Money is expensive right now. If you've tried to buy a house or get a car loan lately, you know exactly what that means. For President Donald Trump, the person to blame has a name: Jerome Powell. This tension recently boiled over in a way we rarely see in high-level government finance—a literal, handwritten note that has become known as the trump powell interest rates letter.

It wasn’t a formal policy memo. It wasn't some polished white paper from the Council of Economic Advisers. It was a blunt, "old-school" message scrawled in black marker.

The Handwritten "Too Late" Note

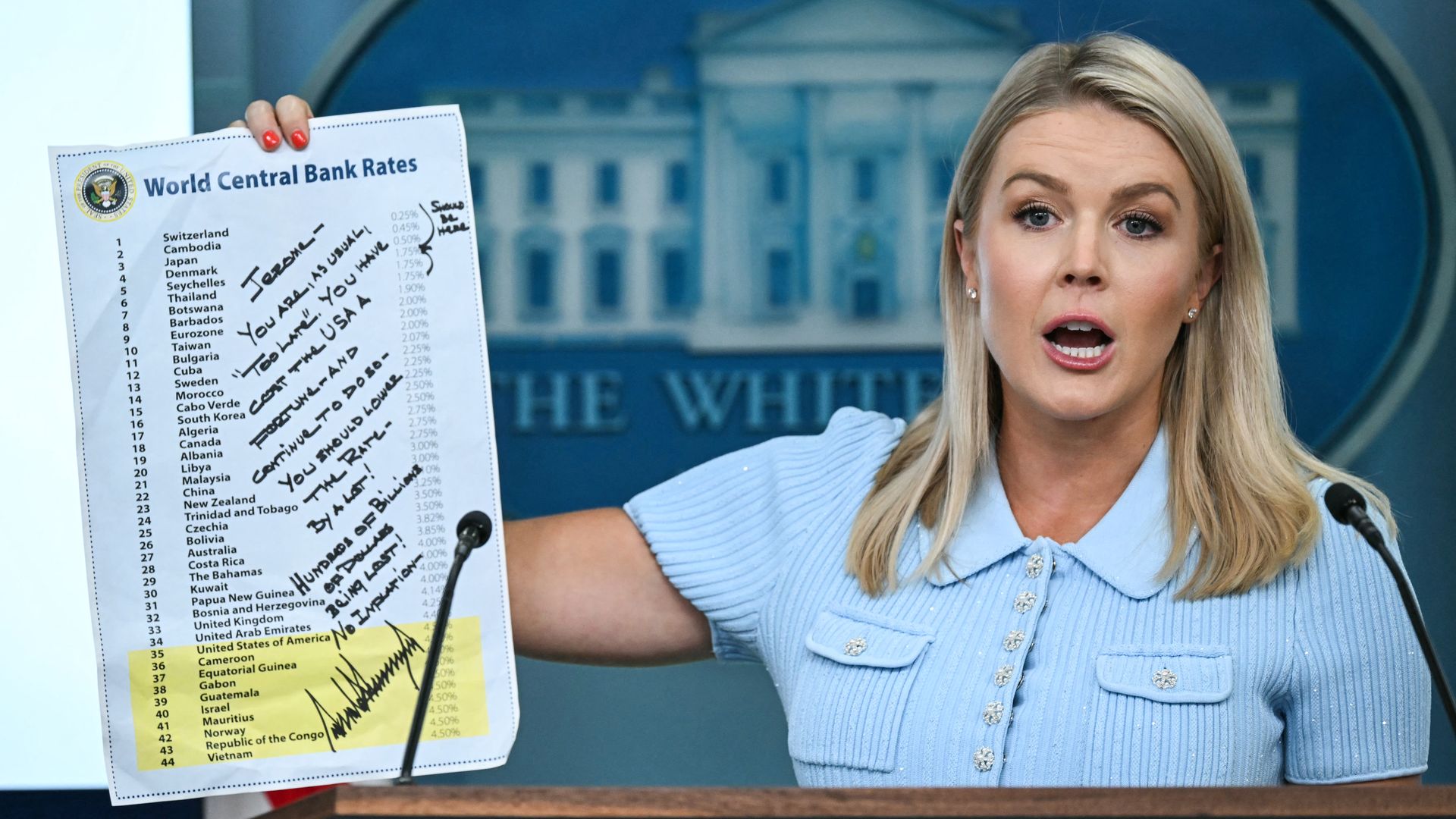

In June 2025, the world got a peek at how the White House was actually communicating with the Federal Reserve. Press Secretary Karoline Leavitt held up a chart in the Brady Briefing Room that looked more like a graded homework assignment than a diplomatic document. On a sheet titled "World Central Bank Rates," Trump had used a thick marker to tell the Fed Chair what he really thought.

"Jerome – You are, as usual 'too late.' You have cost the USA a fortune — and continue to do so. You should lower the rate — by a lot! Hundreds of billions of dollars being lost! No inflation."

✨ Don't miss: What People Usually Miss About 1285 6th Avenue NYC

He didn't stop there. He bracketed a list of countries like Switzerland and Japan and wrote "should be here" next to their rates, which were sitting between 0.25% and 1.75%. At the time, the U.S. federal funds rate was hovering around 4.25% to 4.5%. Honestly, it’s about as subtle as a sledgehammer. Trump even posted the image to Truth Social, doubling down on the "Too Late" nickname he’s been trying to make stick for years.

Why the Trump Powell Interest Rates Letter Matters in 2026

We are currently in January 2026. This isn't just a trip down memory lane; the fallout from that letter is hitting the fan right now. Jerome Powell’s term as Fed Chair is set to expire in May 2026. Most people assumed he’d just ride off into the sunset, but the drama has escalated from handwritten notes to Department of Justice subpoenas.

Last week, Powell went on the offensive. He revealed that the DOJ is looking into him over "pretexts"—specifically a $2.5 billion renovation of the Fed’s headquarters. Powell’s take? He thinks the investigation is just a tool to bully him into cutting rates. On January 11, 2026, he basically told the world that the threat of criminal charges is what happens when you set interest rates based on data instead of the President's "preferences."

🔗 Read more: What is the S\&P 500 Doing Today? Why the Record Highs Feel Different

It’s a mess.

The Conflict Over Inflation Data

Trump’s argument for the trump powell interest rates letter is basically that inflation is dead. He pointed to December 2025 numbers showing core CPI at 2.6%. To him, that’s "very low inflation." He recently told reporters in Detroit that Powell is a "jerk" for not giving the country a "nice beautiful big rate cut."

But Powell is looking at a different set of books. The Fed’s target is 2%. We aren't there yet. Plus, there’s the "tariff factor." Powell has been hesitant to slash rates because Trump's aggressive tariffs could easily spark a new round of price hikes. If you cut rates and then tariffs make everything more expensive, you’re back in the 1970s stagflation trap. Nobody wants that.

💡 You might also like: To Whom It May Concern: Why This Old Phrase Still Works (And When It Doesn't)

Is the Fed Still Independent?

This is the big question. Traditionally, the President stays out of the Fed's kitchen. They might complain about rates, but they don't usually send handwritten "You're a numbskull" notes or launch DOJ probes into building renovations.

Several Republican senators, like Thom Tillis, have actually started breaking ranks. They’re worried that if the Fed becomes just another arm of the White House, the "full faith and credit" of the U.S. might start to wobble. If investors think interest rates are being set by political whims rather than math, they might stop buying U.S. debt. That would make interest rates go up, not down.

What This Means for Your Wallet

If you’re waiting for a mortgage rate drop, this fight is the only thing that matters.

- The Gridlock: The Fed is currently pricing in a 97% chance of holding rates steady. They don't want to look like they’re caving to the White House.

- The "Shadow" Chair: Trump is already vetting successors for May. Names like Kevin Warsh and Kevin Hassett are in the mix.

- The Stability Risk: If Powell is actually indicted or forced out early, expect the stock market to get very twitchy.

Actionable Steps for 2026

You can't control the letters Trump writes, but you can control your exposure to the fallout.

- Lock in what you can: If you’re looking at a loan, don't bank on a "beautiful big rate cut" happening in the next three months. The political tension makes a hold more likely than a cut.

- Watch the May 2026 deadline: That is the "X-date" for the Fed. Whoever replaces Powell will likely be much more aggressive about cuts, but that comes with the risk of devaluing the dollar.

- Diversify away from "Political" Risk: If the Fed's independence is truly gone, traditional bonds might get rocky. Consider looking at inflation-protected securities (TIPS) or even hard assets if you're worried about the dollar's long-term health.

The trump powell interest rates letter was the opening shot in a war for the soul of the American economy. Whether you think Powell is "too late" or a "man with a spine," the result is the same: the era of predictable, boring central banking is officially over.