Honestly, if you were around in the year 2000, you couldn't escape the screeching sound of a dial-up modem or the ubiquitous "You’ve Got Mail" alert. It was the peak of the dot-com fever. That’s why, when the Time Warner AOL merger was announced on January 10, 2000, it didn't just feel like a business deal. It felt like the future was arriving in a $165 billion package.

People thought it was a stroke of genius. You had AOL, the king of the "new media" world, essentially buying the ultimate "old media" titan, Time Warner. It was the biggest merger in American history. On paper, it was supposed to create a behemoth that owned everything from CNN and HBO to your internet connection.

But it turned into what many now call the worst corporate marriage of all time.

Why the Time Warner AOL Merger Actually Collapsed

So, what went wrong? Basically everything.

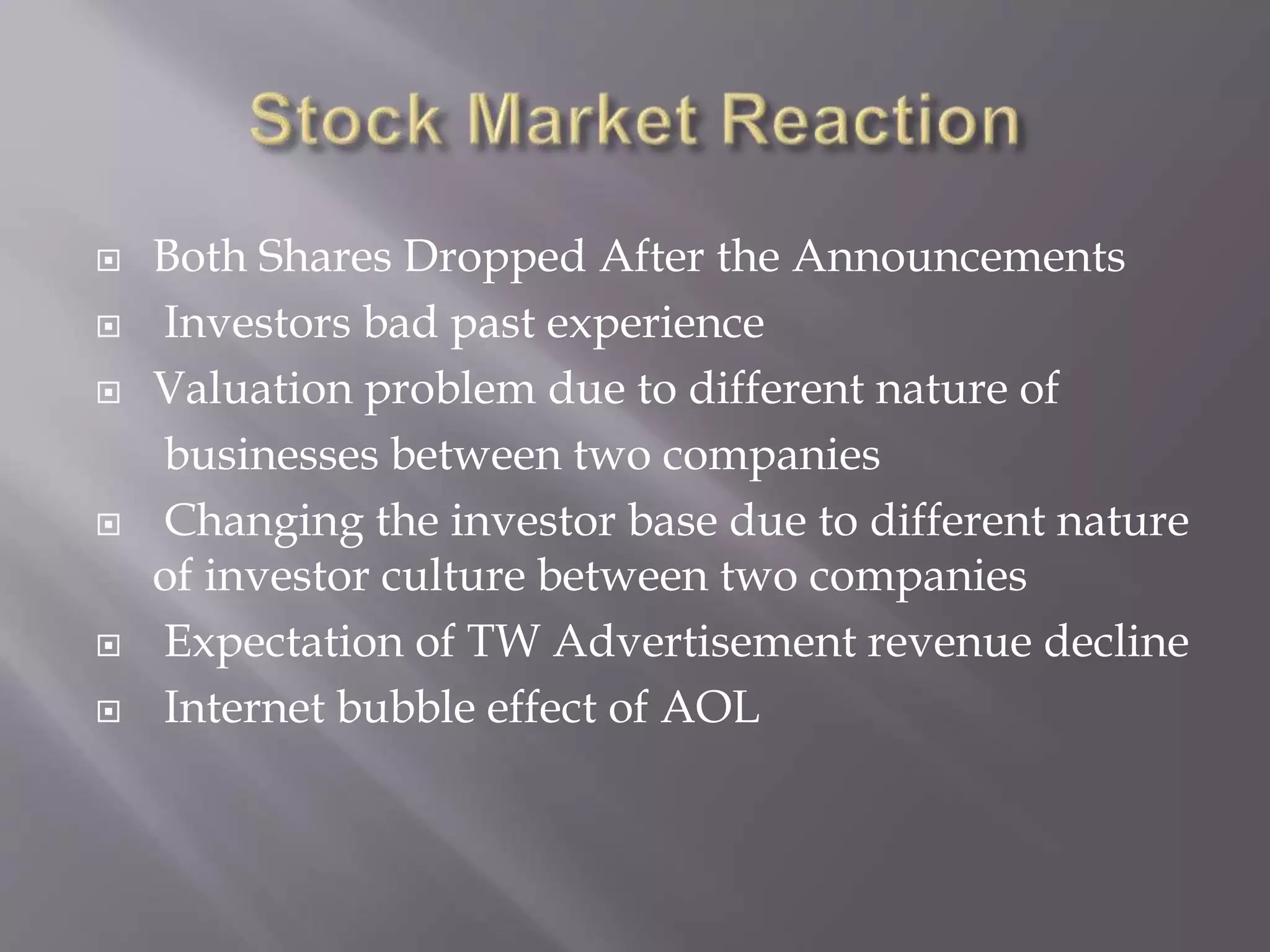

First, the timing was catastrophic. The deal was inked right at the absolute peak of the tech bubble. By the time the merger actually closed in January 2001, the dot-com bubble had started to hiss and pop. AOL’s stock—which was the primary "currency" used to buy Time Warner—was suddenly worth a lot less than it was during the champagne-soaked meetings in late 1999.

🔗 Read more: Philippine Peso to USD Explained: Why the Exchange Rate is Acting So Weird Lately

Then there was the tech. The big vision was "synergy." Steve Case and Gerald Levin talked about how Time Warner’s movies and magazines would flow through AOL’s digital pipes. But the pipes were leaky. AOL was built on dial-up. While they were busy merging, broadband was quietly becoming the standard. People didn't want to wait five minutes to load a web page anymore. AOL was tethered to a dying technology while trying to run a media empire.

A Culture Clash of Epic Proportions

It wasn't just the money or the tech; the people involved simply didn't like each other.

AOL was the "upstart." The employees were young, aggressive, and used to the "move fast and break things" mentality of Northern Virginia tech. On the flip side, Time Warner was the "Establishment" in Manhattan. We’re talking about people who had spent decades at Time magazine or Warner Bros. Studios. They valued tradition, prestige, and—let’s be real—expensive lunches.

The friction was constant. One side saw the other as arrogant cowboys; the other side saw their partners as slow-moving dinosaurs. Instead of working together to fight off competitors like Yahoo or a nascent Google, they spent their energy in boardroom brawls.

💡 You might also like: Average Uber Driver Income: What People Get Wrong About the Numbers

By 2002, the company had to report a staggering $99 billion loss. That is a number so big it's hard to wrap your head around. It remains the largest annual loss in corporate history.

The Long Unwinding

The divorce took years. By 2003, they even dropped "AOL" from the corporate name, returning simply to Time Warner. It was a symbolic admission of defeat.

- 2009: Time Warner officially spun off AOL as an independent company.

- 2015: Verizon bought AOL for a mere $4.4 billion. Compare that to the $165 billion valuation in 2000.

- 2018: AT&T bought Time Warner for $85 billion, trying a similar "content plus pipes" strategy that also eventually failed.

- Today: The remains of that empire are mostly housed within Warner Bros. Discovery.

It's a wild reminder that being the biggest doesn't mean you're the smartest. The Time Warner AOL merger is taught in every business school today as a cautionary tale about overvaluation and the danger of ignoring cultural fit.

Lessons for the Modern Investor

If you're looking at today's massive tech acquisitions, there are a few things you can take away from this 25-year-old disaster.

📖 Related: Why People Search How to Leave the Union NYT and What Happens Next

First, ignore the "synergy" buzzword until you see how the tech actually integrates. If two companies can't even get their email systems to talk to each other, they aren't going to revolutionize an industry.

Second, look at the culture. When a "disruptor" merges with a "legacy" brand, the legacy brand usually wins the internal war, but the disruptor’s value is what gets lost.

Finally, remember that market sentiment can shift overnight. AOL thought their high stock price was a permanent superpower. It wasn't. It was a bubble.

To really understand how the landscape changed, you should look into the history of broadband adoption rates between 2000 and 2005. It’s the single most important factor that rendered the AOL side of the deal obsolete. You can also research the SEC investigations into AOL's advertising accounting that surfaced shortly after the merger, which added a layer of legal drama to the financial wreckage.

The story of the Time Warner AOL merger isn't just about a bad deal; it’s about the moment the 20th century officially collided with the 21st, and the 21st century won.