If you’re moving to Texas, you’ve probably heard the rumors. People talk about the "Texas Miracle" like it’s some kind of financial magic trick. They’ll tell you, with a bit of a smug grin, that the income tax rate Texas offers is exactly zero.

It’s true. Mostly.

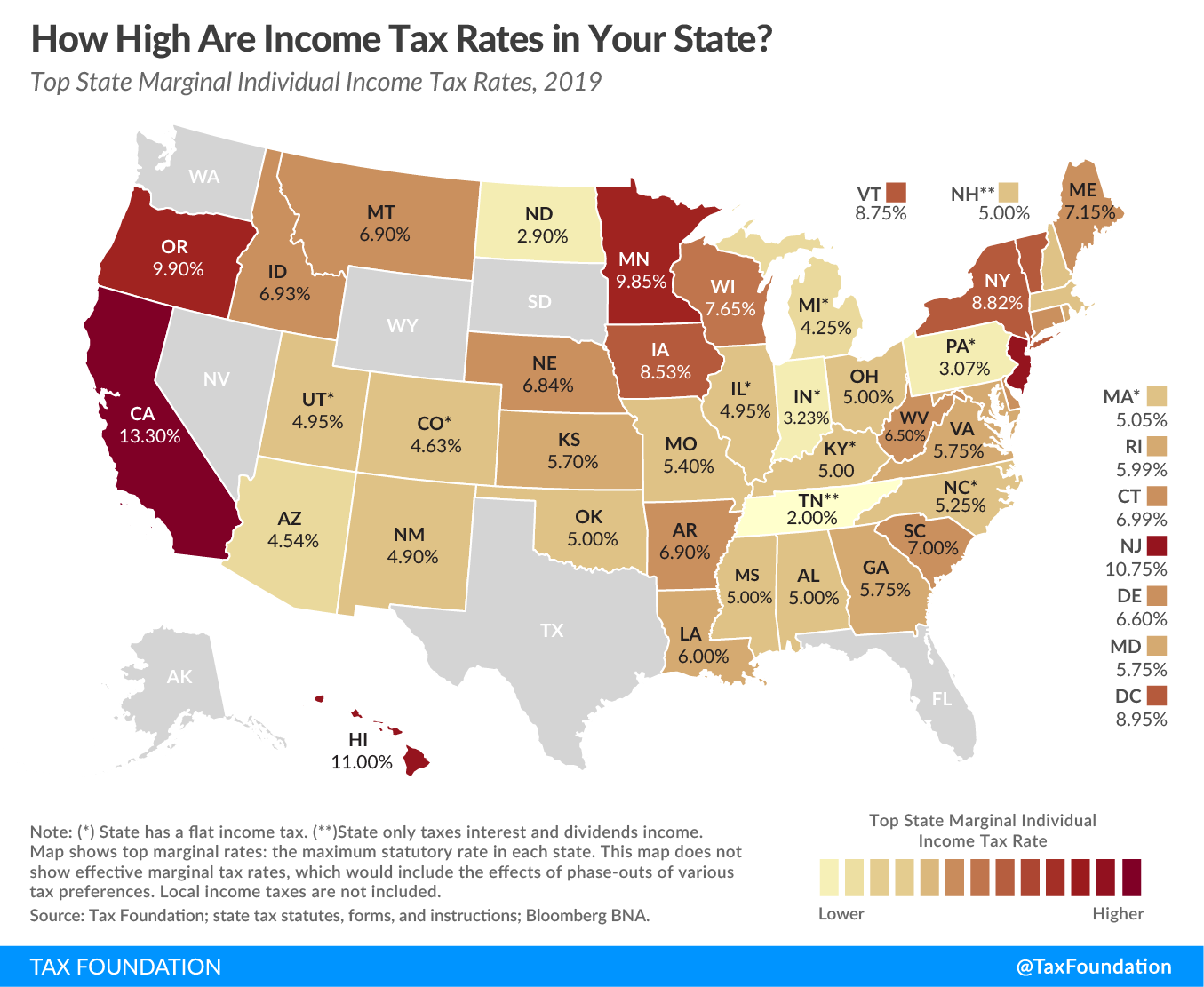

Texas is one of the few states in the U.S. that doesn't take a bite out of your paycheck every month. No state income tax. None. Zip. If you earn $100,000, the state government isn't coming for its 5% or 8% like they do in California or New York. It’s a massive draw for businesses and remote workers who are tired of watching their hard-earned cash vanish into state coffers before it even hits their bank account. But here’s the thing: the government always gets its cut. If they aren't taxing your income, they’re taxing something else. You have to understand the trade-offs before you pack your bags and head for Austin or Dallas, because the "zero tax" lifestyle comes with a few caveats that catch people off guard.

Why the Income Tax Rate Texas Uses is Permanently Zero

Texas didn't just decide to be nice one day. It’s actually baked into the DNA of the state. While some states can change their tax laws with a simple vote in the legislature, Texas made it incredibly difficult to ever implement a personal income tax.

In 2019, voters went to the polls and passed Proposition 4. This wasn't just a law; it was a constitutional amendment. It basically says that the state can’t impose an individual income tax without another constitutional amendment, which requires a two-thirds vote in both the House and Senate, followed by a majority vote from the people. Honestly, in the current political climate, the chances of that happening are basically zero.

This "no-tax" identity is a huge part of the Texas brand. It’s why companies like Tesla, Oracle, and Hewlett Packard Enterprise have moved their headquarters here. They know their employees will get a "raise" just by changing their zip code. When you compare the income tax rate Texas provides to the national average, the savings are staggering. For a high-earner in a state like Oregon or New Jersey, moving to Texas can mean keeping an extra $10,000 to $50,000 a year. That’s a lot of brisket.

The Comptroller's Role

Glenn Hegar, the Texas Comptroller, is the guy who keeps the books. He’s often pointed out that the lack of an income tax makes the state's revenue stream a bit more volatile. Since the state relies heavily on sales tax, when people stop spending—like during a recession—the state's budget can get tight. Yet, Texas has managed to maintain a multi-billion dollar "Rainy Day Fund" (the Economic Stabilization Fund) that acts as a massive safety net. It’s a different way of running a business, really.

The Catch: If There's No Income Tax, How Does Texas Pay for Stuff?

You might be wondering how the roads get paved or how the schools stay open. The money has to come from somewhere. Since there is no income tax rate Texas residents have to pay, the state leans heavily on two other things: sales tax and property tax.

📖 Related: PDI Stock Price Today: What Most People Get Wrong About This 14% Yield

This is where the "zero tax" dream starts to get a little complicated.

Texas has some of the highest property taxes in the entire country. According to the Tax Foundation, Texas usually ranks in the top ten for highest effective property tax rates. While you aren't paying the state a portion of your salary, you are paying your local school district, county, and city a hefty chunk based on the value of your home.

Imagine you buy a $500,000 house. In some parts of Texas, your property tax bill could easily top $10,000 or $12,000 a year. If you’re a renter, don’t think you’re off the hook. Landlords just pass those high property tax costs onto you in the form of higher rent.

Breaking Down the Sales Tax

Then there's the sales tax. The state base rate is 6.25%. However, local jurisdictions (cities, counties, and special districts) can add up to another 2%. In almost every major city—Houston, San Antonio, Fort Worth—you’re going to pay a total of 8.25% on almost everything you buy.

- Clothes? 8.25%.

- Electronics? 8.25%.

- That fancy new truck? Yep, you’re paying it.

Groceries (unprepared food) and prescription meds are generally exempt, which helps lower-income families. But for the average consumer, the sales tax is a constant reminder that the state is getting its piece of the pie.

Is Texas Actually Cheaper for Everyone?

This is the "nuance" part that people often miss. Whether the income tax rate Texas offers actually saves you money depends entirely on your lifestyle and your income level.

Economists often call the Texas tax system "regressive." That’s a fancy way of saying that lower-income earners tend to pay a higher percentage of their income in taxes than wealthy people do. If you make $30,000 a year, you’re spending a huge chunk of your paycheck on taxable goods and rent (which includes those high property taxes). You don't benefit as much from the lack of an income tax because you weren't paying much in other states anyway.

👉 See also: Getting a Mortgage on a 300k Home Without Overpaying

On the flip side, if you’re a high-net-worth individual or a high-earning professional making $300,000+, Texas is a goldmine. The amount you save by not paying state income tax far outweighs what you pay in higher property taxes. It’s a system that definitely favors the "producers" and high-earners.

A Real-World Comparison

Let's look at a quick, messy example.

If you live in a $400,000 home in Austin and earn $150,000:

- State Income Tax: $0.

- Property Tax: Roughly $8,000 - $9,500 (depending on exemptions).

- Sales Tax: Varies, but let's say $2,500.

Now, take that same person in California. They might pay $8,000 in state income tax, but their property tax on a similar home (if they could find one for that price) might only be $3,500 due to Proposition 13. The "total tax burden" often ends up being closer than people realize, though Texas usually still comes out ahead for the middle and upper class.

The Business Side: The Franchise Tax

We can't talk about the income tax rate Texas uses without mentioning businesses. While individuals don't pay income tax, businesses often have to pay the Texas Franchise Tax.

It’s often called a "privilege tax." If you’re doing business in Texas and your entity has "limited liability protection" (like an LLC or a Corporation), you might owe this. It's not based purely on profit, which is weird for some people. It's based on "margin."

The good news? Recent legislative changes have made it so that many small businesses don't owe anything. If your total revenue is below a certain threshold (which was recently raised to $2.47 million for the 2024-2025 period), you might not have to pay the tax at all, though you still have to file the paperwork. Texas really tries to keep the burden low for the "little guy" starting a shop or a consulting firm.

Surprising Details Most People Miss

There are a few "hidden" costs of the Texas tax structure that don't show up on a 1040 form.

✨ Don't miss: Class A Berkshire Hathaway Stock Price: Why $740,000 Is Only Half the Story

Toll Roads.

Since the state doesn't have an income tax to fund massive highway projects, they rely heavily on tolls. In North Texas or Houston, you can easily spend $100 to $200 a month just getting to work. It’s essentially a "use tax" on your commute. If you aren't careful with your housing choice, your "tax savings" might just end up in the pockets of the North Texas Tollway Authority.

Energy Costs.

Texas has a deregulated energy grid (mostly). While this isn't a "tax," it’s a cost of living factor that fluctuates wildly. You might save on taxes but spend $400 a month in the summer just to keep your house at 75 degrees.

The Homestead Exemption.

This is the "secret weapon" for Texas homeowners. If you live in the house you own, you can file for a homestead exemption. This knocks a huge chunk off the appraised value of your home for tax purposes. In 2023, Texas voters approved raising the school district homestead exemption to $100,000. That’s a massive win for homeowners and helps take the sting out of those high property tax rates.

Actionable Steps for Navigating the Texas Tax System

If you're moving to Texas or already here and trying to optimize your finances, don't just celebrate the zero income tax. You need a strategy.

1. Calculate Your Total Tax Burden.

Don't look at income tax in a vacuum. Use a "Total Cost of Living" calculator. Factor in the property tax rate of the specific county you're looking at. For example, Tarrant County and Travis County have very different vibes—and different tax pressures.

2. File Your Homestead Exemption Immediately.

If you buy a home in Texas, this is the single most important thing you can do. It doesn't happen automatically. You have to file with the local appraisal district. It caps how much your appraised value can rise each year (the 10% cap) and lowers your overall bill.

3. Watch Your Business Nexus.

If you own a business outside of Texas but have employees or "physical presence" in the state, you might be subject to Texas taxes. Talk to a CPA who understands "nexus" rules. You don't want to get hit with a franchise tax bill because you didn't realize having a storage unit in San Antonio counted as doing business in the state.

4. Protest Your Property Appraisal.

In Texas, protesting your property tax appraisal is a local pastime. Every year, the county will tell you your house is worth more. Every year, you should probably tell them they're wrong. There are dozens of companies that will do this for you for a percentage of the savings. It works.

The income tax rate Texas maintains is a powerful tool for wealth building, but it isn't a free lunch. It’s a "pay-as-you-go" system that rewards those who earn high incomes and manage their property investments wisely. It’s about freedom, sure, but it’s also about understanding where every cent of your dollar is actually going. If you can handle the property tax bills and the occasional toll road fee, the financial upside of the Lone Star State is hard to beat.