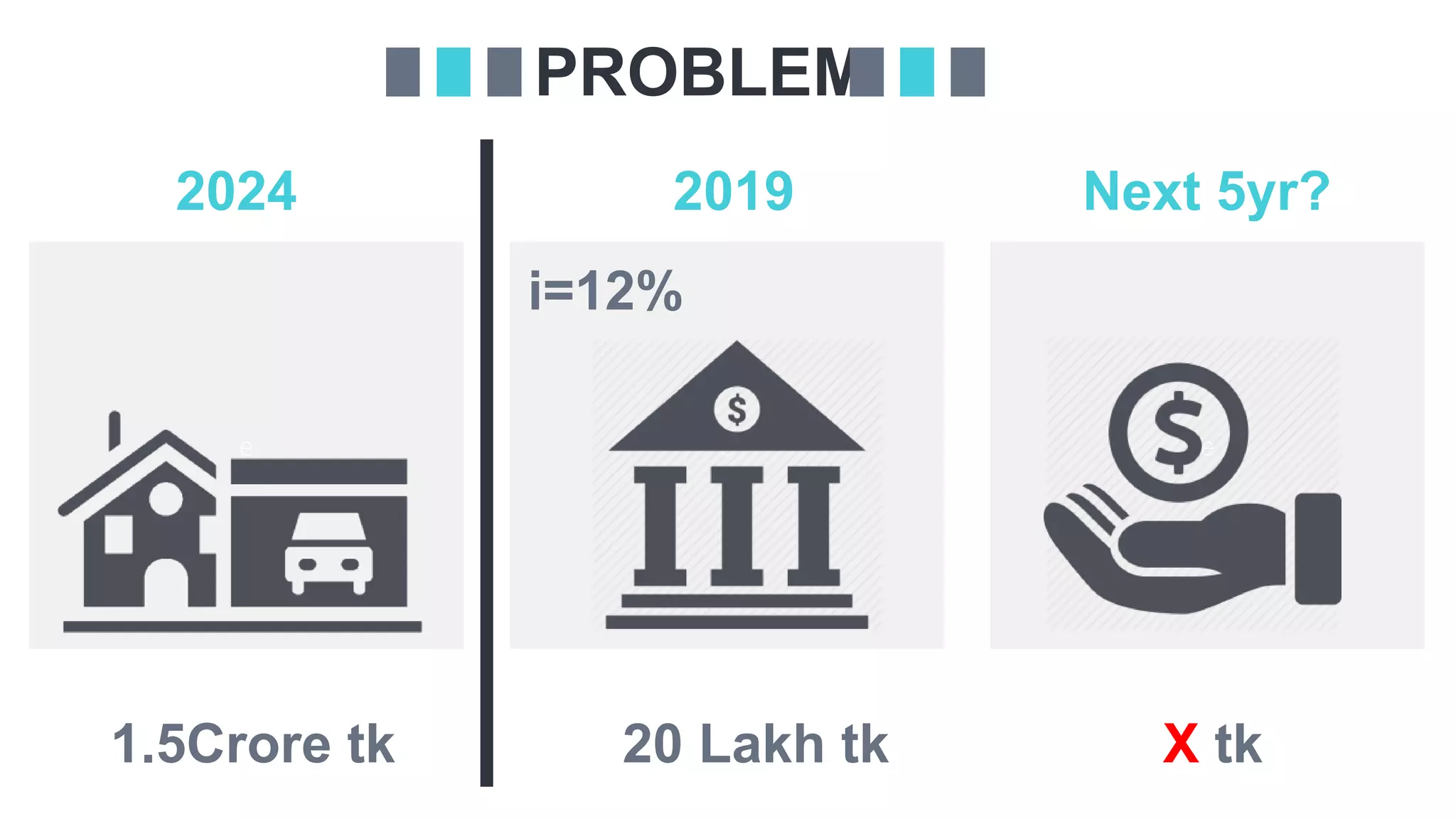

$$PV = \frac{FV}{(1 + i)^n}$$

In this scenario, $i$ represents the interest rate (or discount rate) and $n$ is the number of periods.

It looks nerdy, but it's the reason why a lottery winner might choose a $300 million lump sum today instead of a $500 million payout spread over 30 years. When you "discount" those future payments back to today's value, the smaller pile of cash right now often wins because of its ability to grow immediately.

Inflation: The Silent Tax

We have to talk about the elephant in the room. Inflation.

✨ Don't miss: Why A Force of One Still Matters in 2026: The Truth About Solo Success

In 2022, the US saw inflation spikes that hadn't been seen in decades. If you had $10,000 sitting in a standard checking account earning 0.01% interest while inflation was hitting 8%, you were getting poorer in real-time. Your $10,000 still said "$10,000" on the screen, but its "Present Value" in terms of what it could actually buy was shrinking by the day.

This is why the time value of money isn't just an academic exercise for MBAs. It’s a survival guide for anyone with a bank account. If your money isn't growing at a rate that at least matches inflation, you are experiencing a "negative return" on your life's work.

Real-World Nuance: When Cash Is King

Wait. Is it always better to have the money now?

Usually, yes. But there are weird edge cases. In a "deflationary" environment—which is rare but happened during the Great Depression or more recently in parts of Japan's economy—the value of money actually goes up over time. In that specific, weird scenario, a dollar tomorrow buys more than a dollar today.

But for 99% of us, 99% of the time, the "now" is superior.

🔗 Read more: Who Bought TikTok After the Ban: What Really Happened

Risk and Uncertainty

There is also the "bird in the hand" factor. Finance experts call this the risk premium. If I promise to give you $100 in ten years, there is a non-zero chance I’ll be dead, broke, or living in a cave by then. The further out a payment is, the riskier it becomes. Therefore, the time value of money must account for the possibility that the future payment never actually happens.

This is why corporate bonds for stable companies like Apple pay much lower interest rates than "junk bonds" from struggling startups. You’re being paid for the time, but you’re also being paid for the risk that the "time" won't eventually pay out.

The Magic of Compounding

You’ve probably heard the quote (often falsely attributed to Einstein) that compound interest is the eighth wonder of the world. Whether he said it or not, the math holds up.

If you start investing $500 a month at age 25, you’ll likely end up a millionaire by retirement. If you start doing the exact same thing at age 35, you’ll have less than half that amount. Those ten years didn't just cost you the $60,000 you didn't deposit; they cost you the decades of "growth on growth" that the first ten years of contributions would have generated.

That is the time value of money in its most aggressive, life-changing form.

Practical Moves You Can Make Right Now

Stop letting your cash rot. Understanding the theory is one thing, but your bank account needs action.

- Audit your "lazy" cash. Look at your checking account. If you have more than two months of living expenses sitting there earning nothing, you are losing money every single hour. Move the excess to a High-Yield Savings Account (HYSA). Even a 4% or 5% return is better than the 0.01% most big banks offer.

- Re-evaluate your debt. If you have a mortgage at 3% and the market is returning 7%, the time value of money suggests you should not pay off that mortgage early. Your "present" dollars are better spent investing for a 7% return than "saving" a 3% interest cost.

- Front-load your retirement. If you have the choice to contribute to your 401(k) at the beginning of the year versus the end, do it early. Those extra months of market exposure add up to massive differences over thirty years.

- Negotiate for "Now." If you are a freelancer or business owner, getting paid "Net 30" (30 days after the invoice) is better than "Net 90." Use discounts to incentivize clients to pay early. A 2% discount for immediate payment might seem like a loss, but if you can put that cash to work immediately, it often pays for itself.

The clock is always ticking on your capital. Every day you wait to invest or optimize your cash flow, the "future value" of your wealth takes a hit. It’s not about greed; it’s about acknowledging the reality that time is the most expensive commodity on the planet. Don't waste it by letting your money stand still.