You’ve probably heard the pitch. A politician stands behind a podium, gestures toward a shuttered factory, and promises to "protect" American jobs by slapping a big, fat tax on foreign imports. It sounds like common sense. If we make it harder for the other guy to sell his stuff here, our guys win, right?

Honestly, that’s the kind of logic Thomas Sowell has spent about fifty years dismantling.

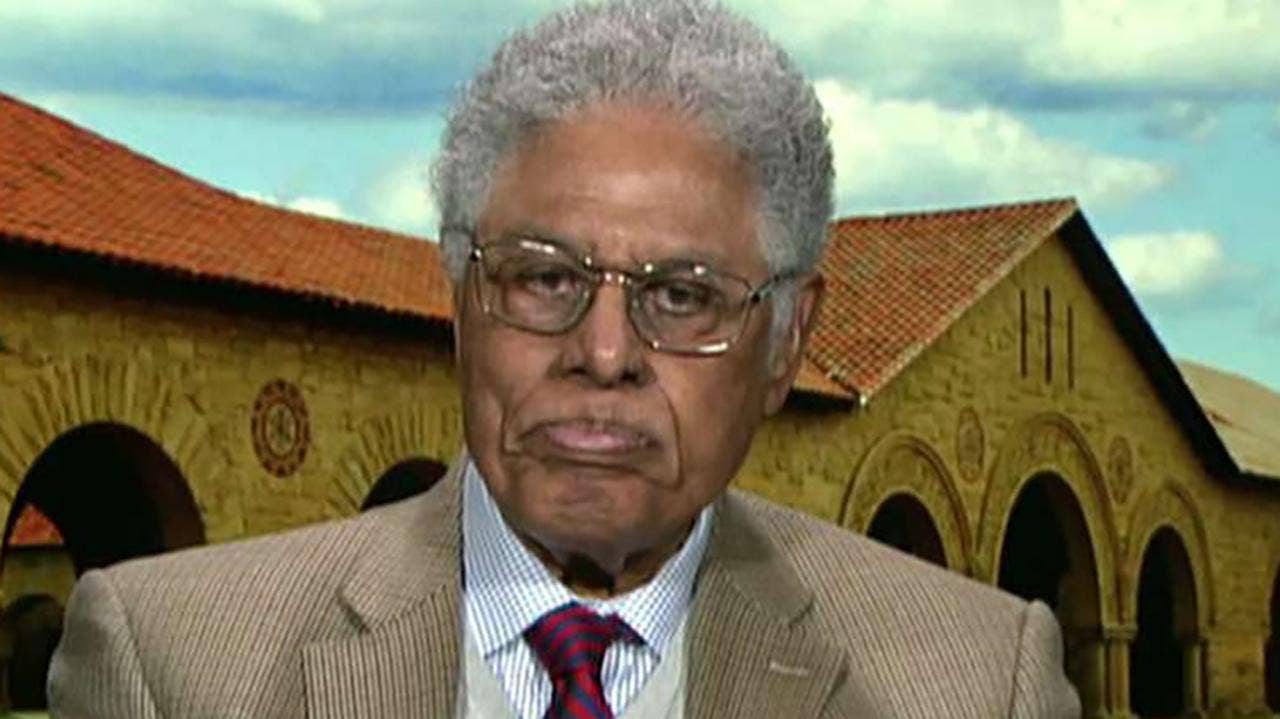

If you aren't familiar with Sowell, he’s a Senior Fellow at the Hoover Institution and arguably one of the most clear-headed economists alive. He doesn't do "expert-speak." He doesn't hide behind fancy jargon or impossible equations. Instead, he looks at the cold, hard evidence. And when it comes to thomas sowell on tariffs, the evidence is pretty brutal for anyone who thinks trade wars are "easy to win."

Sowell’s basic take? Tariffs aren't just a tax on foreigners. They’re a tax on you, the person reading this, and they usually end up killing more jobs than they save.

The "Protection" Racket

Let’s talk about that word: protection. It’s a great marketing term. It makes you feel safe, like a warm blanket. But Sowell points out in his book Basic Economics—which is basically the bible for anyone who wants to understand how the world actually works—that "protecting" an industry is often just a fancy way of saying "subsidizing inefficiency."

Think about the steel industry. Back in the 80s, the US government got worried about foreign steel flooding the market. They put up trade barriers to save those 340,000 steel jobs. On paper, it looked like a win for the blue-collar worker.

But here’s what happened in the real world.

Because domestic companies didn't have to compete with cheaper foreign steel anymore, they jacked up their prices. Suddenly, every American company that uses steel—car manufacturers, appliance makers, construction firms—saw their costs skyrocket.

Sowell notes that while those tariffs might have saved maybe 5,000 jobs in steel, they actually cost about 26,000 jobs in the industries that relied on steel. It’s a classic case of what he calls "the seen vs. the unseen." You see the steelworker keeping his job. You don't see the guy at the Ford plant getting laid off because the car is now too expensive for anyone to buy.

The $600 Million Math Problem

Sowell is big on looking at the "net balance." He doesn't care if a policy helps one group; he cares if it helps the country as a whole.

In one of his examples, he looks at a scenario where protectionist measures might boost an industry's profits by $240 million. Sounds great! But if those same measures cost other American industries $600 million in lost profits because their raw materials got more expensive, you’ve just set $360 million on fire.

It’s like trying to make your house bigger by ripping wood off the kitchen to build a porch. You still have the same amount of wood, but now your stove is in the rain.

Why Sugar is a Sweet Deal for No One

Sugar is another one of his favorite examples. For decades, the US has had strict quotas and tariffs on imported sugar to "protect" American sugar farmers.

The result? You pay twice as much for a bag of sugar as people in other countries.

But it gets worse. Because sugar is so expensive here, American candy companies—the "confection industry"—can't compete. They end up moving their factories to Canada or Mexico where sugar is cheaper. So, to save a few thousand jobs in the sugar fields, we’ve chased away tens of thousands of manufacturing jobs in the candy business.

The Ghost of Smoot-Hawley

If you want to see Sowell get really fired up, ask him about 1930.

👉 See also: US Dollar to Jamaican Dollar Exchange Rate: What Most People Get Wrong

Most people think the Great Depression was just an inevitable crash. Sowell argues it was made a thousand times worse by the Smoot-Hawley Tariff Act. Back then, unemployment was at 9%. Politicians thought, "Hey, let's keep foreign goods out so people have to buy American!"

Over a thousand economists begged President Herbert Hoover not to sign it. They told him it wouldn't create jobs. They told him it would spark a trade war.

He signed it anyway.

Other countries didn't just sit there and take it; they punched back. They slapped their own tariffs on American exports. Within a couple of years, US exports were cut by two-thirds. Farmers, who had been the biggest supporters of the tariffs, saw their markets vanish overnight. Unemployment didn't stay at 9%. It hit 16%, then 25%.

Sowell’s point is that trade isn't a zero-sum game. It’s not "I win, you lose." It’s "We both win because we’re both doing what we’re best at." When you stop that flow, everyone gets poorer.

The Low-Wage Fallacy

"But Thomas," people say, "how can we compete with countries where people work for $2 an hour?"

Sowell has a very simple answer for this: productivity.

If an American worker gets paid $40 an hour but produces 30 times as much as a worker in a poor country getting paid $2 an hour, the American worker is actually the "cheaper" option for the business.

Low wages usually mean low productivity, poor infrastructure, and unreliable power grids. If low wages were the only thing that mattered, the richest countries in the world would be in sub-Saharan Africa. They aren't. They’re the countries with the best technology, the most stable laws, and the most educated workers.

The Political Trap

So, if tariffs are so bad, why do politicians keep using them?

Sowell, ever the cynic about government, says it’s all about concentrated vs. diffused interests.

The steel industry is "concentrated." They have lobbyists, they have unions, and they have a very loud voice in Washington. If a tariff helps them, they will remember it on election day.

The "diffused" interest is you. You might pay an extra $500 for your car or $0.50 more for a Coke because of steel and sugar tariffs. It’s annoying, but you’re probably not going to spend your weekend protesting at the Capitol over fifty cents.

Politicians know this. They’d rather help a loud group of 5,000 people and screw over 300 million people who won't notice the individual cost.

Actionable Insights: Thinking Like Sowell

If you want to apply thomas sowell on tariffs to your own understanding of the world, here is how you should look at the next "trade war" headline:

- Look for the "Unseen": When a politician says they "saved" 1,000 jobs, immediately ask: "How many jobs were lost in the industries that buy from this one?"

- Check the Price Tag: Realize that a tariff is a tax. It’s not paid by China or Mexico; it’s paid by the American company importing the goods, which then passes that cost to you.

- Ignore the "Balance of Trade" Scares: Sowell often points out that a trade "deficit" isn't like a bank account deficit. If you buy $100 worth of groceries from Walmart, you have a $100 "trade deficit" with Walmart. You’re poorer in cash, but you’re richer in food. Both sides are better off.

- Beware of "National Security" Claims: This is the most common excuse for a tariff. While we shouldn't buy our fighter jets from an enemy, Sowell warns that industries like mohair and honey have used "national security" as a loophole to get protection for decades.

Basically, the next time someone tells you that trade is a war, remember Sowell’s evidence. Trade is an exchange. And usually, the only person who wins a trade war is the politician who gets to look like a hero while the rest of us pay the bill.

If you want to get deeper into this, pick up a copy of Basic Economics. It's a big book, but it's written for regular people. No charts, no math, just logic. You’ll never look at a news report on the economy the same way again.

Check your local library or a used bookstore for a copy of the 4th or 5th edition. Start with the chapter on international trade; it’s a total eye-opener.