When Joe Biden packed up his desk in the Oval Office in January 2025, the air was thick with the usual political spin. One side was shouting about a "soft landing," while the other was already prepping for a "golden age" of deregulation. But if you look at the cold, hard numbers from the Bureau of Labor Statistics (BLS), the story of the labor market is actually pretty clear, even if it’s a bit nuanced.

The unemployment rate when Biden left office was 4.0%.

Honestly, that’s a number that would have seemed like a pipe dream back in early 2021. When Biden first walked into the White House, he was staring down a 6.4% jobless rate and an economy that was still coughing from the pandemic's lingering effects. By the time he left, the U.S. had managed a four-year run of job growth that, despite the nagging pain of inflation, kept most people in a paycheck.

How the 4.0% jobless rate compares to the history books

That 4.0% figure isn't just a random stat. It matters because it marks the tail end of a historic stretch. For about two years during the Biden term, the unemployment rate stayed under 4.0%—the longest such streak since the moon landing era of the 1960s.

It wasn't always a smooth ride, though.

The rate actually bottomed out at 3.4% in April 2023. That was the "peak" of the labor market's strength. After that, things started to cool off as the Federal Reserve cranked up interest rates to fight inflation. By the summer of 2024, the rate had ticked up to 4.3%, causing a bit of a panic among economists who feared a recession was imminent. But by January 2025, it had settled back down to that 4.0% mark.

👉 See also: E-commerce Meaning: It Is Way More Than Just Buying Stuff on Amazon

The raw numbers: Jobs added vs. jobs lost

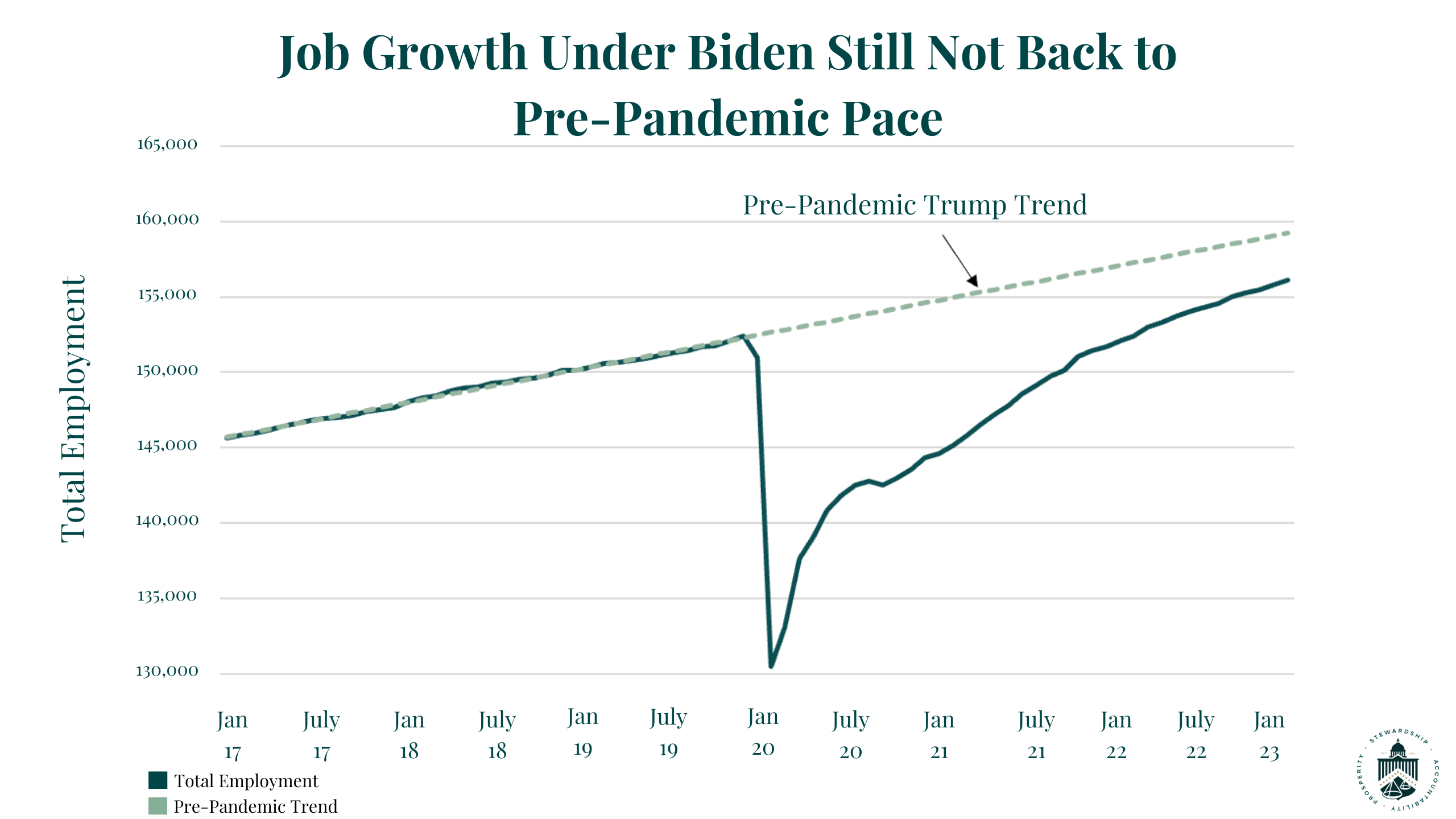

If you look at total payrolls, the Biden administration saw the creation of roughly 16.1 million jobs. Now, it's fair to point out that many of these were just "recovery jobs"—positions that vanished during the 2020 lockdowns and eventually came back. But even if you strip those away, there were about 6.7 million more people working when Biden left than there were at the highest point before the pandemic.

Here is how the breakdown looked in that final month of January 2025:

- Total jobs added in the final month: 143,000 (slightly lower than the 175,000 experts expected).

- Healthcare gains: About 44,000 new roles.

- Government hiring: Stayed steady with 32,000 new positions.

- Manufacturing and Construction: These sectors were much quieter, adding only about 7,000 jobs combined as high interest rates made building and borrowing more expensive.

Who was actually working (and who wasn't)

A single 4.0% percentage point doesn't tell you the whole story. You’ve got to look at the different groups of people to see where the cracks were. In January 2025, the labor market looked very different depending on who you were:

- Adult Men and Women: Both sat at a 3.7% unemployment rate.

- Teenagers: They had it much tougher, with a 11.8% rate.

- Black Workers: Their unemployment rate was 6.2%, which is historically low but still nearly double the rate for White workers (3.5%).

- Hispanic Workers: Clocked in at 4.8%.

One of the big success stories that economists like Wendy Edelberg at Brookings have pointed out is the "prime-age" employment-to-population ratio. This is the percentage of people aged 25 to 54 who actually have a job. When Biden left, this was at 80.7%—actually higher than the pre-pandemic peak. Basically, people in their "working prime" were more likely to be employed than they were in 2019.

The elephant in the room: Inflation and wages

You can't talk about the unemployment rate when Biden left office without talking about what those paychecks were actually worth. This is where things get messy.

✨ Don't miss: Shangri-La Asia Interim Report 2024 PDF: What Most People Get Wrong

While the jobless rate was low, the Consumer Price Index (CPI) rose about 21.5% over the four-year term. For a long time, prices were rising faster than wages. By the end, real wages (wages adjusted for inflation) were only about 0.7% to 1.0% higher than when the term started.

Basically, you had a job, but you probably felt like you weren't getting ahead. Gasoline was 31% higher in January 2025 than in January 2021, and home prices had jumped a staggering 37%. This "cost of living" crisis is why consumer confidence remained so low even though almost everyone who wanted a job had one.

The "Soft Landing" debate

By early 2025, the term "soft landing" was being thrown around everywhere. It refers to the Fed's ability to lower inflation without causing a massive spike in unemployment.

Did they pull it off?

Sorta. Inflation had cooled to around 3.0% by the time of the transition, and the unemployment rate was still sitting at a very healthy 4.0%. Most economists in late 2021 said this would be impossible—they thought we'd need a 6% or 7% unemployment rate to kill off inflation.

🔗 Read more: Private Credit News Today: Why the Golden Age is Getting a Reality Check

The "Benchmark" headache

Here is a weird technical detail that most people miss: the job numbers from Biden’s final year are actually subject to some massive revisions. The BLS recently suggested that the total employment figures for the year ending in March 2025 might be revised downward by nearly 911,000 jobs.

This happens because the monthly surveys are just estimates. The more accurate data from unemployment insurance records takes longer to process. While the unemployment rate of 4.0% won't change (because it comes from a different household survey), the total number of jobs "created" might look a little less legendary once the final 2026 revisions are baked in.

What this means for your wallet today

Understanding the state of the labor market in early 2025 helps explain why the economy feels the way it does now. We transitioned from a period of "labor shortages"—where there were two jobs for every one person—to a more "balanced" market. When Biden left, there were 1.1 job openings for every seeker.

Actionable Insights for the Current Market:

- Check your "Real Wage": If you haven't seen a raise of at least 4% in the last year, you're likely losing ground to the 3% inflation rate that lingered into early 2025.

- Watch the Sectors: Hiring is concentrated in healthcare and social assistance. If you're in manufacturing or tech, the market is much tighter than the 4.0% headline number suggests.

- Stability over Growth: The 143,000 jobs added in January 2025 showed an economy that was "stabilizing," not "booming." It's a good time for job security, but maybe a tougher time for aggressive job-hopping for 20% raises.

The 4.0% unemployment rate when Biden left office was, by historical standards, a solid performance. It was a return to "normalcy" after the chaos of the pandemic. However, the legacy of that number is forever tied to the high prices that came alongside it. Whether you view it as an economic miracle or a period of struggle depends entirely on whether you're looking at your paycheck or the price of the eggs you're buying with it.

To get a true sense of your standing, compare your current salary against the CPI increases from the last four years to see if your "real" income has actually kept pace with the 2025 transition.