If you’re staring at a currency converter trying to figure out the Uzbekistan sum to dollar rate, you've probably noticed a lot of zeros. Like, a lot. It’s a bit jarring the first time you see that 100 USD translates to millions of Uzbek Sum (UZS). Honestly, it feels like you've suddenly become a millionaire overnight, but the reality of the Tashkent markets quickly brings you back to earth.

The Central Bank of Uzbekistan (CBU) keeps a tight leash on things, yet the currency has seen a steady, almost predictable crawl downward against the greenback over the last few years. It’s not a crash. It’s more of a managed slide. If you’re planning a trip to Samarkand or looking at the growing textile export market, understanding this exchange isn't just about the number on Google; it’s about knowing where to actually get the cash and how the local inflation eats into that value.

Why the Uzbekistan Sum to Dollar Rate Keeps Shifting

Economics in Central Asia is rarely a straight line. The Sum is a "managed float" currency. This means the CBU intervenes when things get too wild, but they generally let the market dictate the direction. Since 2017, when Uzbekistan famously liberalized its currency market and eliminated the "black market" rate that used to dominate every street corner, the Sum has been on a path of gradual devaluation.

Why? Well, Uzbekistan imports a lot.

When a country imports more than it exports, there’s constant pressure on the local currency. Plus, you have to look at the neighbors. Russia is a massive trading partner. When the Ruble takes a hit, the Sum usually feels the vibration a few days later. It’s a delicate dance. Investors watching the Uzbekistan sum to dollar parity are often looking at the country's gold reserves—which are massive—as a cushion that prevents a total freefall.

💡 You might also like: Iraqi Dinar in USD: What Most People Get Wrong About a Revaluation

The numbers tell a story of transition. A few years ago, the rate was hovering around 8,000 UZS to 1 USD. Then it crossed 10,000. Now, we're seeing it push further. It’s a controlled descent designed to keep Uzbek exports, like cotton, chemicals, and gold, competitive on the global stage. If the Sum is too strong, nobody buys Uzbek stuff. If it’s too weak, the locals can’t afford bread. It's a tightrope walk for the guys in the high-rise bank buildings in Tashkent.

The Myth of the Black Market

Let’s clear something up right now because old travel blogs will steer you wrong. People used to talk about "bazaar rates" where you’d get 50% more for your dollars if you traded with a guy behind a pile of carpets.

That is dead.

Since the reforms initiated by President Shavkat Mirziyoyev, the official bank rate and the market rate are basically the same. There is no reason—zero, zilch—to risk a run-in with the law for a few extra Sum. Just go to a bank. Or better yet, use one of the ubiquitous 24/7 exchange kiosks that look like high-tech vending machines. They are everywhere in Tashkent and Bukhara.

Handling Money: Practical Realities for the UZS to USD Exchange

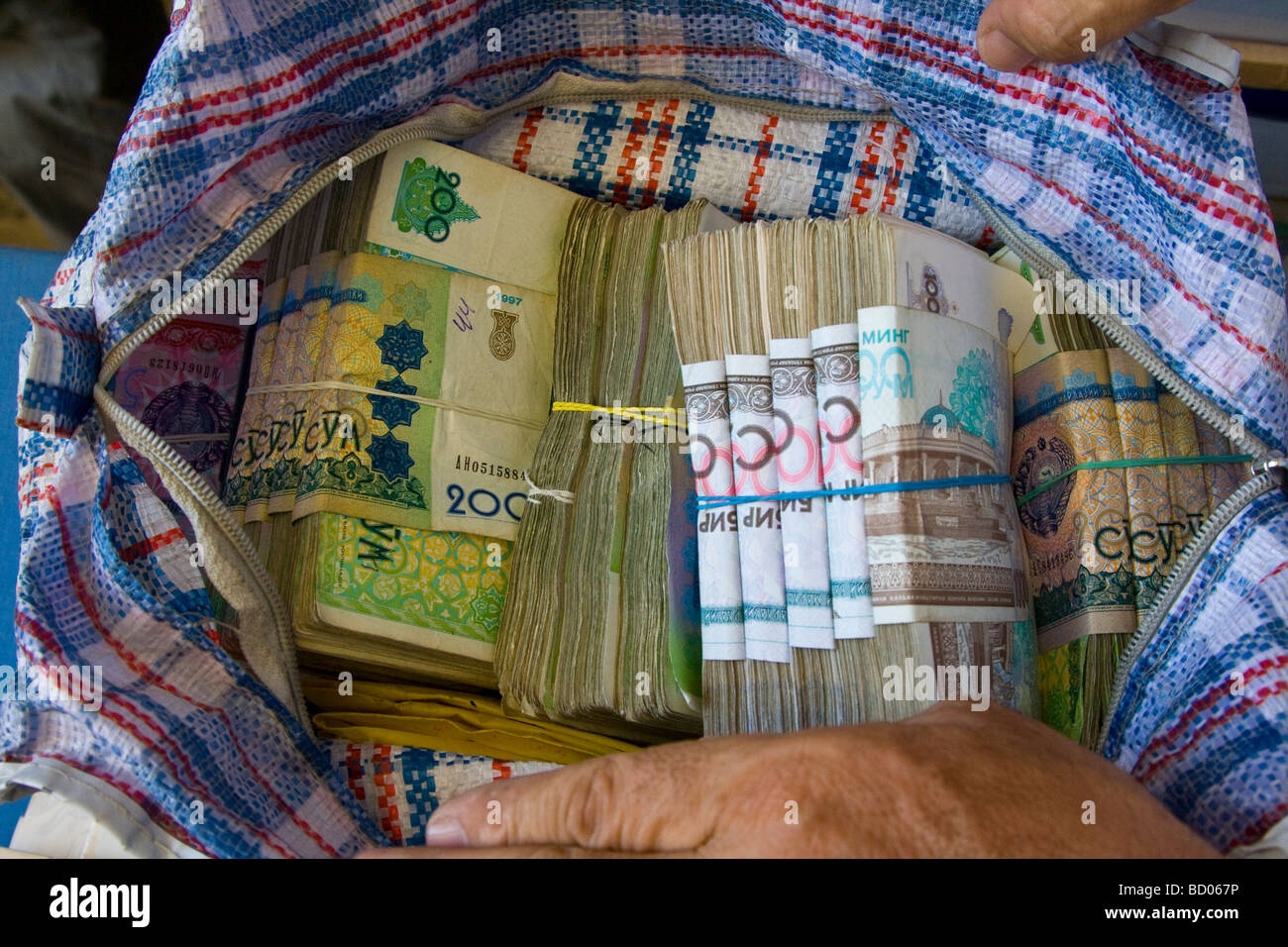

You’ll find that while the official Uzbekistan sum to dollar rate is what you see on your phone, the physical reality of handling that money is different. Because the denominations are so large—with 100,000 and 200,000 sum notes being common now—you will still end up with a wallet that looks like it’s holding a brick.

📖 Related: What Does Attrition Mean? Why Companies Lose People and How to Stop the Bleeding

It’s gotten better, though.

I remember when the largest note was 1,000 sum. You literally needed a backpack to pay for dinner. Nowadays, the 200,000 note (which is roughly 15 to 16 dollars depending on the week) has made life much easier. But here’s the kicker: Uzbekistan is still very much a cash-heavy society. While Visa and Mastercard are accepted in high-end hotels and some fancy restaurants in the capital, once you hit the Silk Road cities or local teahouses (chaikhanas), cash is king.

- ATMs: They exist, but they run out of money. Often. Especially on weekends.

- The Dollar Preference: If you are bringing USD to exchange, the bills must be pristine. I’m talking "fresh from the mint" vibes. If there is a tiny tear, a stamp, or even a heavy crease, the bank teller will likely reject it. It’s annoying, but it's the rule.

- Cards: Stick to the "Kapitalbank" or "NBU" ATMs for the most reliable service with foreign cards.

Business and Investment: The Long-Term Outlook

If you’re looking at the Uzbekistan sum to dollar trend from a business perspective, the volatility isn't the main concern; it's the inflation. Uzbekistan has been fighting double-digit inflation for a while. The government is trying to bring it down to 5%, but it’s a slow process. For a foreign investor, this means your Sum-based returns need to be high enough to outpace the currency's depreciation.

There’s a lot of optimism, though. The privatization of state-owned enterprises and the opening of the Tashkent Stock Exchange (EQV) are drawing in "frontier market" fund managers. They aren't just looking at the current rate; they’re looking at the 35 million people who are increasingly consuming more.

📖 Related: US Dollar to Zambia Kwacha: Why the Exchange Rate is Shifting in 2026

Actually, the real play many experts discuss isn't just the currency itself, but the "carry trade" or high-interest local deposits. Uzbek banks sometimes offer 20% or more on Sum deposits. That sounds amazing until you factor in the 10-12% annual devaluation against the dollar. You’re still coming out ahead, but it’s not the "get rich quick" scheme it looks like on paper. You have to account for the "slippage" of the Sum's value over time.

What Impacts the Daily Rate?

- Gold Prices: Since gold is a major export, when the price of gold per ounce goes up globally, the Sum gets a bit of a backbone.

- Remittances: Millions of Uzbeks work abroad. When they send money home, they usually send Rubles or Dollars. The conversion of these billions of dollars back into Sum provides a huge liquidity boost to the local economy.

- Regional Stability: Any hiccup in Central Asian trade routes usually leads to a nervous sell-off of the Sum.

Common Mistakes When Converting USD to UZS

Don't exchange your money at the airport. It's a universal rule, but it applies double here. The rates at Tashkent International aren't predatory like in some European cities, but they aren't the best you can get. Wait until you get into the city.

Also, don't change all your dollars at once. Because the Uzbekistan sum to dollar rate generally moves in favor of the dollar, your greenbacks will likely be worth a little more Sum next week than they are today. Exchange what you need for 3-4 days.

And for the love of everything, don't try to use your leftover Sum outside of Uzbekistan. Once you cross the border into Kazakhstan or Tajikistan, the Sum becomes incredibly difficult to trade. You’ll get a terrible rate, if anyone takes it at all. Convert your remaining Sum back to USD before you clear customs at the airport.

The Digital Shift: Humo and Uzcard

Uzbekistan is skipping a few steps in the evolution of money. While they still love cash, the rise of "Humo" and "Uzcard" (the local payment systems) and apps like Payme or Click has been explosive.

Most locals pay for their phone bills, groceries, and even taxi rides via QR codes. As a foreigner, you can't easily get onto these systems without a local phone number and a temporary residency registration (which hotels provide). But if you’re staying for more than a week, it’s worth getting a local SIM and trying to set up a basic payment app. It saves you from counting out hundreds of thousands of Sum at a grocery store checkout while a line of impatient grandmothers forms behind you.

Actionable Steps for Navigating the Currency

To handle your finances effectively in Uzbekistan, follow these specific steps:

- **Bring crisp $50 and $100 bills.** Small bills ($1, $5, $10) often get a slightly worse exchange rate at banks than the larger ones.

- Check the official CBU.uz website. They post the "official" rate daily. Use this as your baseline. If a hotel offers you a rate significantly lower than this, they’re taking a massive cut.

- Use the "Golden Money" rule. Keep your USD in a hidden money belt and only carry the Sum you need for the day in your wallet. The sheer volume of paper notes makes it easy to lose track of how much you're carrying.

- Download a converter app that works offline. Internet can be spotty in the desert regions like Khiva. You don't want to be guessing the math when buying a $500 silk carpet.

- Always ask for a receipt at the bank. If you need to convert Sum back to Dollars at the end of your trip, some bank branches might ask for proof of where you got the Sum originally, though this is becoming less common.

The Uzbekistan sum to dollar relationship is a reflection of a country in a massive state of growth. It's a bit messy, the numbers are huge, and it requires a bit of physical effort to manage the cash. But once you get used to the idea that a 10,000 sum note is basically a "small change" bill, the rest of the economy starts to make a lot more sense. Stick to the official channels, keep your bills clean, and enjoy being a temporary millionaire.