You're standing in the electronics aisle at Target. You just picked up a sleek new iPad or maybe a shiny KitchenAid mixer that cost more than your first car. Then, the team member asks that one question: "Do you want to add the Allstate Protection Plan?" Honestly, it feels like a trap. Or a lifesaver. It’s hard to tell which when you're just trying to get home and start dinner.

Most people think these plans are just the old SquareTrade warranties with a new coat of blue paint. They aren't wrong. Allstate bought SquareTrade years ago, and now they’ve deeply integrated into the Target checkout experience. But the Allstate protection plans Target offers aren't a one-size-fits-all safety net. Sometimes they are a total waste of ten bucks. Other times, they are the only reason you aren't crying over a shattered $800 screen three months from now.

What Are You Actually Buying at the Register?

Let’s be real. Nobody reads the fine print while standing in a checkout line with three people behind them huffing impatiently. You’re basically buying a promise.

Specifically, you’re buying coverage for mechanical and electrical failures. If that Nintendo Switch suddenly decides it won't charge or the screen goes black for no reason, Allstate steps in. For portable electronics—think tablets, laptops, and handheld gaming consoles—the Target-specific plans usually include "Accidental Damage from Handling," or ADH. This is the big one. It covers drops, spills, and cracked screens. If you buy a plan for a toaster, though, don't expect it to cover you dropping it in the sink. Standard appliances usually only get "mechanical failure" coverage.

The price of these plans scales based on the cost of the item. You might pay $5 for a cheap coffee maker or $80+ for a high-end smartphone. It’s a gamble on your own clumsiness.

The Weird Gap Between Target’s Return Policy and Allstate’s Coverage

Here is where people get tripped up. Target has a pretty legendary return policy, especially if you have a RedCard (now called the Target Circle Card). Usually, you have 90 days to bring something back if it’s defective. If you have the card, you get 120 days.

👉 See also: Sport watch water resist explained: why 50 meters doesn't mean you can dive

The Allstate protection plans Target sells don't really "kick in" fully until that return window closes, or more accurately, until the manufacturer's warranty ends. Every new electronic device comes with a limited manufacturer warranty, usually one year. If your TV’s motherboard fries in month two, Allstate will likely tell you to call Samsung or LG first. This can be incredibly frustrating. You feel like you're being passed around like a hot potato.

However, the accidental damage part—the drops and spills—is unique to the protection plan. Apple isn't going to fix your cracked iPad screen for free under their standard one-year warranty. That’s where the Allstate plan actually earns its keep during that first year.

Is the Allstate Protection Plan Target Sells a Scam?

"Scam" is a strong word. It’s a legitimate insurance product regulated by state laws. But is it always a good value? Not necessarily.

Think about the math. If you buy a $30 fan and spend $8 on a protection plan, you’ve just increased the price of that fan by nearly 30%. Statistics show that most small appliances either fail in the first 30 days (covered by Target) or last for five years. The "protection window" is a narrow sliver of time where the plan actually pays off.

When it makes sense:

- Kids. If a human under the age of 12 is touching the device, get the plan.

- Portability. If the item leaves your house (laptops, headphones), the risk of a "whoops" moment skydives.

- High-Cost Repairs. Modern TVs are essentially giant, fragile wafers. One stray Wii remote and it's over. Replacing a panel is often more expensive than buying a new TV, so Allstate usually just sends you a check for the purchase price.

When to skip it:

- Static Items. That microwave isn't going anywhere. It’s not going to get "dropped" unless your house has an earthquake.

- Credit Card Benefits. Check your wallet. Many premium credit cards (like Chase Sapphire or certain Amex cards) automatically extend the manufacturer's warranty by an extra year for free. If you bought the item with one of these, the Allstate plan is literally redundant.

The Claims Process: A Reality Check

This is the part they don't tell you at the Target guest service desk. You don't take the broken item back to Target. Target is just the middleman. They sold you the "policy," but they have nothing to do with the "payout."

✨ Don't miss: Pink White Nail Studio Secrets and Why Your Manicure Isn't Lasting

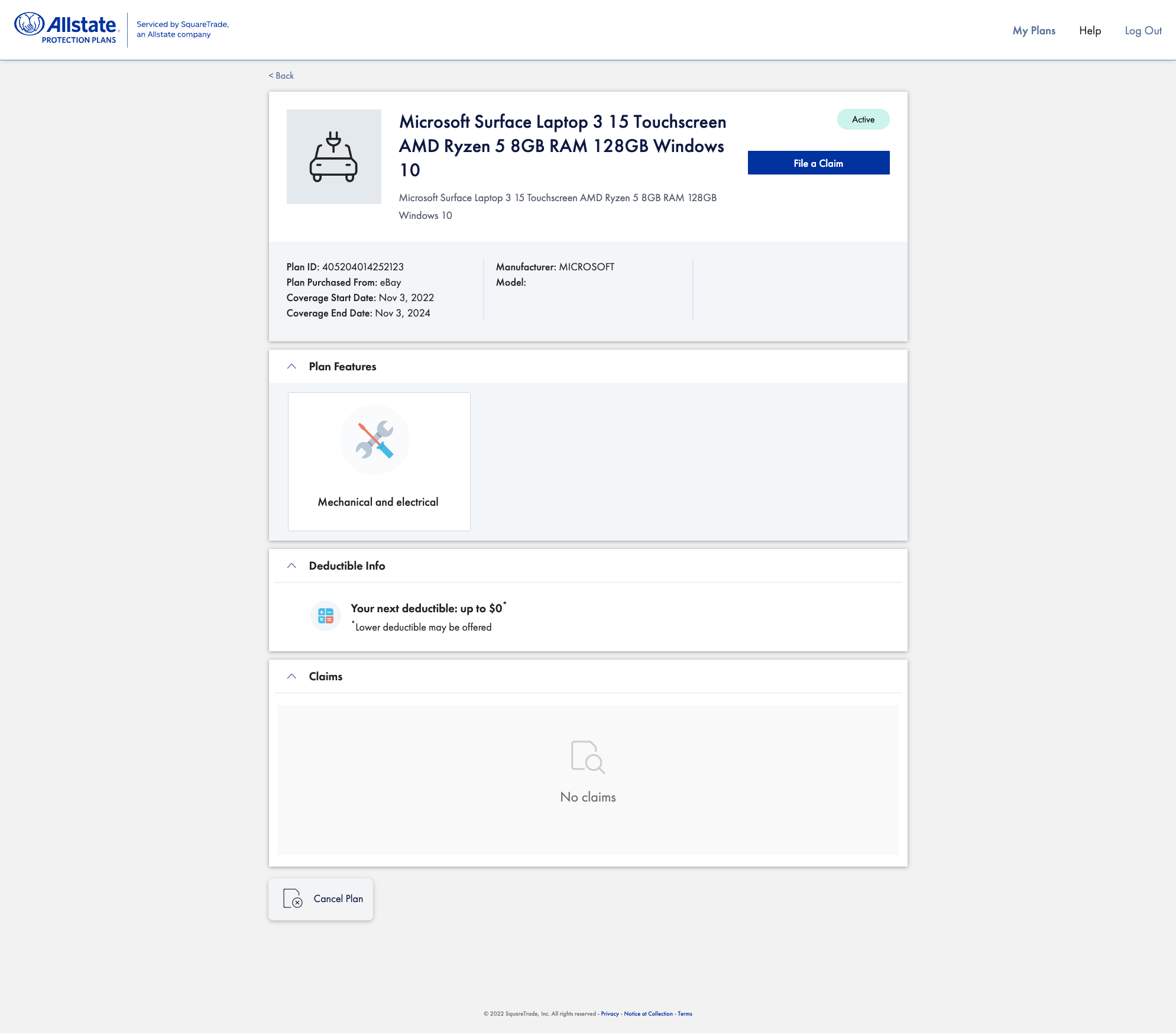

To file a claim, you have to go to the Allstate Protection Plans website or use their app. You'll need your receipt. Pro tip: If you're a Target Circle member, your receipts are saved in the app. This is a lifesaver because thermal paper receipts from the register fade into blank white ghosts within six months.

Once you file, Allstate decides one of three things:

- Repair it. They send you a shipping box, you mail it off, and they fix it. This is common for laptops.

- Replace it. They send you a new or refurbished unit of the same or similar model.

- Reimburse it. They send you a Target e-gift card for the amount you originally paid (minus taxes, usually).

Many users report that for items under $100, Allstate often just issues a gift card immediately after you upload the receipt. They don't want the junk back. It costs them more in shipping than the item is worth.

Common Misconceptions and Frustrations

One of the biggest gripes involves "refurbished" replacements. The terms and conditions—which, let's be honest, are longer than a Tolstoy novel—state that Allstate has the right to replace your broken item with a refurbished one. If you bought a brand-new iPad, getting a "recertified" one back feels like a downgrade.

Then there's the "no lemon" policy. Usually, if the same part breaks three times, they’ll finally just give you your money back. But getting to that third repair can be a nightmare of phone calls and shipping boxes.

🔗 Read more: Hairstyles for women over 50 with round faces: What your stylist isn't telling you

Also, it's worth noting that the plan is tied to the item, not the person. If you buy a gift for a friend at Target and include the protection plan, make sure you give them the gift receipt. They will need to "register" the plan in their own name to make things easier down the road.

The Fine Print That Bites

Watch out for the "Pre-existing conditions" clause. If you buy the plan after you’ve already dropped your phone, and then try to claim it a week later, they might catch on. Most Allstate protection plans Target offers must be purchased within 30 days of the item purchase.

Also, theft and loss are NOT covered. If you leave your Target-bought Beats headphones on a plane, Allstate will not help you. This is a "protection" plan, not a "recovery" plan. It’s for when things break, not when they go missing.

Moving Beyond the Marketing

Target pushes these plans because they are high-margin products. The store gets a cut, Allstate gets a pool of premiums, and most people never file a claim. It's the "gym membership" of the retail world.

But for the person who actually uses their gear, there's a certain peace of mind. Knowing that if your dog knocks over your $1,200 OLED TV, you aren't out a month's rent is worth the $100 upfront for some people.

Actionable Next Steps for Target Shoppers:

- Audit Your Wallet: Before your next Target run, check if your credit card offers "Extended Warranty" or "Purchase Protection." If it does, you can confidently say "no" to the Allstate offer and save the cash.

- Digital Paper Trail: If you do buy a plan, immediately take a photo of the receipt and the box's serial number. Upload them to the Allstate Protection Plan app right then and there. Waiting until the item breaks is a recipe for a headache.

- Check the Deductible: Some plans, especially for mobile phones, have a deductible. It’s not "free" to fix it; it might be $50 or $100. Know that number before you buy so you aren't surprised later.

- Compare with AppleCare or Manufacturer Plans: If you're buying a high-end tech item, compare the Allstate price with the manufacturer's own plan. Often, AppleCare+ is more expensive but offers better "in-person" support at the Genius Bar, whereas Allstate is almost entirely mail-in.

At the end of the day, these plans are a tool. They aren't a scam, but they aren't magic either. Evaluate the "risk of ruin." If losing the item would be a minor annoyance, skip the plan. If losing the item would be a financial disaster or a massive blow to your daily productivity, the protection plan is probably the smartest thing in your cart.